|

Digitization is coming to all services, also linked to physical services. It will change the user experience significantly. It helps us to get rid of many complex and time-consuming processes. Especially the combination of blockchain and IoT offers new powerful tools for this.

Let’s take examples that have been introduced to me most recently. When you buy a house in the future, you can sign the agreement with a smart contract. This signing then triggers an automated process. The payments and loan agreements are accomplished. You are sent digital keys (e.g. to your mobile) to get into the house. The sale starts a process of finding suitable insurance with data that comes directly from your house, and you can select the best one, with the same process for utility contracts. You can get a car for your use based on your needs. It can be for a single drive or longer-term. All agreements, payments and insurance needs can be handled digitally immediately. There can be different pricing models based on your needs. This works also for self-driving cars and you can even send the car to collect something and it can handle a signing and payment when it completes the delivery. You can manage and “carry” your own finance and health care data with you. You can control how and when it is used, and you can track its users and their access. When you need health care or a loan, you can get offer offers based on your own data. The same for insurance contracts. Probably these examples are even simplified, as we cannot even imagine all models to use these two things together in the future. They regardless give an idea about the opportunities to build new services. It will change significantly, how services are offered in the future. This will especially change the user experience. For example, all processes above now include a lot of paper work, take a lot of time, and the data is not properly utilized (for example, you easily pay extra for home or car insurance, when it is hard to find the optimal one). We can compare the scope for change to how it was to book a trip before internet travel services. You had to find information from brochures, booklets, and travel agencies, fetch tickets and hotel vouchers and have everything on paper with you. But this change can actually be bigger, when it gets many services to work together and is also linked to physical services and devices. Technology for these services start to be available now or very soon. A more complex question is, who will implement the actual end-user services, how the business models will look, and if the development is more a disruption or an evolution. Telecoms carriers, finance institutions, cloud companies are all linked to these services with other parties like real estate, car, and logistics companies. But are any of them able to offer smooth end-user services, or do they only implement lower level parts in the value-chain? Technology enables new things, but it needs business models and good customer experience to really change the world. TCP/IP existed since 1960s, but only in the 1990s did we started to get user friendly services and businesses to utilize it. Nowadays, development is faster. It also often so that incumbent players have been able to maintain certain roles, when the Internet has changed a business, but newcomers have really took the major part of a new business. You can think, for example, advertising and media businesses, where many old media and ad companies still exist, but companies like Google, Amazon, Facebook, and Netflix have been the biggest winners and prevail with their new models. We are going to see a race for these new services. We can already see that carriers, banks and insurance companies are becoming more active to utilize new technology. But to really offer these new services we need much more than a conservative technology development. It requires risk taking with new business models that can also cannibalize existing business lines. Therefore it is not easy for large incumbent companies. These new services are based on distributed models and data, open APIs and smooth cooperation of many components. It doesn’t even make sense to try to dominate these services alone. For each company, it is much more important to choose and accept their position and focus on playing that position as well as possible. If someone tries to make it alone, they can lose a lot of money and be out of the actual dominating ecosystem. So, each party should select its own strategy and then start to constructively cooperate to have a valuable role in the ecosystem and value chains. The article first appeared at Telecom Asia. Telecom carriers have looked for a role beyond the bit-pipe for years. Now it looks like the evolving TV and content business is a new game that they want to participate in. Netflix and Amazon are leading the streaming business globally and have stepped to produce their own content too. Now there are signs that some carriers want to enter this business. But consequences can be complex to evaluate.

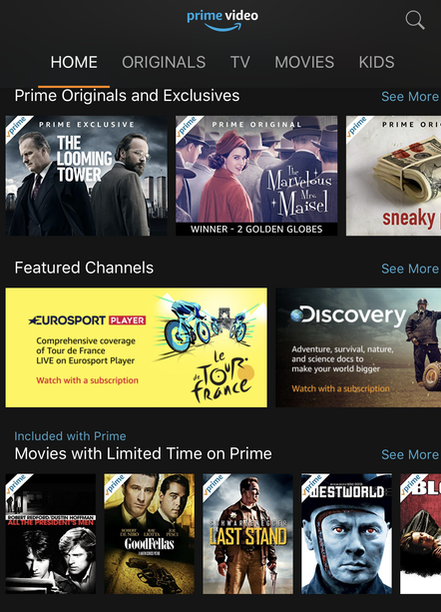

In the US AT&T has tried to merge with Time Warner, but the merger is now a legal battlefield. There are also other similar activities around the world. Maybe the latest one is that Sweden's Telia is talking to acquire Bonnier Broadcasting that owns TV channels and production in Nordic countries. Vodafone just acquired cable networks in Central and Eastern Europe from Liberty Global. Some operators are also in the pay-TV business and even started to produce their own content. The timing is interesting for both parties. Carriers are still looking for value-added services. At the same time broadcast media companies have really started to feel the impact of Netflix and Amazon and other content from the internet. They lose viewers, and advertising money follows. For a longer time it has looked like streaming content is one interesting business opportunity for carriers. People are now ready to pay for good content. An additional opportunity is to bundle data and content, such as by offering ‘free data connections’ for a carrier’s own content services. It is a way to tie in customers. In principle, this sounds good. But as the AT&T and Time Warner case also demonstrated, this kind of vertical mergers can be complex for competition and consumers. We have several questions, like:

How well carriers are able to run this business in practice is its own question. Carriers’ track records in expanding to other businesses is not very promising, and often they ramped down or divested non-core activities. Carriers must at least accept that the media business is very different business from the network infrastructure business. Globally it looks like there will be strong global content companies, like Netflix and Amazon. At the moment, it looks like the vertical mergers are not really a threat to them, they are strong enough. The media and carriers' mergers can be a bigger threat locally and, for example, in certain language areas. At the same time, someone can argue that Netflix and Amazon could become globally dominant players, and it is actually good to get serious competition from Media-Carrier firms. Disney’s acquisition of 21st Century Fox is another example of media consolidation. The competition authorities have commented that horizontal deals are not such a threat as the vertical ones for the competition. But it also indicates that media and content firms are preparing for a new era of competition. There is an old saying that the TV content and distribution business is an example of how one strategy can work only for some time. The past has shown that if a winning strategy seems to be to own cables to customers, then a distributor gets the rights to such a content that every one wants and they start to dominate the value chain, until the best content producers start to dominate it by dictating the terms of the market. So, it is a never-ending pendulum in the value chain. But if you own the whole value chain, which can be the result of vertical mergers, it will be very different game, or no game at all. The article was first published on Telecom Asia. Legacy technology is often debated. Recently, we’ve seen many high-profile privacy intrusions (Cambridge Analytica with Facebook) and system malfunctions (mass flight cancellations in Europe in March 2018), yet we are amassing even more data into increasingly large black boxes (how much data did Equifax have again?). Decentralized and distributed systems have started becoming topical and popular. When will the unbreakable black box finally clear for new systems?

Like any large-scale shift, it’s far easier to see the direction than it is to predict anything close to an accurate timing of said shift. Legacy, monolithic, colossal systems are clearly not the future, and more cracks in the foundations are going to be made public in the months and years to come. However frail these systems may be, getting a large-scale shift of any system requires not only years of R&D, it also requires years of validation. But it is happening. Short of directly overhauling information systems, we can see organizations launching their greenfield projects based on modern technologies, often a step removed from their core infrastructure. For instance, look at what Goldman Sachs did with Marcus, which their technology team has been quite open about. They then rolled out the Marcus platform into GS Bank, but only after taking it to market as a relative standalone. This makes sense – why hold a novel new approach down with archaic systems at the start when the value is minimal, when you can simply link it back in the future? Should it actually be seen as valuable? Yet, the more new greenfield projects an organization has and launches, the more crucial the question of interconnectedness and interoperability becomes. Tying together these new projects, product, and services, we see a new infrastructure emerge. Riding on the API economy principles, this type of connectivity can and should be native and allow a modular architecture, which, by the way, ends up being future proof given the malleability and high specialization (switch out one call for another and you can swap out an entire product). Although modularity and longer-term future-proofing are not only limited to technology, it really becomes a question of delivering the best service to the end client. Collaboration between different parties to achieve certain aims, such as syndicating a larger loan to diversify risk exposure, ultimately yields the client what they are looking for and creates more value. This isn’t without its challenges in a culture which seeks control over client relationships, yet the shift in thinking has to become more purely client-centric. In the case of the syndicated loan, if our bank, in collaboration with various lenders, can provide the client with further value, does that not reflect well on our relationship with the client? Does the client actually care that others are part of the syndicate and if so, does that lessen the perceived value? I would argue that not only is it a more technical nature of the loan for the client, it may even enforce the value created. Yet creating this new infrastructure allows for an interesting question on timing. At what point is the new infrastructure proven enough that the legacy system can be wound down? Surely, it’s under 50% of usage, but is it 15% or 25%? How long is too long to wait? Winding down a successful system is also a political question: why fix it when it is not broken? But history shows us that this thinking and the failure to anticipate change bodes dramatically poorly for organizations that exist in innovative or disrupted industries. The financial services industry is clearly in flux. Crises present themselves as great opportunities, or forced opportunities, and with the future looking full of crises, we are presented with an ever-growing list of opportunities for financial services organizations to leverage. There is, of course, the option that old service lines and offerings simply die out as unused or unpopular following a mass exodus of users, and maybe that is relevant in a few cases, but larger scale change does have to be managed. With financial services systems, having users in the millions and capital in the billions (and more) taking down a system in any manner includes a major disruption. However, that may be unavoidable, so a proactive path may allow you the chance to determine when that disruption takes place. In private meetings, I’ve even been told of systems that are expected to “go down in 2018 – we just don’t know when!” This seems to be an interesting predicament to try to manage. But even a proactive strategy is not without its issues, imagine telling the board that you intend to take down a multi-billion-dollar business for “maybe a few hours,” how will that go? We have to conclude that change in an interconnected legacy systems market is messy, and organic change, even more so. While we wait for these organizations change agents to act when presented the opportunity, we can also be curious about the new silos we are building. We are constantly amassing private and sensitive data behind a central agent’s control all around the world. And the data sets we can today create and generate are truly amazing in their technical nature and terrifying in their implications – with personal identification data, meta-data, smart connected devices in our pockets and homes, the list goes on. To think that central agents and their systems are immune to failure and or attack is naive and time alone will show their integrity. With all the data we have and our seeming determination to store it into centralized systems, it does make one wonder how well all our change agents are lined up. It also has one hoping they have a proactive plan in motion. This post originally appeared on MEDICI. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed