|

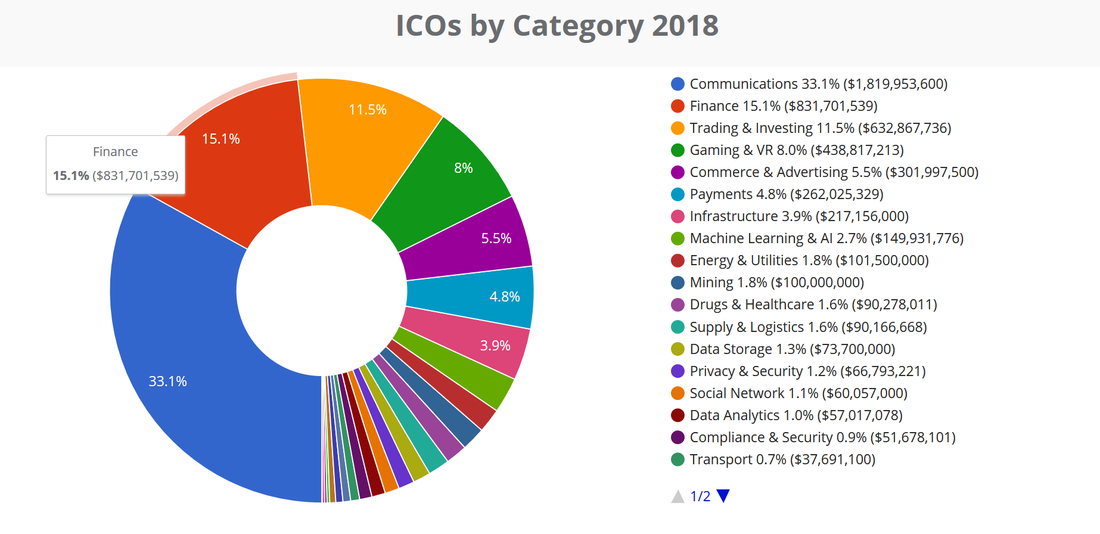

The latest statistics show that the ICO market grew again in March. Yet at the same time, more and more people are skeptical about the ICO market. An interesting aspect of the ICO phenomenon is to look at ICOs by category. When you do, you notice a surprising point – many categories are actually very small, while the volume is in a small number of categories. This indicates we are still in the phase where we are creating independent tokens for fancy ideas, not getting bigger ecosystems to work. According to Coinschedule, the leading ICO categories in 2018 were communications, finance, trading & investing, and gaming & VR. Telegram’s ICO pre-sales explains the communications category – other leading categories represent tokens for services that are often hard to categorize as a utility or security token, and are tokens to be used in new services but at the same time meant especially to raise capital for new services with a white paper. There are several models for categorizing ICOs, as many coin offerings are not so easy to fit to a specific category. But in any xase there are some interesting observations we can make from the statistics:

These are just some examples of interesting conclusions from ICO data. There are several reasons behind these, and, of course, we must remember the market is still very young. But many of these observations raise questions about whether ICOs are still mainly about raising money for new companies and projects, rather than using tokens, smart contracts and more effective processes to improve businesses. Some people argue that this is natural, because it is new business models and innovations in particular where tokenization can make a big impact. So they argue that just using tokens for some existing businesses and asset classes is not really disrupting things – it’s just just improving them. But this is not so simple. For example, let’s think of real estate. We can say that security tokens as a certificate for real estate or property ownership doesn’t disrupt the real estate business – it just saves a lot of paper work. We can also think of utility tokens as a rental payment option, which could create some new ways to offer places to live, e.g. with a pre-paid model. But actually this is only the beginning. When we start to think of more combinations of owning and renting, rights to live, trade ownerships and rights, participating in new development projects and creating different sharing models, then tokenization actually does offer tools to disrupt the real estate business. We can find similar examples in many existing businesses, from insurance and healthcare to gambling and digital rights management. But as usual, new things are first offered by new startups, and they often want (and can only offer) their own independent new services. They don’t offer solutions that are linked to existing big businesses or a bigger ecosystem. I have written and spoken many times about how a big problem for many new FinTech and finance services is that they want to create their own little island that lives its own life isolated from other services and ecosystems. For example, many crowdfunding services wanted to have their own deal flow and investors. It’s the same for p2p lending, online wealth management, compliance and data services – they focused only on their own service. It is not easy for a new company to work with many other parties, especially with big ones. But it is crucial in finance services to be linked to the broader ecosystem. Tokenization and tokenomics will change many businesses – securities, contracts, and money will all go digital. It will create many new business models, new financing models, and make processes more effective and user friendly. But it requires solutions for areas where the money, assets and business really exist today. Right now, ICOs are mainly to raise capital for new fancy ideas, often with some very artificial utility token concepts. I am really waiting for the next wave when tokens start to disrupt existing businesses, finance models and processes. The article first appeared at Disruptive.Asia. Source: CoinSchedule.com

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed