|

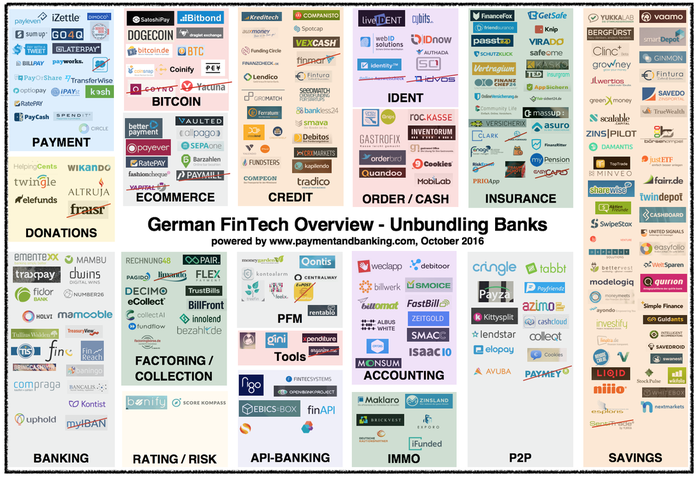

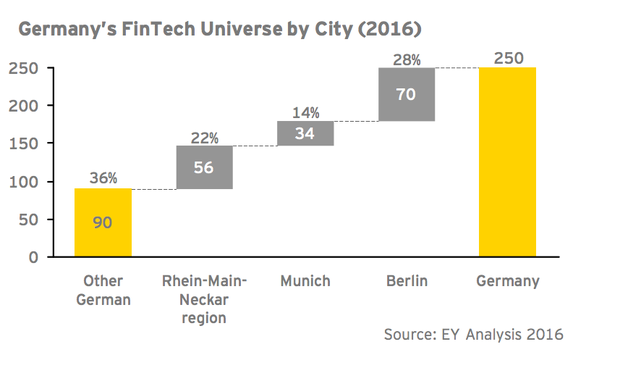

London may still be the fintech capital of Europe but in the wake of Brexit and significant growth and development in its peer nations, the German fintech ecosystem is emerging as a major player in financial technology globally. While, for some time, the domestic fintech scene was not commonly known for its breathtaking speed of innovation, things are changing rapidly. The financial services sector in Germany is facing unprecedented change. Startups and other attackers are jostling for their place in the market, backed by new technologies. While across Europe, overall fintech investment more than doubled between 2014 and 2015 (+120%), investments in German fintech ventures grew by a staggering +843% over the same period. Germany overtook Britain as the fintech funding capital of Europe in the second quarter of 2016, with German startups pulling in $186 million (£142 million) compared to $103 million for British businesses. The three largest fintech funding deals in Europe in the second quarter of 2016 were all in Germany: marketplace lender Finanzcheck raised $46 million; digital-only bank N26 raised $40 million; and payment provider AEVI raised $34 million. KPMG and CB Insights say the findings "suggests Germany as a whole is well positioned to attract fintech investors that may be hesitant to invest in the UK post-Brexit." In Germany, the disruption may jeopardize around a third of all bank revenues over the next few years (McKinsey). German fintech activities and the development of a fintech ecosystem have started later compared to other global regions. Unlike the United States and the majority of the EU, the fintech ecosystem in Germany is a highly decentralized ecosystem with Berlin, Munich, Hamburg and Frankfurt as independent thriving hubs for fintech innovation and growth. The development of the fintech infrastructure is further fuelled by Berlin’s entrepreneurial culture as well as Germany’s strong economy. The test now is whether it and other German cities including Munich, Frankfurt and Hamburg can sustain the recent high level of investor interest. According to Mariusz Bodek, Head of Comdirect Start-Up Garage, a technology incubator in Hamburg, Germany, “the German fintech ecosystem is strongly driven by the regulatory environment and the need to get access to customers. Compared to other countries it is much harder for startups to achieve market maturity. That’s why the majority is seeking cooperation with established banks – a) because they often need a kind of liability umbrella and b) they would like to sell on established customer bases in order to avoid regular customer acquisition costs. Although some characteristics of the German market seem to be tougher than elsewhere, the German fintech landscape is exploding right now. More and more use cases are attacked by startups and that is what drives innovation on both sides – the banks and competing fintechs.”

In this regard, the German Banking Act (Kreditwirtschaftsgesetz) offers numerous advantages (McKinsey). For example, fintech startups in Germany are only allowed to offer loans if they collaborate with a partnering bank. This could lead to new business partnership opportunities which contrasts with the increasingly competitive environment that is prevalent in Europe (see graph below). The german market is one of constant upheaval with customers in Germany open to change as never before. Companies that have a compelling customer proposition with transparent products and superior service will continue to succeed complemented by the strong engineering centric infrastructure and backed by the economic powerhouse Germany is. Crowd Valley (a Grow VC Group company) is committed to the German market and sees its importance increasing in the near term for financial institutions and fintech innovation in Europe. We invite like-minded company to reach out and work together with our ecosystem, in realizing a material vision for fintech across the European continent. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed