|

Thomson Reuter’s Practical Law division published an article that provides a comprehensive review of the 60 crowdfunding offerings that were filed within the first two months of Regulation Crowdfunding becoming effective on May 16, 2016. This publication contains highlights and a more detailed analysis of a nascent, but promising sector.

Companies that have launched crowdfunding offerings differ greatly in terms of size, industry, creation date and origins. And yet, some market trends seem to be emerging, for example:

At Crowd Valley, our goal is to provide our customers with an infrastructure that makes their marketplaces operations as efficient, secure and sustainable as possible. And we look forward to assist established institutions and niche specialists in the creation of crowdfunding marketplace services. Read more at Crowd Valley News. Grow Advisors FinTech Minute: 4 market entry options for banks to compete in online lending sector10/10/2016 Grow Advisors (a Grow VC Group company) publishes its daily insight into the world of alternative finance and fintech. Here are some highlights: 4 market entry options for traditional banks to compete in online lending sector (& an invitation to join the conversation!) Much has been written about the threat that new online lending platforms pose to the revenue and profit streams of traditional banks. In extreme cases, certain commentators have predicted the demise of weaker traditional banks at the hands of these disruptive online lenders. The emergence and proliferation of FinTech platforms has been a wake-up call for the industry that has been trialing a range of responses, from those downplaying the threat to others looking to grasp the opportunity to transform into an innovative customer-centric lender. For this edition, we will provide an overview of the four models and set up the discussion for subsequent editions. Fintech – An Irish banking perspective The number of challenger banks using new digital technology grows everyday. It’s interesting to see that The Irish Times reported that the Bank of Ireland is planning to invest €500 million over the coming years to modernise its group IT infrastructure. Since the financial crisis of 2008 banks across Europe have been faced with the challenge of restoring balance sheets to meet the European Central Bank’s standards. This has involved not only working with customers to deleverage loans but by carrying out stringent cost cutting exercises, which often include branch closures and reductions in staffing levels. According to a 2013 a report in the Irish Independent: ‘Bank of Ireland came last in the study of 21 banks and Ulster Bank came second last. Bank of Ireland had a consumer satisfaction rating of just 41%, a full 50% lower than the leading bank. It performed particularly poorly in relation to customer service, regular communication, clarity of statements and branch availability’ Read more at Grow Advisors Blog. On 27 September TradeUp (a Grow VC Group company) Founder Kati Suominen joined the plenary meeting of theWorld Trade Organization’s Public Forum, that brings together all key players in international trade for three days of deliberations in Geneva. Suominen spoke of ways in which the WTO and the international trade community can advance small and mid-size companies’ trade through new rules on trade facilitation, online payments, finance, and digital policies. You can hear her remarks here, scrolling down. The high-level panel featured also Roberto Azevêdo, Director-General of the WTO, Rt Hon Liam Fox MP, Secretary of State for International Trade of the United Kingdom, Robert B. Koopman, Chief Economist of the WTO, Manuel Aldrete, General Manager of Chicza Rainforest, Sherill Quintana, Owner and Founding President of Oryspa and Hildegunn Nordas, Senior Trade Policy Analyst at the OECD. Suominen spoke at two other panels at the forum on digitization of trade and opportunities ecommerce opens to small busineses. Read more about international trade and its finance at TradeUp site. TradeUp Founder Kati Suominen (right) with UK’s Secretary of State for International Trade Liam Fox and WTO’s Chief Economist Robert Koopman

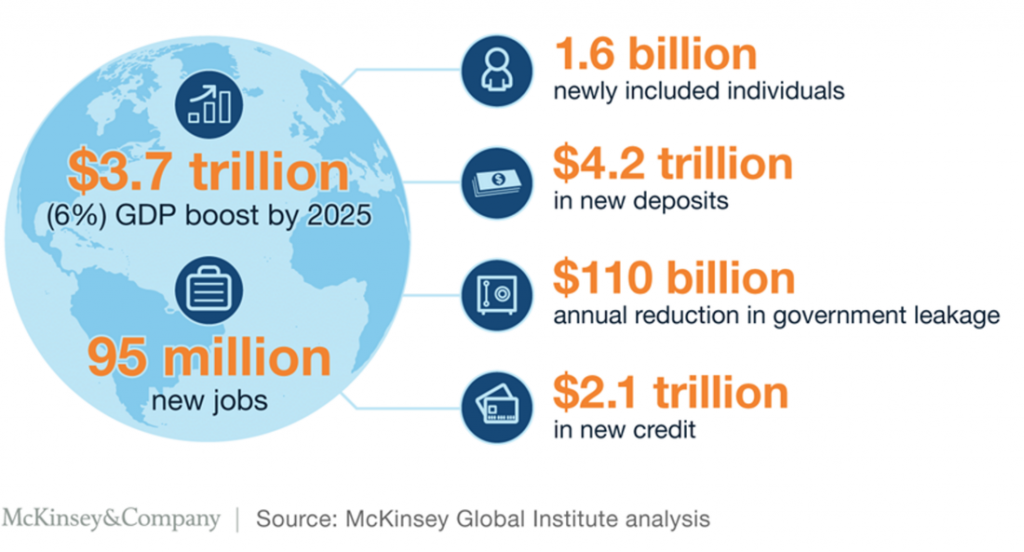

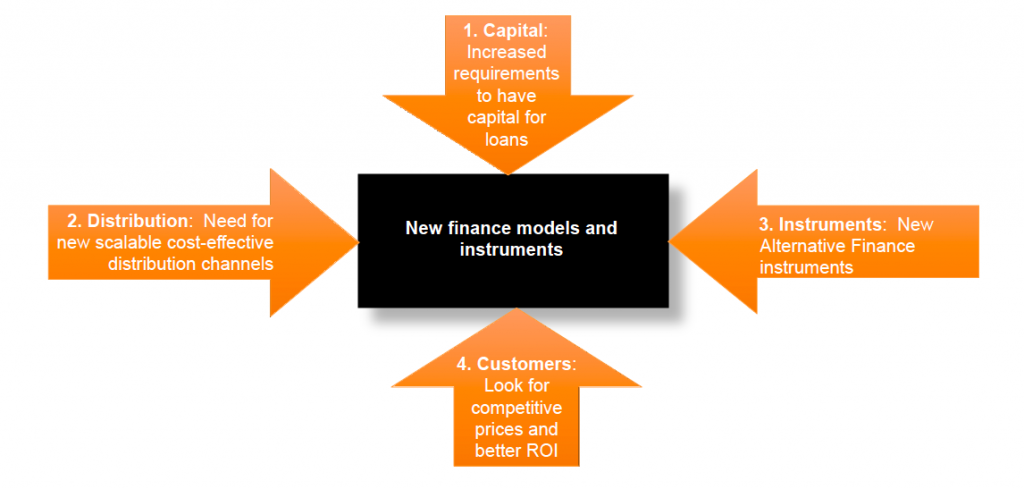

Digital disruption is hitting the financial services and changing the whole retail banking model. Alternative lending models are transforming the banking sector, creating both competitive threats and evolutionary opportunities for financial institutions. According to the 2016 World Retail Banking Report, 96 percent of banking executives agree that the industry is progressing toward a digital banking ecosystem. The largest retail banking event in Europe 14th Annual Retail Banking Forum in Vienna on 12-13 of October will bring together top-caliber banking peers to discuss the hottest issues, such as fintech startups, transformation of the traditional retail banking model, technological innovation and changing customer demands. Jouko Ahvenainen, the Executive Chairman of Grow VC Group, will be presenting at the Forum, discussing the hybrid finance models and how the emerging API ecosystems will change the way companies cooperate in finance. The audience will take away new ideas on how to capitalise on technologies which compliment their portfolios and create sustainable methods for continuous innovation. More information on the event web site. Financial technology adoption has been incredibly fast in the most advanced economies, but it’s a totally different story for what concerns emerging countries, where the penetration of digital finance services is still very low. The good news for those economies, and for those looking to do business there, is that the potential growth is now extraordinary, thanks to the level of smartphone penetration. A new report called Digital Finance For All: Powering Inclusive Growth in Emerging Economies, by McKinsey Global Institute, estimates that with the adoption of digital finance, it is possible to create an additional 95 million jobs and $3.7 trillion in developing economies by 2025. Currently there are approximately 2 billion people and 200 million businesses in the world that have no access to credit or savings. While only 55% of the adults in emerging countries have a financial account, there are about 80% of those that have a mobile phone, making the provision of financial services now viable which seemed out of reach not so far ago. McKinney identifies, “a mobile and digital infrastructure, a dynamic business environment for financial services, and digital finance products that meet the needs of individuals and small businesses in ways that are superior to the informal financial tools they use today”, the key points for businesses and governments have to achieve in order to secure the benefits that financial technology could bring, as well to support the substantial transformation happening in finance in the emerging economies. Finance pioneers are advised, the opportunity with digital finance is remarkable. Read the whole article on Crowd Valley News. The benefits of technology applied to existing processes making them more efficient or effective should be very practical. However, it’s easy to get lost in over hyped terms such as ‘fintech’, ‘peer-to-peer markets’, ‘crowdfunding’ and forget what the practical benefit is.

In this post let’s open up a few scenarios and walk through them step by step, to examine the applications of new technology in existing operations value chains and delve into the practical implications and value at different stages. To set the context, let’s imagine a private market lender with interests in setting up a digitalization strategy for the longer term and position their bank as a leader in the modern financial services market. To achieve this, the lender plans to open a sector specific marketplace where they will originate and lead deals, and invite other institutions with an interest to maintain a regulatory compliant profile, gain access to deal room to diligence and follow deals, with the option to participate in the syndication of these deals as a co-investor. Ultimately bring down the cost of capital, increase distribution and elevate the lenders corporate profile:

We’ve delved into a few different areas of impact that digital platforms can have in a digitalization strategy when employed by an institutional client, such as an asset manager or private market lender. The applications and impacts of digitalization strategies can be very tangible, and we encourage our clients and partners to discuss them and how they can benefit their organizations, rather than the general trends of fintech. Read more on Crowd Valley News. Grow Advisors (a Grow VC Group company) publishes its daily insight into the world of alternative finance and fintech. Here are some highlights:

Why the Wells Fargo debacle should worry many banks In September, Wells Fargo admitted to falsely opening millions of banking and credit card accounts over the course of 5 years, without customers’ consent. The bank fired over 5,000 employees involved in the misdeeds and handed a US$185 million fine. At the heart of the scandal is the stress managers were under to reach [unrealistic] sales targets. Former employees speak of relentless pressure and increasing quotas as the cause for their actions. Consider an alternative and worrying perspective: one that involves a fast changing landscape, reluctance to change, unmet consumer demands and the resulting revenue declines. The world’s financial centres regulate emerging fintech Technology and financial services firms developing fintech services face similar hurdles presented by old regulatory frameworks that were not designed to support digital business. Compliance is a fundamental and immovable base on which to successfully grow the fintech sector. At the same time, central banks and regulators realise they play a vital role in enabling innovation. While regulatory authorities maintain dialogue with counterparts around the world, it has been suggested that cooperation is limited as each country competes to attract business Online Lending – The Fintech Chimera The Chimera was, according to Greek mythology, a monstrous fire-breathing hybrid creature of Lycia in Asia Minor, composed of the parts of more than one animal. Innovation, like evolution, takes on many forms. Though always present in financial and investing services, in the last ten years the pace of innovation in all industries has quickened due to technology, regulation and customer needs. And when it comes to online lending, we are beginning to see an evolution in business models, as in-market experience begins to shape how businesses operate. The innovation will result in evolved organisations that take the best of both worlds. Read more at Grow Advisors Blog. Startup Commons (a Grow VC Group company) co-organizes Connecting Globalizers and Localizers event in Singapore on September 19. The event is a Slush side event. Startup Commons organizes the event with KPMG Digital Village, Slush Singapore and Team Finland.

“Connecting Globalizers and Localizers” is a “selection only” matchmaking event that aims to connect growth stage companies which are looking to scale their solution globally (Globalizers) and serial entrepreneurs or intrapreneurs (Localizers) who are looking to adopt existing innovative solutions from another region to start a new business venture within their local and regional markets in SEA countries. This event adopts an alternative approach towards internationalization by providing leading startups a platform to showcase their solutions with the aim of generating successful partnerships to drive the commercialization and adoption of proven products and business models locally. Commercial models could include, for example, a joint venture or the establishment of a new company which licenses or franchises the proven solution. GLOBALIZERS A Globalizer is a growth-stage revenue-generating company that has a proven business model and product who is looking to internationalize by partnering local entrepreneurs: 1. Your company has a market-validated product and business model 2. You are growing internationally or have international expansion plans 3. You are looking for local entrepreneurs or co-founder teams to build business in SEA countries 4. You are not just looking for partners, employees or resellers, but offering an opportunity for significant local equity ownership to potential partners. LOCALIZERS Localizers are serial entrepreneurs, experienced leaders or resident intrapreneurs who are focused on kickstarting new business ventures in their home/regional markets through the adoption of existing products and business models. Specifically, 1. You are willing to take an entrepreneurial risk to have an opportunity to build a local successful company for an existing product or service 2. You are looking looking to become the local CEO or be part of the founding team. 3. You have past entrepreneurship experience or have been responsible in creating and growing new businesses. THIS EVENT IS NOT for those who are simply looking to: – sell their products or services to others in the event, – find local resellers or distribution channels or – looking for investors. Ask more information from Startup Commons. The Hong Kong Monetary Authority (HKMA) last week announced the launch of a financial technology sandbox, to allow banks to test new innovative products that do not yet meet compliance standards. The new regime is valid as of September 6.

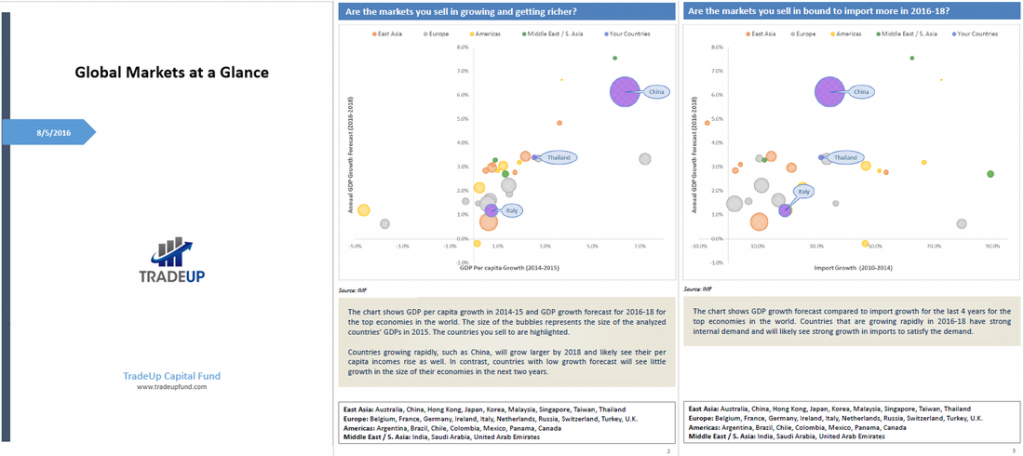

The announcement comes a few months following similar action by various governments around the world, including the UK, Singapore, Australia and France, but more recently also in other countries in the area, including Malaysia, Thailand and last but not least Japan. The main difference here is that the the regulatory sandbox would be not applicable to standalone fintech firms, but it’s only applied to banks. We believe this is a fundamental benefit, given the disruptive innovation being leveraged around the world in innovative banking institutions. This initiative is the third one in less than a year announced by Hong Kong. At the start of the year they established a fintech steering committee, before that the financial regulator announced, just two months later, an office to promote fintech through the organization of industry events. The good news of “Fintech Supervisory Sandbox” was brought by Norman Chan, Chief Executive of HKMA, in a keynote speech at Treasury Markets Summit 2016. Going further talking about the regulatory framework sandbox he says that it “allows banks to conduct testing and trial of newly developed technologies and applications on a pilot basis. Within the Sandbox, banks can try out their new Fintech products without the need to achieve full compliance with the HKMA’s usual supervisory requirements. Read the whole article on Crowd Valley News. Sign up now for Global Markets at a Glance by TradeUp, a free tool for companies expanding abroad.

TradeUp is committed to helping SMEs and startups raise the growth capital they need to get into markets around the world.

Sign up for your free customized report here. Learn more here. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed