|

The Financial Times, in partnership with IDA Ireland, presents the third edition of the European Financial Forum, bringing together international and Irish industry executives, policy makers, regulators and thought leaders to explore the disruptive forces that are shaping the financial sector into the future and discuss where opportunities lie. The forum takes in Dublin on January 31.

The European Financial Forum will build on the success of previous editions and provide a fresh perspective the crucial issues impacting the financial industry today, including its role, priorities, drivers of growth and competitive environment. Through a combination of keynote addresses, on-stage interviews and panel discussions, this high level event will discuss the current geo-political and financial climate and the latest macroeconomic and regulatory scenarios. The participants in the invitation only forum are senior decision-makers and professionals working in banking, insurance, institutional Investment, asset management, financial regulation, economic research or policy, and FinTech. Grow VC Group Co-founder and Chairman Jouko Ahvenainen has been invited to participate in the forum. His interests in the event are especially discussions about FinTech and how it is linked and impacts on finance services as a whole. Kobo Funds, the international investment network which connects global business professionals to entrepreneurs and investors, and ELITE, London Stock Exchange Group’s business support and capital raising programme for high-growth companies, are pleased to announce the launch of ELITE Experts, an added value service that will enhance the ELITE digital platform offering for ELITE Companies, giving them streamlined access to worldwide experts to support their growth journeys.

Kobo Funds uses Difitek's (a Grow VC Group company) cloud finance back office for its platform. Group VC Group's Chairman Jouko Ahvenainen is also a member of the ELITE Exports program. Mr Ahvenainen comments the partnership, "It is great to follow the success of Kobo Funds. It is Difitek's important customer, and also a good example, how the cloud based finance back office enables new innovative finance services. It is also a great honor personally to be a member of ELITE Experts. It is really a unique group of top level finance professionals and business executives." See below the press release of Kobo Funds and London Stock Exchange Group in English and Italian. -- London, UK, 25 January 2018: Kobo Funds, the international investment network which connects global business professionals to entrepreneurs and investors, and ELITE, London Stock Exchange Group’s business support and capital raising programme for high-growth companies, are pleased to announce the launch of ELITE Experts, an added value service that will enhance the ELITE digital platform offering for ELITE Companies, giving them streamlined access to worldwide experts to support their growth journeys. Since 2012, ELITE has been on a mission to foster SME growth through accelerating company access to capital, while Kobo Funds has been pioneering the digital networking space since 2013 to match industry knowledge with financial resources. This strategic partnership is the outcome of their shared goals to provide ambitious companies with the assets they need to realize their growth strategies and adds to the suite of services available to ELITE’s ecosystem of companies, investors and advisors. ELITE Experts will be built by selectively engaging Kobo Funds’ global community of over 130,000 senior executives, industry experts and business angels and will be open to C-suite applicants with minimum 20 years experience in business and a successful track record. ELITE Experts will work with ELITE companies in three main areas: corporate governance, international development and financial management. Alessandro Tosi, founder of Kobo Funds, said: “We are proud to announce a partnership with an institutional player like ELITE, open to innovation in both fintech and professional networking markets. ELITE Experts represents the ideal digital venue for high-calibre business leaders keen on interacting with the fastest growing companies and the broadest community of investors. Top-tier executives have already joined ELITE Experts, acknowledging its uniqueness as the first professional community operating in partnership with a leading international Stock Exchange, where they can leverage their competencies, share their knowledge and embark upon a high-quality networking experience”. Luca Peyrano, CEO, ELITE, said: “Partnering with Kobo Funds is another achievement in the evolution of ELITE, allowing some of the fastest growing companies across the world streamlined access to an extensive network of business experts, ELITE Experts. We look forward to working with Kobo Funds and supporting ELITE companies achieve their enormous growth potential.” For further information please contact [email protected] and visit kobofunds.com/elite About Kobo Funds Founded in 2013, Kobo Funds is a digital platform matching companies and investors with an international community of experienced industry experts and C-level executives: more than 130,000 business leaders providing knowledge and support to entrepreneurs on their journey towards capital markets. -- Kobo Funds ed ELITE, società del gruppo London Stock Exchange, annunciano una partnership strategica Londra, UK, 25 gennaio 2016: Kobo Funds, il network internazionale che connette manager di lunga esperienza con imprenditori e investitori, ed ELITE, la società del London Stock Exchange Group, la cui missione è supportare le aziende nei loro progetti di sviluppo offrendo accesso ad un network internazionale, un percorso di mentorship dedicato e a fonti di finanziamento diversificate facilitando l’accesso ai capitali attraverso l’impiego di tecnologie digitali, sono lieti di annunciare ELITE Experts, un nuovo servizio a valore aggiunto che arricchirà l’attuale piattaforma digitale dedicata alle aziende ELITE offrendo loro accesso diretto a una rete di esperti internazionali a supporto dei loro piani di crescita. Dal 2012 ELITE ha come missione la crescita e lo sviluppo delle aziende facilitandone l'accesso ai capitali, mentre Kobo Funds è attiva dal 2013 come piattaforma di networking digitale, favorendo l'incontro tra competenze industriali e settoriali e risorse finanziarie. Questa partnership strategica è il risultato di obiettivi condivisi, che consistono nel dotare aziende ambiziose degli asset necessari a realizzare le strategie di crescita, e aggiunge un importante elemento ai servizi fruibili dall'ecosistema di ELITE, composto da aziende, investitori e advisor. ELITE Experts verrà costruita coinvolgendo in maniera selettiva la comunità globale di Kobo Funds - più di 130.000 executive di grande seniority, esperti di settore e business angel - aperta a top manager con esperienza almeno ventennale e con percorsi professionali di successo, interessati ad affiancare le aziende ELITE in tre aree principali: corporate governance, sviluppo internazionale e finanza d'impresa. Alessandro Tosi, fondatore di Kobo Funds, ha commentato: “Siamo orgogliosi di annunciare una partnership con una realtà istituzionale come ELITE, aperta all'innovazione nei mercati del fintech e del networking professionale. ELITE Experts rappresenta il punto d'incontro digitale ideale per business leader di alto profilo interessati a interagire con aziende in crescita e con la comunità internazionale degli investitori. Ad ELITE Experts hanno già aderito executive molto visibili, riconoscendo l'unicità della prima comunità professionale gestita in partnership con una delle maggiori borse internazionali, dove sarà possibile valorizzare le proprie competenze, condividere conoscenza e fare networking di qualità". Luca Peyrano, CEO di ELITE, ha commentato: “La partnership con Kobo Funds è un altro traguardo nell'evoluzione di ELITE, che offrirà alle aziende accesso a una rete mondiale di esperti industriali e di settore, gli ELITE Experts. Il progetto sul quale lavoreremo con Kobo Funds ci permetterà di supportare le aziende ELITE, caratterizzate da alta qualità e una forte propensione alla crescita a sviluppare ancor di più il loro enorme potenziale in logica sinergica con la community che già oggi fa parte della piattaforma ELITE ”. Per ulteriori informazioni si prega di contattare [email protected] e visitare kobofunds.com/elite Kobo Funds Fondata nel 2013, Kobo Funds è una piattaforma digitale che mette in comunicazione aziende e investitori con una comunità internazionale di esperti di settore e top manager: più di 130.000 business leader disponibili a offrire la propria competenza ed esperienza agli imprenditori che si affacciano al mercato dei capitali.

Grow VC Group and its companies participated in Crypto Funding Summit in Los Angeles on January 24 and 25. Crypto Funding Summit is a two-day event being curated by crypto enthusiasts, with an audience of about 500 people in the Los Angeles Convention Center. The summit gathered an interesting combination of people from traditional finance executives to startups, FinTech companies and crypto market investors.

Grow VC Group Co-founder and Chairman Jouko Ahvenainen spoke at the event. In his speech "Crypto Investment Ecosystem with Data and AI" he especially highligted needs for basic finance ecosystem components in crypto investing, and the fundamental changes distributed models will cause. He explained, how tokenomics, tokenization and distributed models change many fundamentals in the finance and Internet businesses. It is also a big challenge for many incumbent companies like banks and traditional data and Internet companies. Mr Ahvenainen also participated in a panel discussion "The Rise of Crypto Funds." A few Grow VC Group are also active to develop solutions for crypto funding, distributed finance, and fintech data services. For example, Difitek is the leading cloud based finance back office as a service, and it is used also for blockchain based finance services. Prifina develops new solutions for consumers to manage their personal finance data and use it in different services based on distributed ledger technologies. Token Index Fund is an investment company that invest especially in qualified crypto tokens and help other parties to make tokenization for their their assets. With the advent of PSD2 in Europe, financial services companies have embarked on their Open Banking initiatives, which are set for full swing in 2018. Banks have been writing and exposing APIs for third parties to pull data and perform actions on the banks platforms through these APIs in order to provide more customer facing service innovation. For many banks this is the final step for complying with the PSD2 regulation, but the reality is that it’s only the very first step in the total transformation to an open financial services ecosystem.

I had the pleasure of speaking at Google’s and Apigee’s CIO Summit on Ecosystem Strategies and showcasing our experience in financial services. Equally I was fortunate to listen to the presentations and the Google / Apigee teams fantastic work. It was extraordinary to hear first hand accounts of how large enterprises such as Pitney Bowes and Walgreens had adopted an ecosystem strategy and seen a vast return on their investment. This wave is now truly setting its sight on financial services. Connecting to the Ecosystem Exposing APIs is a way to allow third party access to data and actions on the banks systems, connecting to a community of service providers and ecosystem partners. These connections can yield fantastic new innovative services, such as we’ve seen in the first fintech wave with e.g. payments innovation, yet through the lateral exposure of new banking API platforms, these innovations will not be limited to one vertical and indeed over time they will impact every single financial services vertical application. This new position is, well new and with it these infrastructure provider and value add service provider relationships will be forged, yet no one knows what it will look like yet. What’s for certain is, that there will be a lot of new experimentation and the end users will get to play a part in shaping the future of financial services through their usage of newly created financial service offerings. Becoming a True Enabler As with any ecosystem strategy, these technical APIs need to become more than technical functionality. Ultimately the mere connection does not make the initiative valuable, but the potential the APIs provide for the third party ecosystem to ultimately together better serve the end users. The focus on value generation should be on the end user of financial services, the ordinary people and the quality of services they are offered directly and indirectly. Yet it’s important to recognize the vastness of financial services and that these applications range from life insurance products to car leasing and health care financing. But unless the end client consuming this service, for example the efficient financing of a vehicle purchase through increased competition, experiences that value in the most tangible way, such as better service, value for money etc, the revolution itself will be short lived. Or in fact, the model for the revolution would have been wrong. There’s a pervasive question at the heart of modernization in financial services, which goes something like this. There are two competing forces, 1) the modernization of financial services such as banks and 2) the re-writers of services, such as developers and larger software companies (Google, Oracle, Amazon…). In a give and take, who will take the most and who will give the most? Where does the balance sit in five years, how about in ten? Not One Wave, but an Ocean This vastness in financial services, including the fact that there is an inherent depth to each vertical of added dimensions (regulatory, domain expertise, scale needed etc) means the shift will not be one wave of change, but rather a series of waves that will gradually shift the entire services market. Adopting an ecosystem strategy will take time, but the time is now. Keeping a direct focus on the end user value, we look forward to welcoming adopters of ecosystems strategies to the open market as well as the innovators writing new code to serve clients in a new way. This second wave of fintech has got to include you all. The article first appeared at Difitek Blog. Again there is speculation in the US over whether companies like Amazon, Facebook, Apple or Wal-Mart could acquire a banking license. The tradition in the US and many other countries has been that lawmakers and regulators have wanted to keep banks separated from other businesses, like retail, as it could for example create conflicts of interest in terms of making lending decisions in purchasing the company’s own products. Whatever happens about this regulation, thanks to FinTech, we’ll see more finance services integrated with other services.

If you go to buy items online, you might need finance for your purchase. The easiest solution nowadays is probably to use a credit card to make the payment. Then, depending on your card, you have more time and flexibility to make the payment. The problem is the actual annual interest rate of the card is easily 30% to 40%. You could get a loan with much lower interest rates, but it is complex to get a loan quickly when you are buying something. Some services offer you ‘financing models’. For example, you can buy a mobile phone by taking a two-year contract with a carrier. Those packages then typically include some call time, text messages and data. As a whole those pricing packages are often complex and it is difficult to calculate how much you actually pay for the phone and what is your interest rate is on the deal. FinTech solutions distribute the whole finance industry in many ways. There are more niche services for lending, investing, savings and many other needs. We are moving from a model where a few finance institutions were big black boxes offering all services to a network of countless smaller services with open APIs. An important part of the new services is better usability. You don’t need to go to a bank branch to apply for a loan and take your ID card, utility bills and bank statements with you. You can create an online application in a few minutes and systems based on data analytics make the lending decision and pricing in real time. Now it is also easy to build these kinds of services technically. There are finance back office services, development components and open APIs available, and it is possible to implement a service in a couple of weeks. This also means that these kinds of finance services can be easily integrated to the check-out process of an e-commerce service. An e-commerce service can also integrate many lending services to their service offering, and a lending service can be integrated to many e-commerce services. It opens the market for open competition. In practice, this means a consumer could have a list of finance solutions on an e-commerce service, when she or he purchases something. She could compare which one is best for her needs, receive financing on the spot and make the purchase. This doesn’t mean that the e-commerce service offers the finance services or is a finance company. They just make those services available on their web store as part of the ecosystem. Traditionally available finance has been an important part of competition, for example, in the car market. Many car companies have their own internal or external finance partners. When you have bought a car, it has always included some paperwork and the finance part has been an additional layer extra. But for smaller purchases that kind of paperwork would be too complex. Now we see a situation FinTech that integrated finance solutions are easily available for all kinds of retail services and they offer also a smooth customer experience. This is part of a much bigger development in the finance industry. Finance services are no longer their own isolated islands, but they can be components in any service. The FinTech discussion has still often been linked to some highlights like p2p lending, bitcoin or mobile banking. The reality is that the impact is much larger for the whole industry and how it works. It will also change how and where finance services are offered to people. For example, you need credit or a loan, but when you buy something, you just want to buy it, not to go to a bank or a lending service. When the services are truly built based on customer needs, it changes their availability and customer experience fundamentally. This post originally appeared on Telecom Asia. Grow VC Group and its companies participate in Crypto Funding Summit in Los Angeles on January 24 and 25. Crypto Funding Summit is a two-day event being curated by crypto enthusiasts, with an audience of about 500 people in the Los Angeles Convention Center. The main goal is to connect crypto investors with most promising blockchain entrepreneurs. Crypto hedge funds, crypto investors, ICO projects, blockchain enthusiasts from all over the world will get connected at the Crypto Funding Summit.

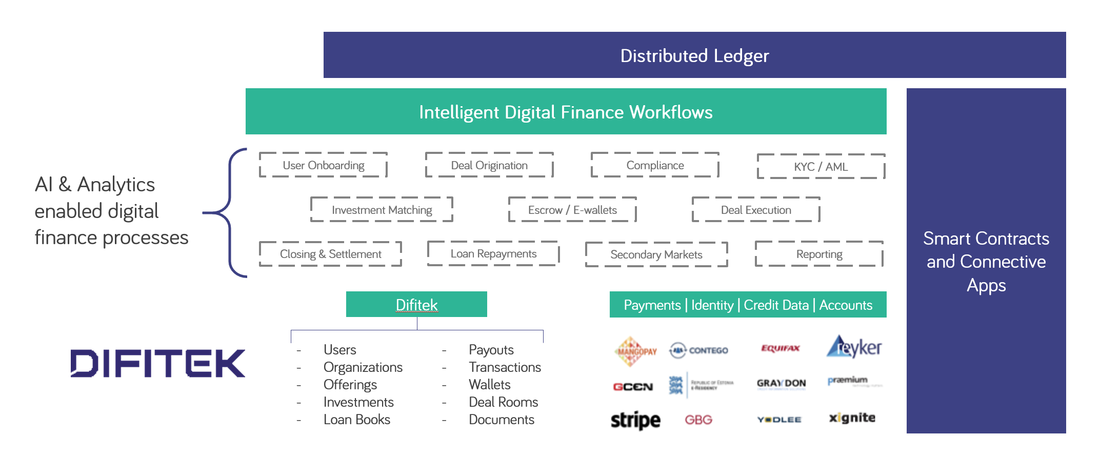

Grow VC Group Co-founder and Chairman Jouko Ahvenainen will speak at the event. In his speech "Crypto Investment Ecosystem with Data and AI" he especially talks about needs for basic finance ecosystem components in crypto investing, blockchain and funding services. This means, for example, importance of regulatory processes (KYC, AML, compliance), interfaces to the traditional finance services, and transparency. Data and AI are coming to an important role in all fintech services, including crypto investing. Mr Ahvenainen also participate in a panel discussion "The Rise of Crypto Funds." A few Grow VC Group are also active to develop solutions for crypto funding, distributed finance, and fintech data services. For example, Difitek is the leading cloud based finance back office as a service, and it is used also for blockchain based finance services. Prifina develops new solutions for consumers to manage their personal finance data and use it in different services based on distributed ledger technologies. Token Index Fund is an investment company that invest especially in qualified crypto tokens and help other parties to make tokenization for their their assets. January 10, 2018 – As part of capitalizing on its market success and strategic developments, Crowd Valley will now be known as Difitek (www.difitek.com). The company belongs to the Grow VC Group. Following the growth of the digital finance market, the company has a full offering through its back office and API for a wide range of financial offerings, such as online lending, online investing, trading, cryptocurrencies and ICOs, neobanks, energy and real estate applications.

Further the company has unveiled its new offering, a Distributed Finance Platform, featuring the Difitek Intelligent Connectivity Layer built on serverless technology, currently in an alpha phase with select clients and partners. The platform has full support real time data and high volume applications, supporting such use cases such as real time pricing of private loans. Current customers and partners have initial access to new products and services. Existing applications provided under the former name will remain in full effect and unchanged. Difitek has since 2012 provided a Platform as a Service (PaaS) for new finance products and applications. Today it adds the Difitek Intelligent Connectivity Layer as a value add service on top of its API first offering, allowing the smart combination and automation of API functions, resulting in the creation of meaningful workflows using artificial intelligence. This will allow the piloting of unprecedented financial applications, with cutting edge tools and world leading bank grade security. “Today marks a new chapter in the company’s history, with its team in the digital finance market since 2009”, says Markus Lampinen, CEO of Difitek. “2018 will see new starter module announcements, new enterprise partnerships and a deeper focus on training data as a true enabler in access to capital and financial inclusion.” For more information, please visit www.difitek.com and keep reading further announcements to be unveiled this year. Contact information: [email protected] 415-580-0087 One Market Plaza, 36th Floor, San Francisco, CA In Asia, FinTech development has taken several paths. China is probably the leading FinTech country in the world. Singapore and Hong Kong want to add “FinTech hub” to their finance hub reputations. And emerging markets need basic finance solutions for the unbanked.

Let’s compare Singapore and Vietnam, which have very different levels of FinTech opportunities and development. Which nation has the better opportunity to become an advanced FinTech country? A tale of two ASEAN nations Vietnam has 95 million people, but less than 30 million have a bank account, and fewer than five million have a credit card. Singapore has excellent infrastructure, sophisticated services, and a well-developed finance ecosystem. But although Singapore’s existing services fulfill basic needs for businesses and consumers, traditional finance companies want to protect their positions, and regulators struggle to find a balance between traditional and cutting-edge services. In Vietnam, the financial infrastructure and ecosystem are weak. However, its growing population and economy need access to financial services, and nowadays there’s a clear path to next-gen services which bypasses obsolete finance services and technology. Asia’s diverse FinTech markets Singapore and Vietnam are just examples of the Asian finance and FinTech markets. They represent two different tracks of development, and how development is different in various Asian countries. This also means totally different situations for regulations, services, and technology developers. In emerging economies like Vietnam, demand is high for basic finance services-like a simple account to receive, hold, and transfer money, get loans, and make payments. This opens opportunities for mobile banking, online lending, and mobile payment solutions. Integrated FinTech solutions offer many opportunities in these markets, e.g. online lending can be offered via e-commerce or a check-out process for people who have no credit card. Developed economies like Singapore focus on increasing the efficiency of their existing services and offering advanced services to consumers and businesses. This means solutions for wealth and personal finance management, and more data- and AI-based end-user services. But how can FinTech change the IT infrastructure, value chains, and processes within the finance sector? Banks and other traditional institutions must begin to renew their IT sooner or later. New solutions are more cloud-based, with open APIs, and will offer better tools to make data-oriented services and empower customers to do more. The new models New IT and data solutions are a common factor on both tracks. For example, a modern cloud-based back office-as-a-service can be maintained for a fraction of the cost of a legacy back-end IT. This makes it easier for companies in emerging economies to get to the new era fast, and requires courage from management of traditional finance companies in developed countries to dump legacy systems and move to new technology. The PSD2 regulation in Europe will have impact on this globally, and companies realize the influence of open APIs is not to use old banking IT, but build the ecosystem in a new way. It also requires courage to go for open APIs and cloud-based models and choose a position in the changing value chain. Now is the time that finance institutions need visionary people to join management teams. In 2018 we won’t see the finance world change overnight. We’ll see accelerating development within digital finance services and the ecosystem. Finance companies build their positions and capabilities for the future. In 2018 you cannot yet win the FinTech race, but you can lose it, if you ignore essential developments. It’s not enough to repeat key words like ‘blockchain’, ‘AI’ and ‘ICO’-you must build concrete things, go for new IT solutions and design future services based on actual customer needs. The article first appeared on Telecom Asia Vision 2018 publication. ICOs and cryptocurrencies had a bigger than expected role in FinTech and alternative finance in 2017. We haven’t yet seen a big disruption in the finance ecosystem and value chains as a whole, but the technology and components to create one are a reality. What can we expect in FinTech in 2018? Do we finally see cryptocurrencies finding real uses? Will we get rid of banks, distribute finance data, and see data replacing form-filling in lending processes?

Here are my five main predictions for FinTech in 2018. 1. Tech companies will really begin their attack on finance in the B2C and B2B frontiers Traditional finance companies have significant challenges to adapt to FinTech. As examples in other industries demonstrate – such as retail, e-commerce and media – software and tech companies are in a strong position to challenge the incumbent players. Tech companies can design new services for customer needs from scratch and they have better competence to utilize the latest technologies. This offensive will happen on many frontiers, from simple consumer services like payments and money transfers to core back-office and transaction handling services. And this will be done by a number of companies, from plentiful startups to a few tech giants. Companies like Google, Oracle, Microsoft and Amazon will bring their own consumer and back-office services to the market, and also acquire startups. 2. Distributed ledger and finance solutions will start to come to the mainstream, but (proof of work) blockchain will see real competition from other distributed solutions Distributed solutions will become important – not only for Bitcoin and other cryptocurrencies, but also for many other finance solutions to handle smart agreements, authorize transactions and store data. But there will be a race regarding which kinds of technologies will be used for these purposes. Most probably it will be different solutions for different situations – cryptocurrencies have their own needs, but the amount of data is very limited; data management solutions with a lot of data need more effective storage solutions and high capacity payment solutions of their own. 2018 will provide more ideas about which solutions are going to dominate and where. 3. Data, data analytics and AI will be the big change-makers in finance services Almost everything that is being called ‘AI’ in marketing presentations and business plans is not really AI, but some kind of use of data and data analytics. Anyway, data is starting to play a very central role in finance services. It really is the component to enable more automation and better decisions. Lending and debt markets are areas where data and analytics (and eventually proper AI) can make a big difference. Lending is one of the most significant businesses in finance, and it is still very old fashioned in areas such as loan application processes, decision-making and secondary markets. This will change – and when it does, it will change the whole market. 4. The ICO boom will calm down, but tokenization will spread to more established asset classes People must start to investigate tokens and underlining assets or services behind ICOs more. Perhaps right now it is exciting to participate in an ICO, but it is not enough in the long run. Projects, services, and startups are currently very difficult ‘asset classes’ to invest in. We can assume we’ll see more tokenization of other assets, like real estate, loans and later-phase companies. Those assets have much more data and transparency to the actual investments, and they will become much more prominent in the market. 5, The value of Bitcoin and other leading cryptocurrencies will remain volatile and unpredictable Bitcoin and some other leading cryptocurrencies will stay in the headlines. But please be very skeptical of people that claim they know something about the future value of them. Typically in investments, you can select one of two strategies: (1) luck, and (2) build a well-diversified portfolio. This applies also for cryptocurrencies. If you choose Strategy 1, then timing is everything. With Strategy 2, cryptocurrencies are only a part of your total portfolio, and depending on your risk assessment, you adjust the size of that part. Empirical finance research backs a diversified portfolio theory. Timing is often the most difficult to predict with new emerging technologies and businesses. This is certainly true of FinTech. I believe all of the things described above will happen. But it is hard to say how much will happen in 2018. In any case, I would assume we will see changes. The emergence of FinTech will accelerate in 2018. All companies really must build their positions to prepare for the big FinTech race. This post originally appeared on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed