|

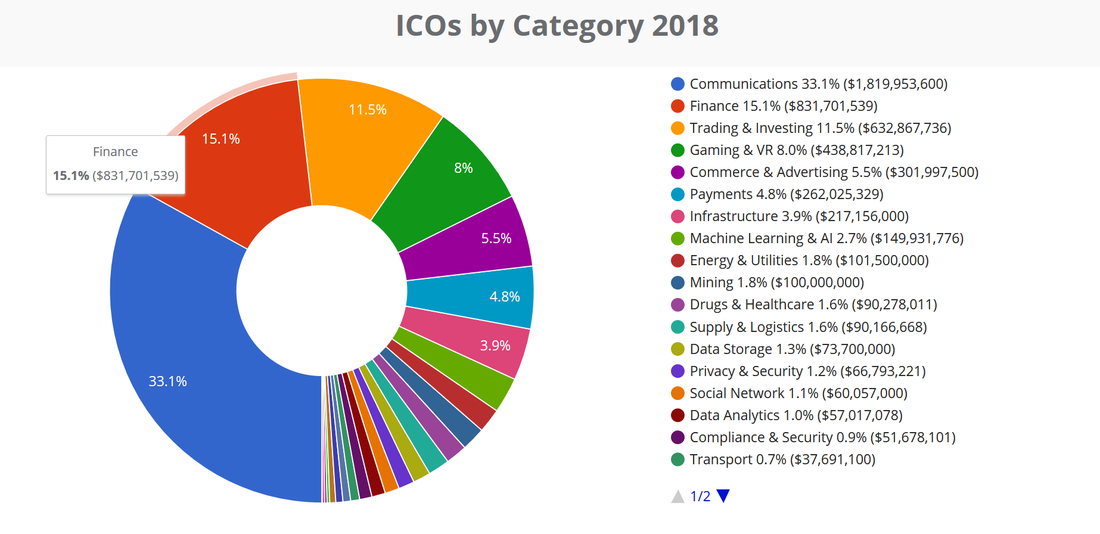

The latest statistics show that the ICO market grew again in March. Yet at the same time, more and more people are skeptical about the ICO market. An interesting aspect of the ICO phenomenon is to look at ICOs by category. When you do, you notice a surprising point – many categories are actually very small, while the volume is in a small number of categories. This indicates we are still in the phase where we are creating independent tokens for fancy ideas, not getting bigger ecosystems to work. According to Coinschedule, the leading ICO categories in 2018 were communications, finance, trading & investing, and gaming & VR. Telegram’s ICO pre-sales explains the communications category – other leading categories represent tokens for services that are often hard to categorize as a utility or security token, and are tokens to be used in new services but at the same time meant especially to raise capital for new services with a white paper. There are several models for categorizing ICOs, as many coin offerings are not so easy to fit to a specific category. But in any xase there are some interesting observations we can make from the statistics:

These are just some examples of interesting conclusions from ICO data. There are several reasons behind these, and, of course, we must remember the market is still very young. But many of these observations raise questions about whether ICOs are still mainly about raising money for new companies and projects, rather than using tokens, smart contracts and more effective processes to improve businesses. Some people argue that this is natural, because it is new business models and innovations in particular where tokenization can make a big impact. So they argue that just using tokens for some existing businesses and asset classes is not really disrupting things – it’s just just improving them. But this is not so simple. For example, let’s think of real estate. We can say that security tokens as a certificate for real estate or property ownership doesn’t disrupt the real estate business – it just saves a lot of paper work. We can also think of utility tokens as a rental payment option, which could create some new ways to offer places to live, e.g. with a pre-paid model. But actually this is only the beginning. When we start to think of more combinations of owning and renting, rights to live, trade ownerships and rights, participating in new development projects and creating different sharing models, then tokenization actually does offer tools to disrupt the real estate business. We can find similar examples in many existing businesses, from insurance and healthcare to gambling and digital rights management. But as usual, new things are first offered by new startups, and they often want (and can only offer) their own independent new services. They don’t offer solutions that are linked to existing big businesses or a bigger ecosystem. I have written and spoken many times about how a big problem for many new FinTech and finance services is that they want to create their own little island that lives its own life isolated from other services and ecosystems. For example, many crowdfunding services wanted to have their own deal flow and investors. It’s the same for p2p lending, online wealth management, compliance and data services – they focused only on their own service. It is not easy for a new company to work with many other parties, especially with big ones. But it is crucial in finance services to be linked to the broader ecosystem. Tokenization and tokenomics will change many businesses – securities, contracts, and money will all go digital. It will create many new business models, new financing models, and make processes more effective and user friendly. But it requires solutions for areas where the money, assets and business really exist today. Right now, ICOs are mainly to raise capital for new fancy ideas, often with some very artificial utility token concepts. I am really waiting for the next wave when tokens start to disrupt existing businesses, finance models and processes. The article first appeared at Disruptive.Asia. Source: CoinSchedule.com

Through the increased availability of data and online connectivity through novel interfaces & APIs, we are faced with more opportunities than ever before. For instance, today, you can use many services to get data on purchases you’d like to make and suggestions on when the optimal time to make the purchase would be (e.g. flight tickets).

However, soon, this operation may seem antiquated as artificial intelligence (AI) and assisting algorithms have become more prevalent and can make these decisions in your place. In imagining a future like this, will the balance of power shift toward the data owner and end-purchaser or will tool manufacturers and conduits be able to gain an upper hand? With consumer preferences for regained privacy and control, as well as new regulation such as the General Data Protection Regulation (GDPR), it’s plausible to see more data held by the consumer and the consumer exercise more control over where their data is used. Will the new emerging industry for personal assistants & algorithms that empower the consumer and leverage their data for their benefit take over the third-party applications that support consumer behaviour? Who will hold the power in this ecosystem? Will it be the consumer or the algorithm? Ownership and control may seem removed from how these systems will shape up to be, but I do believe that they are the very core of where interests will lie. Imagine if the algorithm itself has enough power to have a self-interest – meaning, for example, the company that developed it sells it to enough consumers and is primarily driven by adoption in one way or another (to get to monetary transactions, data or both). Would that type of algorithm then optimize for individual representation or the adoption of the actual algorithm itself, where agency theory and agency dilemmas would clearly argue the latter? Even if seemingly innocent (of course, they want to create a business for themselves!), this may be less of a transition from the current internet, where troves of data reside in many forms of companies where users frequent (Amazon, Google, Facebook, etc.). Now, consider if ownership and control sit with the individual consumers, for example, in the shape or form of individually licensed and tailored software on the consumer’s end-device with full rights to the software. You can even consider a situation where we all get literate enough to produce these algorithms ourselves – the more radical scenario. If “my AI” now literally represents me and is oblivious to all the rest of the consumers with “their AI,” I’ll surely have more power because the system’s incentives and interests will be my own. What I may indeed lose is the centralized, horizontal data benefits and products of scale these algorithms may have if distributed broadly, which would surely be an algorithm developer’s first response why distribution will serve the greater good. Yet, it’s not easy to translate this greater good to something practical or know whom this greater good actually serves. How could you plausibly get this type of horizontal power as an individual consumer? Could you do so even with remarkable resources at your disposal? And if so, could it be seen as benefiting anyone but yourself? How about when “my AI” can self-determine where this horizontal benefit may exist and talk not only to “your AI” but to all the “other AIs” in order to get a group discount on a purchase, for example? It may seem far-fetched at the moment, but this type of distributed-node thinking may well be on the horizon sooner than later. Especially, combined with breakthroughs in distributed connectivity and real time processing, we could be at a stage where the power of the network could benefit the individual without a central connectivity. Decentralized and distributed systems may be the key to unlocking a true network system, where central authority & control are absent and individualism can be discovered through a network. We’d need individual interfaces that are attached to the end-user and a true portability that allows it to interface with the broader network, but it’s hard to imagine that this would not be attainable with current or soon-to-have tools. Maybe this is indeed a future we will soon see, where individual interests will actually be represented rather than those of global corporations. The article is from Difitek Blog (a Grow VC Group company). We are excited to announce that Difitek (a Grow VC Group company) is invited to speak at the Zero-in Conference, the first edition of the world’s largest Personalization event for Fintech and Marketing products, that will take place on April 19th 2018, at Pakhuis West in Amsterdam. Difitek’s CEO and Co-founder Markus Lampinen will represent the company at the event and give a talk about Life with Intelligent Algorithms.

Organised by the team that has built UPRISE Festival Europe, with 6 International Tech Festivals and Conferences in Amsterdam and Dublin, Zero-in Conference will be focused on the products that bring personalization in the fields of Blockchain and Cryptocurrencies, Banking and Payments, Funding Tech and Ecommerce, as well as Marketing and Adtech. There will be two stages, one dedicated to Fintech and one to Marketing, with 70 well selected international speakers, more than 500 companies, and about 1,500 attendees. The conference featured speakers include our very own CEO Markus Lampinen, Kelsey Cole, Co-founder and Chief Brand Officer of AdBank, Filipe Castro, Founder of Utrust, Sally Eaves, Member of the Forbes Technology Council, Antti-Jussi Suominen, CEO of Holvi Bank, Alexander Neymark, CEO of TiesDB, and Bryan Mason, COO of VSCO. In his talk on the Fintech stage, Markus Lampinen will speak about the advancement of automation with new technologies such as blockchain and distributed services, the new role of software engineers that are set to become the bankers of the future, the increasingly predominant role of AI, the key importance of creating an ecosystem to make automation more intelligent, and many other interesting topics. For more info you can check this page: https://zeroin.tech/schedule/anticipate-and-act/ Event details: Date: 19th April 2018 Venue: Pakhuis West, Elementenstraat 25, 1014 AR Amsterdam, Netherlands. For further information on the event, please have a look at https://zeroin.tech/. Get in touch now to meet our team in Amsterdam! Cambridge Analytica and Facebook data have made headlines during the last few weeks. I wrote about this already a year ago for TelecomAsia (read here). Information on most concerns and issues were available already then. The only real new piece of information is the role of another Cambridge University academic project that used Facebook’s data and help to develop analytics models. The discussion now focuses on one case and one scandal, but it is worthwhile to look at what is really going on in the data business.

The issues with Cambridge Analytica and Facebook are really only the tip of the iceberg. I would actually like to summarize some other important trends and issues I have also written about earlier that have an important impact on data business:

We can see that the data business is becoming more and more important all the time. As it is said, software ate hardware, but now data is eating software. At the same we have many different trends and new innovations in the data business. It is not only about having even bigger giants that have all data in their clouds, but we also have totally opposite development to solutions where people can manage and utilize their own data. It is hard for many people and also for companies to follow all these developments. As we now were able to see, it took over a year until the mainstream media really realized the importance of the Cambridge Analytica case. When we talk about new data models and technologies, it is even harder to explain and get attention for them. But my prediction is that we start to see quite many new innovative startups in this area in this and next year. It is happening already especially for finance and healthcare data. Of course, this big change won't happen overnight. There will be data giant companies for a long time. That’s why it is definitely important to develop people’s awareness, legislation and transparency surrounding how data is collected and used. We can also say many people have been extremely naive by using, for example, all kind of fancy apps that “tell your special skills based on your first name” or “find an optimal profession based on your profile photo” - and that the same time the user gives this app the rights to collect all his or her Facebook data. The most important thing is to find the right balance between people and companies that use the data. People must realize, if they get something free, there are other models to do business, and nowadays it is often data. But companies must also understand they cannot just utilize data without clear value to the user. They must be also transparent, what and how they conduct business. As I wrote in a linked article above, data must be an enabler to people, not only a way for companies to exploit people. It will be a long journey to this new more balanced data business, but we can say the Cambridge Analytica and Facebook data case have been a wake up call for many people and this will accelerate the change. The article first appeared on Telecom Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed