|

Different as they might be, marketplace platforms have something in common: their purpose is to match investors with the right issuers, and vice versa. Regardless of the nature of those transactions, platform operators can ease the sometimes lengthy process that consist in onboarding its different categories of users while meeting regulatory requirements.

Before further describing the onboarding process, we’ll make a distinction between the different categories of users that interact through marketplace platforms:

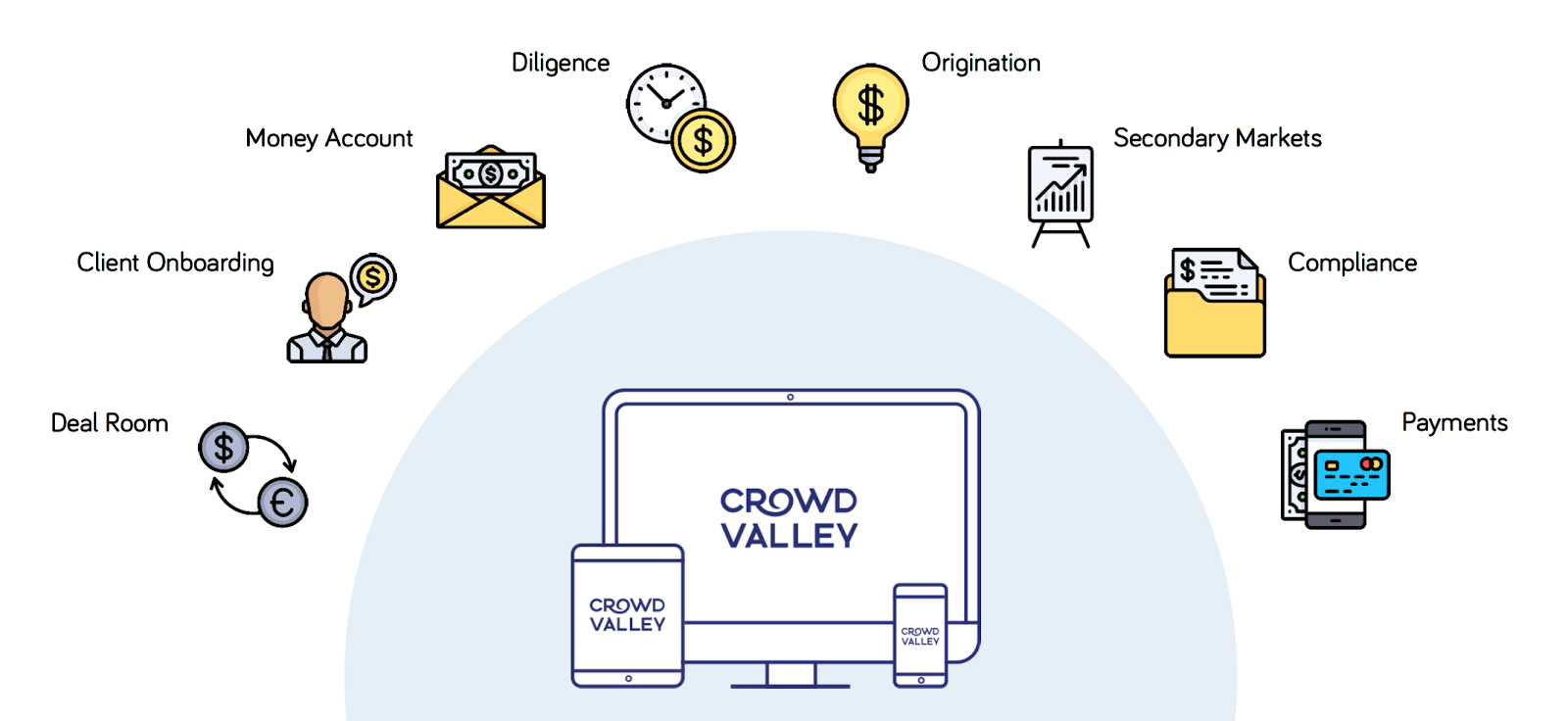

Depending on the type (disposable income, nationality, etc.) of investors that the platform operator is aiming to onboard on its platform, different regulatory requirement have to be met. By having 3rd party service providers integrated in its platform to process ID verifications (for instance to meet Know Your Customer and Anti-Money laundering requirements), platform operators can easily approve or reject potential investors before allowing them to open an online-wallet or to invest directly. Similar to the investor onboarding process, platform operators need to verify the adequacy of issuers to their platform’s standard. Both personally, and regarding the overall viability of their projects. In order to efficiently achieve this, credit scoring partners can automatically assess the solvability of an issuer and integrated deal rooms are used to gather and validate all relevant information before submitting an offering to potential investors. Once the platform’s basic workflows are established, it is then easy to adapt its settings to the evolving expectations of its users. To do so, a platform operator can easily set and update ‘triggers’ that automatically notify a user when a given event occurs on the platform. Practically, it means that an investor could be automatically aware of investment opportunities that match his criteria once they’ve been verified by the platform operator. It could also be used to automatically notify an operator once an issuer has provided the required documentation, who could then approve the offering and automatically notify investors that already registered their potential interest for this type of offering. From the onboarding of users to the settlement of transactions, Crowd Valley’s framework enables platform operators to tailor their online finance workflows to the needs of their users. Any interested party shouldn’t hesitate to contact us. Read the whole article and more details on Crowd Valley's Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed