|

The Australian Parliament, through the voice of Treasurer Scott Morrison, recently introduced a bill aimed at removing the regulatory barriers to Crowd-Sourced Funding (CSF). CSF is a fundraising model that allows individual investors to directly invest in small companies, which might otherwise struggle to access affordable sources of funding. The concept of CSF is better known as ‘equity crowdfunding’ in other countries, and is for instance described as such in the American legislation. Once in effect, the new legislation will lift some regulatory requirements (reporting, compliance, and governance) for issuers that meet the following criteria:

On the other hand, individual investors cannot invest more than AU$ 10,000 (or $7,200) per issuer and per platform over the course of a given year. In April 2016, research and consulting firm Scott & Sullivan released a study that estimated the market size of the Australian fintech sector around $184 million in 2015 but also expected it to represent more than $3 billion in 2020 with an average annual growth of 76.36%. Prior to the recent change in regulatory requirement, one of the main drivers for growth was the improvement of the currently low adoption of alternative finance in the country. Indeed, Australian alternative finance volume per capita was four times lower than in neighboring New Zealand, and 7.5 times lower than in the USA, who leads the rankings with its more mature alternative finance industry. Today more than ever, Australia’s potential to become a major fintech hub is fueled by the activity of its local actors. And it seems that recently passed legislation will give them sufficient flexibility to adopt innovative solutions. In the words of Treasurer Morrison: “From today, all eligible businesses will be able to test a range of financial or credit services (with up to 100 retail clients and unlimited wholesale clients for up to twelve months) without the need to apply for an Australian Financial Services Licence or Australian Credit Licence and without seeking approval from ASIC (the regulator)”. In practice, it means that Australia went beyond the frame of usual sandboxes where approval from the regulator is needed prior to beginning the experimentation of innovative services. Here, there is only a need to notify the regulator when the testing phase begins. Thanks to its world-leading infrastructure and an international network of expert partners, Crowd Valley is ideally positioned to assist investors, issuers, and intermediaries in entering the Australian CSF market. Any interested party shouldn’t hesitate to contact us. Read the whole article and more details on Crowd Valley News. Photo: Melbourne (from Wikipedia).

Billion dollar startups are emerging faster and faster. Given innovative startups’ critical role in the information economy, the importance of healthy startup ecosystems only stands to increase in the future, being this the reason why local, regional and national governments across the world are establishing programs to support tech entrepreneurs in an effort to stimulate economic growth and job creation.

One quite common starting point to connect, support and grow a startup ecosystem is by mapping it in order to know what is going on in the startup ecosystem, who are doing what and why, where and when are things happening or how different parties can "get in on it". Some relevant reference cases related to that are Berlin Startup Map, Mapped in Israel or Digital NYC to name a few. However, usually in this type of cases there’s an important speed gap between the showcased information and real startup ecosystem activity that generally becomes into outdated and inaccurate information for all user roles within the startup ecosystem, generating a lot of frustration. Countries like Vietnam are implementing digital backbone to digitally connect and visualize Vietnam startup ecosystem functions to stimulate further innovation in its emerging tech scene with the objective to collect, maintain, distribute, showcase and use Vietnamese startup ecosystem information on real-time to benefit all parties involved. This Digital Ecosystem Infrastructure solution has the architecture to connect these manual mapping efforts with systematic approach to get primary measurable data from the startup ecosystem and one key component connected to this digital infrastructure via API's is the ecosystem view module that can showcase all the information and resources of cities' digital economy in one place, visualizing the pulse of startup ecosystem functions by startup development phase, location, industry, time, etc. helping people and startups find the right services and connections at the right time and also helping public & private sector decision makers and service providers target their services to the specific needs of the startups and other ecosystem actors. This ecosystem view provides access to tools, services and support needed to turn ideas into real businesses, including:

Overall, this digital ecosystem view simplifies things and makes the startup ecosystem more transparent and all parties can get more benefits from them. Additionally, by just adding startup development phases layer, it provides the right services at the right time. This alone is valuable for the future. The digital ecosystem approach is all about better access, transparency and efficiency. This, along with the statistical data that this it generates, leads to accelerated development of all areas it spreads to and effectively connects a city or country with the new digital finance world. If you want to explore how this digital solution fits on top of the work you are doing now to support startups and innovation to go further with what you’ve got, then contact Startup Commons to organise a workshop to take your startup ecosystem to the next level. Read the whole article on Startup Commons Blog. This is the time of the year when you should take your agenda and carefully pick the events that you want to attend to or speak at. We know that and we are also aware that it could be quite difficult because the number of events is so large that it could be tricky to select the ones that are worth to consider. For this reason we decided to prepare for you an extensive but well selected list of the essential fintech events of 2017. Enjoy.

Here are some highlights, read the full list on Crowd Valley News: Next Money Fintech Finals Date: 18-19 January 2017 Location: Hong Kong Website: https://ff17.nextmoney.org/ Next Money event part of the StartmeupHK Festival with more than 1000 people expected at PMQ in Hong Kong, with notable international speakers covering fintech design and innovation. 24 startups from around the world will be selected to win prizes and cash. Finovate Europe Date: 7–8 February 2017 Location: London, UK Website: http://europe2017.finovate.com/ Finovate Europe comes back to Old Billingsgate Market Hall on London Thames with a big showcase of the most innovative new financial and banking technologies. Lendit USA 2017 Date: 6–7 March 2017 Location: New York, USA Website: http://www.lendit.com/usa/2017 The world’s biggest show in lending and fintech with 5000+ attendees, 350+ thought leaders, 2400+ companies and 1000+ companies from over 40 countries. Some info on our experience there, with our CEO that spoke about the market best practices in efficient back office operations, can be found here: http://buff.ly/2j8gTI0 Retail Banking Innovation Date: 14-15 March 2017 Location: London, UK Website: http://retailbankinginnovation.fintecnet.com/ The second Annual Retail Banking Innovation conference that will be held at CityPoint, London, with the aim to “develop an industry leading innovation strategy informed by the latest regulatory and technological influences to execute customer-centric, digital transformation”. Speakers include Jonathan Webster, from the Lloyds Banking Group and Jonatan Alonso from Banco Santander among others, but also people from the new digital banks as Monzo and N26. Africa Mobile & Digital Banking Summit Date: 22-23 March 2017 Location: Nairobi, Kenya Website: http://africadigitalbanker.com/ Summit held in the east African hub of Kenya, gathering together innovative bankers, mobile money telecom operators, banking and financial markets regulators, fintech firms, banking tech suppliers, banking cyber security consultants as well as government representatives. This event presents an exciting platform for players from both the east and west to interact and collaborate. Grow VC Group and its Chairman Jouko Ahvenainen has been invited to participate in the European Financial Forum in Dublin on January 24th. The European Financial Forum is an event designed to meet the needs of senior decision-makers and professionals working in the following areas: Banking, Insurance, Institutional Investment, Asset Management, Financial Regulation, Economic Research or Policy, and FinTech. The participants are C-level executives around the world.

The Financial Times in partnership with IDA Ireland presents the second European Financial Forum, bringing together international industry leaders, policy makers, regulators and subject matter experts to explore the various forces - political, social, economic and technological - that are shaping the global financial services industry. This year’s European Financial Forum has added significance following the UK referendum on EU membership and a new administration in the United States. The Forum will consider a broad agenda through a combination of keynote address, on-stage interviews and panel discussions moderated by a team of the most respected journalists and commentators from the Financial Times. Topics will include: the impact and likely industry response to Brexit, the view from the markets, investment challenges and opportunities in a low interest rate environment, identifying and managing risk and the increasingly important role of innovation in financial services. This years’ Forum will include perspectives from China courtesy of senior representatives from the China Investment Corporation (CIC) and the Asian Infrastructure Investment Bank (AIIB). All kinds of organizations are now struggling with cyber security threats and risks. There are a lot of consultants that are happy to manifest risks and sell their services. Some security companies and hacker groups also like to demonstrate how they have been able to get into some companies and systems. FinTech and finance services are very concrete examples where companies and all people must manage cyber-risks. But is it even realistic to be able to stop all attacks, and do we need totally new approaches?

The situation in cyber security has been compared to the time when artillery was invented and made castles useless. It basically forced all parties to think about security in a new way. It was no longer enough to build great walls and consider the inside safe. Another good comparison, interestingly, is an avocado. An avocado has a soft part and a hard core. In this analogy, only the very important core needs hard protection, while a lot of the surrounding material is not so critical, but it is important to have the ability to trace if someone gets into it. However, whatever analogy you use, it is also fundamental to understand that nothing is 100% secure. When you set up a server and connect it to the Internet, there are many parties that connect to it immediately. But there are also different levels of attacks. Some are simple to stop without any specific effort, and some are almost unstoppable, although these also require a lot of effort from the attacker. Obviously, finance services is one popular target for attacks, whether the motive is to steal money, seize accounts or blackmail institutions. FinTech presents the opportunity to offer better and more cost-effective finance services, but it has also comes with its own cyber security risks. A recent conference presentation in Germany demonstrated how easy it was to seize accounts at a new Internet bank, N26. The whole cyber security area is a complex discussion, as even the recent US presidential election has demonstrated. People underestimate the risk and don’t understand that no one is totally safe in the Internet. At the same time, it is easy to spread misleading information about the risks. A year ago, there were some cases in the UK where some people lost money from their bank accounts when the account numbers were stolen from an ISP. Immediately there were some experts on TV commenting that they had always said Internet banking is not safe. But the problem wasn’t the stolen account numbers so much as it was the users giving account access codes to criminals on the phone. (Those criminals, incidentally, were some teenage boys.) Rethinking the security paradigm The sad fact is that nothing is totally safe when it is connected to the Internet. However, the physical world is also risky, and we manage that risk all the time. When you walk on the street, there are all kinds of risks, but you can decrease them by selecting where, when and how you walk, for example, or how you carry anything of value that a pickpocket would want to steal. Lots of people tell terrible stories about how risky it is walk in the evenings near stations and other crowded places, but still many people do this without any problems. Internet security has always been a balancing act between costs and potential risk – it doesn’t make sense to build a $1,000 system to protect only one dollar. Returning to the avocado analogy, there is a lot of data and services components that belong to the soft part of avocado – you cannot protect it totally, but you want to see if someone gets inside it. And then there is the small part – the core of the avocado – that is so fundamental that it must be completely safeguarded. We also need more business-oriented security consultants that don’t just write horror stories, but can also calculate risks. And we need realistic “cyber-wise” business people who understand cyber security risks and digital business opportunities enough to build optimized secure services. This article was first published on Disruptive.Asia. We’re proud to announce that Crowd Valley (a Grow VC Group company) shall be speaking at the Paris Fintech Forum to address the forum, on how the global fintech market is evolving and what the future holds.

The Paris Fintech Forum is organized under the patronage of M. Michel Sapin, Ministry Of Finance, Economy, Industry & Digital Affairs. Sponsored primarily by Alteir Consulting, who has played a significant role in strategy, organization and innovation most notably in the banking, insurance and telecommunications industries. The forum is set to convene on January 25-26, 2017 at the Palais Brongniart in the french capital of Paris. Crowd Valley’s CEO, Markus Lampinen will be discussing the democratization of capital and investable asset classes, as well as possible synergies between fintech companies across industries in achieving financial inclusion for audiences that have not held it before (non-accredited investors but also non domain experts). In addition, Markus would provide insight on Europe’s dynamic regulatory environment and how Crowd Valley’s infrastructure can support both traditional banking institutions and incumbents through the adoption of PSD2 as well as streamline wealth and asset management processes. In this manner, he would highlight how Crowd Valley’s work over the past several years has been promoting the democratization of finance wherein end to end value chains and structures can be made more immediate and effective. For further information on the event, please have a look at http://www.parisfintechforum.com/. If you’re interested in Crowd Valley’s efforts in democratizing finance and how you can be a part of that movement, please feel free to get in touch with us at https://www.crowdvalley.com/contact . Grow VC Group and one of its companies, Crowd Valley, are in the next week in several finance events in Hong Kong:

Asia is coming a leading fintech market and Hong Kong is a leading finance hub in Asia and now also building its fintech community. Grow VC Group has been active in Asia and Hong Kong years and invests significantly more in the Asian fintech market in this year. For example, Crowd Valley (a Grow VC Group company) has already a significant customer base in Asia and expands its operations in the region. You can read Jouko Ahvenainen's predictions for Asian fintech in 2017 here. If you want to meet Grow VC Group or Crowd Valley in the next week in Hong Kong, please send us email. Photo: Jouko Ahvenainen speaking at the previous Fintech O2O event in Hong Kong in September 2016.

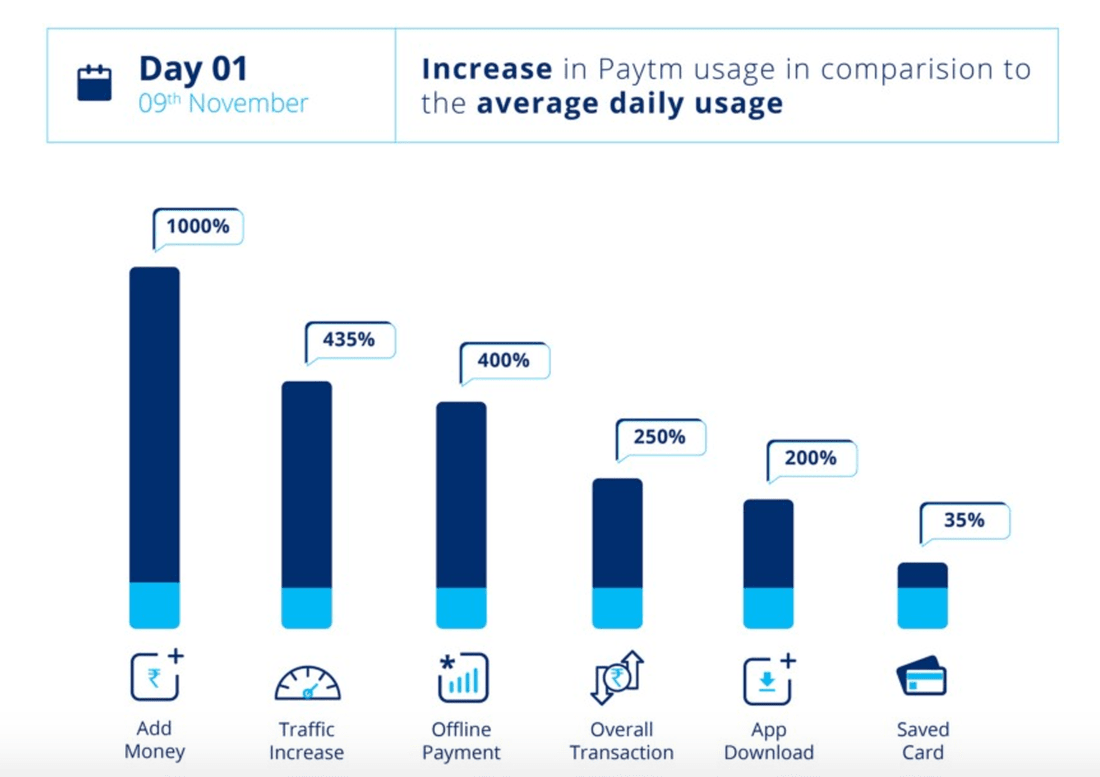

With the recent implementation of the demonetization rules by the Government of India, a lot of interesting events have taken place in the day-to-day life of the Indian masses. With the largest denomination bank notes of Rs. 500 and Rs. 1,000 taken out of circulation, that accounted for about 86% of India’s cash circulation by value, people were forced to explore alternative routes like online banking and e-wallets as their cash alternatives. For those without any bank accounts or access to internet/online services, this event triggered additional hardship to deal with as they’d face long queues at banks to get their currency deposited or exchanged. Even with the inconvenience caused, this decision is largely welcomed by the masses in a bid to curb the counterfeiting and proliferation of black money that has plagued the Indian economy for a long time. In one of his recent rallies, the Prime Minister of India, Narendra Modi, encouraged the country to adopt a cashless economy by using digital payment options like wallets, online banking, debit and credit cards, etc. He also urged the business traders to take this opportunity to join the digital world. Demonetization has certainly sparked a surge in adoption of cashless alternatives but the uptake for the majority of the masses seems lukewarm. For India to go truly cashless and sustain that kind of economy, we need to look at the various aspects required to support its digital infrastructure. According to the Telecom Regulatory Authority of India (TRAI), the total internet users in India are around 350 Million (approx. 27% penetration), surpassing the US and is only second to China. According to Counterpoint Research firm, India currently has over 700 Million mobile phones, out of which 250 Million are smartphones. NASSCOM estimates 50% of travel transactions in India will be made online by 2020. Also, according to Worldpay’s projections, the Indian e-commerce market is predicted to reach $63.7 Billion by 2020 and overtake the US by 2034, becoming the world’s second largest e-commerce market. According to the Reserve Bank of India report, there were 1.46 Million PoS (Point of Sales) machines in use in India, which means 856 machines per million people. To incentivize banks and manufacturers of PoS terminals, the government has waived-off some percentage excise duties on these machines. India’s Fintech market is expected to grow by 1.7 times between 2015 and 2020, according to this report. According to the Reserve Bank of India (RBI), at present, the financial inclusion in India is low, where 145 Million households still do not have access to banking services. RBI has come up with a plan for financial inclusion, which aims to set the path for 90% financial inclusion in India by 2021. In a report by Statista, the transaction value for the Indian Fintech sector is estimated to be approximately $33 Billion in 2016 and is forecasted to reach $73 Billion in 2020 growing at a five-year CAGR of 22%. As per KPMG, the Fintech investments in India increased mani-fold from $247 Million in 2014 to more than $1.5 Billion in 2015. With the reducing costs of internet data plans and smartphone prices, and with the Digital India and Smart Cities initiatives by the Government to promote digital infrastructure development in the country, the driving force behind adopting a cashless economy looks promising in the coming years. Crowd Valley (a Grow VC Group company) is committed to transform the financial services landscape with its API framework and is keenly interested in helping the Indian Fintech ecosystem grow. Read the whole article on Crowd Valley News. Image source: Paytm Blog

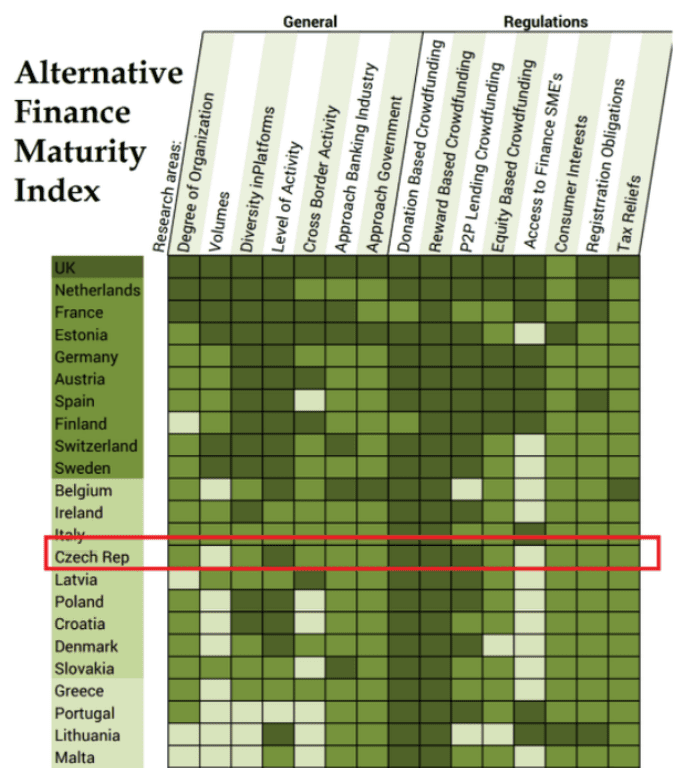

Turning our attention to Eastern Europe, the beautiful country of Czech Republic, steeped in history, catches our attention. With focus of the fintech world concentrated on hubs such as New York, Silicon Valley, London and Berlin, Prague seems to run under the radar for the most part but given that Prague is the fifth most visited city in Europe, it can’t afford to fall behind. Looking at the figure below, we see that there are a number of successful fintech firms comprising the Czech ecosystem.

As far as crowdfunding in the Czech Republic, the most common form is reward-based crowdfunding, which has existed in the Czech Republic for four years now and is growing every year. For example the Hithit platform raised 80% more money in 2015 than in 2014. The second most used form of crowdfunding in the Czech Republic (that is actually not publically perceived as a form of crowdfunding), is P2P consumer lending. It started to accelerate during 2015 when Zonky.cz was launched. This platform has built its public recognition on the emphasis that people who do not match the criteria of banks should nevertheless have a chance to get a loan. SymCredit and Pujcmefirme represent Czech P2P business lending. These platforms are slowly gaining the trust of the public equity crowdfunding has not been an active form of financing in the Czech Republic so far. Just one campaign has been successfully funded. Czech law does not explicitly regulate crowdfunding, but it does lay down certain rules and limitations for the collection of funds from the public and their use, rules on consumer protection and the prevention of money laundering. In addition to the general rules establishing consumer protection conditions, including the negotiation of contracts through the internet, regulated by the Civil Code and the Consumer Protection Act, the following Czech laws may be applicable: (i) the Act on Banks, which prohibits the acceptance of deposits from the public without a banking licence; (ii) the Act on Payment Systems, determining rules for the provision of payment services, including transfers of funds; (iii) the Act on Capital Markets, regulating the mediation of investments in shares and bonds and public offerings; (iv) the Act on Public Collections, regulating the collection of voluntary cash contributions from contributors for a predetermined public benefit; and hypothetically also (v) the Lottery Act, where winning or losing is decided by chance. Significant regulatory burden arises, however, in case of equity-based crowdfunding as it remains rather problematic to offer investment stakes in limited liability companies to a crowd of investors in the online environment of crowdfunding marketplaces. In case of equity crowdfunding models, the current environment may require compliance with the provisions of the Act on Banks, the Act on Undertaking Business on the Capital Market, the Act on Bonds or the Act on Investment Companies and Investment Funds. The Czech Ministry of Finance is currently preparing a new Act on Consumer Credits, which will tighten the conditions for the provision and procurement of credits to consumers, probably also including some form of regulation of dedicated crowdfunding platforms for the funding of consumer loans. Moreover, the EU has long been considering the establishment of harmonised crowdfunding legislation. The European Banking Authority (“EBA“) as well as the European Securities and Markets Authority (“ESMA“) proposed a series of measures to reduce risks connected with crowdfunding, including the possibility of introducing specific registration and regulation of operators of crowdfunding platforms. Czech investors are currently also investing on several international P2P platforms as Bondora, Mintos or Twino. The launch of equity crowdfunding platform Fundlist.cz was highly anticipated and since its launch in June, 2016, $760,000 has been raised through public offerings on the platform. Read the whole article and more details on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed