|

Working in Fintech since 2008, I’ve seen many models emerge and be reimagined. Standardization and cost efficiency have been led by technological improvements. Stages around the world from Toronto to Paris to Singapore have showcased how finance is changing and evolving through the embrace of Fintech. This has been a global phenomenon since the very start, yet its development is not linear and the spearhead varies from region to region.

I recently had the opportunity to host and sit down with a leading Fintech pioneer in Singapore and exchange views on these spearheads. Singapore has adopted a strong position in establishing itself as the Fintech hub for Asia and make significant investments in the sector, such as setting up a regulatory sandbox and strong incentives for companies in Fintech. It’s apparent there are differences with adoption in different parts of Asia versus North America and Europe. However, there are many universal realities that resonate irrespective of location. Applications – Wealth Over Private Equity Through our conversation with our Singaporean partners, the difference in Fintech applications in market segments became clear. There is a prevalent focus on wealth management in established financial hubs in Asia, such as Singapore, and applications of Fintech such as robo-advisors and wealth chatbots have really taken off. With a significant segment of the market embedded in wealth management, it’s a clear sector to embrace the benefits of Fintech (which we will explore shortly in the universalities). With vastly different regions and economies in Asia, there are also different corresponding strengths and opportunities. Strong established finance hubs may have a more traditional outlook on Fintech, leveraging roots in for example comprehensive wealth management practices, wherein emerging markets in Fintech such as Indonesia, Malaysia, Vietnam may present broader opportunities to change the entire fabric of financial models utilized. A different reality is true especially in the US, where private equity models, including venture capital applications, are the norm. Certainly, there are robo-advisors as well, even launched by prominent firms such as Vanguard, yet private equity applications and private debt, even retail models are multiple in the US. Just look at how far Goldman Sachs has come with personal online lender Marcus, reversing over a century of policy and entering the retail market and even with Marcus Goldman’s name at the helm. Wealth management is also characterized by heavy pressure and a true paradigm shift after the financial crash. The market is clamoring for transparency, there is an increased pressure on margins and no one quite knows what to do with millennials that soon will have money to manage. Innovate too fast and you alienate a lucrative client segment, innovate too slowly and you go down in history as a firm that failed to keep up. Reducing Costs by a Magnitude of 100 With the high pressure on margins, wealth management is a logical sector to embrace Fintech and standardize processes. Through standardization of cumbersome and cost-intensive processes, such as new client onboarding, KYC, and diligence, these can be structured and even automated. This brings about a clear reduction of cost and by changing cost structure, operators can expand and provide further client value. Despite the applications varying around the world, an increased competitiveness found in the standardization of processes and requirements and their automation is clear. By being able to dramatically decrease cost, opportunities for serving new client segments, for different private equity models are within reach. This can be as simple as a bank now being able to lend to a small business that it has been unable to lend to since the financial crash, all due to the fact that they now operate on a standardized technology stack that uses AI to power mundane tasks and harnesses the data for data driven decision making in underwriting. This is a universality that transcends location, where we will see Fintech not only be a growth platform but a reality across all business lines. Where functions can be standardized, they can be made more competitive. Regions around the world are setting themselves up as Fintech hubs, embracing the fabric they already have. We are excited to see the opportunities and possibilities as the transformation continues. This post originally appeared in Let's Talk Payments. Borderless Finance is quickly changing the landscape for international financial flows asking more of the competitive players in this market while pushing for a reduction of the costs. Amidst this disruption, the consumer and entrepreneur continue to emerge as the beneficiaries.

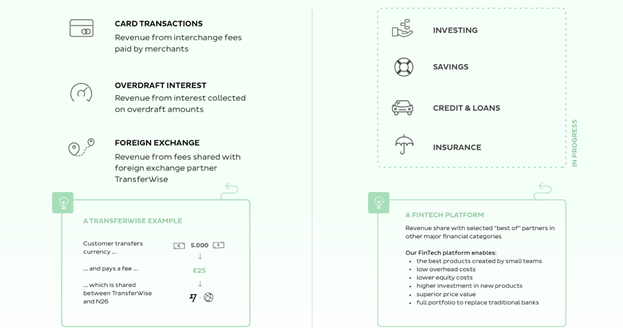

Institutions emerging in this space are representative of a large wave of technological advancement that is sweeping across a range of different institutions and asset classes, introducing new models and ways to monetize assets in a more efficient, accessible and inclusive manner for the entrepreneur, consumer and average investor accompanied by the complementary rise of infrastructure provider pushing the bounds for innovation. German Fintech startup, N26 has brought borderless banking to mainstream consumers with a focus on a comprehensive mobile experience. Customers can open a bank account – linked to a MasterCard – from their smartphone, and complete the process within eight to ten minutes. The MasterCard can be used worldwide without any fees at all. Valentin Stalf, Founder and CEO of N26, stated: “Our vision from the start has been to build Europe’s first bank account for the smartphone. We see traditional banks as having failed to adapt to the demands of the digital generation. The response to Number26 has been fantastic and we’re thrilled to expand to further markets.” N26 account holders can make transactions and withdraw cash anywhere around the world without ever being charged for the service. Your entire banking needs are catered for through the app, even setting up of your account, something which is a painful process in any regular bank around the world. Your account is setup via a video call from your phone during which you will be asked to present identification for scanning. In terms of a business model, N26 offers free ATM withdrawals globally by taking on the withdrawal fee that their customers would conventionally bear. Considering the above listed revenue model, N26 is able to cover the fees that would be traditionally covered by customer from the earned revenues. Digital Finance/borderless institutions such as N26 are able to do so as result of there being a relatively low overhead operating cost. This did, however, lead to complications when a number of customers would use their free account exclusively for a large number of monthly withdrawals. This is because N26 utilizes a “attract customers with one thing, then sell them another” whereby customers are monetized via extra products and services around the base account such as international transfers or overdraft and in the future savings or investment products, etc. N26 is not alone in pursuing this model with Fidor, Revolut and Tandem utilizing similar models or set to incorporate it in the near future. As to how this business model addresses market demand and consumer sentiment, there does seem to be some discrepancy with regards to the assumptions employed in the novel business models, especially with regards to consumer behavior. While initially offering a free service for the offerings other than for a credit card and USD debit/credit card, Revolut introduced a "fair usage" clause that charge some fees above certain thresholds , such as a 2% levy on ATM withdrawals above £500 a month. This seems analogous to the response N26 had when their consumer base took undue advantage of their free cash withdrawal feature resulting in N26 bearing too high of a cost in covering the withdrawal fees. N26 had originally decided to cover this fee with the assumption that most customers would use their accounts and this benefit, reasonably. Hence now, they charge a fee for monthly withdrawals over 500 Euro. Sound familiar? Another major player in this space is TransferWise, who originally launched the ability to make international cross border transactions at a fraction of the price offered by banks and other traditional financial institutional and service providers. It remains to be seen whether TransferWise has found a longer term sustainable model but considering that TransferWise doesn’t actually bear the costs on behalf of its users and that they have captured a large share of the cross border transaction market from the banks is perhaps indicative of the fundamental strength of their venture. The company manages to offer its services so cheaply by matching up payments with those going the opposite direction using sophisticated software. So "your" money never actually leaves the country — it's rerouted to someone who's being sent a similar amount by someone overseas. Your foreign recipient, meanwhile, receives their funds from someone trying to send money out of their own country. So in actual execution, there is no cross border transaction taking place but the system is actually an efficient reallocation of funds within the ecosystem of fund transfers. The new borderless bank accounts are built upon this fundamentally simple infrastructure. Transferwise has local banking partnerships and a global network of banking accounts which, when coupled with their cross border money transfer system, allow funds to be deposited into local bank accounts in the local currency utilizing the efficient reallocation that was their original product. Essentially, they’ve added end points or deposit points to their original system which is why they can continue to grow and offer their services at such a low cost. Where their money comes from is similar to the business model utilized by N26, wherein customers are monetized by the additional services and products to the base account. In TransferWise’ case, the only times you are charged are when you convert money between currencies in your Borderless Account, send money to a bank account in the same or a different currency. They can just as easily integrate third party services such as auto loans and mortgages to truly capture the banking space. The fees charged are fairly low and the logic behind is very transparently conveyed to the customers. This facility is a true catalyst in facilitating international flow of skills, services and goods with firms placed anywhere in the world now able to easily acquire and remunerate their suppliers and employees locally, reducing the monetary and logistical speed-bumps that may prevent the most efficient utilization of skills or service providers across international borders. if you move money from one TransferWise country account to another or any of the 15 internal currencies supported, or if you make an international money transfer, you will only ever be charged the standard TransferWise ‘mid-market’ exchange rate and commission, with no minimum fee, which works out much more competitive than incumbent banks. Initially the new service will only be available for small businesses, sole traders and freelancers in the UK, Europe and — from June — the US. But TransferWise plans to make it available to consumers in the three markets later in 2017. Such innovation while advertised as a borderless account actually breaks down borders that exist between different business communities and allow for easier cooperation and synergy globally. When TransferWise does launch a card, however, it puts the Fintech unicorn squarely in ‘neobank’ territory and in competition with a slew of startups offering a banking experience, including Revolut, whose banking account is built on the promise of low exchange rates and targets consumers with a “global lifestyle”. TransferWise’s main target here, however, is undoubtedly the incumbent banks, and initially the rather neglected SME or sole trader market, for which the need to receive and make payments in multiple currencies and to and from different countries is increasingly a requirement. The impact of borderless banking of this sort is significant in enhancing the purchasing power of the global consumer base in mitigating the obstacle of service and product provider not accepting an international bank. TransferWise shares this borderless finance space with Revolut that launched in July 2015 allows conversion of currencies at the interbank exchange rate utilizing a prepaid MasterCard. Like TransferWise they also offer multi-currency business bank accounts and now international money transfers for free up to 5000 pounds. Another example of such forces at work is, the partnership of the Estonian e-residency program with the Finnish Fintech company Holvi allowing a completely borderless digital banking experience for entrepreneurs in the EU. This means a EU company with complete EU business banking and payment card can be established entirely online. This provides the perfect catalyst for large scale business growth with low start-up costs for establishment of a potentially thriving business. Such environments break down bureaucratic costs that deter small business owners with ideas as well as allow individuals to navigate roadblocks such a reluctance to work within certain emerging markets. While the response to institutions such as N26, Revolut and TransferWise has been fantastic, it is impossible to void the legacy banking system. Despite persistent issues around inefficiency, exclusivity and high fees, there continues to be a strong inclination for the brick and mortar institution which can be attributed to a preference for a more tangible and face-to-face human experience highlighting the value consumers see in human interaction. At the same time, the borderless finance institutions discussed in this piece are able to offer attractive fair alongside a range of base free services due to innovative technological models and minimal operating costs. However, taking into account statistics like the ones below it can be inferred that these institutions, at least in the immediate term, do lose out on elements and value of the conventional institution:

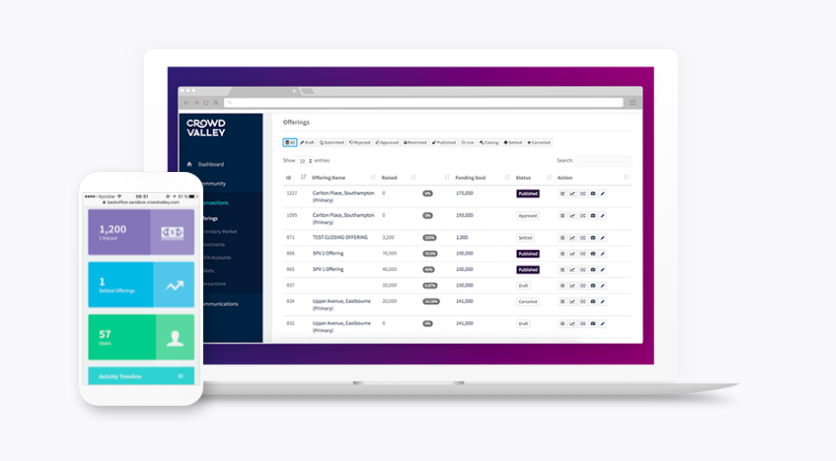

The borderless digital finance revolution changes the playing feeling with a dynamic approach to financial inclusion and consumer experience. N26 users can now get a credit line in under 5 minutes. As mentioned earlier, the Estonian e-residency program’s partnership with Holvi is a major catalyst for small business growth across the EU. The proliferation of services that continue to evolve with the consumers’ needs is reaching a point of disruption for the banking sector where the incumbent institutions are being forced to commit time and resources to change the way they interact with consumers and consumer data but are bogged down by their legacy systems and massive scale. But as borderless FIs continue to make moves to tackle consumer and business issues such as exclusive and outdated credit models, expensive cross border business transactions, for goods, services and labour, and obstacles for business growth and personal investment, the scales and statistics are sure to tip in favour of the new kids on the block, complemented by increasing global digital, Fintech and internet adoption. To top it off, the unpredictable innovation that has been borne out of the great recession has found answers to pain-points every step of the way so it is likely that the brick-and-mortar human element will be addressed soon enough down the line. And as iterated in the first paragraph of this piece, whether it’s the spread of the borderless finance revolution or the reformation of the traditional banking sector, it is the consumer and the business owner that wins. Crowd Valley prides itself in its commitment to supporting both consumers, investors and institutions bridge the gap that exists between in the lending, borrowing and alternative finance space by optimizing tools that work at the fundamental level of financial services and would be more than happy to discuss how our infrastructure can support your ideas and entry in the digital finance space. This article was first published on Crowd Valley Blog. I was at an event recently where alternative finance companies introduced their services. There were many new finance solutions for lending, real estate, investing and short-term finance. These companies explained how they have built their own platforms, have handled some finance (millions or dozens of millions), and are now looking for more investors. After witnessing all this activity, it seems the bottleneck of finance is not really the number of services and platforms available, but somehow getting the whole ecosystem to work.

Traditionally banks and other lenders have been able to use capital from deposits for loans, and use securitization to get additional capital for loans. Lending has been part of a huge finance system. It guaranteed money for lending and investing, but also created many complex finance instruments that have also combined more and less risky products – sometimes very risky, as seen in 2008. Now we’re seeing new FinTech-based finance services whose technically excellent premise could be integrated to the whole finance ecosystem. But the technology as such is not enough to get the ecosystem to work. Many of these services have focused on building their own platforms and collecting their own investor user bases. Maybe they haven’t totally figured out yet in which business they really want to operate. Some leading p2p lending platforms, like Lending Club, have institutional partners to lend and invest in their platforms. It is a starting point to use these platforms as a distribution channel for traditional finance services, such as banks. I earlier wrote that the invisible impact of FinTech is probably greater than the impact on visible services. This means that there are a lot of opportunities to really integrate these new solutions to the ecosystem, but also many challenges. New digital finance services can help create much better finance products than the old models. The services can collect much more data, analyze and monitor the data in many ways, and monitor real-time information. This enables much better financial decision-making, better syndication, better pricing and better secondary markets. But to achieve this situation, the services much talk to each other, understand each other’s data, and there must be a market for them. We are still in a situation where people and companies must fill out a lot of old-fashioned forms on paper to apply for a loan in a bank – even when much more data would be available in digital formats to make this simpler. Online finance services collect more data automatically from other systems, like using digital KYC and importing data from other finance tools, but they still do securitization in quite traditional ways, or hold roadshows to find investors. These simple examples show that many new services are still sub-optimized and don’t even have smooth digital processes, much less an ecosystem. I have sometimes compared FinTech-based ecosystems to mobile and digital advertising ecosystems. It is not enough just to show some ads on screens. Digital advertising needs a lot of data from publications and users, targeting tools, systems to sell inventory, planning tools for advertisers, and many other components. This ecosystem includes thousands of companies and systems that must be able to talk to one other. A similar scenario could play out for the alternative finance ecosystem, but it’s still early days, and the critical mass needed to get the market to really work is missing. We have, at least, three issues getting in the way of that critical mass:

This post originally appeared on Disruptive Asia. Private transactions, both private equity and debt, have been inefficient and littered with information asymmetry due to the way the transactions have been made. The emergence of public distribution of information on private transactions seeks to change that and the quickly arriving secondary markets for private transactions can bring liquidity and efficiency to typically cumbersome asset classes.

The definition of an efficient market requires efficient access to information, no transaction costs and standardization. By definition most private deals do not correspond to these criteria. However, with more private information becoming public through new securities law changes around the world, we are beginning to establish process trust in asset classes that can become vibrant with further rigor. Recently Seedrs announced the establishment of a secondary market for equity crowdfunding transactions in the UK. Private companies are among the most inefficient as an asset class, given the apparent lack of information, information asymmetry and long lock in periods. The situation in the US is no different, where private companies are even more private compared to the UK with publicly reported information even on private companies. The promise of liquidity in crowdfunded securities could be a fantastic development for an asset class which is difficult to manage. The Financial Conduct Authority (FCA) in the UK has been a pioneer in this regard as well in digital finance and set various standards worldwide, including the rollout of a regulatory sandbox. At its core, a secondary market is an option for liquidity. Holders of securities can post a request to sell their positions, and those looking to acquire shares can bid for these. Depending on how the system is set up, matches can be made automatically or the marketplace operator can have a facilitator role. Automatic matches can follow procedures such as auctions, reverse auctions or Dutch actions. We work a lot with secondary transactions and markets through our digital back office, not only with smaller transactions but also with institutional grade assets. Private equity is however not the only sector that benefits from liquidity. From private loans in peer-to-peer markets, a liquidity offer through a secondary market offers shorter cycles in the market and more trust in the underlying asset class. Many peer-to-peer or marketplace lenders globally run internal secondary markets, as yet there is no overarching liquidity destination for the sector. Both Lending Club and Prosper have offered secondary markets in the US, but only Lending Club’s remains open for business. Last October Prosper announced the closing of its secondary market, which the company said was underutilized by investors. Private transactions becoming more and more public also open access to information that has previously been unattainable. In order for true efficiency to be a possibility, standardization of information has to be achieved. By being able to make comparisons and establish standards in private transactions and on private assets, we open up new possibilities of use with the data that was historically locked away. We are now beginning to realize what uses there are for this data, including being able to provide more tailored financial products such as debt for private companies while placing the company in charge of its own data. Private companies and peer-to-peer lending markets are both relatively new asset classes that are governed by new policies, however there are also more traditional asset classes that benefit from private or even open secondary markets. Real estate holdings for example are highly popular, both equity and debt, and some times holders of positions may wish to divest part of their portfolio. Similar is true in areas such as renewable projects, solar bonds, insurance or private equity in a broader sense. More Data, More Options What secondary markets bring is more optionality for the investors and maybe by inference underlying security. This can be seen as an important area in establishing process trust for the transaction infrastructure, and a value add for the investor base. Yet at the same time it’s another area of the private securities transaction which is moving toward greater efficiency as a whole market, offering a higher value service in typically cost intensive asset classes. With more data becoming available, we can expect more financial products to be developed that are more tailor-made and utilize even real time data. For years we’ve talked about the convergence of the private and public market and this is a tangible development where these new quasi-public transactions and novel services are charging ahead. This post originally appeared on AltFi. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed