|

Mobile World Congress, Barcelona – February 28 – Startup Commons has released the latest versions of its Digital Ecosystem Infrastructure with full support for mobile front-end services.

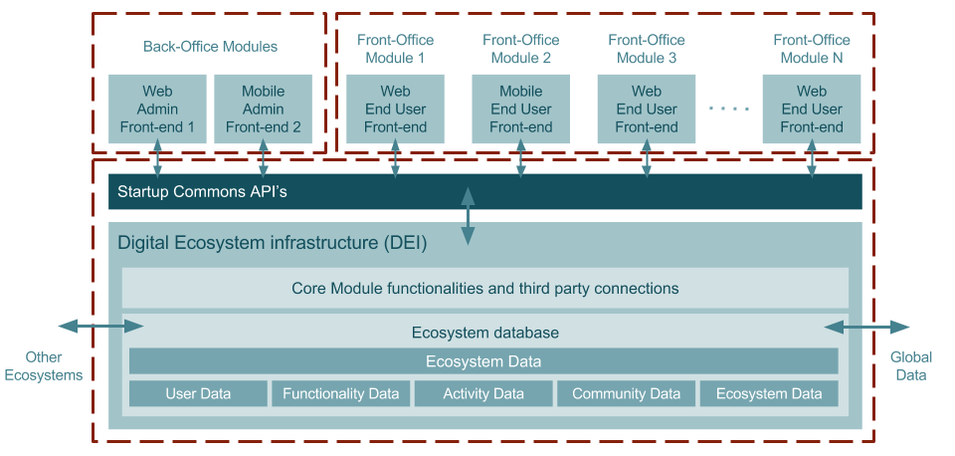

Digital Ecosystem Infrastructure (DEI), the core element of the overall Startup Commons Digital Solution, is an ecosystem management software built specifically for startup ecosystems to automate back office functions connected to user facing front office functions - a suite of integrated modules, applications and views that national, regional and local governments and economic development organization use to collect, store, manage, visualize and analyse data from their startup and entrepreneurship ecosystem activities. “We see increasing demand for our digital startup infrastructure platform, when most of countries, cities and regions plan, how they can better support and develop their growth company and SME ecosystem and also better measure the results and use of money,” commented Óscar Ramírez, Startup Commons CEO today in Barcelona. He continues “Today we announced a support to build mobile front-end services, for example, manage and participate in startup events locally, share and find information and use the local services for entrepreneurs and startups. Mobile services are an important part of startup infrastructure services especially in our fast growing Asian market.” Ecosystem Explore is module of the DEI to provide "one-stop-shop", of real-time information about ecosystem startups, events, services and support organizations directly from DEI database. To visualize the pulse of startup ecosystem functions by startup development phase, location, type and time to help manage connections between all stakeholders. Now this module can be used also in mobile. More information on Startup Commons Digital Ecosystem Infrastructure on http://www.startupcommons.org/product.html About Startup Commons The Startup Commons Digital solution is designed and built from the ground up to serve startup ecosystems - to automate and connect back office functions like community management, CRM, reporting and analytics to user facing front office functions like events, forums, social networks and communications. Startup Commons customers are, for example, national and regional economic development organizations, universities, corporates and entrepreneurship programs in Europe, Asia and North America. Startup Commons is headquartered in Helsinki, with offices in the US and Asia. Contacts: Startup Commons CEO Óscar Ramírez +34 656 180 880 oscar@startupcommons.org Mobile World Congress, Barcelona – February 27 – Crowd Valley Inc. has released the latest versions of its mobile developer tools for building mobile digital finance applications on top of the Crowd Valley Cloud Back Office through its API.

Fintech developers can now access a new set of Software Development Kits, code samples and full developer documentation through the Crowd Valley website, with support for Swift and Objective-C for iOS and Java for Android applications, along with many others such as Go, Node.js, PHP, Python and Ruby. “We have seen how hundreds of new and traditional finance organizations, including banks, now develop new services on the Cloud Back Office and it changes finance services and paves the way for distributed digital services, with open APIs and access through all kinds of devices. Juniper Research has predicted that in 2021, 3 billion people will use their banking services on mobile, tablet and laptops. Crowd Valley enables an easy and sustainable model to build and maintain those services,” commented Jouko Ahvenainen, Crowd Valley Chairman today in Barcelona. Crowd Valley CTO Paul Higgins continues “Mobile services are becoming more important to all finance services, and this development toolkit offers the easiest way to develop mobile services and at the same time guarantee back office services that fulfill finance regulation, security and compliance requirements.” The full suite of digital finance functions that help developers create online workflows for deal origination, investor on boarding, compliance, due diligence, execution and settlement, including online services for KYC/AML, payments, credit scoring and blockchain verification, are now available for mobile developers. Crowd Valley also provides a free sandbox environment for all developers, which can be accessed instantly by signing up online through www.crowdvalley.com. About Crowd Valley Crowd Valley (a Grow VC Group company) provides Cloud Back Office for fintech platforms. Its powerful API is used to build digital finance services such as lending, real estate, alternative asset marketplaces, digital KYC, crowd funding, peer to peer investing for financial services institutions. Its services are in live use by regulated or exempt operators worldwide: the United States, Canada, the UK and throughout the EU, Latin America, South Africa, South East Asia and Japan. The company is headquartered in the heart of San Francisco with other offices in London, New York and Hong Kong. Contacts: Crowd Valley Inc. sales@crowdvalley.com +1 (415) 580 0087 At MWC: Jouko Ahvenainen, jouko@crowdvalley.com, +44 7889 833 165 On February 9 Nokia announced its intention to acquire Comptel, a listed Finnish company. Five years earlier Comptel acquired a data analytics company called Xtract. I was one of the founders of Xtract. We founded it in 2001 and built it to conduct world-class advanced data analytics. This is a story about success with paying customers, investors, revenue growth and exits, but at the same time this is a story about lost opportunities that illustrate the whole telco industry. I hope, for example, the finance industry can learn from this.

In October 2001 a few smart guys and myself founded Xtract. A few founders held PhD’s in developing data models, and at one point we had 13 PhD’s in the company; it really was top-level competence. Our first plan was to utilize self-organizing maps technology to make a new kind of customer segmentation for telcos. We talked with one telco about that for a long time, but it never happened. We started to develop many kinds of analytics solutions (big data as we would say today). In 2002 I studied in the US and one professor told me about social network analytics. One of our scientists also had thoughts about that and it was the starting point for the product that made Xtract globally famous. As a whole we created many analytics solutions including retail loyalty program analytics, credit card fraud detection, targeting in marketing and personalization for banks and media companies, as well as automated insurance claim processing. But it was the social network analytics that was the globally best-known solution. It included solutions for finding influencers (Alpha Users as we called them), followers and potential social network clusters for different marketing campaigns. The concept combined social network, behavior and demographic analytics, and we called it 3D Analytics. It was the time before social networking services. In 2005 we named our product Xtract Social Links and one of our business angels called me and said “don’t use ‘social’ in the product name, Americans can think it is something communistic.” We didn’t get social networking data yet from the Internet, but some telco carriers were interested in using it to find influencers for product campaigns and also to predict churn. It was and still is slow to sell anything to carriers. I remember when my colleague and I met Vodafone Germany the first time in summer 2005 at one conference, and they were interested in what we did. It took about 4 years, many pilots and technical evaluations to get the deal. Some others, like SingTel, were faster, when they used it as an independent system, but then version 2.0 that was integrated to legacy IT was a very long story. Anyway, we started to accumulate telco customers. In 2007 we got the first VC investor, and in 2008 two more. The investors were from Finland and Sweden. It was the time social networking, mobile apps and more data oriented internet services started to emerge. We had different strategic views, especially with the investors and some newly hired management team members. The founders started to be more interested in the internet and social media solutions and related new business models. The investors and some new people (who were actually more senior and came mainly from corporates with Finnish and Swedish telco business experience) liked the telco business. It was thought to be simpler and less risky to sell software to telcos, not to test new business models, data collection and other unproven things on the internet. As a new CEO said to me “never again use the word ‘freemium’ in the board meeting, it is not serious business.” And in early 2007 one of the investors said about our handset analytics app concept that “it is not realistic that people would start to install some apps into their phones.” Telcos had then a lot of plans and opportunities with data. They were sitting on mountains of data. It was also the starting point of mobile apps, and telcos wanted to get a good position in that business. Some telcos, like Vodafone UK, also entered the social networking business. And it was a total failure as most carriers’ plans to open new businesses, utilize data and create ‘value-added services’ have been. We also worked with Nokia, including Nokia Ovi, which was going to be their answer to Apple and Google. Needless to say, they never got their business to work and it also failed. Step by step many founders and core team members left the company (the whole story has much more details, maybe enough for a book, but this is just a simplified summary). The telco business was growing, but very slowly. Some other business still made decent money, but they were not really the focus. Then in 2012 Comptel acquired Xtract. Comptel’s background is especially mediation devices and billing solutions. With the acquisition they wanted to get analytics competence and solutions to offer more value added services in data processing for carriers. Comptel has made a stable, systematic effort to keep it growing and profitable, but hasn’t been a huge success story since the 1990s. Today almost none of real Xtract talents work anymore at Comptel or with telco analytics, they are now working, for example, with the internet, gaming, AI, robotics and finance services. So, in many ways someone can say everything went well, Xtract generated revenue, got customers, achieved the exit and so did Comptel. But, this story is about opportunity costs. It is not only about Xtract and Comptel as companies, but the entire industry. Telco business was a license to print money in the 1990’s. Still in the early 2000’s they had all opportunities, customers, data and a gatekeeper role on their hands. But when Apple and Google created the application business, the Internet really came to mobile the carriers became bit pipes. They couldn’t utilize any of these opportunities. And the same happened to their vendors, because they were tied with the carrier’s position. It useless to talk about the past, if it is not to make things better in the future and utilize all this experience. At least, my five lessons from this for my businesses later have been:

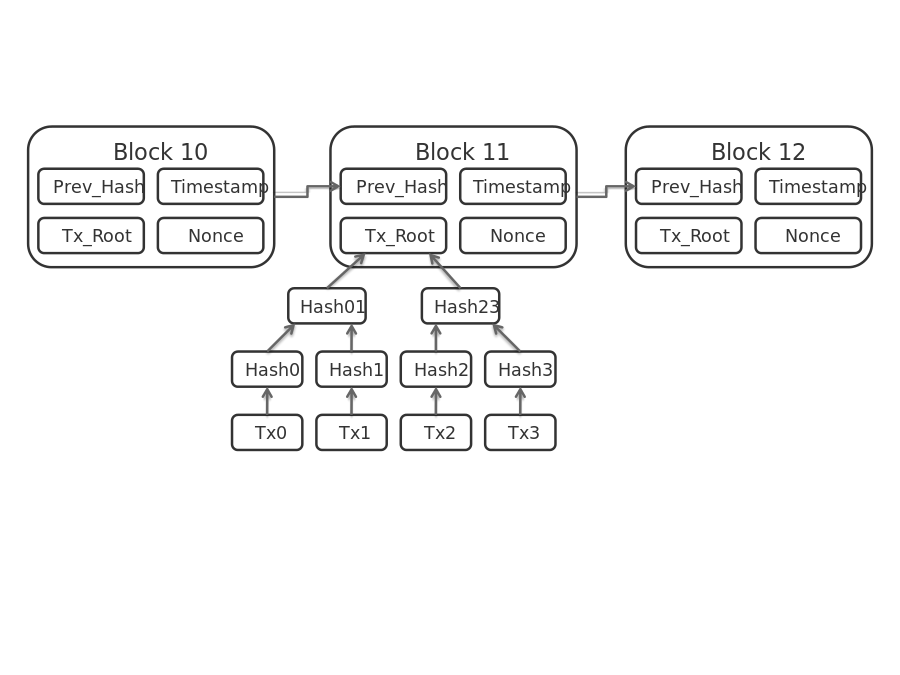

It doesn’t always need to be directly to consumers, it can also be how and what you offer b2b, as Salesforce.com famously did and open API companies do. But if you want to change the market, never make yourself totally dependent on guys who have more to lose if the market starts to change. Hopefully, finance companies and other industries can also learn from telcos and actually do things in another way. Nokia, good luck for telco data processing! This article was first published on Telecom Asia. It is written by Jouko Ahvenainen, Grow VC Group Chairman. There’s a lot of excitement about blockchain and the opportunities it offers the financial services ecosystem, but a lot of work is still needed on bridging the learning curve around actual applications and implications. The very fabric of blockchain, it is distributed, is what makes it both interesting and at the same time, difficult to fit into current structures. Blockchain is technology that lets people ‘sign contracts’ electronically — without the requirement of a trusted third party (such as a government or a lawyer or a bank) to verify the contract as valid and legal. "Signing a contract" could be interpreted pretty broadly. For instance it could mean performing a trade of shares, transferring Bitcoin between accounts, Signing a will, purchasing a coke from a vendor machine, moving a train ticket to your phone and being able to prove you have it or essentially any interaction between people or entities, regardless of industry or action. In the blockchain, every time a transaction occurs, a block of data is added to a digital chain. For example, if person (A) transfers money or information to person (B) this transaction will be logged in the blockchain with a certain code. The blockchain creates trust because a complete copy of the chain, which shows every transaction, is held by the entire network. If someone attempts to cheat the system or steal, they can be easily identified. The concept of distributed presented by blockchain is inherently difficult to grasp. The fact that an online application is distributed between a network of machines, powers technical redundancy and works in its own right to protect the entire system, i.e. the blockchain. However, fitting this into current mandates around central control and governance in the stakeholder ecosystem is complex to say the least. Policy is created on the basis of governance and special access, if needed, to ensure that policy enforcers (for example regulators) can fulfill their own capacity and function. The blockchain offers an unencumbered transparency previously impossible, and a comparable ledgering of transactions to that of the exchange traded assets on public markets. The concept of having a universal timeline of sorts, to companies, transactions and even individuals is an interesting thought process, allowing to trace transactions back to their origin and find the entire value chain that led to a certain transaction. There are clever ways of attempting to harness the positive and mitigate the risks, for example with sophisticated access rights and different layers of information accessible by different stakeholders, yet the ultimate transaction remaining public record. Read the whole article on Crowd Valley News. Photo: blockchain data transaction model (Wikipedia). Recently I looked at Vertu phones in a luxury shop at the Frankfurt airport. They were sold for half the price. I know people who liked them years ago, but now I don’t know anyone who has talked about them, and definitely no one who has bought them recently. I also checked the latest Apple Watches - quite expensive, but not really a popular luxury yet. At the same time Montblanc, Omega and Philippe Patek were selling more expensive normal watches at the same airport. Why it is so difficult to create high tech luxury products? Over 20 years ago in internal strategy papers and management courses Nokia compared the phone market to the watch market. They thought that when the market becomes more mature, it will become like the watch market - people could have several phones, one for work, one for sport and one for parties. Nokia also hired some people from the Swedish car industry, and they liked to talk 10 years ago about how the market is mature and it starting to be like a car market. This transformation never really occurred, because Apple and Google changed the rules before it happened. Now Apple and even Samsung are starting to find themselves in the same situation - they also need to utilize the brand and make higher margin new products. Apple has been targeting the high end of the smartphone market, but it is not really in the luxury brand category. Both of them must now also find new ways to protect their market share and especially profits. Vertu has fired people, some executives have left and the company is also looking for new investors. One could say a Vertu phone is like an Italian sport car, a status symbol and expensive, but not very practical. And someone could add that Italian cars are more beautiful anyway. It looks like its very hard to make luxury mobile phones. I have also seen several plans to create a luxury carrier (or MVNO) that offers personal services, special value and status symbols. But this hasn’t really happened. Why is the watch market so different from the phone market and even from the smart watch market? Is it that smart devices are still such a new market that it hasn’t got the maturity of the watch or car markets? Or is it more linked to the technical development and disruptions in the market that the state-of-the-art technology inside devices is more important than a status brand? Or is it something more common for digital products that it is difficult to create status symbols there and people go after price, usability and usage value? One factor is definitely the technology development, especially the digital and internet aspects that have fundamentally changed how the devices are used and the value they offer to the end users. There are sometimes some ideas to make more basic mobile phones and retro phones, but the reality is that a phone just for talking and text messages would be quite useless now for most users. Technology development would make a phone old in a couple of years. To see the time is a very clear and focused need and watches have become like jewels that are allowed for men too. With digital and online services that value is really in the Internet, cloud and services, not in the device to use them. The device must just offer almost like an invisible access to the actual service. This is why Apple’s great value has been good user experience, why Amazon offers its tablets for very low price and Google tries to manage software in all devices. The access device is a tool, not intrinsic value. It is still hard to say what will be the future developments in digital devices and services, and what could be the model to create luxury brands in those categories. One learning is that the luxury products are typically produced for a very specific need, not multi-function latest technology. People also look for different kind experiences with luxury products than daily tools. Luxury products like expensive watches, coffee machines, pens and cars are typically for special situations, not to compete with products for daily use. Maybe the first thing to do, if you want to a luxury product for the smart digital devices market, is to ignore the mainstream competition totally, not even try to compete with them, and instead find a very specific single need and make a totally different kind special product only for that. This article was first published on Telecom Asia. Photo: HSBC Premier.

2016, a look in the rearview mirror In mid-2016, the marketplace lending sector experienced some turmoil leading to increased scrutiny from regulators and institutional investors’ concerns about the securitization process and the quality of the underlying loans. However, this slowdown was temporary and personal marketplace loans globally grew by 210% (+64% for small business marketplace loans). 2017, what to expect Several trends are to be watched for the year to come, some that were already driving the marketplace lending sector in 2017, and others that emerged more recently: - Partnerships: by nature, banks and fintech companies have different advantages: the formers having an easier access to equity easily and an existing customer base, while the latters provide cutting-edge technologies and a more customer-centric approach. - Technology: the perpetual technical innovations that power the growth of the fintech ecosystem are often behind the success of the marketplace lending sector. - Diversification and consolidation: if most marketplace lending platforms originally specialized in a single niche, they tend to develop their offerings by entering new lines of business, as they grow. - US regulatory reforms: even if the new administration’s upcoming changes to the regulatory requirements have yet to be fully disclosed, its desire to renew the American “entrepreneurial spirit” through the dismantlement of the Dodd-Frank Act (that is seen as a barrier for small businesses’ access to credit) might translate into more flexible regulations for marketplace lenders. Crowd Valley’s framework is used worldwide by both upstart and incumbent lenders, and our team has years of expertise in the field. Any interested party shouldn’t hesitate to get in touch. Read the whole article on Crowd Valley News. Picture: Credit Peers, an example of an innovative specialized lending service.

Siena is a medieval city in Tuscany, whose historic centre is a UNESCO World Heritage Site. Siena is also home to Monte dei Paschi. Founded in 1472, the oldest bank in the world has nurtured an exclusive relationship with Il Palio which is based not only on its philanthropic mission but also on a creditor-debtor link.

Unfortunately, one of the reasons why Monte dei Paschi was rescued by the Italian Government is the huge amount of bad loans owned by some most prominent Italian entrepreneurs. Also for this, Monte dei Paschi’s story has been seen by many as a sign of the decline of the country. However, something new is happening and this comes from the alternative finance sector. Let’s consider, for example, the equity crowdfunding segment. The Italian government, through the Stability Law for 2017, extended access to equity crowdfunding to all kind of SMEs in a move which has been considered to be one of the most innovative and game changing in the European Union. One of its main elements is the strategic aim of funnelling capital into the real economy offering fiscal relieves to investors. This potential is confirmed also by the fact that the sector is still in its infancy and the margins to grow are massive. Indeed, compared to the global industry, Italian share of market counts just for 0.14 percent as capital raised over 2016 equalled 7.7 million euros against 5.4 billion euros on a global scale while analysts forecast a capacity of 67 million euros to be reached in the next future getting to a kind of tenfold increased market share worth 1.2 percent. As a consequence of this, in Italy there are only 7,000 startups while the most entrepreneurial city in the United Kingdom outside London, Birmingham, counted 17,743 new businesses registered during 2016. Nonetheless the number of new ventures created can grow thanks to equity crowdfunding. Since the introduction of web based capital raises, it has proved to be more effective than the traditional channels like venture capital with 57 percent of campaigns reached their funding target with an average of 277.419 euros of capital raised. From the investor perspective, one needs to also consider that traditional investments, nowadays, are not as remunerative as they were in the past. On the flip side, though, significant effort has to be put in to get people more aware of these new investment possibilities. In practical terms, this would mean transforming the potential of the market into reality. In fact, despite the innovation brought into the system by new regulations, other requirements and rules remain unchanged, which continue to act as obstacles for market to flourish. Nevertheless, what has been done until now confirms the interest of the decision maker along with the other players in the scene to support a sector which could trigger a new renaissance for the country as the wealth of nations is still made by entrepreneurs. Read the whole article on Crowd Valley (a Grow VC Group company) News. Grow VC Group Research Paper 1/2017 - Shaping a New World Order

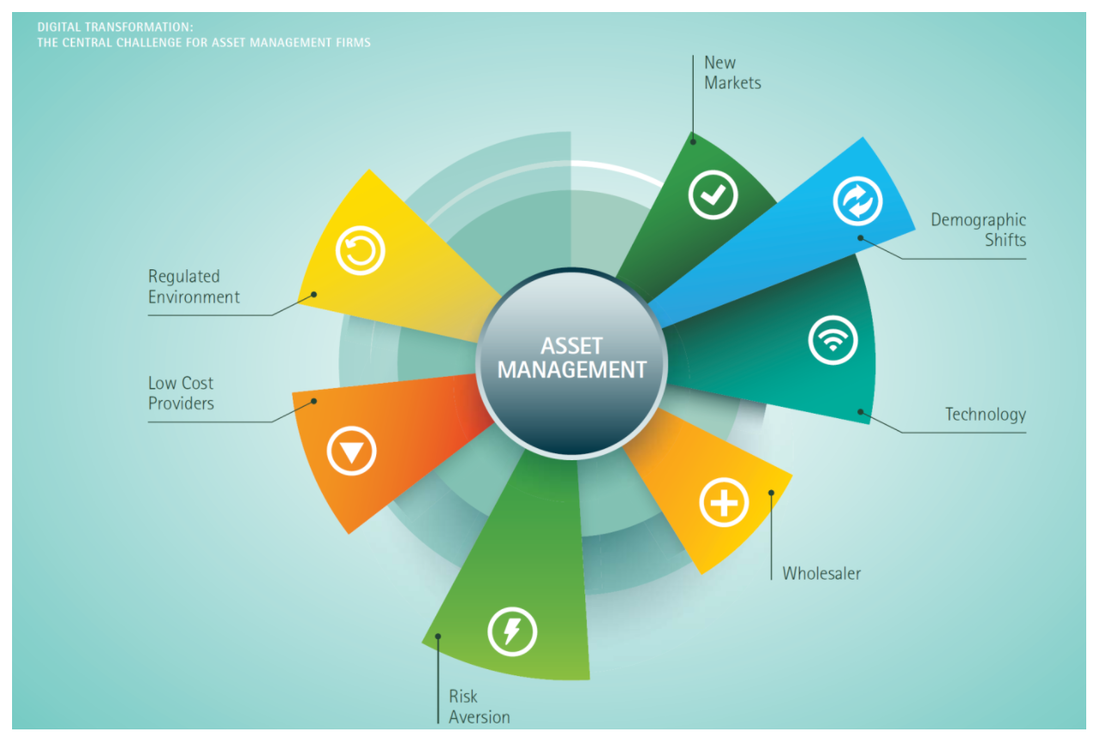

Jobs of 3.5M men that drive cars or trucks in the US are going to disappear through the advent of self-driving cars. Each former driver could get a new job in the future if they moved to China to teach English. Prime Minister Abe gave to President Trump a golf club, when they met in November; it was actually a product of a Chinese company. These stories are just some anecdotes, but they illustrate, how the world is changing. In the past, industrial revolutions have caused political destabilization, new political movements and even civil wars. The United States and the United Kingdom have been at the forefront of economic development since the Second World War. Both countries have benefited from these networks and often seen themselves as leaders in global development, often above all others earned by their struggles and ultimate victory during the Second World War. The rise of Asia has been underway for decades. In contrast to today’s China, Japan never challenged the US in foreign policy and was fully dependent on the US from a military perspective. Last year Chinese companies completed the most international M&A transactions in the world. Asian Infrastructure Investment Bank was a Chinese initiative, but it has now representation from dozens of countries even though the US had a negative initial reaction to it and saw it as an attempt by China to challenge the positions of institutions like the World Bank and IMF. The US has accused China of protectionism and of currency manipulation. At the same time, most of countries or market areas, including the US and EU, protect their own markets through various restrictions, customs policies and requirements for local market approval. Asia is far larger than only China. ASEAN countries have for decades worked for economic cooperation and integration. They were a key coalition in the Trans-Pacific Partnership (TPP) which President Trump has decided to abandon. ASEAN countries have disagreements with China regarding the South China Sea and especially China’s desire to expand its influence in the region. Now the Trump Administration is seeking to challenge China’s position, while opening the door for China to lead economic policy in the region. Automation, digitalization and artificial intelligence are having an increased impact in world markets and fundamentally changing jobs. Artificial intelligence, Turing Machine, already won a war 70 years ago and had been a major contributor to the post-war security and geopolitics new order that we’d been living in until recently. Countries are also vastly different in how prepared they are for the paradigm shift of the machines. Digitalization also changes the face of the economy. It allows the rapid creation of global business with minimal equity. Digitalization allows true grass roots global business, where that was earlier limited to multinational companies. Digitization also raises new political and security questions. One example is data security and privacy. Some people say distributed ledger technology (such as blockchain) will do for finance what TCP/IP did for the Internet – it could change the whole finance world, just as the Internet has changed many businesses and operations since the 1990s. When finance and fintech services become globally distributed, then we can talk about real globalization. When Asia is emerging to be a leading economy in the world, several countries and cities in Asia are also building their future positions. Brexit has an impact on the role of London as a European and global finance center. Emerging economies, intelligent machines, and raise of middle class in the emerging markets are shaping now the global economy, but also all local economies. More democratic finance services should include all people in the world to use them, enable run business and raise funding anywhere in the world, and enable fairer systems to collect taxes and distribute wealth. Read Grow VC Group’s latest research paper that focuses on the mega trends in the world and their influence on finance, fintech and economies. You can get the report here. In recent times, everywhere one turns, disruption seems to impacting every aspect of the diversified financial services space, leaving no sector unturned whether it is in lending, borrowing, alternative finance or investment space. Financial technology coupled with social media input is altering the dynamic of the sector in pushing costs lower while creating a more efficient but equally more personalized user experience for investors and borrowers. The clear winner amidst this disruption and democratization of financial services is the consumer. Disruption has also allowed challengers to pose credible threats to age old traditional institutions drawing customers and funds away from the behemoth institutions. Despite the rampant change in funds flows and business models, a A PwC report from 2016 conveys that asset managers don’t see a significant threat coming from emerging technology, stating that even though many believe that asset and wealth managers will be disrupted by Fintech, industry players hold the belief that they are immune to the disturbance potential of new entrants. When asked about any type of threat, Asset managers were the least concerned. The surveyed industry players believe Fintech will have only a limited impact on their businesses. The primary challenge to the asset management space comes from financial technology developments in the form of robo-advisors and efficiency gains from big data and analytics which are paving the way for cost effective strategies. The impact of technology on the asset management space is particularly interesting because it seems to follow a set cycle for disruption; after leading the way with technology in the 1980s, asset and wealth managers (AWMs) have become dismissive of contemporary technology innovations and disruptions to their industry, which is surprising considering that the current model disrupted the traditional asset and wealth management space. In reality, prices significantly dropped. Eventually, the upstarts introduced new pricing models by splitting advice from transactions – full service brokers started to charge on a fee per asset under management basis versus fees per trade. How does this period of innovation appear unique from the those before?

Since millennials hold just $1 trillion in wealth, with just $250 billion invested (and hold the bulk of the $1.2 trillion in US student debt), traditional wealth managers contend over high-net-worth baby boomers. This represents a huge opportunity to target younger HENRYs—high earners not rich yet. Millennial investors have shown a strong preference toward passive investing. Having lived through two crashes and a steady upward creep in asset prices in the recent environment, millennials don’t believe in beating the market. These millennial investors are tech savvy and conscious about fees. Active investment management is becoming an increasingly tough sell. Demand for index mutual funds and ETFs is accelerating. Digital investment managers use them as building blocks, and digital financial advice platforms tout them as effective alternatives to pricier fund options. As these digital disruptors gain momentum, they’ll contribute to the decline of active investment management. Even those investors who stick with active management could question the conventional wisdom about where investment talent resides, as social investing sites expose exceptionally talented individual investors. Advisors may create the stickiness, but the digital experience and the technology become the enabler to provide an omni-channel experience with the right amount of professional support. This can have a large impact on the economics of the industry as technology can reduce the friction causing high attrition rates and putting the market share of incumbents at risk. A recent PwC survey quoted an asset manager “The organization is not quite sure what to make of Fintech yet.” On the other hand, Fintechs and challengers have evaluate their potential impact for the AWM space extensively and would be looking to either collaborate or disrupt the current ecosystem, which shows increasing amount of assets under management as technology enables greater access and democratization. Crowd Valley’s infrastructure can support both challengers and incumbents embrace the capabilities of financial technology to provide quality digital user interfaces that are robust and accommodate a range of asset and wealth management functions. Feel free to evaluate our offering at www.crowdvalley.com and drop us a message. Read the whole article on Crowd Valley News. Image Source: Digital Transformation: The Central Challenge for Asset Management Firms (Accenture).

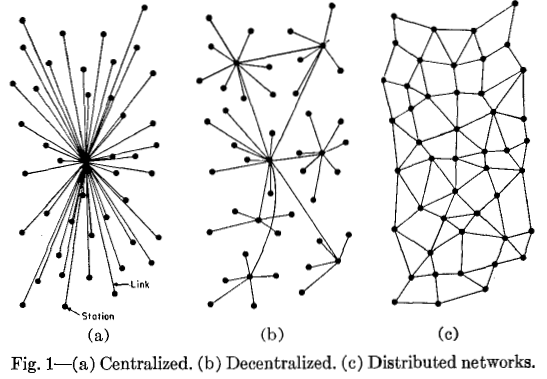

Nationalism and protectionism are rising in some countries, and we see speculation about global trade wars. National governments naturally want to control things as much as they can, especially when it comes to online businesses and services, particularly finance services. But as more and more people and businesses get connected to the internet, the way they interact with each other both inside and outside country borders is evolving fast. From a services standpoint, we are moving from a decentralized world to a distributed world for many services. Finance services are slowly but surely heading in the same globalized direction, and while government regulators may not like that, there’s little they can do to stop it.

E-commerce, social media and low-cost communications services have changed our lives significantly during the last ten to 20 years, but money and finance services have developed slowly in comparison. It’s an area that’s not only heavily regulated but also dominated by old banks that have wanted to protect their positions, as well as expensive services for transferring money or keeping an account. Governments are also very interested in maintaining the status quo for such services when they want to follow the money (e.g. to prevent money laundering or terrorist financing) and collect taxes. Despite that, however, finance services clearly are evolving. Today, we can send money via international money transfer services, and even some chat, social media and email services. (We’re actually seeing speculation that Apple, Google and Facebook could become banks if they so desired.) We also have neo-banks, like N26, that are only in your mobile and bank’s servers. You can open a bank account from many countries without visiting a branch. And then there are p2p and crowd-financing and lending services that enable people to get loans and raise capital from other people and institutions directly. All of this heralds a push towards more decentralized finance services, although most of these services are local (on the national level) rather than global. However we’re already starting to move beyond this decentralization model. Bitcoin and blockchain have been important buzz words in FinTech for a couple of years – more generally, we talk about digital currencies and distributed ledgers. Some people say distributed ledger technology (such as blockchain, which is just one model) will do for finance what TCP/IP did for the Internet – it could change the whole finance world, just as the Internet has changed many businesses and operations since the 1990s. When this starts to happen, we’re no longer looking at decentralized finance services, but distributed finance services. (See this article for a good visual illustration of the difference between decentralized vs distributed.) Distributed finance services enable real p2p, bypassing some parties (like banks) to authorize and control your monetary transactions. It is more like having digital tokens – a huge distributed network can identify your tokens, confirm they are real, and allow you to send and receive them. As one FinTech expert said: you don’t need a credit card, you need credit, and you don’t need a bank account, you need a place to keep your money. What we’re really talking about here is re-inventing finance solutions, whether for investments, loans, investment vehicles, or many other instruments that enable individuals, companies and governments to finance their needs. We still need finance services, back office functions and applications, but they don’t need to be as old as our finance institutions. Blockchain is admittedly a somewhat overhyped term. Banks use it for their internal database solutions – but that is not really what “distributed” means. We already have a lot of open API solutions, p2p services and cloud-based finance back-office services – very concrete components to build new solutions for distributed finance. But we still need to see some development with distributed ledgers to make it real. But this brings us back to the earlier point about protectionism and border control. How can we see a more distributed finance world if governments that want to regulate finance services want to take more control? Well, we know from our experience with the internet (which, again, is based on TCP/IP, an open standard) that it’s not easy to control things when people have easy low-cost access to them. Of course, some countries respond with national firewalls, and they can slow down development – but they cannot stop it, whether because of political pressure on finance institutions or younger digital-savvy generations who have no patience for old-fashioned solutions and will seek out services that make sense to them. At the very least we will see distributed finance solutions appear within country borders. This will be a huge challenge for national finance regulators, but perhaps it’s the incentive they need to think of new ways to collect taxes and manage fiscal policy. Despite all the idealism about bitcoin and blockchain, the finance sector will probably still develop more slowly compared to other areas, and there will always be some form of regulation in the future. But we have enough evidence to conclude that nothing will stop this development. It is just a matter of time before distributed finance services hit the mainstream and replace old services. Those old services won’t completely disappear – we’ll still have them just as we still have circuit-switched phone calls today. But when finance services become globally distributed, then we can talk about real globalization. This article was first published on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed