|

The European Union (EU) Executive's Vice President Valdis Dombrovskis said on Thursday, 23rd March 2017, that the Commission is considering how to regulate the expanding sector to encourage its development in Europe, while protecting consumers from risks that may emerge.

Passporting for Fintech services is a right or license that would allow Fintech companies to expand across border and operate anywhere within the EU’s single market. This is significant in that it significantly lowers regulatory and bureaucratic obstacles for operations, growth and expansion of Fintech, an industry and concept that is slowly but surely affecting practices and efficiencies across a wide range of sectors, not just financial services. This statement by the EU is also significant in context of London’s position as a leading global Fintech hub which is coming under significant scrutiny as the UK secedes from the European Union. While terms are yet to be determined, there is a high probability that the UK will lose the single market privileges of the European Union, which would adversely impact its growth potential. Continental rivals such as Berlin, Frankfurt, Paris and Luxembourg are among those queuing up to replace London in the spotlight amidst the uncertainty that will surround London over the next two years as the UK negotiates its divorce from the EU. The Commission said it will propose rules by the end of the year to cut retail fees imposed on payments made across borders inside the EU with currencies other than the euro. If approved by legislators and EU states, the measure would strongly impact banks, which profit most from the cross border charges. Fintech payment services already offer much lower fees. Hence, we can see how these passporting right would allow incumbents to become increasingly competitive, provided that they are in EU. The Commission is also considering measures next year to make conversion rates more transparent for EU consumers using payment cards or withdrawing money in other member states, in a bid to bring down costs. Crowd Valley welcomes the measures to boost Fintech growth since they align with our principles of financial inclusion and innovation allowing the consumer and entrepreneur to easily engage financial services across the large single EU market by lowering cross border fees and making Fintech demand-supply more symmetric and efficient. With regards to Crowd Valley, these measures would reduce fees associated with some members of our third party ecosystem such as payment processors for cross border transactions. This article was first published on Crowd Valley Blog. Finance is swooshing into blockchain, machine learning and artificial intelligence. Each organization is adopting new ways of serving clients faster than the other. Or are they? Is this the actual reality we live in? While the challengers have nothing but upside, existing institutions find themselves in a swamp of technology black boxes they have to grapple with and loath the idea of marrying yet another complicated technology octopus that will just not let go in decades. That might seem like an exaggeration, but go through an institutional procurement process or a dozen, and the reality will be quite apparent. On one side, you have technology adoption being faster than ever before. FinTech challengers are indeed coming and fast. Established companies are launching their own robo-advisors (ex: JPMorgan’s recent plans for an ‘automated advisor’) and lending mobile apps. At the same time, established companies are still trying to overhaul systems from decades ago in an effort to find new competitiveness. Systems that are incredibly critical serving large client segments and interconnected across service lines. Where do these two trends clash? It’s no secret that technology that serves millions of people today in finance is legacy. It’s often poorly documented, misunderstood and poses a systemic risk. However, overhauling it is also no easy task and oftentimes it gets surrounded by a lot of red tape in bold letters stating “DO NOT TOUCH” given the inter-dependencies legacy systems will have due to the way they were built (giant monolith applications – the “API Economy” wasn’t invented yet!). Why would you even want to connect systems? I’ve been asked countless times, “How do you connect to our systems?” and my answer is always the same, “Do you actually want to?” Oftentimes, in new greenfield projects, isolation is your friend. Proving out a new business line or technology in a smaller segment in its own stack can be far more nimble and easy to roll out. Based on validated data and use, it’s then easier to justify integration into other technology stacks on a basis of broader deployment and actual usage need. New business lines are exactly that, new and with that newness, comes the choice of design. Credit scores and data is a perfect example. Lenders have these on record for their borrowers, so it should be a simple case of retrieval right? Yet, I can count the times that organizations have wanted us to seek that information from their systems on my fingers versus getting it from specialist, modern third-party source. Especially, the more complex the environment, the more benefit from a focused, modular approach. These legacy systems process an abundance of data and requests; they really are a gold mine of information. But it’s not like they are built on modern JSON APIs, which is why banks are going overboard on building out connectivity internally as well as externally, cheered on by policy such as PSD2. So getting your hands on this information, both due to the critical and sensitive nature of systems and the lack of modularity, is an issue. Legacy Systems: Connect or Die? We seem to be in a new era of software development. API Economy, specialization and modularization – all call for a data-driven go to market with rapid prototyping and decision-making based on real observed user behavior. Getting organizations and their processes to change to this mindset isn’t a walk in the part, yet at the same time, this means that how we approach technology today is not the same as even five or ten years ago. Despite legacy, we now have the opportunity to build finance applications in a modern way and due to modularization; we can make risk-weighted decisions that are always an API call away for an upgrade. This article was first published on Let's Talk Payments. Photo: Wikipedia.

Crowd Valley (a Grow VC Group company) is excited to announce that our UK clients and partners can now get full access to ISA and IFISA products through its back office API.

Last Spring, the British government created a new type of Individual Savings Account (ISA), allowing British citizens to invest in peer-to-peer lending platforms regulated by the FCA without being taxed on the income generated by doing so. This Innovative Finance ISA is particularly attractive in the current context: with low interest rates and an unusual amount of uncertainty regarding the future of the British stock market, investors are now able to diversify their portfolios using P2P lending opportunities under a tax shield similar to the stocks & shares ISA. P2P lending platforms provide their investors with an opportunity to realise returns significantly higher than average. The government itself estimates that investors can expect their investments to generate returns in the 6%-8% range. However, it also underlines that retail investors should keep in mind that those higher returns are meant to compensate for higher risks. As the end of the tax season gets nearer, initial conclusions can be drawn: there is a consensus on the fact that P2P lending platforms allowing their users to invest through their IF ISA accounts were ideally positioned. Indeed, UK investors have shown a clear preference for ISA structures throughout the year, and the ones that integrated this feature to their platforms were able to meet their investors’ increasing demand for tax deductible investments. Thanks to its central position in the British Innovative Finance market, Crowd Valley is proud to provide P2P lending platforms with features that will allow them to:

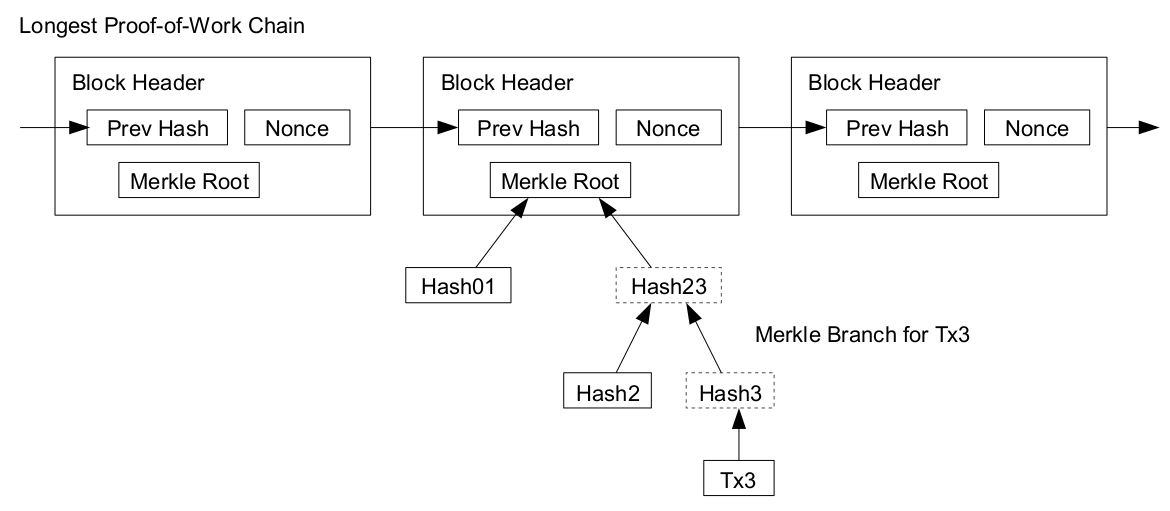

All parties interested in implementing the Innovative Finance FSA feature on their platform, or looking to build a P2P lending platform shouldn’t hesitate to get in touch with Crowd Valley. New technology is based on less human trust, but better tools to verify and track things. The concept of trust has been and is central in finance. People work with those they trust, as the parable goes. At the same time, ‘trustless’ transactions and design is becoming prevalent across sectors. Disregarding blockchain hype, the concept of distributed finance implies a fundamentally different take on trust. This very concept will change the way we think about how business is done in financial services. R&D Coming Full Circle in 2017 The past few years have signaled a clear period of research and development and market exploration for financial services firms as it relates to distributed technology and blockchain. The technologies offer a different take on trust, where transactions exist in a trustless system, and due to its inherent design transactions can be reconciled in the absence of a trusted central authority to verify transactions. Complicated? Maybe so, yet the consequences may be even more unanticipated. Already in 2015, Nasdaq announced its commitment with the first ever private securities transaction documented with Nasdaq Linq, a blockchain-enabled technology. In a press release on Dec 30th 2015, Nasdaq went as far as stating that ‘blockchain holds potential for 99% reduced settlement time and risk in capital markets’, which can be seen as quite a strong signal. The interest is however much broader than marketplace operators. The US State of Delaware has pushed blockchain as a distributed ledger to increase speed, security through distributed automation mainly of document handling and filings. The State has made the implementation of blockchain technology a core tenet in their strategy to adopt new technologies. With 66% of Fortune 500 companies and 85% of initial public offerings (IPOs) in the state, the ramifications are significant. It’s clear the potential is there. However, embracing a trustless architecture leads us to ask different questions, such as where should trust be placed in the future if not in the parties themselves. Should you Trust a Banker in the Future? Speaking at conferences and in private meetings with bank and asset manager CEOs around the world, one thing that keeps coming up is the notion of trust. “We work with people we trust” and “why would we work with anyone we do not trust”. For years I’ve been saying that once a transaction can be handled faster, more securely and more efficiently than currently, trust becomes secondary. If you can provide more value to each and every party along the value chain – where is the value of trust? The terminology for ‘trustless’ transactions or systems may be a bit misleading. The trust is still there, however it encounters a fundamental shift from the actors to the system. Indeed the only way to transact with another party that you do not know, is to be able to have 100 per cent confidence in the system to have nullified the opportunity for a fraudulent, incorrect or otherwise unproductive transaction. Through distributed verification, immutability and various levels of privacy and encryption these concerns are addressed through the technological design rather than the actors involved. It should also be noted that blockchain still suffers from limitations, which are indeed being worked on, such as full homomorphic encryption support and upward transaction scalability. However, distributed technology and distributed finance is far larger than only blockchain. Trust in a Trustless Future Distributed technology offers higher security by enabling impartial and immutable distributed validation of chains of events and transactions, but I would argue it goes even further and will fundamentally change our collective attitude toward transacting online. By virtue of ‘trustless systems’, what if you in the near future could trust anyone by nature of system design and seek out the best transactions independent of the parties involved and their reputations? Would this ‘trustless’ system drive higher deal making efficiency and indeed focus on the goal at hand, versus bandwidth being spent on the mechanics rather than the transaction itself? Digital challenger banks such as Germany’s N26 and the UK’s Monzo have won customer appeal by being digital first and far more efficient than their traditional counterparties. They market their utilization of innovative approaches such as Artificial Intelligence for better customer value and decision-making, yet establishing trust in their services still largely relies on heavy banking regulations and licenses which establish these digital banks as ‘trusted actors’. In a ‘trustless’ future, could we see this trust established elsewhere by virtue of network design rather than heavy infrastructure and oversight? If a trustless system is set to be more sophisticated and secure than any individual and fallible trusted parties, then are trusted central actors truly a thing of the past? Maybe even more tellingly, we need to ask ourselves, do we now have an opportunity to build a distributed finance platform, that is trustworthy and unbiased by design and can we leave our industrial era concepts of trust aside in this pursuit? This article was first published on AltFi News. Picture: A bitcoin transaction verification example (source, Wikipedia).

I saw a fourth motorcycle accident on our street in Western London in the past 15 months. All the motorcycle riders in the accidents have been food delivery people driving with a learner’s license. I was told food delivery competition has gone totally berserk in London.

It is one example of a new business model, where everyone can be an entrepreneur. We see digital and business model disruption now in many industries from taxis and food delivery to finance, just to mention some, and there are also many regulatory questions to be solved. Are these normal growing pains of a new market, or something more complex? New business models are coming to disrupt many traditional markets. They offer more options to consumers, better efficiency and more competition. Often these new solutions are also coming to businesses that have been regulated, like finance, taxi traffic, restaurant or hotel business. These new companies also offer new models to work, often enable more entrepreneurial models, but at the same time they don’t offer similar traditional employee positions as many traditional companies. As a result, many new services have also encountered employment law issues, e.g. Uber has faced many disputes about the legal status of its drivers around the world and Airbnb has been at the centre of discussion on hotel regulation and the local rent level problems. The easy solution is to say that all new services and companies should follow old laws and regulations. It means that Uber should work like the old taxi companies, Fintech services should work like the old finance services and bankers, and food delivery should have employees and delivery cars like old courier firms have. The problem is that, if we only follow the old rules, there is no development. No one can really claim that the old finance sector, taxi services, or courier services are perfect. Many people are totally frustrated with traditional corporate positions. We also witness that thanks to automation and machines fewer people are needed in many industries. It is also important to create new jobs and working models in new services and industries. For example, Uber (and similar companies) and food services offer jobs and earning to many people who could be without work otherwise. Disruption always creates its own problems. One part is that new companies with venture capital money often want to buy market share, which can also create temporary businesses that are not sustainable. For example, people who follow the food delivery market in London have been told that when UberEats entered the market, it started to buy experienced drivers and market share. It had forced other competitors to go for unprofessional, low-cost delivery guys, who have gotten a motorcycle somehow and don’t even have a driver license, but start to drive with a learner’s permit. It then can contribute to those accidents I have seen, and also creates fights between drivers, when they try to earn their living. Often they have no guaranteed compensation. Even free markets need some regulations and limits. They are also needed in many new digital businesses. The problem is often that the old industry and many regulators just want to keep the old models and rules, not really try to learn about new models and adapt regulations rapidly enough to new models and to accelerate innovation. It then creates situations that old players want to protect the old rules, and new players lack suitable rules to follow. Fintech has quite positive examples in this development. Many Fintech firms have actually wanted to get regulation for their new models and they have started to talk with regulators. In some countries this has worked well, in some other countries regulators have been too old-fashioned to go for these approaches, and caused harm for finance services in their country and sometimes created also risky services to consumers, when they were allowed or forced to operate outside regulation. Regulator Fintech sandboxes are excellent examples to allow innovation and develop new rules together with innovators and companies. Laws, politicians and regulators always follow behind innovation and businesses in new developments. Many examples show that it would be better if lawmakers and authorities were active in following development and looking for new models within their industries. Often the old regulation is simply not compatible with new business models, and it is much more harmful to deny the development and force innovative companies to run in a gray or black area. Digitization, AI and automation are part of the disruption that economies face, but also play a vital role in finding new solutions. In their work, lawmakers and regulators have an important role and responsibility to play, but that they must also innovate new solutions, not just close their eyes. This article was first published on Disruptive.Asia. Managing regulations and compliance is becoming increasingly difficult for banks because it is time consuming and expensive, experts claim. For example, when asked by a journalist about the difficulties for top banks in managing compliance costs, a top investor commented: “(…) that is a massive challenge for these banks.”

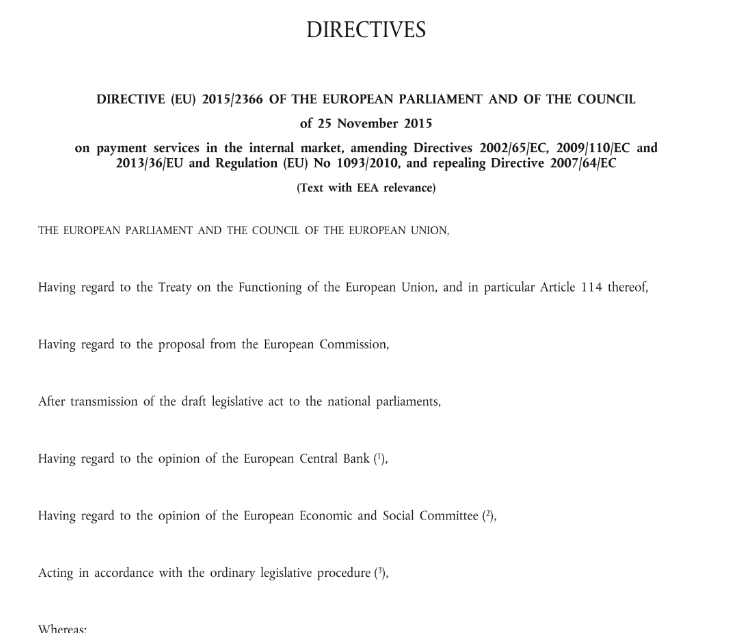

In this respect, Citi admitted that 59 percent of their expenses savings are consumed by additional investments in regulatory and compliance activities. Also banks such as HSBC, Deutsche Bank and JPMorgan, confirmed that they spend over $1 billion a year on regulatory compliance and controls. More in general this discloses a trend which ended up in extra costs of $4 billion just in 2015, the Financial Times reported. As a consequence of this trend, the interest around the issue is constantly growing by involving a number of players which are trying to find viable solutions to solve it by using their authority to act as a catalyst for change. For instance, in the UK the FCA stated that they are planning to increase collaboration with Regtech companies. Also Innovate Finance, the independent membership association which represents the UK's global FinTech community, set up the Transatlantic Policy Working Group (TPWG) in order to look for solutions to fix the fragmented scenario in the US. In all these cases, Regtech, a blend word which indicates the mix of regulation and technology, is emerging as a way of effectively addressing regulatory challenges and connected costs by using software. According to FundRecs’ CEO, Alan Meaney, “like FinTech, PayTech, and many other combinations of XXXTech, Regtech is another example of an industry that is being changed rapidly by software.” Generally speaking, the Institute for International Finance (IIF) argued in a recent report that by adopting new approaches to approaches to regulatory compliance. companies will free capital to be used for different purposes. In giving this advice, the IIF also identified the areas which could large benefit from this adoption such as risk data aggregation, modelling and real-time transactions monitoring. A recent survey, moreover, revealed that 85 percent of professionals in the sector consider that RegTech can simplify and standardise compliance processes hence driving down compliance costs. However, even though some critics argue that Regtech cannot be viewed as a panacea for all compliance challenges as subjectivity and other factors should be still considered pivotal in managing compliance risks, it definitely is a value addition in working well with heavily quantitative based obligations, information based obligations and risk identification and more in general with management tools. Read the whole article on Crowd Valley Blog. It’s not unclear that policy makers around the world want to see new models to serve and add value to the end-users in finance. They’re not against increased transparency either. In Europe, the European Commission’s Executive Vice President Valdis Dombrovskis announced last week it’s considering introducing ‘EU passporting’ for FinTech companies. Passporting is the concept of having ‘finance standards’ from one EU territory to another for maximum compatibility and transferability. Separately, the Commission also moved to prevent large fees imposed on money transfers within the EU, affecting mainly established banks and agents where most fees are present. Combined with new business models, client demand and policy changes, these will catalyze technology adoption and push the pace of transition within financial services. PSD2, GDPR, MIFID2 – The Barrage of Acronyms Attack The policy is moving in one direction. Markets are moving toward efficiency. Client demand is pushing end-user value and control over their personal affairs, such as data. Alone, all these trends have uncertainties regarding practical implications and are open to interpretation, yet as a whole, they represent a leg of a changing competitive market. New entrants are effectively sprung from the same fabric as these new policies and likely see these policies as natural and a secondary element of driving end-user value. However, those who bear 200 years of tradition and a deeply rooted track record in the financial services market fundamentally have to adapt. Policy Changes in Europe With Global Implications The European Union is still the world’s largest single market and guaranteeing access to the single market is a crucial tenet of belonging to the union. Fragmentation has plagued Europe in the past, which can be seen as a clear inhibitor to the progress also in the digital finance market. I wrote about this already as early as 2013 after speaking in front of the European Commission in Brussels. Even since then, it has not changed because the fragmentation is innate to the single market. While the European Union is where much of this policy originates, it’s not the only area these changes are happening and manifesting themselves. FinTech and challenger organizations are creeping up from the US, the Middle East, Southeast Asia and practically everywhere. Where the establishment is strong, the challengers clearly focus on providing superior value and service than the existing service providers. Incumbents are rolling out open APIs to core banking services around the globe, such as BBVA’s API Market. Where it gets interesting, however, is where services do not exist and challengers get to define the future of how modern financial services look. Just look at how online wealth managers (robo-advisors) have taken off in China, where a large market segment previously only had their deposit banks and the stock market as the places to place their capital. By definition, the two are at extreme ends of the market with nothing in between, until now. The growth has been exponential and the technology sector often looks to China as a benchmark on how future services will function. New Operating Models Push Pace of Change Lowering costs of operations is a particular core tenet of FinTech companies. It’s also their competitive advantage in most cases, where they can provide valuable services in a more modern way using automated technologies and artificial intelligence in decision-making. If a challenger bank can onboard a new user in under 8 minutes, how can a traditional bank achieve the same efficiency and user experience? Further, this means the lowering of margins particularly forces adaptation of technology in the incumbent sector, where costs of operations and of staying compliant are rigorous, which ultimately are passed onto the end-user in the form of fees. If the fees are set to change, which seems evident from announcements like the one from the European Commission, the cost structure needs to be amended. A recent PWC report wrote about the importance of branches to customers. While we can speculate if the established ways of servicing clients are in fact more valuable than what the technology sector often gives credit for, I would argue this is nothing more than a manifestation of the ‘what I see is all there is’ cognitive bias, that is mistaking the observed universe for the total universe. The fact is that most people till date have experiences with branches and most do not have experience with a mobile app as a bank. Existing institutions are finding new ways to serve clients, where models embrace end users interests and allow them to be in control, e.g., where their data is used. New standards are being set daily and they will have to move faster than ever. This article was first published on letstalkpayments.com. MEFTECH is the largest and most prestigious event for the financial technology community from across the Middle East and North Africa (MENA) region. It is the premier international platform dedicated to innovation in financial services. Crowd Valley (a Grow VC Group company) was glad to be invited by Matchi to demo and exhibit at this event. MEFTECH 2017 took place in a spectacular venue, the Abu Dhabi National Exhibition Center on the 13th and 14th of March 2017. We witnessed a great lineup of speakers and panels spread over the two days of the event. The event showcased financial services innovations from across the globe and proved to be a good experience for us. We interacted with like-minded founders and Fintech industry leaders and met executives from the leading banks and financial institutions from the MENA region. It was good to learn that banks from that region were quite optimistic in adopting digital strategies to position themselves with the fast changing pace of technology seeping into the financial industry. With the recent announcement of Yielders becoming the first Sharia Compliant Fintech platform in the UK, our Cloud Back Office framework was well received by the attendees. On stage: Paul Higgins, CTO, Crowd Valley

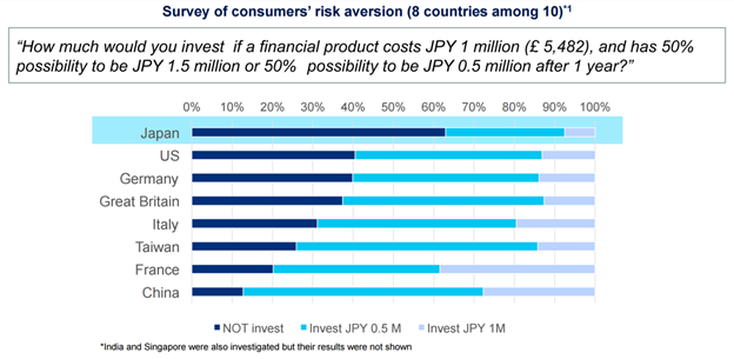

With its high GDP, 2nd highest e-commerce volume in Asia and high rate of technological adoption, Japan presents a high potential for Fintech investment and adoption. However, the uptake has been lukewarm so far, owing to significant cultural and regulatory obstacles with Japanese investments accounted for only 0.40 percent of the roughly US$12 billion invested into Fintech globally in 2014, according to a report by Accenture.

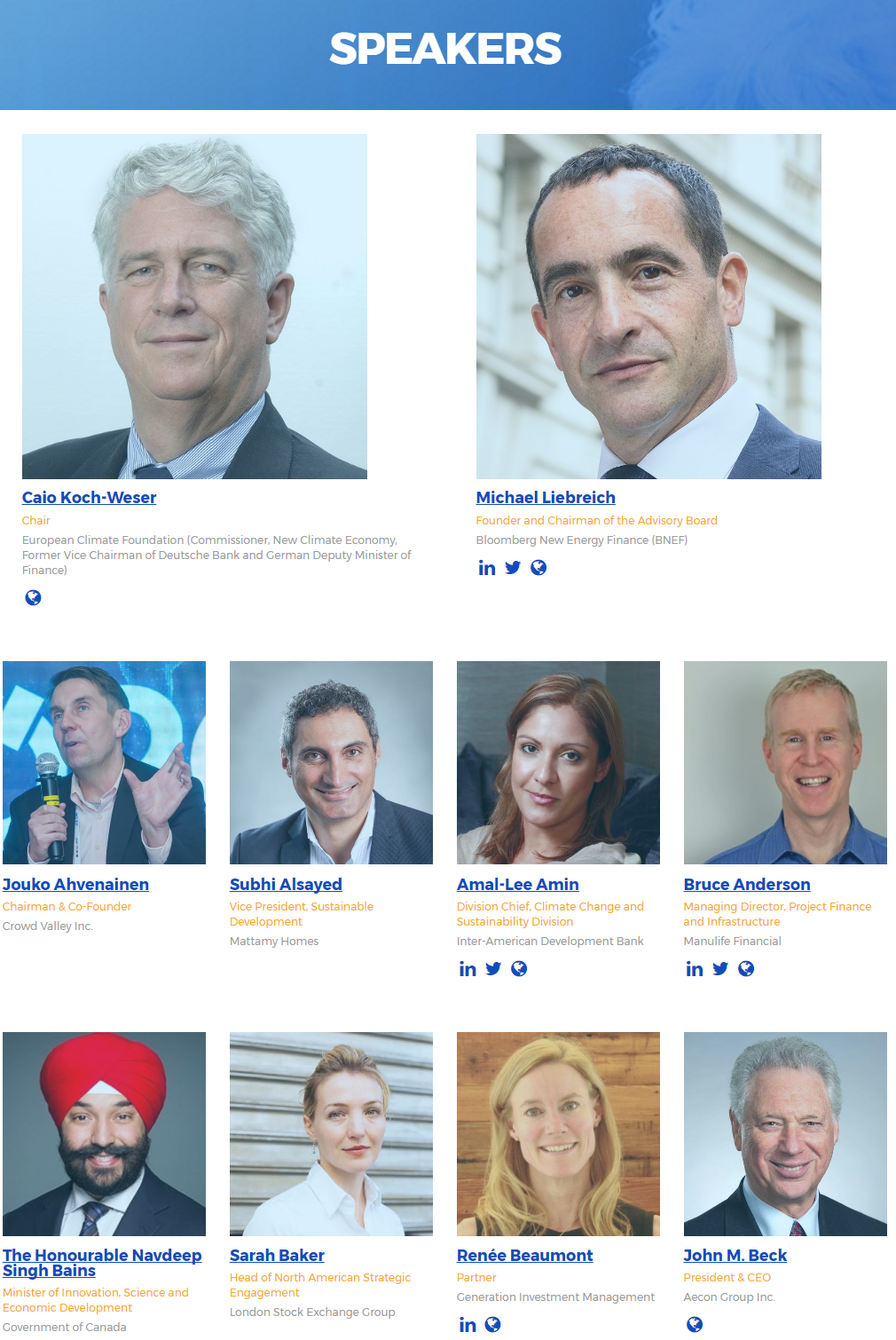

However, with efforts being made by incumbents and the FSA, 2017 is poised to be a potentially mercurial year for Japanese Fintech with the 2020 Tokyo Olympics representing a key trigger to accelerate legal revision and inject momentum into the Fintech industry. With the West continuing to display consistent growth and adoption of financial technology, there are significant changes afoot within the institutional and regulatory framework to act as catalysts for Japanese Fintech growth. The changes are part of a national effort to push financial technology, highlighting fears in Tokyo that Silicon Valley could damage Japan’s banking sector as it did the country’s mobile phone industry in the past. “Japanese institutions are concerned that a Google Bank or Facebook Bank will conquer Japan,” said Naoyuki Iwashita, head of the Fintech Centre at the Bank of Japan. It also means that Japan could become a big new source of capital for startups, especially in Asia, that are experimenting with technologies such as Blockchain or Artificial Intelligence. Yasuhiro Sato, Chief Executive of Mizuho told a conference in Tokyo in October 2016 that Japanese banks had been constrained by regulators wanting to preserve old, but tried and tested, IT systems. IT investments by Japanese financial groups have historically stagnated at around 3%, a level well below their global peers. This can partly be explained by the lack of support towards innovation from senior management, and, most importantly, by the legal limitation on banks’ IT investments. Until recently, the Banking Act prevent Japanese banks from having a stake higher than 5% stake in an non- finance-based company, limiting them from investing heavily in Fintech startups. Taro Aso, Deputy Prime Minister, suggested that some of the same spirit from the West needed to be instilled in Tokyo. “We have revised the Banking Act and, through the revision, people in banks, in business suits work together with young people in T-shirts and jeans. They work together and the combination of this gives rise to new things.” He added: “The financial ministry which used to regulate the industry must now nurture the industry. We are making efforts towards this end. We haven’t done enough but with this new policy we have greatly changed our thinking in approaching the issues.” Beyond the Banking Act, Japan has also taken other steps forward, like recently legislating to regulate digital currency exchanges in the country and establishing a number of working groups involving the Bank of Japan and the Ministry of Finance. But there is still a lot of bureaucracy to get through in order to launch and grow a new company. The regulatory environment in Japan ties in closely with the prevalent culture towards banking and investment. Traditionally, Japanese people have been seen as risk averse with regards to banking and investment practices. Over 52% of personal assets are composed of cash and deposits, with 0% interest. This is complemented by a lack of financial literacy that hinders investment and makes it harder for Fintech services in the wealth management and investment sectors to grow. This same trust is seen in the massive banking system in Japan. While Fintech is certainly growing in the country, it appears the reason it hasn’t taken off so quickly is partly due to a strong bank-branch culture. The Data Market has found that the number of commercial bank branches per 1,000 square kilometres in Japan in 2013 was 103. This is significantly higher than those found in the rest of Asia. Ripple, the US Fintech that uses Blockchain technology for payments and settlement, has entered into a joint venture in January, 2016 with Japanese financial services giant SBI Holdings. It's called SBI Ripple Asia, and in August 2016, it was announced that a consortium of 15 Japanese banks, will build a platform using Ripple technology to enable instant national and cross-border payments. It plans to expand the consortium to 30 banks and launch the service in spring 2017. The number of merchants accepting the cryptocurrency is expected to quintuple to 20,000 this year. By 2016’s end, there were over 4,200 bitcoin-accepting merchants and storefronts in the country, quadrupling from the total from 2015. The frenetic growth followed a bill, approved by the Japanese cabinet, to recognize digital currencies as real money, or legal tender. CoinCheck’s chief of business development Kagayaki Kawabata points to Japan’s regulatory moves as the primary factor for bitcoin’s growing popularity in the country. Once shunned in a negative light during the fallout of the now-defunct Mt. Gox exchange, the cryptocurrency is seeing plenty of press that is helping spread awareness in the country. Mitsubishi UFJ Financial Group and the two other Japanese megabanks have been laying the groundwork ahead of the rules change, such as establishing dedicated divisions and launching contests designed to unearth promising startups. The legislation's passage opens the door to full-fledged investments and tie-ups. Sumitomo Mitsui Financial Group is interested in operating a virtual marketplace much like Rakuten's. The rapid growth is in part due to the recent deregulation. In addition to the existing lending and funding types (‘Charity’, ’Rewards’ and ’Lending’), the ‘Equity-type’ market has emerged since 2015. Due to the contribution of this new funding type, we expect to see a further growth in the market with recent market trends expected to provide a boost to foreign players in entering the Japanese market and domestic players are likely to seek global partners to access overseas investors, technologies and ‘Equity-type’ knowledge. This is going to be a big year for Japan. Is it heading towards its next financial data monopoly or an era of open APIs and blossoming startups? No one knows for sure, but Fintech is here to stay and we at Crowd Valley look forward to supporting your digital finance venture in Japan. Read the whole article on Crowd Valley News. Crowd Valley (a Grow VC Group company) has been invited to speak in a leading sustainable business finance event in Toronto on April 4 and 5. Crowd Valley has contributed also earlier in the GLOBE series and Crowd Valley back office is used for several digital finance services that especially focus on sustainable business finance. GLOBE Capital is proudly produced by GLOBE Series. GLOBE Series is best known for its world-renowned international GLOBE Forum Conference and Innovation Exposition held in Vancouver every two years. Since 1990, GLOBE Series has curated some of the world’s largest leadership summits on sustainable business which are designed to educate, empower, and connect leaders in pursuit of a cleaner, more prosperous world. GLOBE Capital is an important summit where global, innovative thought leaders and influential officials will gather to explore how to fully realize the enormous economic opportunity ahead. Seating at GLOBE Capital is limited to 350 participants. Attendance is by invitation-only to ensure adequate representation of important sectors, as well as reserving space for our extraordinary speakers and partners. The event focuses to identify specific actions and mechanisms that will:

Mr. Ahvenainen speaks at the panel "How Can Sustainable Infrastructure be a Superior Investment Grade Opportunity?" Infrastructure is strongly correlated with the growth potential of an economy. This session will answer the following question “What criteria ensures infrastructure is both more resilient and sustainable across its life cycle?” along with exploring: The barriers and opportunities associated with investing in sustainable infrastructure in the United States and Canada; New sources of capital, in addition to innovative new finance solutions. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed