|

The holiday season is coming after an interesting year in finance and data businesses. This year has been a turning point in many areas: from the fading ICO business to emerging real blockchain solutions, from brutal data monetization to new distributed data models, and fintech window dressing of banks to real fintech services. Grow VC Group has had a good year, several companies have done good progress and we have seen our sustainable long term business approach bring results, at the same time of course, there are also activities we have ramped down to prioritize resources to best areas.

Especially, we like to thank all our customers, partners and supporters. We hope you have now time to take a break, spend time with love ones and also get fresh ideas for the new year. Season Greetings from Grow VC Group and its companies! The cloud business is very much dominated by Amazon, Microsoft and Google, although there are many more regional, niche or smaller cloud providers. The push towards edge and serverless computing mean many technical changes for cloud services. It can also change the market, and offer opportunities to other players like telcos.

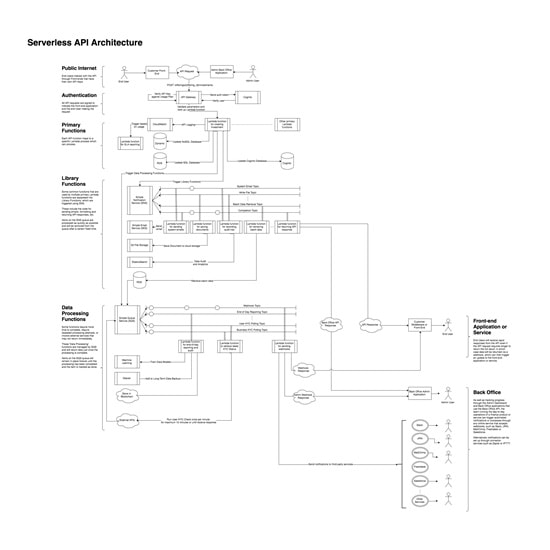

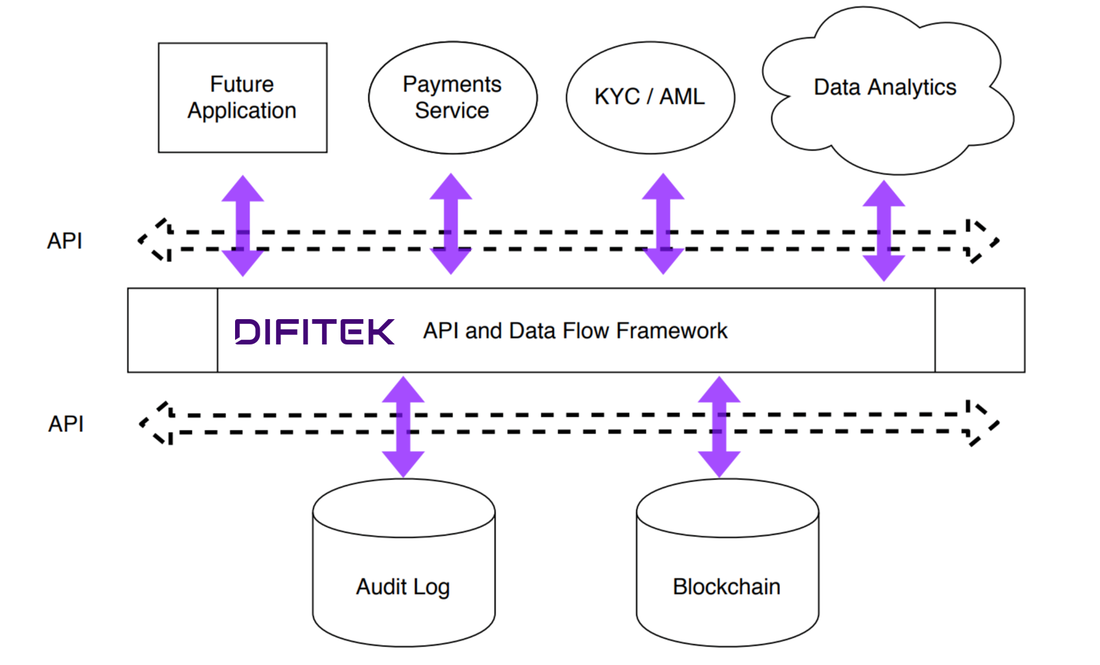

Current cloud architecture is very centralized, although there are regional clouds. Edge computing is bringing processing nearer the users. Serverless (read my earlier article about serverless) make the actual servers invisible to the users and programmers. Together they bring new abstraction layers, and challenges involving how to implement services and software in the cloud. The main cloud providers have already launched their serverless services AWS Lambda, Google Cloud Functions and Microsoft Azure Functions, but the market is still in the very early phase. Application developers are just learning how to really utilize the serverless model, and the ecosystem still needs additional components, starting from monitoring functions. But we can see that, for example, in fintech services with open APIs and distributed models, the model can be fundamentally disruptive. It is said the model gives developers the freedom to focus purely on usability and the customer experience, without having to worry about capacity and technology infrastructure details. The edge (read more here) can especially offer benefits with availability, latency, security and bandwidth. With volumes of data increasing all the time and the proliferation of smart devices and AI, it is hard to process everything in central places. But it is not easy to design an optimal Edge architecture. It is not easy to say what is the optimal place to keep and process data, and even for the same data, it can depend on the situation. Another issue with Edge is that networks (backbone or mobile) are not designed to fully support these kinds of models. An optimal Edge and serverless utilization should also be considered in the network design, regarding bandwidth, storage, and processing capacity on the different layers and nodes. Now cloud and network providers are separate companies, only this fact makes it complex to optimize. So, we can say that telcos could be in a good position to offer serverless edge supporting cloud services. The challenge is that telcos don’t really have experience and competence in offering these services. Network vendors also offer some solutions to build cloud services. But they don’t have very strong software competence in this area either. AWS, Microsoft and Google have very strong software competence, and the culture required to get new services fast to users. It is hard to compete with this. At the same time, it is said that edge can change the game so significantly that companies like Amazon and Google that are based on very centralized architecture may face difficulty adapting to the change. First it sounds like telco and mobile networks are an optimal place to implement edge and serverless services. But it is good to realize, that those services can be done without anything new from carriers and the carriers are only dummy data pipes. This means, for example, models that make users' devices part of the processing and data storage, and cloud providers expanding their offering capacity globally. Blockchain is the wild card in this development. It can change fundamentally how and where data is stored, but also where the processing is done, and even the fundamentals of internet services to more distributed technology and business model. Blockchain as such doesn’t offer database solutions, but enables new ways to store data and handle access to data. Blockchain processing (often called mining in a certain context) also creates its own needs and requirements for processing and networks. Changes in cloud services offer opportunities for new providers to offer cloud ecosystem services, and to develop new types services in the cloud. The development pace is now very fast and anyone who wants to be successful in this game must really have top level competence and get new services to users constantly. Some companies still struggle to utilize any cloud, whereas advanced companies are already moving to the next phase of cloud technology. This just demonstrates that all companies must work hard all the time to follow the development of the sector, as it becomes harder and harder to compete with obsolete technology. The article was first published on Telecom Asia. Read more about Grow VC Group Serverless Developer Trainee program. Fintech, blockchain and regulatory changes are driving the finance sector towards a fundamental change. It is not so difficult to predict what will happen so much as when it will happen. History doesn’t repeat itself, but we can get ideas from other industries. So, let’s try to predict what will happen in the finance sector in the foreseeable future.

Before we look ahead, let’s first look back at how changes and disruptions have unfolded in some other industries:

When we look at the finance sector, banks obviously play a central role. When we talk about banks, we don’t talk about companies that offer one or a few products – in reality, banks are massive black boxes that offer hundreds or thousands of products, and mix them in a way that often obscures their visibility from outside. So, when we think about the future of the banks, the thing to consider is not whether banks will survive, but rather which banking services and roles will be relevant in the future and who will offer them. For example, banks have very obsolete IT, ineffective processes and inflexible business models, and these can become obsolete rapidly. But money, assets and positions in finance instruments don’t lose their value overnight. Based on the preceding observations, we can now make the following predictions:

As mentioned earlier, the hard part to predict is the timing. Change has come slower to the finance sector compared to many other industries, even though all the above-mentioned components are available. What’s missing is new business models. Some people have compared ICOs to the Year 2000 dotcom bubble, and indeed there are similarities. It is worth remembering that many companies rose from the ashes of the dotcom bubble that now dominate the world. When the ICO bubble bursts, we will really start to see new FinTech and finance companies, and we probably see companies that will have a major role in the finance business for the next few decades. The article first appeared on Disruptive.Asia. We had this slogan ‘live your data’ for our data analytics company in 2007. The company was growing, attracted investors and many new people, and especially the new management and marketing people thought the slogan is too abstract and unclear. I think I had quite a lot of responsibility with that slogan. Probably it was too early, but we now are coming to an era that we can say people truly live their data.

Maybe it is still abstract, but let me try to explain the background. We already made very advanced analytics, combining traditional segmentation, machine learning behavior and social network analytics. We also had the very first concepts for ‘distributed’ data and analytics models, for example, how a mobile phone could learn from the user’s behavior and propose and choose things based on their profile, and a user could even have an anonymous avatar to do things online. Some of those things were too early for that market and technology. The point of the slogan was that data is becoming a fundamental part of each person’s life. Your data influences your life, your data helps you to live your life and your data can even do things on your behalf. Data is really taking a fundamental role in your life. But, you need tools to control, utilize and manage it, or other people will manage and use it to drive your life. Now we see this clearer than in 2007. Your finance data very much controls your financial opportunities. Your social media profiles and data create your public image. Your purchase history data determines what kinds of offers and pricing you get. Your health care, and now even real time wellbeing and exercising data, defines your insurance policy and pricing. You live your data. We have also seen the negative side of this. If someone steals your data, he or she can literally live your life after the identity theft. If someone is able to modify your data, it can change your life drastically, e.g., result in a bad credit score or cause troubles at immigration, or you can even become a terrorist based on your data. You live your data. We see countries and governments that start to collect all kinds of data not only for credit scoring people, but scoring their reliability and ‘citizenship’. If your data tells that you are not a good citizen, your life can suddenly become much more difficult. You live your data. Now we are really at a point that we must get control on our own data. There have been enough scandals about data misuse, theft and trading. We are also in a point where legislators, regulators and technology are driving new models to own, manage and use data. We already see new solutions where people can start to manage their own health care (e.g. MedRec and Patientory) and finance (e.g. Prifina) data. They are still early phase companies and models, but the change has started. Telcos are near consumers and their data, they should also think about how to help their customers embrace a new way to manage data. There are also many more plans about distributed data models, e.g. a social network that doesn’t own data, but just enables people to show their posts (data) to their friends, or a personal AI that helps to find relevant things. In 2007 we finally started to use ‘data is the black gold of 21st century’ slogan and dumped the ‘live your data’ slogan. The black gold slogan became very popular and many parties have used different versions of that since then. Now this old slogan came to mind at a time when I feel we really are moving from the data as oil era, to the data drives your life era. Personal coaches and psychologist give advice, how to get your personal life under control. Now we need coaches and tools to take our data into our own control. Live your data, or someone else lives it. And, by the way, your data lives much longer than you. The article first appeared on Telecom Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed