|

Turning our attention to Eastern Europe, the beautiful country of Czech Republic, steeped in history, catches our attention. With focus of the fintech world concentrated on hubs such as New York, Silicon Valley, London and Berlin, Prague seems to run under the radar for the most part but given that Prague is the fifth most visited city in Europe, it can’t afford to fall behind. Looking at the figure below, we see that there are a number of successful fintech firms comprising the Czech ecosystem.

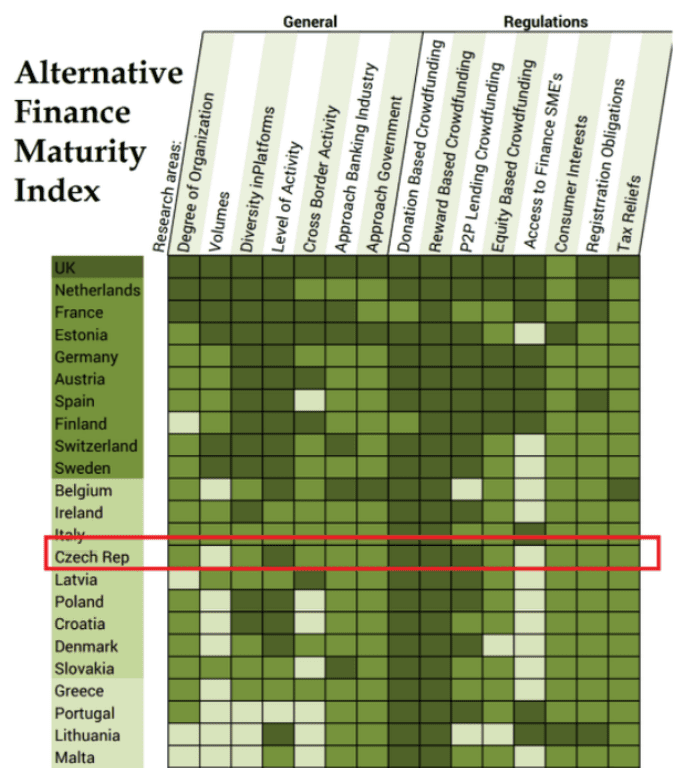

As far as crowdfunding in the Czech Republic, the most common form is reward-based crowdfunding, which has existed in the Czech Republic for four years now and is growing every year. For example the Hithit platform raised 80% more money in 2015 than in 2014. The second most used form of crowdfunding in the Czech Republic (that is actually not publically perceived as a form of crowdfunding), is P2P consumer lending. It started to accelerate during 2015 when Zonky.cz was launched. This platform has built its public recognition on the emphasis that people who do not match the criteria of banks should nevertheless have a chance to get a loan. SymCredit and Pujcmefirme represent Czech P2P business lending. These platforms are slowly gaining the trust of the public equity crowdfunding has not been an active form of financing in the Czech Republic so far. Just one campaign has been successfully funded. Czech law does not explicitly regulate crowdfunding, but it does lay down certain rules and limitations for the collection of funds from the public and their use, rules on consumer protection and the prevention of money laundering. In addition to the general rules establishing consumer protection conditions, including the negotiation of contracts through the internet, regulated by the Civil Code and the Consumer Protection Act, the following Czech laws may be applicable: (i) the Act on Banks, which prohibits the acceptance of deposits from the public without a banking licence; (ii) the Act on Payment Systems, determining rules for the provision of payment services, including transfers of funds; (iii) the Act on Capital Markets, regulating the mediation of investments in shares and bonds and public offerings; (iv) the Act on Public Collections, regulating the collection of voluntary cash contributions from contributors for a predetermined public benefit; and hypothetically also (v) the Lottery Act, where winning or losing is decided by chance. Significant regulatory burden arises, however, in case of equity-based crowdfunding as it remains rather problematic to offer investment stakes in limited liability companies to a crowd of investors in the online environment of crowdfunding marketplaces. In case of equity crowdfunding models, the current environment may require compliance with the provisions of the Act on Banks, the Act on Undertaking Business on the Capital Market, the Act on Bonds or the Act on Investment Companies and Investment Funds. The Czech Ministry of Finance is currently preparing a new Act on Consumer Credits, which will tighten the conditions for the provision and procurement of credits to consumers, probably also including some form of regulation of dedicated crowdfunding platforms for the funding of consumer loans. Moreover, the EU has long been considering the establishment of harmonised crowdfunding legislation. The European Banking Authority (“EBA“) as well as the European Securities and Markets Authority (“ESMA“) proposed a series of measures to reduce risks connected with crowdfunding, including the possibility of introducing specific registration and regulation of operators of crowdfunding platforms. Czech investors are currently also investing on several international P2P platforms as Bondora, Mintos or Twino. The launch of equity crowdfunding platform Fundlist.cz was highly anticipated and since its launch in June, 2016, $760,000 has been raised through public offerings on the platform. Read the whole article and more details on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed