|

We have now waited a decade for the big wave of fintech company launches. People are frustrated with traditional banks and their services. Neobanks grow, but they are still tiny compared to conventional banks. Crowdfunding and P2P lending were going to change the market too, but they are still relatively marginal. Crypto finance grows, but is it a finance model, asset class or speculation?

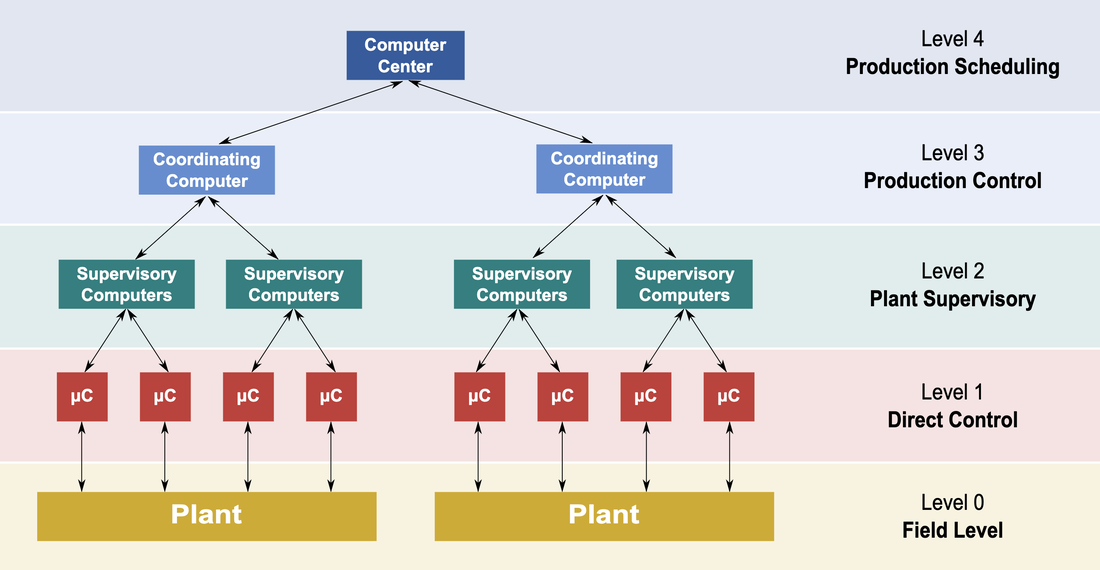

Stripe and Coinbase have been the big success stories in fintech with huge valuations. On the other hand, the collapse of Greensill Capital in the UK was seen as a setback for fintech. These examples just demonstrate how broad the fintech sector is. In reality, Greensill had nothing to do with fintech, but it wanted to attach that attractive tagline to itself. Greensill was a supply-chain finance service and failed due to its risk management. There are dozens of digital-only neobanks in the world. It is estimated they have approximately 40 million customers. This is still a very small number, but the valuations of the neobanks have grown rapidly. According to Accenture, a neobank loses on average $11 for each customer, i.e. costs versus returns. They still struggle to find a profitable business model. Basic bank accounts are not profit centers. Lending, investment, and niche services (e.g. business banking, special customer groups) are more common areas to make a profit. Still, they are very different from basic digital accounts, and their risk management is markedly different. Some neobanks such as N26, WeBank and Monzo, offer the full-stack, i.e. they have a banking license and have their front and back-end operations. Then there are neobanks, like Revolut and Chime, that have no banking license and offer a front end but use legacy bank licenses and back ends. The banking license is the complex part if we think of scalability and global growth. It is a significant investment to get a banking license in every new country. Ten years ago, we had a lot of expectations with crowdfunding and peer-to-peer lending. Those services have grown but not yet come to the mainstream. The P2P lending market is growing approximately 25% per year, but a significant part of the money comes from financial institutions that use those services as a customer interface. One of the biggest P2P lending success stories, LendingClub, acquired a bank last year and decided to close down its P2P lending platform. Crowdfunding has had many models. Startup equity crowdfunding focuses primarily on startup funding and pre-order models, like Kickstarter, that help sell new products before they are available. There are also other models that sell investment fractions in real estate, art and other assets. Kickstarter has been an important test market for new consumer products, but otherwise, these models have suffered from regulatory restrictions and haven’t come to the mainstream. In equity startup crowdfunding, the UK has been the leading country. However, its most significant services Crowdcube and Seedrs, are still small businesses, and they tried to merge, but the competition regulator blocked the merger. Cryptos hit new records, especially with bitcoin’s growing value. NFT’s have become popular. It is still hard to say what this means for blockchain-based distributed finance services. Many parties still see cryptos as more digital commodities and NFT’s like digital asset certificates, but not yet as challengers to the whole traditional finance system. Coinbase, which managed a successful IPO, is still more like a conventional trading service for ‘crypto assets’, not, e.g. a distributed finance service itself. If cryptos become more accepted and feasible with daily payments, and NFT’s make asset certificates and transactions digital, it changes the everyday use of those. Could they better enable crowdfunding and P2P finance? Some experts see it as the case, but it is still hard to say when the last decade has shown those models are not easy to get working. It is not only about technology but really about getting a market to work with enough supply and demand. And regulators also have a significant impact on the market. In some countries, we might see more approaches like government-run digital currencies than genuine cryptos. Then we have the fundamental question about the banking system. Banks are not just there to offer accounts, payment cards and to lend money; they also have an essential role with the central banks to issue money and keep the economy running. Some people criticize that system and would like to see the power of banks disappear. In reality, it is not so simple, and governments prefer to keep their control over their finance systems. The pandemic time has also reminded us of the value of government stimulus activities. Some banks are starting to accept cryptos, and one of the leading VC’s, Andreessen Horowitz, is planning a $1 billion fund for cryptos and blockchain, and it’s third in the sector. We can assume blockchain and distributed solutions will change and digitize daily assets and transactions. The first phase will probably be in digitization, not changing the fundamentals of the finance and banking system. But it is still hard to say how they can change the finance sector and services in the long run. The article first appeared on Disruptive.Asia. There’s been a growing trend to get rid of middle management, which coincides with the belief that AI and software robots can automate work done by human professionals. So, fewer managers are needed and, therefore, less human resources management. But when we have more machines to work, they also need to be managed. Consequently, we probably need digital counterparts of middle management and human resources. A recent podcast has an interesting discussion about micro tasks to analyze data and make micro-predictions, such as analysing a specific dataset from one source and trying to conclude something from it. This analysis doesn’t try to understand or optimize a more significant problem or task. It just focuses on one specific part. A more extensive system can have dozens of components like that. Then there is another layer to combine output from those micro-tasks. It can then combine the output and conclusions from several micro-AI modules—individual micro AI’s focus to model and explain one specific data set. For example, running shoe data (yes, there are already running shoes that collect all kinds of data) of your cadence, stride length, ground contact time and foot strike angle to optimize your running speed. When you think about your running performance as a whole, this is only one part. You must also think about heart rate, energy levels (blood glucose), readiness (have you slept enough) and many other things. But it would be too complex to build one huge AI to optimize all this data, and it is better to have modules for each need and then another layer to combine all this. It is the same with software robots. One robot can transfer inventory numbers at the end of the month from SAP to your accounting system. To produce monthly financial statements and reports is much more work than simply compiling those inventory numbers. Other robots could perform the individual tasks and some higher-level robots to put all this information together. This is nothing new as such. Modularity has been an essential principle in designing software for decades. With AI and automation, we often talk about extensive and complex solutions linked to many tasks and systems around an enterprise. When these are also relatively new areas, each company and project usually try to build large systems that try to make a perfect solution for a significant process. When we have these micro modules to handle a specific need, we can then develop design principles. Not to implement from scratch, but to find the best components to do micro-tasks, optimize their use and then get them to work together. It is a kind of HR and management function. You must find the best resources to do things you need, and then you must manage them. But these management layers are digital, i.e., algorithms that choose the best algorithm for each micro-need and optimally use them. Algorithms manage algorithms. This also changes the ecosystem and business models for AI and automation. You have, for example, the following business areas:

Sometimes it is good to compare technology and machines to models of how human beings perform jobs. Especially when AI and automation are to perform tasks that humans have previously done. People have anyway used centuries to develop models, how to organize tasks in organizations. It doesn’t mean we can or should copy the same models to machines, but it can give us ideas on how best to use machines. There are reasons why people specialize in certain areas, how different professionals work together and how the management layer must optimize resources. We need to solve similar issues when designing, using, and managing algorithms, machines, and digital processes. The article first appeared on Disruptive.Asia. Photo source: Wikipedia.

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed