|

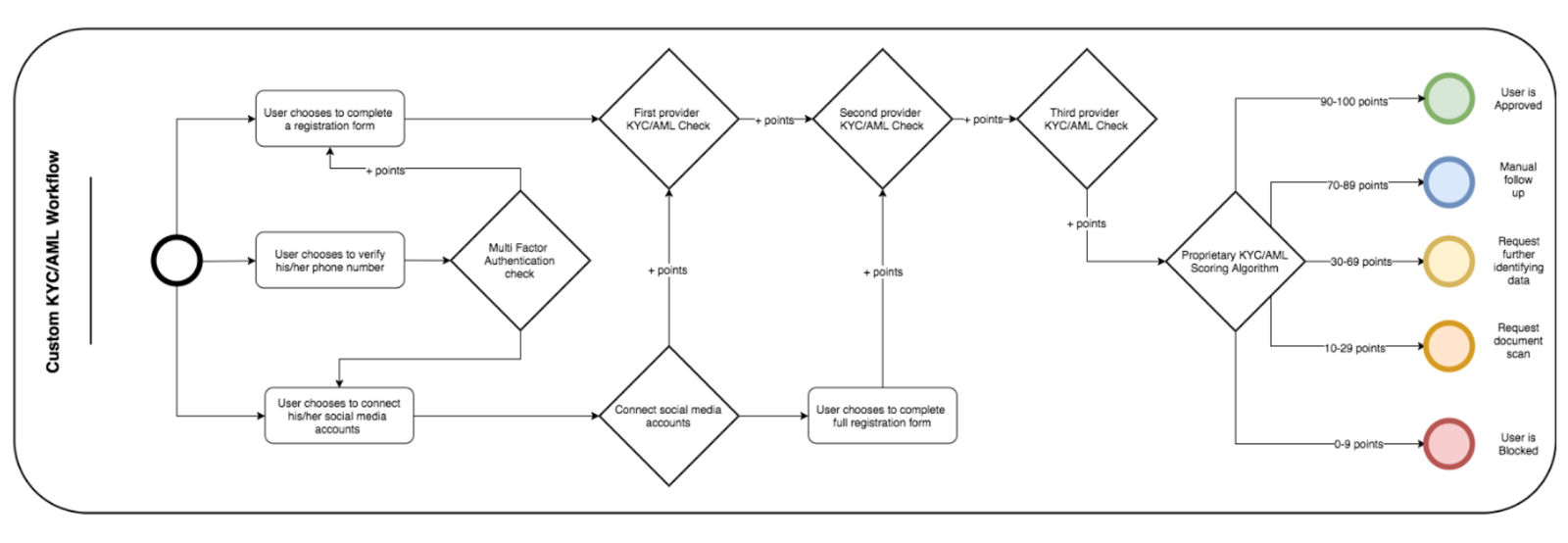

The adoption of open APIs by banks and financial institutions has been steadily growing, as has the ecosystem delivering these services. Companies providing KYC products rank among the most well established services to help financial institutions cut cost, increase scalability and help comply in a more scrupulous regulatory environment. A Thomson Reuters global survey reveals that banks are taking as long as 48 days to onboard a new customer. Also, the banks are spending in excess of $60 million per annum on KYC and client onboarding.

Although newer more dynamic platforms process KYC in an automated fashion, most financial institutions still handle KYC verifications manually. Manual verification is cumbersome and error prone. This is more true as institutions scale, adding further compliance officers compounding the problem at hand. Outside of basic requirements, Booz Allen Hamilton estimated compliance failure costing firms $13.4 billion in 2014. When taking a practical approach to deploying automated KYC workflows using open APIs into financial institutions, they need to support both technical and operation members. Technical teams are burdened with ancient core banking systems that are costly to service and as time passes, more difficult to do so. The cooperation between Fintech and financial institutions allow these technical teams to leverage cost effective solutions when compared to building and managing new infrastructure. They also vastly increase time to implement systems from an average of more than 36 months down to a period of 8 to 12 months. Making systems future proof, scalable and cost effective is a core concern being addressed by open APIs. Operational teams are focused on workflow efficiencies and the bottom line. KYC APIs allow the compliance officers to be more productive while decreasing headcount. Officers are able to monitor rather than process, needing a light touch on most onboarding workflows. Better reporting, record-keeping and the near complete reduction of manual paper work can reduce compliance failure. Decoupling the rise in deal flow with the increase of headcount allow financial institutions to scale more efficiently while mitigating compliance failure. We at Crowd Valley support both technical and operation teams migrate legacy systems into an open API environment. Technical teams can leverage our Bank grade Cloud Back Office connected to global KYC providers to efficiently launch compliance workflows into their core systems. Operational teams leverage our global reach where we have helped more than 130 institutions navigate the use of open APIs and industry best practise. If you are looking to capitalise on KYC efficiencies within the Fintech space and would like to discuss this further, please do not hesitate to get in touch with us. This post originally appeared on Crowd Valley Blog. Fintech is growing at an astronomical rate. According to Bloomberg, more than $8 Billion has been raised in Fintech so far in 2017. Also, 5 companies have already joined the “Unicorn” status with values over $1 Billion. We have compiled a list of best Fintech reports for 2017, from some of the leading names in the industry. Fintech Reports: 1. Capgemini - The World Fintech Report 2017 Traditional Financial Services firms acknowledge the impact of Fintech on the shifting industry landscape and are confident of their innovation strategy, but they are struggling in successfully applying innovative Fintech-like capabilities to achieve tangible results. Capgemini explores some of these key issues in its World Fintech Report. 2. PwC - Global Fintech Report 2017 According to PwC, Fintech and Financial Services are competing less and coming together. PwC explores the Fintech’s growing influence on Financial Services in its Global Fintech report. 3. EY - Fintech Adoption Index EY states that Fintech has reached a tipping point.In its report, EY surveys more than 22,000 digitally active consumers which highlight the impressive and rapid growth in adoption and the variations among 20 different mature and developing markets. 4. KPMG - The Pulse of Fintech Q1 2017 | The Pulse of Fintech Q2 2017 In these reports, KPMG explores global trends and deal activity within Fintech industry including how the recent adoption of the Payment Services Directive (PSD2) is driving the Fintech activity in Europe. 5. CBInsights - Global Fintech Report Q1 2017 | Global Fintech Report Q2 2017 A comprehensive Fintech report by CBInsights which includes data-driven look at global financial technology investment trends, top deals, active investors, and corporate activity that took place in 2017. 6. Deloitte - Digital transformation in financial services Deloitte’s new study reveals that to become fully digital enterprises, many Financial Services firms may need to shift the focus inward and innovate the employee experience. 7. StartupBootcamp - The State of Fintech in 2017 This report draws out parallels seen between general technology trends on a macro scale and correlates them to the impact on Fintech. Insurtech Reports: 1. PwC - Global Insurtech Report 2017 This report is based on the responses of 189 senior Insurance Sector executives from 40 countries who participated in PwC’s Global FinTech Survey 2017. 2. Capgemini - Top Ten Trends in Insurance 2017 This report explores the two driving forces behind the insurance industry; Connected technologies and data analysis. 3. Accenture - The Rise of Insurtech A wave of startup-driven innovation is putting insurers’ approaches to innovation and technology under the spotlight, highlighting the challenges these traditional companies often face. 4. EY - Global Insurance M&A themes 2017 The increase in large deal activity could be interpreted as a sign that insurers have decided to get on with addressing their strategic priorities, despite ongoing global uncertainty. EY explores the shift in the insurance industry and adoption of Insurtech. Banking Reports: 1. Capgemini - Top Ten Trends in Banking 2017 This report aims to understand and analyze the trends in the banking industry that are expected to drive the dynamics of the banking ecosystem in the near future. 2. Accenture - Banking Technology Vision 2017 This report highlights the five trends identified in the Accenture 2017 Technology Vision that underscore the importance of focusing on “Technology for People” to achieve digital success. Payments Reports: 1. Capgemini - World Payments Report 2017 Get a preview into the Global Payments Landscape in 2017. 2. Nordea - Future of Payments Get insights from customers, partners and experts from Nordea, PwC, SWIFT, SAP and FIS. Artificial Intelligence and Blockchain Reports: 1. CoinDesk - The State of Blockchain (Q1 2017) This report includes the activities, speculations and trends in cryptocurrencies like Bitcoin, Ethereum, etc. and the Initial Coin Offering (ICO) ‘Gold rush’. 2. McKinsey - Artificial Intelligence, The Next Digital Frontier In this independent discussion paper, McKinsey experts examine the investment in artificial intelligence (AI), describe how it is being deployed by companies that have started to use these technologies across sectors, and aim to explore its potential to become a major business disrupter. This is certainly not an exhaustive list in itself, so feel free to suggest any Fintech reports, which are easily accessible, that you feel should be included above. You can also check out our post on the Top 20 Fintech Blogs to follow in 2017 and some of the Best Fintech Events and Conferences in 2017. This post originally appeared on Crowd Valley Blog. "A decade ago we had the first big leap, and that was web to mobile,[…] Now the next one is mobile to conversational” said Edrizio de la Cruz, co-founder and CEO of Regalii, a startup whose application programming interfaces are used by dozens of financial services providers to build their chatbots. The pressure today to innovate and embrace new technology and practices is significant across a range of industries with financial services at the epicenter of the pressure but research by Econsultancy and Adobe shows that 9% of FS businesses claim to be digital first, compared to 11% across all sectors. Alongside the drive to embrace digital, there is additional pressure from the market to:

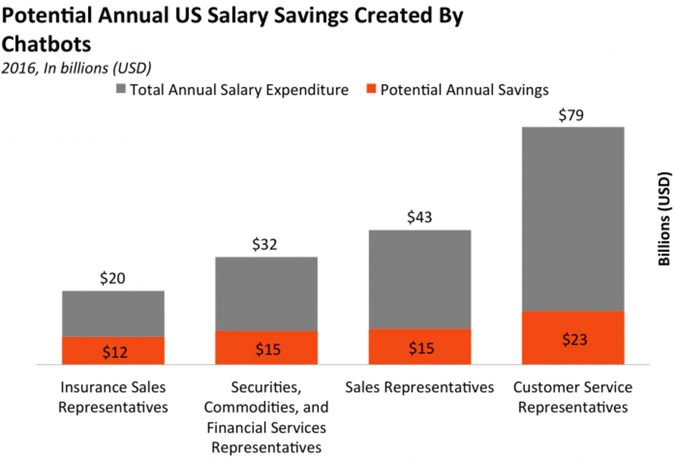

So, chatbots? Chatbots are essentially pieces of software that simulate human, natural language conversations and can respond to and act upon queries and commands from users. The advantage these systems have over a real conversation with a human is that they are able to extract and analyse a user’s needs and intent and ultimately return the information a user has requested or perform actions for them faster, at any time of day or night and at significantly lower cost than a human counterpart. The benefits of this type of technology are clear with many people choosing to apply and research investments or loans through these types of systems rather than spending the extra time and potentially cash on a human broker that may not necessarily have the best deals available. These systems could potentially pave the way to a fully automated digital process, further removing the potential for human error and bias from financial services. An apt example would be Capital One’s Eno. Eno is able to interpret text based conversational queries and commands alongside emojis. This includes the ability to check balances and pay off credit cards, while cash transfers are also in the works. Additionally for customers with Amazon Echo, Capital One has also built out a skill that allows for voice commands. At the business side, Capital One stand to make significant savings in terms of time and manpower as users transition from face-to-face and telephone queries to simply asking Eno. This is only one form that chatbots have taken on so far with the sky being the limit on the functions a chatbot might serve. Other options include:

Furthermore, chatbots do allow for a smoother digital experience overall with the ability to sync with popular applications such as Whatsapp and Facebook messenger, removing the need for an additional download that may alter existing mobile usage patterns. This interface could be instrumental in data analytics as well in improving operational efficiency, promoting innovative practices and improving the customer experience. Banks usually have a mountain of customer data at their fingertips, but often struggle to understand and get value out of it. Customer data is the key to establishing meaningful, personal relationships with banking customers and offering customized products and experiences. Banks need to effectively analyze this data to better know and serve their customers. Conversational banking enables banks to acquire more nuanced customer data. By engaging customers in small talk through conversational interfaces, banks get insight into customer intents, desires, and concerns that are not apparent in banking app and website interactions. Conversational AI can also help banks better understand this data. Through deep data analytics, pattern recognition, and predictive algorithms, chatbots can communicate intelligent insights about banking customers’ present and future banking needs. These insights can be used to offer more personalized banking products and services to build lifelong customers. There may be concern that chatbots and other AI supported technology will put significant pressure on a number of customer facing services across a range of industries due to the attractive operating margins and this is certainly true but this is analogous to the widespread worry at the time when motorized options replaced horses, a slew of new roles develop and grew out of the adoption of a new technology. An August 2016 report by Forrester suggested that banks should focus on developing the AI technology to build better bots in the future, rather than launch bots on messaging platforms now and provide poor experience to their users. The main criticism against chatbots is that they lack the empathy and the emotional response that a human can provide, which makes them less capable of dealing with complex situations involving financial decisions. Generally speaking, humans working in customer services will know how to respond to frustrated customers and not aggravate the situation; they can listen, reason, empathise and read between the lines. A lack of emotional intelligence is a serious limitation that existing bots have. There is definitely a whole new world out there to explore in considering chatbots as an investment for your own business or in a third party capacity through a promising Fintech firm but there is a degree of risk in this relatively nascent space with regards to meeting customer requirements and security. There is potential for significant secure data being shared with these interfaces as clients address their needs. In addition, Forrester (2016) found that although chatbots are developing rapidly, customer experience is not. Many fail to effectively meet users’ needs due to poor infrastructure and lack of fundamental understanding of AI. Hence it is imperative to work with institutions that have the infrastructure to support your venture effectively on the front end as well as on the back office. This post originally appeared on Crowd Valley Blog. Source: http://www.businessinsider.com/chatbots-are-coming-to-financial-services-2016-8?IR=T

In between pauses at the WWDC, Apple announced it will be expanding their financial services strategy by going beyond Apple Pay and issuing virtual payment cards to all iOS users. There are 1bn iOS users around the world. At the same time, this same week Amazon made headlines by having lent over $1bn to third party sellers on the Amazon marketplace. Amazon has also rolled out a highly aggressive credit card offer with Chase, which offers 5 per cent cash back for its Prime customers. Neither company is a traditional financial services company. So what is going on?

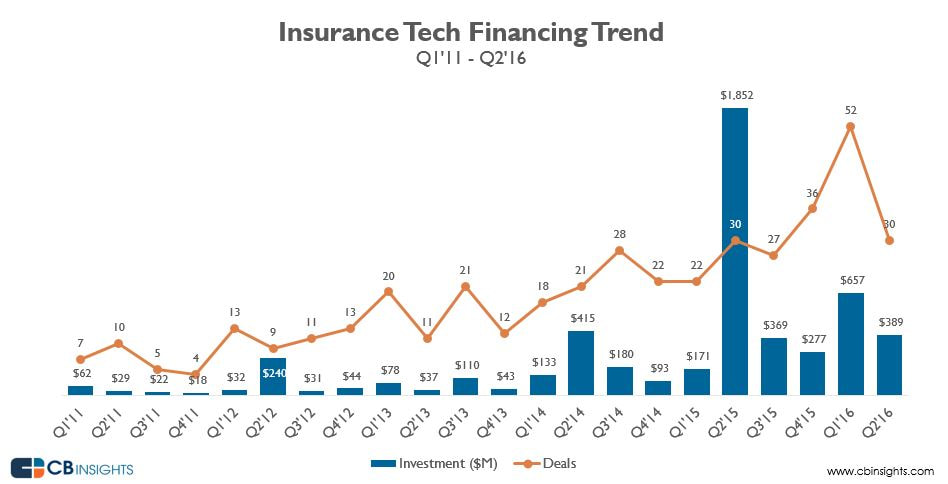

Due to complexity and benefits of scale, banking has historically been confined to incredibly large companies and their global operations. Sure, some are stronger in some segments or regions, but this is the broad definition of an incumbent sector. What technology has allowed over the past years is the specialization of software and therefore service providers. No longer do you have to have one stop shops for everything in finance, you can actually challenge high margin verticals, e.g. payments or foreign exchange, with a standalone business in just that market segment. Policy changes such as PSD2 play directly into this trend, setting requirements on financial institutions to open up their infrastructure in order to allow third parties access to their core processes. With globally interconnected institutions, the race into API Markets is well underway, with organizations such as BBVA, DBS, US Bank already far along. With these trends ongoing, we also find many new organizations entering finance, such as Facebook, Google and Amazon, as mentioned earlier, with a lot of personal data and connections to billions of people. It creates a perfect setting to offer a financial service, when the habits of the individual or merchant in question are known and the service, e.g. a loan can be offered at the point of the transaction in near real time. The $1bn loans issued by Amazon is a testament to this, but so too is the fact that you can send money via Facebook Messenger at the click of a button (at least in the US). Financial services are becoming increasingly embedded. The digitalization of finance is a wide-ranging theme. In addition to the companies discussed above, established banks are also modernizing their products and services, or how these products and services are offered. It seems there are two ongoing trends in different directions: 1) toward more integration of financial products in non-banks and 2) toward specialization within financial institutions. The latter may be less prominent, yet with PSD2 and pressure on margins, institutions will likely need to choose the businesses they want to invest and compete in. What is a bank? Is a bank where you place your money? Is it where your home mortgage comes from? Is it where your wealth advisor sits or who sends your payment remittance? Through specialization and an embracing of the API economy, we can expect that the future consumer will have several parties that serve their ‘banking needs’. Some of these will be companies like Amazon through the increasing position and information they hold in the market and some will be traditional banks such as Wells Fargo. Fast forward long enough, and it becomes an interesting thought experiment. Which grows in prominence, the higher margin specialized businesses or the one stop shop business that also faces the highest level of regulatory scrutiny? One thing is however certain, our concept of a “bank” is quickly becoming outdated. The bank emerged during the industrialization and has had a central role in shaping societies. Are we at a different point in history where the next paradigm shift sees information technology giants as playing a further pivotal role in shaping the societal development and if so with what implications? The “embedded bank” seems like the direction of the future. Embedded in points of interaction and specialized services, riding on the API economy and truly integrating into the customer’s life and habits, rather than serving as an interruption. How we get there is a true technological adoption across the sector over time, that places the consumer in control of their data and privacy and allows for real time decisions at the consumer’s fingertips. This post originally appeared on AltFi. As the senators in the United States Congress maneuver a health care bill of massive significance for the insurance industry, let’s a take a closer look at the wave of disruption that has firmly placed the insurance industry and Insurtech in the spotlight of the cross industry technological wave borne out of the great recession. Insurtech joined the party at a later stage than its related counterpart Fintech. Given the revenues volumes and investment flowing into both these sectors, in 2014 insurance premiums amounted to $3,8 trillion while banking revenues were $3,6 trillion, it does come off, initially, as a surprise but a closer look at consumer relationships and regulatory changes in both spaces do provide an answer. In considering the early uptake of Fintech or Bankingtech; first, insurance is a very passive product. Ideally, consumers have limited contact with their insurance provider , because ideally nothing goes wrong. Around 70% of all insurance customers interact with their provider only once a year or less. In comparison, the study states, consumers interact with banks 200 times per year on average, compounding the level of dissatisfaction and frustration. Furthermore, the wave of regulatory changes introduced after the 2008 financial crisis, forced the banks to put massive efforts into adapting to the new rules. Financial regulators, most notably the American Department of Financial Services (DFS), the Fed, and others, started investigating banks more closely and burdened them with heavy fines, as well as more compliance enforcements. This forced the banks to restrict their business and shift resources, opening up a tremendous opportunity for innovative startups in the banking industry, from non bank lending, because banks could no longer provide enough capital, to consumer friendly apps and efficient payment solutions. The dissatisfaction with the banking sector on issues of inclusion, transparency and consumer agency further prompted a significant exodus of talent from the banking sector and related financial services to pursue solutions to these issues. The insurance sector encounters the same issues but due to relatively limited exposure, focus and the passive nature of consumer engagement, did not experience the same forces of change that both the public and regulators demanded on financial services. Fast forward a few years down the line, according to data from CB Insights, global Insurtech investment totaled $1.7 billion, across 173 deals, in 2016. Both those numbers are roughly double what they were in 2014. In terms of total investment, 2015 was actually the bumper year to date, at $2.7 billion, although $1.4 billion of that was due to two mammoth investments, the financing of Zenefits and Zhong An. In January 2017, investors from around the world were asked what the hottest area for investment in Fintech and the same sector kept coming up again and again: insurance. At the Economist Finance Disrupted conference in London in January, three out of the four VCs on the panel "Unicorns vs. Unicorpses" named insurance specifically when asked what was of most interest to them as an area for investment. The sector was name checked by Yann Ranchere, a Geneva based partner at Fintech VC Anthemis, Reshma Sohoni, the CEO and cofounder of early stage UK fund Seedcamp, and Timo Dreger, a managing director at Berlin based Apeiron Investment Group. All the panelists offered up other areas of interest, such as optimising banking backends and artificial intelligence, but somehow the conversation kept returning to insurance. Dreger summed up it up well, telling the audience: "Right now we are looking at Insurtech. It's for sure the hottest thing in 2016 and for sure the hottest thing this year too. The answer is pretty easy why. In the whole insurance industry, there's a lack of innovation and the user experience is pretty horrible." Rachel Botsman, a recognized expert on digital technologies and visiting academic at the University of Oxford, says, “the insurance industry is ripe for disruption”. Botsman has made this statement on the basis of her theory of collaborative consumption that identifies four root causes that are putting the insurance industry at high risk for disruption. Our first cause is the complexity of the experiences people have in engaging with insurance providers, with the processes consumers have to go through are usually far from user friendly, entail a lot of paperwork and are cumbersome. Compared to earlier, this is of more significance as the Fintech space is significantly more saturated with startups addressing pain points as well as institutional funding backing these ventures. Hence, both increasing inefficiencies and opportunity for investors to get in at an early stage in an unsaturated environment have placed Insurtech in the spotlight. The second cause is the lack or the low level of institutional trust in the entire system. The global financial crisis is often pointed out as a reason for this lack of trust, but there are two other major drivers. First, there is a lack of transparency in the insurance industry which creates uncertainty and dissatisfaction for consumers in accepting policies that protect their assets and lives. Second, peer trust is preferred above institutional trust. The third stated cause is the concentration of inefficient intermediaries which hinders the ability to operate and react in a lean and agile way due to the longevity of the relationships existing with these middlemen. Customers experience these layers of intermediaries as something that ultimately does not add real value to the product, although they account for an estimated 15 to 20% of the average P&C insurance premium. This is tough obstacle to overcome for the traditional insurance industry, which has focused on distribution through brokers, financial advisors and more recently comparison sites, and typically lags behind other industries in its ability to provide seamless, multi channel customer experiences. Botsman’s fourth cause is the limited access to insurance. Exclusivity echoes as a core issue for scores of individuals as insurers change policy conditions and premiums at their discretion, pricing out thousands of the ability to get coverage in both a partial or comprehensive manner. As a result, in the last few years, Insurtech has started to steal revenues and increase market share, by addressing these pain points with technology, pushing overall costs lower and thus premiums lower as well as introducing new models that promote trust and transparency such as Peer to peer insurance models and blockchain based infrastructure. These new avenues are making insurance companies uncomfortable in holding onto their legacy systems, principles and models. Insurtech Trends So, what kind of technologies do these challengers invest into? McKinsey’s 2017 global digital insurance report sheds more light on this matter. It shows that 85% of insurtech firms are focusing their innovation efforts on one of the following six domains: 1) Software as a Service (SaaS) & Cloud Computing - 21% 2) Big Data & Machine Learning - 20% 3) Usage based insurance - 13% 4) Internet of Things (IoT) - 12% 5) Digital insurance & Robo-advisory - 10% 6) Gamification - 9% Other top ten innovation domains include more complicated and comprehensive themes such as the usage of blockchain technology, peer to peer insurance, and the improvement of micro insurance through the use of technology. A slew of smart startups have sprung up and are attracting heavyweight financial support. They include US companies like Zenefits, Oscar Health, Clover, Collective Health and Gusto (formerly ZenPayroll) as well as Chinese innovator Zhong An. Agile companies are using digital technology to leap frog competitors by delivering highly personalized online customer services and creating new, lucrative markets that are bringing more consumers into the space via the digital medium. To develop our understanding of the energy and interest in the Insurtech space, it is worthwhile to review the reports PWC’s collaboration with Startupbootcamp through their Insurtech programme and fast track events. Aligning with the sentiments echoed within Botsman’s statements, the largest volume of applications to the Startupbootcamp programme came from startups aiming to enhance the quality and frequency of insurers’ interactions with customers and, as a result, to build more trusted relationships with them. (Botman’s second cause). It reflects the evolution of the broader digital economy, where customer expectations are constantly increasing in a cross industrial manner set off in a domino style fashion by rapid Fintech growth. Consumers want the same levels of service and engagement from other businesses, including insurers. They want to use their smartphones and digital devices to secure insurance that is customized, priced right and employs easy to use payment solutions. The latest annual survey conducted by Engine, the service design consultancy, ranked insurance as the worst of all industries for customer experience. Startups recognise this issue and are well placed to exploit it. Unburdened by complicated legacy processes and technologies, innovators do something quite powerful in going beyond just digitizing existing interactions; they combine digital with the human touch, often using technologies such as artificial intelligence (AI), machine learning and robotics, utilizing more and more data to understand their consumer base on an individual level allowing for a personalized solution versus a general broad spectrum approach promoted through intermediaries in a scripted manner. The need of the hour seems to be adaptation and customization and this bespoke approach is where a lot of institutional investment is flowing. But this raises an interesting question about the fundamental nature of the insurance industry and the principles on which its models function. The fundamental age old purpose of insurance is to allow people or companies to pool their risk, thereby obtaining relative safety (from unfortunate or unforeseeable events) in numbers. But personalisation is gradually allowing us to de-pool that risk. Insurers are starting to understand, at an increasingly personal and forensic level, which policyholders might be more prone to unfortunate or unforeseeable events and to price accordingly, or to refuse cover altogether. Hence, through Insurtech, we may be embarking on a path that espouses a fundamentally different approach to insurance overall that may result in a model that is more punishing to those who, for example, are bad drivers or those of us who don’t make sufficiently regular use of our gym memberships and thus more rewarding to those who are considered lower risk. This dilemma will increasingly feature as avenues such as the Internet of Things gathers greater traction connecting more devices in our lives in a constant flow of personalized data with a prediction of 20.8 billion connected devices in use worldwide by 2020. Large companies, both from within insurance and beyond, are already investing in Internet of Things technologies such as Generali, Aviva and Allianz, as well as Google. Insurtech Innovation Using a variety of approaches such as online aggregation and comparison, self service, new distribution channels, education and engagement of customers and omnichannel offers, startups can enable ongoing engagement that leads to trusted relationships. In embracing new paths, while AI has previously been seen as most useful to underwriting, its application in distribution is helping insurers increase conversion results. AI and robotics help insert a human characteristic into what might otherwise be an impersonal digital experience. Robo advice, including applications of AI, is now starting to gain traction in insurance. Robo advisers provide customers with 24 hour access to information that empowers them to take financial decisions at a much lower cost. Meanwhile, some 7% of applications to Startupbootcamp also came from peer to peer insurance startups. And reflecting on the earlier mentioned statement that consumers are now placing greater trust in peer ventures versus institutional set ups, these ventures have the potential to both disrupt the status quo and improve the image of insurance. Built to deliver trust and transparency, they address these key concerns of many customers today. Peer to peer insurance businesses are now beginning to take off. Examples include Lemonade, which recently raised a $13 million seed round, Guevara and Friendsurance, which is growing at 20% a month and has plans to expand globally. The model is tough, however, as it is much more capital intensive than other types of Insurtech startup. It may take time for customers to get to grips with the concept of peer to peer in insurance, and for startups to prosper. At the ground level, P2P insurance refers to a set of practices and models which, through technology and community, allow individuals and companies to get together in order to diversify and mutualize common risks. In a way, Due to long value chains prone to friction, high overhead costs, and a lack of transparency for the end customer, these market failures and frictions result in higher premiums being borne by insured parties, while displaying a lack of transparency and agency by the consumer. By redefining the traditional insurance structure, P2P insurance aims to eliminate some of these frictions, and to remove the inherent conflict of interest (between the insurer and the insured) that arises during a claim. P2P insurance is now growing quickly. 2015 was the real ‘lift off’ year, which saw 16 launch announcements from P2P startups. That’s more than during the previous five years combined. As the momentum has built up, so the P2P models have also evolved: from broker or distribution only models (where the P2P firms simply group people together based on their insurance needs, and then arrange for a traditional insurer to cover the group) to carrier models (where the P2P firm looks to cover some or all of the risk themselves, and not necessarily as formally underwritten insurance). Moving Forward on Insurtech In moving forward, efficiency and skill specialization becomes of increasing importance. By increasing the efficiency of insurers' back office processes and systems, these startups have the potential to enable insurers to operate more profitably at greater scale. Such efficiency can be most easily achieved through collaboration with API based infrastructure that allows existing system to supplement their current infrastructure with new plug in systems that can act as a concierge of sorts for boosting data aggregation, analytics, fund transfers and even creating peer to peer marketplaces or incorporating blockchain technology. There are a number of firms in this space that are establishing themselves. Crowd Valley is an industry agnostic pioneer in this regard that is able to offer a very robust set up for its clients across the globe. In contrast, the cost of developing and implementing proprietary new systems is quite prohibitive. As we move forward, newer technologies such as AI, Internet of Things, the sharing economy and blockchain technology will push the boundaries of modeling effective value chains and revenue streams across the board, highlighting an accelerated form of the natural process of disruption in a sector that is very due for change. Information proliferation and education play an even greater major role in these times. Almost a third of insurers in PwC’s research said that they are not familiar with blockchain at all. The Insurtech firms, by contrast, are eyeing this opportunity. But it also presents much more exciting opportunities for insurers to leverage their deep industry knowledge to not only assess the viability of these emerging use cases but also to identify other opportunities where it may be possible to measurably improve efficiency and transparency, particularly in back office operations. There’s growing recognition across the financial services sector that, whereas banking and capital markets may have started their Fintech journeys earlier (and built up a considerable weight advantage), it will ultimately be the insurance industry that sees the most benefit, and the greatest levels of disruption, from this global upsurge of innovation. This post originally appeared in Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed