|

Vietnam has a huge young population that is very active on internet, mobile and with highly national enthusiasm for technology, startups and entrepreneurship, and as a result, vietnamese startup ecosystem is rapidly growing in cities like Ho Chi Minh, Hanoi and Da Nang, aiming to become a modern industrialized state by 2020. In order to achieve that, the national government has planned to develop a functioning national innovation system, fostering its startup ecosystem and supporting the growth of innovation via Startups and SME's. The project has set the following targets for 2020: Complete the main legal framework for a startup ecosystem; run an online portal for the National Innovative Startup Ecosystem; support about 800 startup projects and 200 startup enterprises, of which 50 will raise follow-on investment from private venture investors or will undergo mergers and acquisitions worth about 1 trillion VND (about 50 million USD). By 2025, the project is expected to have supported 2,000 startup projects and 600 startup enterprises, of which 100 will have raised follow-on investment from private venture investors, or will have undergone mergers and acquisitions worth about 2 trillion VND. One of the key challenges in this work is to maintain a holistic picture of the constantly developing and evolving ecosystem and measure the results of different actions and sub projects and to share these openly for the benefit of everyone in the ecosystem.

Startup Commons team, due to our proven international track record on startup ecosystem development, supporting tools and holistic digital ecosystem solution used by ecosystems, was selected to carry out this national pilot project. The collaborative work for Vietnam digital ecosystem is being conducted step by step in very transparent manner to achieve consensus and solid progress within the key stakeholders of innovation ecosystems and it has been splitted into three different phases:

As we are moving to actual pilot phase to implement digital ecosystem solution in Vietnam context, by setting up the base version with geographical scoping in Da Nang, Hanoi and Ho Chi Minh ecosystems, along with Vietnam national ecosystem to showcase these local startup ecosystems and Vietnam as a whole also for further deployments, implement related communication framework and roles to support the platform at core level, define needed key operative roles needed to support the development and management of the different ecosystem functions at different levels, train and empower local teams and people to key roles to take “ownership” of the key functions, showcase how platform implementation and different development tracks can be managed to further accelerate the progress, and support in finding a good balance for PPP (Public Private Partnership) regarding the digital platform in different cities going forward. And eventually, to pass on the ownership and core responsibility of the platform the logical entity, entities or consortium to conclude the pilot phase. Read the whole case study at Startup Commons Blog. In the wake of the Brexit, European financial hubs are competing to attract London-based firms looking to relocate in order to ensure the stability of their operations. If the true impact of the Brexit on the Fintech sector cannot be accurately predicted at this point, actors like money-transfer and payment companies might be tempted to move from London to another European city, which could guarantee a more stable political environment.

In the words of Valérie Pécresse, President of the Ile de France Region (in which Paris and the financial district of La Défense are located): “The sensible choice [for businesses] is not to stay in a land that could leave Europe one day, but to make a choice to invest long term in a land that will always stay in Europe.” Consequently, countries all over Europe aim to attract talents and businesses seeking a more stable footing within the European Single Market. Paris doesn’t always naturally comes to mind as a potential Fintech hub; which is why French government agencies have already decided to publish leaflets listing reasons to choose Paris as a base for companies looking to enter the European market. For instance underlining the fact that “four French banks feature in Europe’s top 10, including two of the top three”, or that “the Paris metropolitan area is home to 12,000 startups”. And indeed, the Paris region is home to nearly 100 business incubators, including Le Cargo, Europe’s largest. Even bigger, the Halle Freyssinet is a structure set to open in January 2017, and that will be able to host up to 1,000 startups. Despite relatively heavy operating costs, Paris is centrally located and has a well-connected infrastructure; and in its quest to claim London’s Fintech crown, Paris should be able to rely on the credibility of its financial services and the availability of talented employees. Overall, the Parisian financial marketplace is (self) described as “up to speed with new ways of financing SMEs, including private equity and crowdfunding”. However, only time will tell if France will be able to attract London Fintech firms: other countries like Ireland (with Dublin) and Germany (Frankfurt & Berlin) are also pursuing a similar objective - the strengths and specificities of their respective financial places making them serious contenders to the Fintech crown. Read the whole article on Crowd Valley News. Since we set out to modernize financial services in 2012 as Crowd Valley Inc (a Grow VC Group company), and even earlier in 2008 as early entrepreneurs in what’s been now called fintech, we’ve come a long way. Not just as a company, but as a global market calling for new efficient models in finance. However, today we wanted to share a brief update on our progress and focus on Crowd Valley as a company first and foremost.

Through our work of supporting now over 100 innovators and leaders in financial services, we’ve been fortunate enough to see the dawn of fintech in countries around the world. Here are some interesting facts about where we’ve come as a company: Wide-ranging approval and support - the Crowd Valley Digital Back Office is in use and approved or exempt by regulators in the following countries: the United States, Canada, Mexico, South Africa, the United Kingdom, the EU, Switzerland, Singapore and Japan. Select use cases exist in several further countries. Through our work with leaders in their fields, both partners and clients, we have put a lot of scrutiny on our product development and our testing practices. This means that every time an update to our product is made, over 1,000 tests are run through on various environments to ensure we catch conflicts as soon as possible. While through long term investments, we’ve been able to establish a robust core of our platform product, we continue to heavily invest in security as well as middle layer products such as web hooks that pull entire arrays of interlinked functions such as compliance lookups or onboarding workflows. Through this work, we expect to make the deployment of fintech products more efficient, but also more sophisticated, secure and compliant. Partnerships, such as the one with the Government of Estonia and their e-Residency program allow us to be on the cutting edge of fintech and e.g. offer access to the EU market through a virtualized portal rather than the arduous older channels. Through the network of over 80 partners around the world, such as big four consultancies, compliance experts (such as KYC and AML service providers), legal pioneers and fintech leaders in their fields, we are proud to truly be creating an ecosystem around the world. We are proud to be supporting cutting edge initiatives such as Convergence backed by prominent institutions such as the World Economic Forum, existing leaders in their own sectors such as Galliard Homes with the Property Club and novel innovations in areas such as peer to peer lending exemplified for example by Credit Peers. All our clients are modernizing a specific market segment and providing a fluid service to the end client. Read the whole article on Crowd Valley News.

According to the news, hackers were able to steal digital currency Ether (on the Ethereum platform) tokens equivalent of more than $50 million in June. The Ethereum community has solutions to freeze and return stolen tokens. The hacker group Anonymous has conducted cyber attacks against terrorist organizations. Technology companies like Facebook and Apple want to protect their users also against governments. All these examples raise new complex legal and ethical questions regarding who has authority, legal and ethical rights to rule in global digital communities. And now AI is emerging, we have even more complex questions. Traditionally it is authorities and the courts of a country that have the highest power to decide between right and wrong and then also trigger actions based on that. But when we have, for example, a global digital currency that is not really authorized or regulated by any government, the situation can be very different. The service and currency tokens are distributed to a network of thousands of computers around the world and it is managed by its own community. Can the community have the right to decide about right and wrong and then execute actions based on it, e.g. return tokens to someone that were allegedly stolen. Some hacker groups have taken actions that many people can feel are ethically right, for example, to make cyber attacks on terrorist organizations. The complexity is that those actions are not based on any local or international legitimate decisions. In that way one can see they are a threat to the traditional international laws and institutions, even they could be ethically right. At the same time, one can argue, no traditional legal system or institution works effectively in this global cyber space. Apple refused to open iPhone encryption in the San Bernardino terrorist investigation. US authorities were finally able to use a third party to open messages in the phone. Facebook and Microsoft have announced that they inform users if a governmental organization tries to compromise their privacy. These things are also seen as a positive policy from the companies to protect their customers and users. At the same time one can argue they help protect criminals. Then we have a question as to whether these companies have more power and capability to control justice than governments and courts. Artificial Intelligence raises its own ethical questions. Already ‘an old discussion’ is how a self-driving car should behave, if it must e.g. chose to smash into a bus, or drive over a person who is walking on a pavement. The military is already now active to use semi-automatic and automatic systems to make decisions, when things can happen so rapidly that a human being cannot handle decisions. We remember the War Games movie already from 1980’s. These are real ethical and hard decisions about life and death. And we can also ask if a machine or a tired human being makes better decisions. The examples above are quite different, but all of them are about new legal and ethical issues in the digital space. They are typically global, not in a territory of a country as traditional justice systems. And they are managed by international companies, loose Internet communities or even by machines. These issues are reality already now, but will be much bigger issues in 5 to 10 years. If governments really try to limit activities in the cyber space, they can damage innovation and development, or just tilting at windmills, like British government that planned to forbid encryption on the Internet to fight against terrorist. It is not an option to stop the development. But it is like the Wild West, governments and legal systems haven’t yet a proper control, and sometimes it is fighting between good and bad boys, and then local communities try to establish common rules and hire a sheriff. Digitization and global networks can have much bigger impact on life and business than globalization in international trade and international trade treaties that people are now worried in many countries. Often this discussion has been left only to cyber security experts and some governmental agencies. These are significant legal and ethical questions that have impact on every human being and his and her rights, privacy and liabilities. These questions need open and public discussion and democratic decisions. The complexity is that these often require global rules and understanding of technology. This article first appeared on TelecomAsia.net. The US House of Representatives passed two bills on Tuesday 5th of July, aiming to make it easier for entrepreneurs to raise money and to improve conditions for SME and startup investing.

The “Supporting America's Innovators Act” (H.R. 4854) passed the House by a vote of 388 - 9, while the “Fix Crowdfunding Act” (H.R. 4855 ) passed the House by a vote of 394 - 4. Both are part of the Innovation Initiative which was launched by Congressman Patrick McHenry of North Carolina and Majority Leader Kevin McCarthy of California. Congressman Patrick McHenry was a vocal advocate for the JOBS Act initiative. The two bills now pass to the Senate where they should be voted again in order to become law. H.R. 4854 included an exemption from the Investment Company Act by increasing the investor limitation for venture capital funds, from 100 to 250 persons. H.R. 4855 relates to investment crowdfunding, made with the aim to fix the current perceived issues enacted on May 16 2016 under the Title III (Reg CF) of the JOBS Act. The bill will permit the use of single purpose funds to participate in the sale and offer of crowdfunded securities. It will also clarify certain requirements under the Exchange Act 12(g), giving companies a longer period before having to comply with the pre-IPO documents required by the SEC. “Today, the House passed two bills with strong bipartisan support that begin to confront this crisis, [...] Angel investing and investment crowdfunding are both innovative new forms of capital formation that—in the proper regulatory climate—can become vital tools for entrepreneurs and small businesses. My two bills help to ensure investment crowdfunding and angel investing reach their true potential.” added McHenry. The news has been well-received by the vast majority of the actors in the market. Bobby Franklin, President and CEO of the National Venture Capital Association (NVCA) said: “We are pleased to see Congress focused on proposals to help startups access the capital they need to scale and hire new workers, which is critical for the entrepreneurial ecosystem and the American economy.” We agree that’s another good step forward towards a more open and accessible capital market in the US and that Congressman McHenry continues to drive a visionary role since 2011 when he started working on investment crowdfunding regulations. Great progress have been made since and there is now a good foundation and multiple opportunities, to deliver more efficient and effective finance services for new audiences. Read the whole article and find the text of both Acts at Crowd Valley News. By Kati Suominen, Founder and CEO of TradeUp

A great DHL Express report reveals that the majority of small and medium-sized enterprises (SMEs) see growth opportunities internationally and expect to derive up to 50 percent of their revenues internationally by 2019. The survey of 480 SME executives and experts from business lobbying groups around the world also reveals that SMEs across the world say that international growth often comes at a significant upfront costs - of meeting standards, finding customers, complying with trade rules, etc. While many globalizing companies of today are too small to have their needs for these larger-scale capital injections effectively met by banks, there are non-bank solutions. TradeUp is one key part of the solution - opening globalizing SMEs access to growth capital that enables them to take care of the upfront costs of international expansion and grow. Read more about globalization and its funding at TradeUp Blog. By Jouko Ahvenainen, Chairman of GrowVC Group The British voters indicated that they want the UK to leave the EU (called ‘Brexit’). The UK has been an integral part of the European Union since 1970’s and it is not a simple process to leave the EU. The UK and EU must agree on the future arrangement, including trade agreements, possible common regulation and movement of people. This has an impact on finance services, including digital finance and fintech. The UK Prime Minister David Cameron decided to resign after the referendum. The new Prime Minister Theresa May starts on July 13, and it is then her duty to start to work with the resignation and EU relationship negotiation process. The referendum decision is not binding, although it is politically difficult for the Members of Parliament to ignore it. There is a lot of speculation whether Brexit really will happen. It is not an easy step to leave the single European market. Theresa May has said she is going to respect the will of the voters, but there is a lot of uncertainty on how the breakup will actually be implemented and on what the UK’s relationship with the EU will be going forward. Politically, the situation is even more complex. Scotland has had its own independency plans for a while now, and has said it would leave the UK if the UK leaves the EU. And there is also a threat that Brexit could shake the relatively new peace in Northern Ireland. People in Northern Ireland also have talked about an exploring an option to join Ireland. In Northern Ireland and Scotland, the majority of voters wanted to stay in the EU. At this point it is impossible to give a detailed analysis when we have no information on what the EU - UK relationship will be in the future. We don’t even know the negotiation targets of the UK or the EU. In principle, we can say it can be anything from the models Norway and Switzerland have with the EU to the global WTO model. For example, Norway is a part of the single market, but it has to follow all EU rules, including free movement of people that is a big issue in the UK. Switzerland is not directly a part of the single market, but it has agreements to cover free trade and also free movement within certain limits, but its banks cannot operate in the EU single market (that’s why many Swiss banks have had EU business HQs in London). The UK will need to negotiate trade agreements not only with the EU, but with many other countries in the world, because up till now, it has been able to trade based on EU’s deals with those countries. It takes a lot of time and resources to negotiate these agreements and already there have been comments that the UK does not have enough competence to handle this given that for 40 years they haven’t had a need to. So, they probably need to hire competent negotiators from other countries, including the US. According to the EU rules, the resignation process takes two years. Officially the UK hasn’t yet triggered the resignation, and it is still unclear when they are going to do it. And it is also possible that it takes more than two years to agree to all terms and conditions of the resignation and agree on a new arrangement. For example, the EU is now finishing a trade agreement with Canada that has taken 7 years. The TTIP and TTP negotiations have also taken years. It has been said that Brexit is the most complex and expensive divorce in the world. It will take years, and it is still unclear if it really changes things, or if is it will be more like an “almost a member” arrangement with a new name. But it has already created a lot of uncertainty for the UK economy and its trading partners, forcing many companies to consider what to do with their UK based operations. It would be important for companies and the economy to find a new arrangement or at least targets for the new arrangement as soon as possible. Read the whole article and more details on TradeUp Blog.

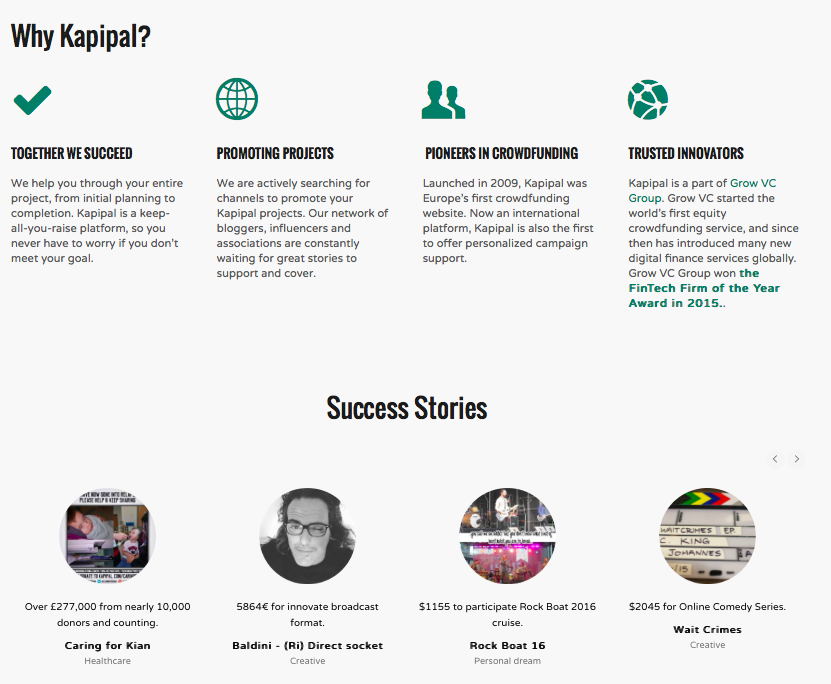

Successful crowdfunding campaign needs attention and dedication. According to Massolution, the total global crowdfunding industry fundraised $34 Billion in 2015. The biggest piece of the money came from P2P lending with $25 Billion, followed by donation & reward crowdfunding with $5.5 Billion raised and equity crowdfunding with $2.5 Billion…And the growth keeps accelerating. Still we are not there where we can say that crowdfunding is mainstream. People recognize the word crowdfunding but still there are many unknowns and assumptions towards it. Crowdfunding is not to place campaign online and wait for the money to come. As many of those who have actually run a crowdfunding campaign know, being successful is not easy. You need to have to think the following aspects to make your campaign successful:

Read more about each activity at Kapipal Blog. We hope these best practises help you with your crowdfunding campaign. Feel free to start even today! As always, don’t hesitate to contact Kapipal if you have any questions. Crowd Valley (a Grow VC Group company) is on a mission to modernize financial services, with its sights on being the back bone platform for new digital finance applications around the world. We’re growing fast and looking for talented individuals to join us on our mission.

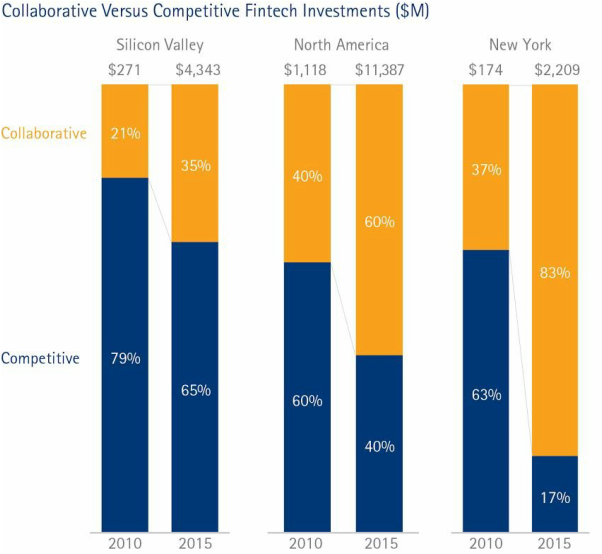

Our culture is transparent and meritocratic, customer centric and long term value based. We believe in the mission we are on and we all align ourselves around this goal, daily and long term. Take a look at two new positions below and get in touch if you’re the one we’re looking for: http://news.crowdvalley.com/apply.html Role: Relationship Manager The role of the relationship manager is to build and manage substantial relationships with clients and partners of Crowd Valley, with the aims of increasing long term client satisfaction and account development. The role will include manage relationships with partners, indirectly affecting the ultimate client experience. Requirements: - Excellent written and spoken English, and general communication skills (other languages a plus) - Experience in managing people and expectations, whether internal teams or account management - Problem solver attitude, does not blame others for mistakes, but regroups and learns - Comfortable in a collaborative environment and with project management, communications and CRM tools such as Trello, Capsule CRM and Slack - Passion for learning: ability, willingness and drive to learn new concepts and tools Role: Growth Marketer (Remote OK) Responsibilities include: - Collaborate with the marketing team to evaluate and optimize growth strategy - Reach out to media contacts for articles / interviews / speaking opportunities - Assist with blog and social media management - Help to build databases and relationships with journalists and media outlets to ensure coverage for Crowd Valley - Stay on top of the latest trends in digital marketing and in the fintech industry Requirements: - Well-versed in digital marketing tactics, including email marketing, SEM, SEO, etc. - Comfortable in a collaborative environment and with project management, communications and CRM tools such as Trello, Capsule CRM and Slack - Savvy with all social media platforms - Excellent written English, and verbal communication skills (other languages a plus) - Passion for learning: ability, willingness and drive to learn new concepts and tools - Positive, entrepreneurial can-do attitude - Experience with Google Analytics - Experience with Weebly and other CMS - Desirable experience with visual design tools such as Photoshop, Illustrator, InDesign and Canva Get in touch if you’re the one we’re looking for: http://news.crowdvalley.com/apply.html According to a report published by Accenture Strategy and the Partnership Fund for New York City, Q1 2016 was the first quarter ever that New York passed Silicon Valley in fintech venture financing.

Financial technology (fintech) companies based in New York have been able to raise $690 million in venture capital funding in the first quarter of the year, against to the $511 raised in the Silicon Valley area. Compared to the previous year, fintech investment in New York tripled to $2.3 billion in 2015. At a global level, the percentage of investments in fintech companies disrupting the financial services industry and that of of those looking to collaborate with traditional financial institutions has not changed much in the past five years, with the majority of the deals (62%) going to competitive companies. In New York instead we can see a different story. While in 2010, only the 37% investments went to fintech companies collaborating with financial institutions, in 2015 the percentage rose to 83%. As we have previously noted when examining the global fintech investments, as well as from the conversations that we had recently with our clients and partners, it emerges that a rising number of traditional financial players, like banks, financing institutions and insurance companies are looking to make partnerships with fintech startups, to help them with innovation inside their organizations. Contextually there is also increased attention from major banks to invest in the fintech sector with Goldman Sachs, Citigroup and Banco Santander between those with the highest number of investments. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed