|

Grow VC Group and other shareholders sold Kapipal to another crowdfunding service. Kapipal website and all active campaigns have temporarily been closed. The new owner will decide how Kapipal will be re-opened in the near future. You can follow news at kapipal.com.

Grow VC Group started to work with crowfunding services in 2009 and was the pioneer especially in the equity crowdfunding. We have participated to develop finance regulation in many countries. In 2012 we decided to focus on more significant growth businesses in fintech, including technology platforms, data and digitization in finance services. Kapipal was the last crowdfunding business in our portfolio. We see great growth in many areas of fintech, finance data and digital platforms, and continue our work in those areas. Our companies offer, for example, a one-stop-shop to operate digital finance services, solutions people can own and manage their personal finance data, and Robotic Process Automation. Kapipal and its former shareholders would like to thank everyone who crowdfunded on the platform and were able to raise money for their dreams. Crowdfunding will help people, startups and innovators also in the future, and Grow VC Group continues to disruption finance sector in many areas. Equifax, HSBC, British Airways, Cathay Pacific, Marriott, Quara – and we could continue the list much further. They are some of the companies that have had a significant customer data breaches this year or last. Does anyone believe their data is really safe with any company? Should we have totally new models to protect and use data?

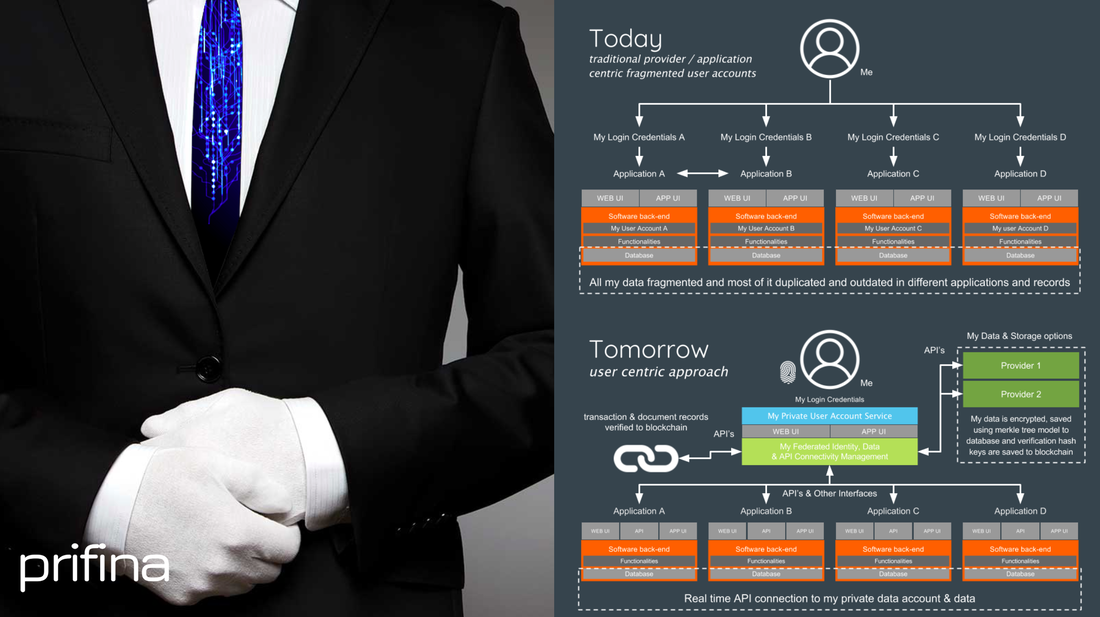

These cases have demonstrated that hackers can get to most companies and steal your data – if they really want to. Name, address, passport details, credit card numbers and passwords of hundreds of millions individuals have been stolen this year alone. After a breach, some companies have offered their credit score and identity theft protection services for free. I wrote earlier about the avocado model to consider for data protection, making a difference between hard core data and data that is less critical. It is one example of new paradigms to better focus on critical data and detect attacks. But many companies are still in a very early phase with their plans to change the paradigm. They still believe that just by putting bigger locks on the main door they are safe. It is also often said that the worst scenario is not that your data is stolen, but if someone is able to modify your data you could lose your credit score, be seen as a criminal or terrorist and be unable travel and get a visa anymore. This can happen, if criminals get access to data and don’t steal it, but simply modify it. We can also have many other terrible scenarios like nuclear weapons, airplanes, food processes and many other things, if the data is compromised. Distributed data Blockchain and distributed data models have gotten plenty of interest during the last two years. Cryptocurrencies and tokens have dominated the discussion but significant technological and data model concepts have received less attention. These also offer new models for data management and protection. Distributed data models are not necessarily based on blockchain or only on blockchain. The important part is that there is no one party that collects and keeps all data for a certain purpose. These solutions can offer several new offerings to better protect against stealing or misusing of data, for example:

These are changes that don’t happen rapidly and we have a lot of legacy systems and ‘experts’ to handle data management. It is, anyway, quite clear that problems and risks cannot be handled only with traditional models. Many companies now just try to buy time for their old ways to manage data. Consumers haven’t been too keen to worry about or protect their data. This year has been a turning point, but the reality is that people still look for easy solutions. We can expect changes only, when there are easy enough options for consumers and companies to protect and use their data in a new way. We already see startup activities in this area, and it is a matter of time, when we start to see more mainstream solutions. The article first appeared on Disruptive.Asia. Smart watches are making their breakthrough and getting people to monitor their health data. Insurance companies and health care providers are developing new products that utilize customer’s data in the service and pricing. Now Amazon, Alphabet and Apple are interested in the health care business. Telcos must also think through their positions.

I wrote earlier that health data is to smart watches what camera and social sharing is to mobile phones (read more here). It is one important service category, and and a reason people are now buying those products, and companies can start to collect data and use applications to analyze it. For telcos this means increased business in terms of smart watch sales and greater data usage by customers, but telcos might also have more value-added opportunities. A well-known Silicon Valley investor John Doerr had commented at the Forbes Healthcare conference that Amazon is one of the best positioned firms help customer utilize their data and he expects Amazon to offer services in health care. Amazon published a health care initiative with Berkshire Hathaway and J.P. Morgan Chase earlier this year. In late November Amazon announced its new service Amazon Comprehend Medical that uses machine learning and natural language processing to extract relevant medical information from doctors' notes, clinical trial reports and patient health records. Apple has its touch point in collecting and analyzing health data in its phones and watches. Google and its parent Alphabet also have already activities in health care areas, although it has also encountered challenges. For example, in the UK, Google DeepMind works with the national health care service, NHS and its use of data has raised many concerns and also a political debate. Insurance companies are actively utilizing more data. Health data is one important part of this. Many insurance companies already offer price discounts, if a customer e.g. is ready to use a smart watch that then delivers data to the insurance company. The use of data and smart pricing models is one of the most active areas in insurtech. Health care and health insurance business are globally a huge business. It is not a surprise the tech giants are interested in this business area. Advertising and content business on the internet start to be quite mature businesses and their earning models have their challenges. Fintech, insurtech and health care offer a lot of growth opportunities. Content business can be a good comparison for digital health care services. There are companies that focus to actually make and produce content. Then we have giants like Netflix, Amazon and Apple, but still in many countries telcos have been able to find a role in this market too. They are near each customer. Trust and reliability are very important components in health services. Google’s issues with data in the UK are a good example, how companies must be very careful as to what kind of services they offer, how they use data and with whom they work. Based on this year issues, it would be hard to see Facebook having a role in health data. Other tech giants have somewhat similar issues. In many countries regulatory requirements also specif, how the data can be used and where it can be stored (e.g. it cannot be exported to other countries). Data is a fundamental part of health care. We are still in very early days regarding how it is utilized. Even the devices and censors are not always very accurate to measure, better software is needed to correct and analyze data, and much more services are needed really to utilize the data in actual services. Privacy and user’s control also need new solutions. Telcos as a local trusted partner have an opportunity to get into this business. It just needs a very careful analysis as to what would be the role, services and partners to offer the service. This will be one of the fastest growing digital business areas. The article first appeared on Telecom Asia. RoboCorp Technologies Inc. is a startup that offers a cloud-based platform for license-free open source robotic process automation (RPA). The company operates in San Francisco and Helsinki. Siili Solutions Plc announced today investment in the company. Grow VC Group is a shareholder in RoboCorp.

The aim of RoboCorp is to disrupt the RPA industry by changing its licensing and delivery models through open source technologies. The company focuses on enabling efficient development and secure deployment of RPA solutions globally through its cloud platform. RPA is a fast growing market, estimated to reach $2.3B in 2019, but the whole market is still today dominated by license based solutions. RPA is very a crucial technology in digital platforms, data and fintech businesses. It enables to automate processes and also get legacy and new systems to work together without expensive integration work or changes to the legacy systems. “RPA is a key technology to accelerate the use of modern fintech solutions in finance institutions. RoboCorp's cost-effective versatile solutions make it possible to fully realize the potential of RPA in many new applications where it has been earlier too complex or expensive,” comments Jouko Ahvenainen, Grow VC Group Chairman. RoboCorp already works with selected partners and clients to deliver pilot solutions. The company takes more pilot customers during the next weeks and generally available products come during the first half of 2019. If you are interested to participate in pilots or get more information, please register RoboCorp's' mailing list. RoboCorp Technologies Inc. press release on January 17, 2019. Siili Solutions Plc press release on January 17, 2019. Blockchain and AI will be important technologies in 2019, and they develop beyond the initial hype stage to real business cases. They also offer significant new opportunities for telcos that have huge ‘distributed’ networks and are near the customers.

Development is fast and carriers need technology partners to catch these opportunities. Blockchain and AI can be the most significant new technologies in the mobile and internet during the next five years. They can change many internet services, and even the fundamental structures and business models of the current internet services; from very centralized services to much more distributed models. Let’s focus just on a few opportunities of those technologies for telcos:

Professor Mahadev Satyanarayanan from Carnegie Mellon University made a strong case at MWC2018 for edge computing and how its time is now. Wikipedia defines edge computing as “a method of optimizing cloud computing systems by performing data processing at the edge of the network, near the source of the data. Reasons to use this local AI is especially bandwidth, latency, privacy, and availability.” Carriers have an excellent opportunity to have a major role in these local AI and edge technologies and businesses. All devices are linked to carrier’s network and the carriers are in a position to offer services to each consumer near them. But carriers should find a business model to do this, rather than try to do everything themselves. This has been a year of data breach and privacy scandals. Consumers have also started to see the data in a new way, although attitude changes always take some time. Companies have also had such serious issues that they are starting to realize that data is not only asset, it is also a liability. The time when all companies just tried to collect all data and trade it is over. Utilizing blockchain The industry is now seeing a lot of development of totally new data solutions, where consumers and businesses can really own and manage their own data. Many of these utilize blockchain. Carriers can carve out a good position also in this data model disruption when they can offer these new solutions and even storage models for each consumer. In a way carriers missed the chance to adopt business models that really utilize data, as Google, Amazon and Facebook have done, but now this can be to their benefit. They have more credibility to offer new solutions. But again, the carriers should not do this alone, but with the right technology partners. Smart contracts can be a more important outcome from blockchain than cryptocurrencies. It is an area where telcos can really offer new solutions to consumers and businesses, but also utilize them for their own business. This can really enable digitization of many services, and mean huge savings in IT and back office costs. It can start from telco’s own customer care and billing systems and end with new ways to also offer financial services to customers. A challenge for telcos has been often that they try to make too much inhouse. In the services mentioned above, telcos should really take a role to orchestrate the ecosystem with open APIs and truly multiparty open framework. It is also fundamental that telcos have a business model that not only defines how they make money from the ecosystem, but the model also motivates all other parties to invest in and develop the ecosystem. Telcos have destroyed too many previous business opportunities by trying to get too large share to themselves and control everything too much. It is now time to orchestrate things in a new way with these new opportunities. This article first appeared in Telecom Asia Vision 2019 Supplement. Money, power and politics have always been linked to each other. The control of banks and finance services is an important way to use power and control macro developments. For example, anti-money laundering measures are an important way to fight terrorism. With FinTech and blockchain ushering in a new phase of finance services, that also means a battle over who will control them.

The US government and financial institutions have had an important role in international finance. Many British and Swiss bank have learned this the hard way, paying billions of dollars in penalties or settlements when the US caught them in money laundering activities or other investment regulation issues. The blocking of Russians banks and money sources of influential Russians has been an important part of sanctions against Russia since the Crimea occupation and East Ukraine war. Russia has also realized this and is trying to develop alternative systems for finance. The big game will be between China and the USA. On a broader level, this is also a battle between centralized government-controlled systems and more distributed blockchain-based systems. The rise of Chinese FinTech finance services and distributed services are challenging the positions of the US institutions. UnionPay card services are expanding around the world, initially to serve Chinese tourists. WeChat is also used worldwide, and its money transfer services are also becoming more global. Alibaba’s Ant Financial Services is a huge business – the highest valued FinTech company in the world, in fact. New money transfer services and payment services – centralized or distributed – are a threat to SWIFT and credit card networks, which have also been very important to control international finance and money flows. If someone can block card payments and money transfers in a country, they can have a major impact on life and politics in that country. We now witness trade wars and increasing tensions in international affairs. At the same time, we’re seeing disruption in finance services. Sooner or later governments will also be interested in FinTech services. They have mainly been interested in controlling services in terms of finance regulations, but the political role of these services is also becoming more evident. We can already expect that Southeast Asia and other emerging markets in Africa will be important areas in the battle of future finance dominance. In those areas, FinTech services can rapidly achieve a key role in financial inclusion of people who have lived without access to traditional finance services like banking or credit cards. These are also areas where China is investing heavily and exerting as much influence as it can. FinTech companies have become strategically important quite rapidly. They offer access to money and its control that is similar to banks and credit card companies, but with the ability to become global much faster than incumbents. They also collect a lot of data that governments and institutions would love to have access to. The impact of distributed models is still difficult to evaluate. If governments lose control of money and finance institutions, what is left? The monopoly to collect taxes and use violence are the ultimate tools of governments, but to keep those, they need to monitor money transaction flows and collect tax money. At the same time, many blockchain visionaries have been too ideological. For all the talk of radical transformations to distributed systems, the old institutions won’t give up their position without a fight, and totally distributed trustless systems and communities are not easy to implement. In the longer run, however, their influence could be really fundamental, once we get past the fancy ICO phase and move on to more serious solutions. We’ll see a lot of development in FinTech services during the next few years that will challenge the position of banks and other traditional institutions. But it won’t be a battle of market shares and revenue so much as a battle of international politics and strategic positions. We’ll probably see this soon also in FinTech investments. We have already seen how important the control of data and social media can be. The control of finance services and money is even more important. As the digital age ‘Deep Throat’ might say, “Follow the FinTech.” Follow the money comment: https://en.wikipedia.org/wiki/Follow_the_money The article first appeared on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed