|

Private transactions, both private equity and debt, have been inefficient and littered with information asymmetry due to the way the transactions have been made. The emergence of public distribution of information on private transactions seeks to change that and the quickly arriving secondary markets for private transactions can bring liquidity and efficiency to typically cumbersome asset classes.

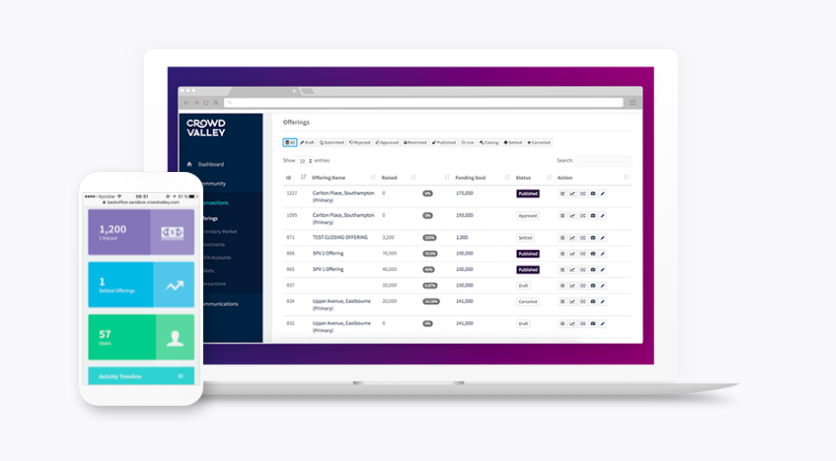

The definition of an efficient market requires efficient access to information, no transaction costs and standardization. By definition most private deals do not correspond to these criteria. However, with more private information becoming public through new securities law changes around the world, we are beginning to establish process trust in asset classes that can become vibrant with further rigor. Recently Seedrs announced the establishment of a secondary market for equity crowdfunding transactions in the UK. Private companies are among the most inefficient as an asset class, given the apparent lack of information, information asymmetry and long lock in periods. The situation in the US is no different, where private companies are even more private compared to the UK with publicly reported information even on private companies. The promise of liquidity in crowdfunded securities could be a fantastic development for an asset class which is difficult to manage. The Financial Conduct Authority (FCA) in the UK has been a pioneer in this regard as well in digital finance and set various standards worldwide, including the rollout of a regulatory sandbox. At its core, a secondary market is an option for liquidity. Holders of securities can post a request to sell their positions, and those looking to acquire shares can bid for these. Depending on how the system is set up, matches can be made automatically or the marketplace operator can have a facilitator role. Automatic matches can follow procedures such as auctions, reverse auctions or Dutch actions. We work a lot with secondary transactions and markets through our digital back office, not only with smaller transactions but also with institutional grade assets. Private equity is however not the only sector that benefits from liquidity. From private loans in peer-to-peer markets, a liquidity offer through a secondary market offers shorter cycles in the market and more trust in the underlying asset class. Many peer-to-peer or marketplace lenders globally run internal secondary markets, as yet there is no overarching liquidity destination for the sector. Both Lending Club and Prosper have offered secondary markets in the US, but only Lending Club’s remains open for business. Last October Prosper announced the closing of its secondary market, which the company said was underutilized by investors. Private transactions becoming more and more public also open access to information that has previously been unattainable. In order for true efficiency to be a possibility, standardization of information has to be achieved. By being able to make comparisons and establish standards in private transactions and on private assets, we open up new possibilities of use with the data that was historically locked away. We are now beginning to realize what uses there are for this data, including being able to provide more tailored financial products such as debt for private companies while placing the company in charge of its own data. Private companies and peer-to-peer lending markets are both relatively new asset classes that are governed by new policies, however there are also more traditional asset classes that benefit from private or even open secondary markets. Real estate holdings for example are highly popular, both equity and debt, and some times holders of positions may wish to divest part of their portfolio. Similar is true in areas such as renewable projects, solar bonds, insurance or private equity in a broader sense. More Data, More Options What secondary markets bring is more optionality for the investors and maybe by inference underlying security. This can be seen as an important area in establishing process trust for the transaction infrastructure, and a value add for the investor base. Yet at the same time it’s another area of the private securities transaction which is moving toward greater efficiency as a whole market, offering a higher value service in typically cost intensive asset classes. With more data becoming available, we can expect more financial products to be developed that are more tailor-made and utilize even real time data. For years we’ve talked about the convergence of the private and public market and this is a tangible development where these new quasi-public transactions and novel services are charging ahead. This post originally appeared on AltFi. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed