|

Once upon a time, in a small and dark country, there was a small bank. Well, actually, it was not such a small bank for this country. It was also an important bank for many people, especially in the countryside, because this bank was also near its customers and the local staff really knew those customers personally and had forged meaningful relationships. The leader of the bank had a vision. He saw that banking business would change and that it would be better to act before that change happened. He wanted to drive the change, but he was leading the change from the castle in the heart of the capital, and well away from his customers. They decided to innovate at the bank. They thought that very basic saving accounts and offering loans with heavy paperwork were not the businesses of the future. They thought it would be a great idea to offer people new services they would really want to use and integrate finance options to those services. People, they thought, weren’t normally looking to them for a finance service so why not to offer them together. They could combine their old strength of knowing customers personally and utilizing modern technology and new services. They hired many new people. People who had technology competence to build new modern services, people who had created new businesses from scratch, and people who had seen elsewhere that it is better to act before disruption destroys a business. These people were excited about new opportunities to build a totally new business. They got freedom to develop new ideas and implement them. The bank was to have a new and more important role in its customers’ lives. However, there was also a group of traditional banking folk inside the bank and in the finance sector. They didn’t really like that the bank was starting to do something that was not ‘traditional’. They felt the bank had broken the rules and it became difficult for them to tolerate this rebellion any longer. Other people inside the bank also felt they were not in their comfort zone, with all kinds of new things happening. They complained, that it was confusing. From this an ‘empire strikes back’ plan was hatched. When it came time to get a new leader for the bank, it became an opportunity for the old banking gang to get control back. They started their work to ensure the next leader would take a step, no, many steps, backwards. Their plan worked. They managed to get a traditional finance wizard to lead the bank. He had the track record of doing things the traditional way. He had also read more traditional business management best sellers than most airport bookshops stock. He was an excellent leader to implement the ‘empire strikes back’ plan. It didn’t take long time for the plan to start working. The bank decided to stop new activities, and focus on traditional banking. People who came to the bank to do new things, decided to leave. And those who decided to stay, started to repeat the mantra “it is great to have a clear focus, it was so confusing earlier,” although earlier they had been excited about new things. But they were also smart people and they wanted to protect their positions under the new leader. The new leader wanted to make it clear, that this was another new era in the bank. He wanted to take the bank back to the local social clubs of the bankers in the country. They didn’t want to use modern digital technology, instead keeping their old IT model and developing it further. By adopting a puritan management and process consultant attitude the bank not only killed off the innovate trial and learn model, but it also managed to get rid of the traditional strengths of the company – the local presence and personnel that really knew their customers personally. They wanted to take the HSBC, Chase, or you name it model and adopt it to this small bank without realizing even the big banks were struggling with fintech and other disruptions that were emerging. It was a successful ‘revenge’ by the old banking gang and process consultants. The new innovations and businesses were killed off within a couple of years, and not only that, but the personal touch went too. No one can say they were ineffective because peace did come back to the bank and the local finance community. People in HQ were happy in their comfort zones and continued their old activities as if nothing had happened. They are now living happily ever after, or at least they will be, until the day the disruption wave really comes and changes everything. In some markets, it might have arrived already! The article first appeared on Disruptive.Asia. Photo: Sleeping Beauty Castle, Wikipedia.

Being a data scientist has been a hot job for several years. Concurrently, we have more and more questions about ethics and who the industry really develops value for. If you are a data scientist and want to create state of the art things, you probably must work for one of the giant data companies and accept their models to utilize data. Could this change soon?

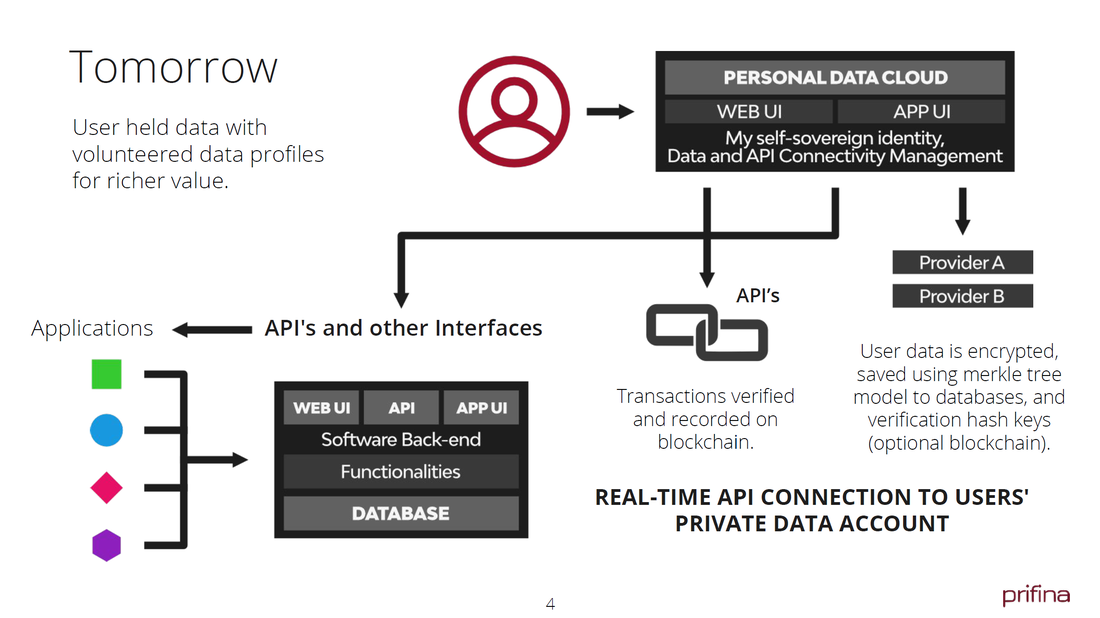

We still remember the days, when you had to work directly or indirectly with a mobile carrier or Nokia, if you wanted to make an application for a phone. It also had a very small likelihood that your app ever got to consumers and basically you did what some business folk had decided people wanted. Then came Apple’s App Store and overnight everyone in garages or bedrooms around the globe were able to make and publish mobile apps. It became a consumer market. We also know very well what it’s like to work for a bank and create finance services. You are a part of a huge machine and only work on some small components. No wonder, when blockchain opened the market to finance services, it activated millions of people to develop things. Of course, it hit some hype too, which often happens, and we are still in the early days of how distributed ledgers will change many services. How could the same happen to data scientists and AI developers? Or is it so that Google, Facebook, Amazon, the NSA and some others dominate the data market so overwhelmingly that no one can challenge them? Or at least so that individual developers or small companies cannot ever compete with them? Personal control and ownership of data are becoming very important. Privacy regulations, like GDPR in the EU and CCPA in California, are only one part of that. More and more companies are emerging to develop solutions for personal data control and also many big companies are starting to see the benefits from the new model. More companies could better compete against the data giants and they could also decrease their own risks and liabilities, if consumers could keep their own data. There are also technology needs to make more distributed data and AI solutions. For example, many personal assistant-type services require availability, latency and security where it would be better to have local data that is utilized in analytics and AI. We would move from very centralized massive big data cloud services to distributed data in local devices and consumer’s own repositories. All this will also change the data application market and how to generate business with them. It opens a market to new actors and also independent developers to offer their applications direct to consumers. When consumers have their own data, they are able to utilize many new services and applications in their daily lives. It is similar to over 10 years ago in the mobile application market. Of course, this needs many components in the ecosystem until it really works properly. We need a framework to develop these applications, an active developer community and enough parties to orchestrate the ecosystem and services. We already see a lot of development in this area, so there are probably not so many missing components anymore. Whereas data scientist work has been to develop algorithms, make more or less advanced data mining or develop some ad or sales targeting services, this new development could change job descriptions significantly. Those things are all still needed, but there will be more opportunities to innovate totally new services on data, make new business models for consumer data apps and start to offer AI apps directly to consumers too. We are approaching a disruption point in data services. It won’t only be about privacy, consumer control or distributed data and AI, but it will also introduce a significant change in how data services and applications are developed. It opens business opportunities to new companies and developers. This is development that has also happened in other software areas, from centralized business management driven systems to more independent services, an open market and individual developers. It gives more freedom to consumers, how they want to use data. And for developers, what kind of data applications they really want to develop and bring to market. You can explore more at Github: “Liberty. Equality. Data.” Sign up to Prifina’s Developer API. The article first appeared on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed