|

DOKU:TECH is an inspirational and interactive annual event which brings together individuals and tech talent to meet with top-tier international future makers, executives and thinkers. Between 2014 and 2016, DOKU:TECH convened over 4,000 attendees and more than 60 renowned speakers for the two-day event. On this video Valto Loikkanen talks about startup ecosystems at DOKU:TECH.

Valto addresses questions and also talks about key challenges behind ecosystems:

Startup Europe of European Commission offers funding to develop and connect startup ecosystems, more information about available funding and how to apply here. Startup Europe is a part of EU's Digital Single Market project. Startup Commons (a Grow VC Group company) develops digital tools to develop and manage startup and entrepreneurship ecosystems. Startup Commons has also a resource bank to find a lot of material, documents and templates to design, measure and plan startup ecosystems. More information on their web site. The finance sector is changing as banks lose their power and influence and everyone realizes they must take FinTech and new digital services seriously. Big banks need to realize this too. Casper von Koskull, the CEO of Nordea, Northern Europe’s leading bank, recently threatened to move the company’s head office out of Sweden if the government implements a tax proposal that would levy an additional 15% tax on the costs of companies that provide financial services. The money would be collected especially for a system to manage potential bank crises. Of course, companies are never happy with new taxes, and after the initial complaints and threats there are typically negotiations. But now Sweden’s Finance Minister Magdalena Andersson has hit back, saying that in fact banks pose a risk for a country and are a potential liability, so maybe it is not so bad if Nordea moves. But was this only a typical left-wing political statement, or does she actually have a point? Many governments have been forced to use taxpayer money to save banks, most recently after the 2008 financial crisis. Of course, it’s not only about where the head office is located – countries have risks elsewhere, as consumer savings are guaranteed in many countries. But in practice, the home countries carry the biggest risk – something that small Iceland realized, for example, when its aggressive internally growing banks collapsed. Many governments now try to limit their risks and create new models to handle crises. One aspect of this is to split financial institutions, for example, so that investment banking and retail banking isolated from each other. Then there are also models for better stress testing and financial oversight of banks, collection of special funds from the finance sector that can be used in crises, and finding new mechanisms to handle crises that would see shareholders lose first. The objective of all these actions is to ensure that governments don’t need to bail out failed banks anymore. Taxpayers are tired of being on the hook. After the 2008 crisis, many countries introduced a lot of new regulation. This can help avoid some problems, but more regulations can also mean even more complex instruments and also even bigger “too-big-to-fail” banks. It is often said that banks are like big black boxes. New regulation hasn’t really helped solve this problem. It is extremely expensive to be a regulated bank. It is even said, that banks might become highly regulated, high-cost money pipes in a similar manner in which telcos became bit pipes. Some regulations, like EU’s PSD2, put even more pressure on this development, when banks must open APIs to their core services so other parties can develop value added service on top of them. FinTech influence At the same time, FinTech is rising globally, creating new services to help businesses and people get loans and capital. FinTech has an influence on many high-profit services such as international money transfers, wealth management and consumer/SME loans. A top level former banker who has worked in London and Asia commented that new finance services are especially growing in new finance hubs in Asia like Shanghai, Jakarta and maybe also Kuala Lumpur and Ho Chi Minh City. His reasoning was that it is easier for these hubs to go to the next phase when they have little or no history, culture, IT and liability of the old models and institutions. So, it could mean a tough time for Singapore and Hong Kong, as well as London and New York. Sweden has a left-wing government, and the finance minister comes from the Social Democratic Party. So, it is easy to claim her statement is a typical left-wing anti-business comment. Banks are important in the finance market, they generate taxes and offer jobs. But maybe the minister has also a point. The finance sector is changing, banks are losing their role, and they must also revamp their models. Historically they have had a strong negotiation position with governments, but maybe it also is changing. Especially after 2008, politicians are also under much more pressure from citizens to be tougher with banks and bankers. The finance sector is still changing slowly. The industry itself has started to realize the direction everything is going, and that everyone must take FinTech and new digital services seriously. We are still in the early phase of these changes that most probably will result in a much more fragmented finance industry – which is why those fragments must be able to work together in a transparent way. Governments and regulations are also preparing for this change. They must also start rethinking banking services and their role in the economy. Less regulation would make it easier to create new banks, encourage more innovation and competition, and reduce the number of too-big-to-fail banks. Big giant banks are still a risk and potential liability to governments. This Swedish discussion can – and should – be a positive opening to discuss banking regulation and the future of the banking sector. Functional finance services are the cornerstone of each country and economy. But no one can say that the finance sector and banks must stay the same as they are today. This article was first published on Disruptive.Asia. Photo: Gröna Lund amusement park in Stockholm, Sweden (source: Wikipedia).

From the conversations I’ve been able to have, my view is that the end of 2016 marked the end of the “R&D phase” in fintech, where the majority of institutions largely talked about the market and its implications, largely surveying the market and circling it, where 2017 is the year of practical implementation. This raises the questions; what will drive behavior and what type of collaborations are likely to emerge?

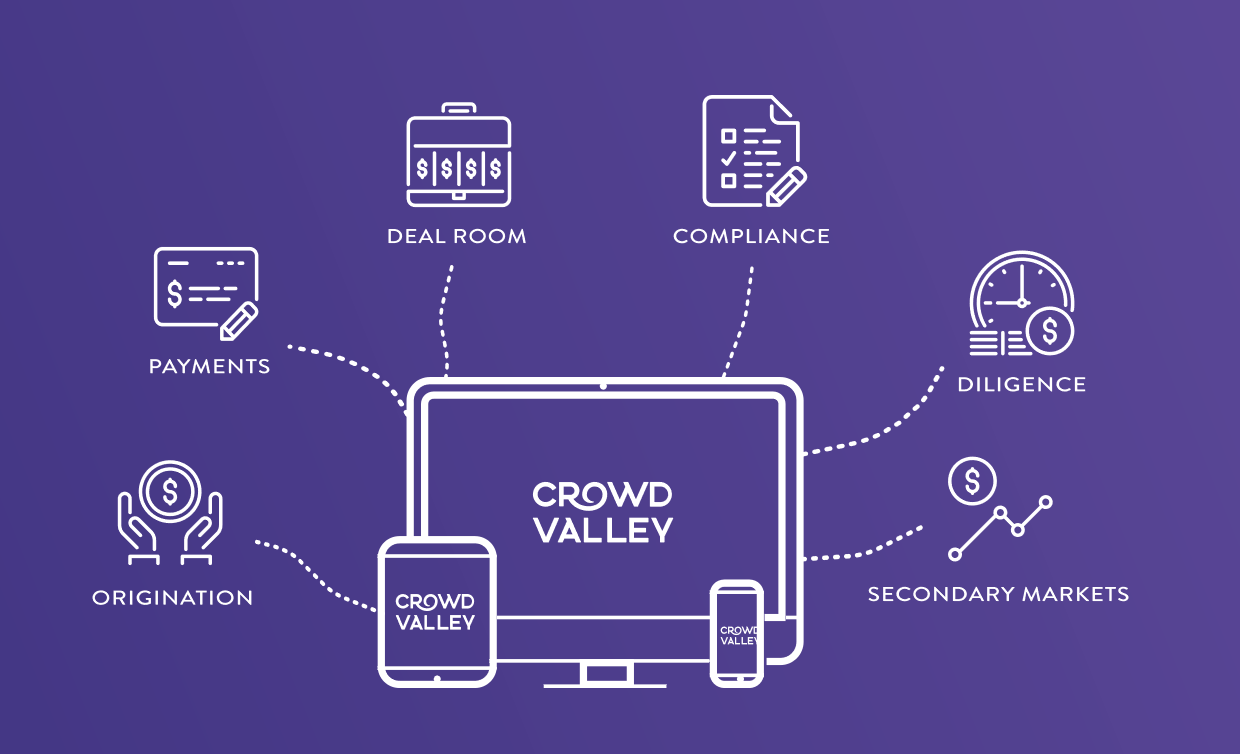

I’m a staunch believer in what we refer to as ‘distributed finance’, which alludes to distributed technology as well as distributed source of innovation and progress. We’re going to be seeing new innovation shape the financial services market both from upstarts as well as from the establishment. This innovation will go through all the market phases of cooperation, competition, acquisition and integrations on various fronts. Where can we expect these movements to play out? Being a Bank Still Means Something Evoking a passionate brand experience around a global retail bank is difficult. Yet at the same time brands such as Citi, BNP Paribas, HSBC, still signify a strong signal to stakeholders. Especially in an investment banking context, sophisticated investors take strong signals of operational quality from the association of a big name brand, likely in part due to the knowledge of conservative and risk averse internal processes. Among the biggest assets the existing establishments have are their brands. Therefore the question that stands is where can that type of a brand be used in the best way to serve the organization’s mission. Combined with the notion that there are several organizations that have an excellent track record of acquiring businesses, even more so than rolling out proprietary greenfield projects. This may be a reason that so many organizations have rolled out internal venture funds (see e.g. the global exchanges, like Nasdaq) dedicated to fintech. Benefits from Cost of Operations I’ve seen first hand how institutions get intimidated by changes in their market segment by upstarts that do not have the same impediments as they do, such as cost structure or internal compliance requirements, and thus can approach the market in a vastly different way. This may come in the form of targeting smaller investors or serving smaller transactions that are simply out of reach for larger market participants. For an existing diversified behemoth of a company, this type of cost efficiency may be out of reach. However, the benefit that such an organization has is the clear reach and breadth of service. Through upstarts emerging as very specialized and policy requirements pushing an unbundling of services (e.g. PSD2), the future will likely look much more unbundled and distributed than the current incumbent sector. Sweetspot #1: Significantly lower cost of operations in an industry dominated by benefits of scale. Focus on Mutual Client Value Taking the premise that fintech is about serving end clients better, the most natural areas of collaboration are the ones that represent indirect competition. For example, online lenders may target clientele that would not satisfy a traditional lenders risk profile, yet the cost of operations makes it attractive for the online lender. Or similarly an online digital investment bank may be able to source and transact in smaller size of deals (e.g. sectors such as private equity and real estate) where traditional players may have a difficult time adding value. User experience is also vastly different. Being able to acquire and onboard clients in a retail service may be a vast competitive advantage or being able to originate and process a loan application with a fraction of the cost. Usability and a more transparent decision making process, explaining to the end user how their data helps them get a better deal through their mobile app, will go a long way in competitiveness and in order to appeal to those larger scale organizations focused on exactly these questions internally. Seeing the overlap is a fundamental part of the collaboration and potential consolidation to start, before we can start talking about mechanics (for arguments sake, there may be a clear benefit in the lack of integration in some models to keep the competitive advantage making it appealing in the first place). However, getting all parties to recognize this overlap and mission of serving the end user better may indeed be trickier than it seems. This understanding is key in order to generate the drive to see these joint models emerge. Sweetspot #2: New offering on smaller scale attractive to establishment. I want it! What is it? Even to this day, fintech remains often misunderstood. It’s disadvantaged by the fact that technology centric publications charge forward with buzzwords as their weapon talking about great disintermediation and largely the innovative approaches taken by upstarts. Unfortunately this often translates to innovation being written off to new market participants that have no respect for the sector or its rules, when the reality is in fact far broader. I’ve also seen first hand how management of institutions have no fintech strategy, and quite frankly don’t see a need for one when the top focus of the company is to increase short term shareholder value, cut costs and improve operational efficiency. Internal politics may also come into play, when, let’s face it, this type of automation and efficiency isn’t always a popular topic within an organization. For all of the reasons fintech may represent a misunderstood or uncomfortable discussion, I believe we are past the large-scale resistance and are accepting fintech as a means to serve our end clients better. Like a waterfall, this push to adopt new models to serve clients doesn’t always happen in the most calculated way and we are likely to see calculated, as well as hasty moves in the model to integrate solutions into existing establishment. On a macro level I believe this will work out to the end customers benefit, with more diverse expertise making it into baking and brokerage roles, however not each integration will see a vast shareholder value. On the other hand, such is the life of M&A. “Sweetspot” #3: Existential threat and strategic blue ocean strategy. Upstarts Make Big Bets One of the most exciting things for me to see, as an entrepreneur in fintech since 2008, is when the upstarts are able to not only make ripples but truly generate waves. Marketplace lenders applying for banking licenses, N26 delighting clients with a client onboarding lasting minutes through their smartphone and Transferwise taking on hidden margins. These are interesting anecdotes, even though over time upstarts often end up integrated into existing institutions. However, technology has changed and so have business model needs since the financial crisis. Through disintermediating forces such as PSD2 and possibly even MIFID 2 with its implications, we will see a deeper specialization in the financial services offerings. There are areas that do and will benefit from a true scale benefit, but I would argue there are areas that not only will benefit from specialized service, the end user may even pay a premium for a very focused and conflict free offering. Gritty entrepreneurs and upstarts that are passionate about client value and serving their users at the highest level to no end will hopefully always have a role in the world of finance, maybe even an independent one. Institutions Bet Big On Proprietary Technology Given the benefit of having a strong brand, the appealing choice for many organizations is to roll out their own proprietary greenfield projects. I’m fortunate to be able to see many of these in my day to day, and can attest to the fact that there are far more projects making their way through internal new business groups than apparent from the surface. Notable examples so far in the market have been Marcus by Goldman Sachs or Vanguard’s robo advisor platform. The latter is interesting given the fact that the organization is member-owned and an insistent member focus is true to the very DNA of the organization. I would expect the large organizations to roll out far more innovative ways to serve their clients in retail and investment banking 2017 onward. Grandparents and Toddlers Through these trends, a clear re-imagination of services is underway. A notable additional trend is the winding down of legacy technology within large organizations, which has been underway a long time. The need is clear, many projects work on technology where the experts would much rather spend time with their grand children and worse, no one understands the modules, their dependencies or implications. This type of ‘black box’ technology is on the way out and organizations are loath to start new projects in a way that repeats past mistakes. If the assumption that we are past a large-scale resistance and the R&D stage of the market, we’re sure to be seeing much practical innovation being unleashed to the market and co-operation emerge to maximize end user value. This article was written by Markus Lampinen, Crowd Valley (a Grow VC Group company) CEO, and was first published on altfi.com. Commenting on the announcement that the OCC intends to design standards that will allow fintech companies to be chartered as special-purpose national banks, Controller of the Currency Thomas Curry said: “More than 85 million young adults in America are entering the financial world with the majority of their financial lives still ahead,” he said. “They want technologies and services that provide better, faster, more accessible products and services, and they are willing to switch providers or use multiple providers to get what they want.”

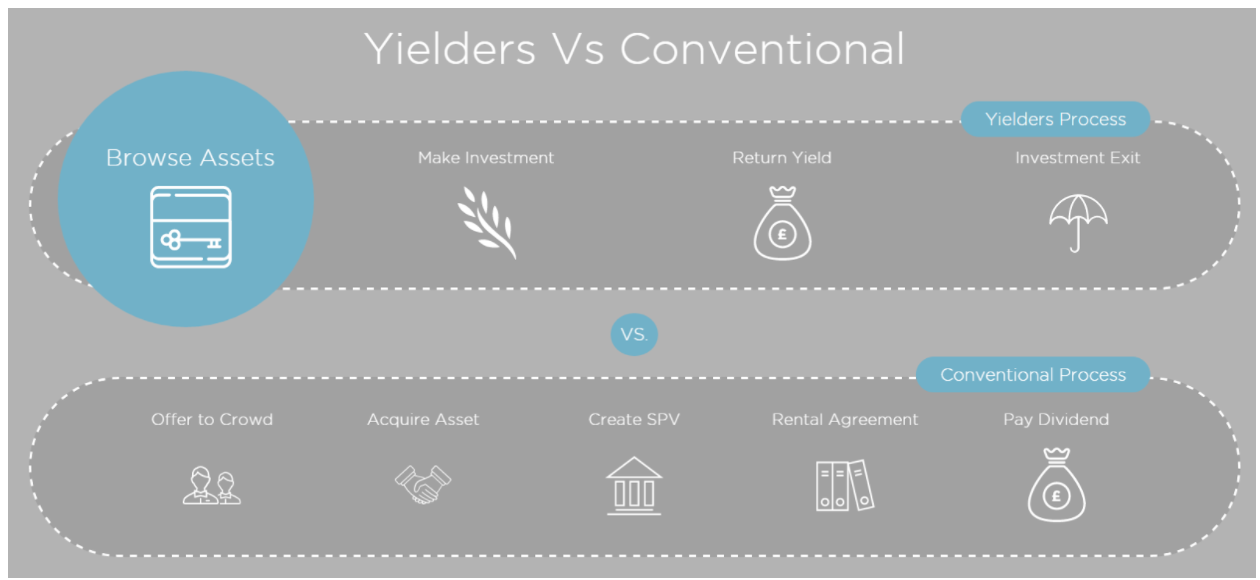

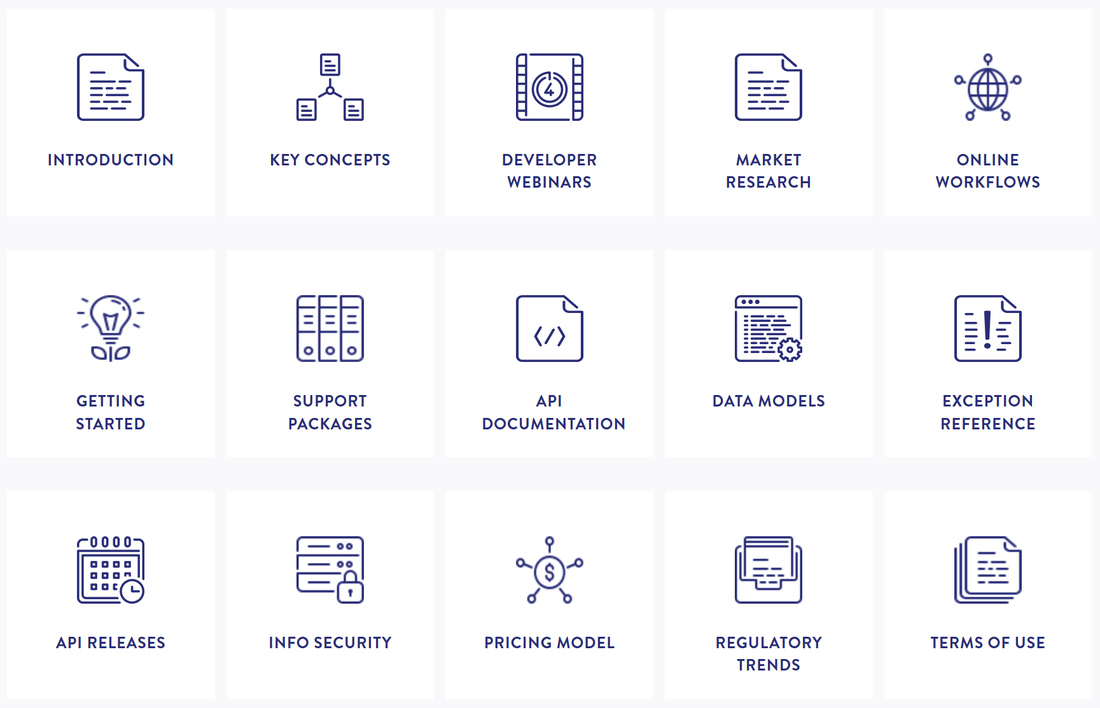

To get on the radar of this new customer base, credit unions should take advantage of technological innovation to increase focus on efficiency and the end user experience. That does not mean grabbing the latest fad off the market and implementing it with hope to seem “up-to-date”, but rather having a solid core platform in place with the option to allow third parties to utilize the platform to innovate and develop new applications on top of the credit union’s own solutions. A project to either digitize existing processes or launch new ones will never be the same for every credit union, however, there are several areas that need to be addressed before the implementation phase: 1. Setting up strategic goals and corresponding solutions. Depending on what issues a credit union wants to address via technological upgrade, the process can significantly vary. 2. Considering upgrading core processes first. Consider improving services critical to your members and revenue generation, such as lending. 3. Involvement of the legacy system. IT infrastructure in place is commonly found to be several years old and might not be suitable for current business needs. 4. Choosing a platform. Keeping in mind that high pace of innovation makes it more likely that we’ll witness new services and corresponding customer expectations emerging in the near future, it is worthwhile to consider open APIs (application programming interface) and a Cloud Back Office to keep all components in one place. 5. Finding developers. If the API provider offers a “sandbox”, the developers can test the platform to ensure a seamless operation process for the applications. 6. Reviewing fringe offerings. While traditional banking services – lending and taking deposits – remains at the core of credit union services, the open API enables other options. Read the whole article and more details on Crowd Valley Blog. Starting a Fintech company is a challenge in itself especially when it comes down to the regulations and compliances one has to abide by. We are delighted to share that one of Crowd Valley's clients, Yielders, has become the first UK Fintech company to get the Sharia Compliance certification. The service is powered by Crowd Valley's (a Grow VC Group company) finance back office.

Yielders is an equity based crowdfunding platform for property investment. After being compliant with the FCA regulation, it can now operate across Asia, Europe and the Middle East. Yielders enables the public to invest as little as £100 towards a share of a crowdfunded property. An Ethical Islamic investment is very crucial to the Yielders philosophy. In his statement, Irfan Khan, the Founder of Yielders, said “We are delighted to be the first UK FinTech company to be Sharia certified. While it says much about our business ethos and ethics, it also demonstrates our place as a dynamic player in the UK Islamic finance sector. We are dedicated to what we do and to be recognised as doing so in a responsible and ethical way that will allow us to reach potential investors for whom this is important too.” We would like to congratulate Yielders on achieving their profound milestone and wish them all the success in their endeavour. The demand for Islamic FinTech is growing globally and Crowd Valley offers back office solutions to build implement those services. Read more about new finance service at Crowd Valley News. According to Investopedia, “Fintech is a portmanteau of financial technology that describes an emerging financial services sector in the 21st century”. Originally, the term described technology applied to the back-end of established consumer and trade financial institutions. Since then that definition has expanded significantly to include any technological innovation in the financial sector, including innovations in financial literacy and education, retail banking, investment and even crypto-currencies like bitcoin.

But today as we review the Fintech ecosystem, the term Fintech in itself fails to capture its true impact and significance as a ecosystem bringing together a number of different functions and impact under the umbrella term Fintech. Using the word Fintech is analogous to using the word retailer. It’s too vague to give you (whether consumer or service provider) a real idea of the myriad of different application, efficiency gains, accessibility and profit making possibilities. On a daily basis, Crowd Valley (a Grow VC Group company) engages in conversations with clients from a range of different industries, demographics and backgrounds, a number of them unrelated to the conventional financial services space and they all echo a few common themes which can be woven together to define Fintech as one of the following:

According to Chris Skinner, Fintech extends to Regtech for Regulatory Technologies; Wealthtech for Wealth Management Technologies; Insurtech for Insurance Technologies; and so on. On top of that, Fintech has gained subcategories like Lending, Analytics, Digital Identity, Cybersecurity, SME and Student Financing, Payments, Robo-advice, Blockchain Distributed Ledgers, Neobanking, and more. Then there are also some generic technologies around Cloud, the Internet of Things, Artificial Intelligence, Machine Learning, Biometrics and others that are also creating Fintech themes and impacts. These can also be surmised into 3 streams:

But Fintech goes beyond just banking and the diversified financial services space. It’s a means to change the way any business works and the way a business or a person may interact, exchange information and transact with each other. APIs are facilitating this synergy at a breathtaking pace and allow a number of functions or processes to be integrated into single interfaces. With API’s your business’ digital interface could be empowered to provide the latest data on the website. If this piece struck a chord with you, feel free to get in touch with us at Crowd Valley. We’d be happy to have a discussion about how our API framework and Cloud Back Office could help you. Read the whole article and more details on Crowd Valley News. Oliver*, a leading alternative finance blog, interviewed the Chairman and Co-founder of Grow VC Group Jouko Ahvenainen. In the interview Mr. Ahvenainen commented the future outlook of fintech, crowdfunding and data services. They also discussed, how the new US President Trump might have impact on the finance and fintech market. Some highlights of the interview: "I would say that FinTech forces are making the world more global. Moreover, as we pointed out in our report, FinTech is creating more complex networks which are more difficult to control by governments." "Nowadays, traditional finance companies are losing their power while new services are emerging. The difficult question to answer is how long it will take." "Startup equity crowdfunding alone is not so great business." "Consumers will eventually ask for more tools to take back control of their data as it is unfair that others own your own data but you. Blockchain is starting to help people in this respect." Read the the whole interview on Oliver*. Alessandro Ravanetti (L), Co-Founder and CMO of Crowd Valley, a company part of the Grow VC Group, co-founded and chaired by Jouko Ahvenainen (R), a pioneer in the FinTech Industry.

From $19 million in 2012 to an estimated $3.5 billion in 2016, the real estate crowdfunding sector is amongst the most active of the global alternative finance industry. Some even expect it to represent more than $300 billion by 2025. Impressive as this figure might seem, it is well within reach as real estate crowdfunding only represents a fraction of the global real estate market.

In 2015 for instance, the $1.5 billion of the US digital real estate market accounted for 60% of the activity globally, and this while representing only 0.3% of all real estate transactions in the country. The predominance of the US can be partly explained by the housing crash of 2007 that drove property prices down, followed by the JOBS act that paved the way for the emergence of alternative financing mechanisms to ward off the credit crunch. Naturally, leading real estate crowdfunding platforms are well-placed to benefit from this situation, but upstart firms also have room to grow and many niche segments have yet to be impacted by this shift. Several trends are expected to drive the growth of the global real estate crowdfunding industry in 2017:

At Crowd Valley (A Grow VC Group company), we have been actively following the global emergence and expansion of real estate crowdfunding. We’ve also assisted many clients in the creation of their own platforms, in all the major markets and across many types of asset classes. Any interested party shouldn’t hesitate to get in touch with us to benefit from our expertise in this growing industry. Fintech has become an important topic at Mobile World Congress too. This year we saw big finance institutions, startups and also companies from other verticals offer some fintech products. But the products we see in Barcelona are more elements and building blocks, not proper larger solutions. Some areas of fintech are already quite crowded and some other components are largely missing.

Payment products and components were probably the most popular fintech application at the event. Some products are really a full offering to make payments, and some are more enablers, for example, to handle an NFC transaction. A payment can also mean many kinds of things, it can be a physical touch payment with NFC, or it can be a payment inside a mobile app, it can be a money transfer as such or inside social networking, or a mobile device for point-of-sale to collect payments. Generally, this is a very fragmented area at the moment, but it is clear the main global players are Apple and Google, maybe a little Samsung, and we will see if there will be room for other players. The GSMA estimates that more than half a billion mobile money accounts have been opened globally, so it is also a big market. User identification, authentication and know-your-customer (KYC) are also becoming very important fintech domains. But there is a bottleneck for many digital finance services - how to make it easy for new customers to start to use the service, log in to the service and authenticate transactions and at the same time guarantee high security and finance regulation requirements. KYC has become so important that for example many banks have paid billions of dollars in fines or settlements in the US, when they have taken customers that have had links to drug or terrorist money. At the same time users expect now an easy process to start to use a digital service. The FIDO alliance is an interesting initiative for more secure authentication. It has dozens of member companies from big organizations like Google, Microsoft and Amex to smaller startups. The alliance basically develops a framework, with principles and guidelines to implement secure authentication solutions. Actual applications can use many kinds of solutions from physical tokens to biometric components like finger print, face and voice recognition. This is probably an area, where we will see much more new solutions also in mainstream services in the next one to three years. Samsung, VISA and MasterCard were the big players with fintech solutions at MWC17. They didn’t tell anything significantly new. For example, MasterCard demonstrated how to track the use of your card in a mobile app in real time. It is a nice feature and not all card issuers offer it yet, but at the same time mobile banks (e.g. N26) and some traditional banks (e.g. Chase) have been offering it for a long time. Of course, VISA and MasterCard have a very important role in new payment solutions too, when still many of those are based on credit and debit cards. But they must also innovate, when we see in China how Alipay processes 10 times transactions a peak second than VISA. It is a good reminder their position is not guaranteed. Identification and payments are still quite simple solutions, if we think the whole finance industry. The critical thing is to get all components to work smoothly together and not only handle the consumer interface, but also a lot of back office functions, transactions between finance institutions, and also corporate services. There were some examples of larger finance solutions too at MWC. Crowd Valley, a cloud based finance back office provider, published its new mobile development tool kit, focused on how to build mobile finance applications by getting all needed back office functions, regulatory and compliance features from their back office. Tag Pay was there again to talk about its mobile banking services, that can be used also with feature phones, especially for developing countries. And then there were some new interesting startups, like Barcelona based Unnax, that offered more solutions for corporates, such as downloading data directly from a bank account to an online loan application and transfering money. MWC is also getting a fintech event too. One fact seems to be that fintech innovations are more driven by tech people and entrepreneurs than traditional finance people and institutions. Of course, that is similar in many other industries, when someone must disrupt it. A surprising detail was that not so much about blockchain yet in Barcelona, maybe because tech people know it still needs a lot of work although it is promising, when bankers like to talk about it even when they don’t know what it is. My expectation is that next year we see more fintech at MWC, and not only elements but whole frameworks and finance solutions. This article was first published on Telecom Asia. Non-performing loans are an area of concern for banks especially in tough economic times. NPL portfolios will impact profitability in two areas: 1) loss of the value of the loan not recovered and 2) ongoing management using labor intensive and manual workflows. By digitizing the management using Crowd Valley’s back office, we have seen institutions improve portfolio performance nearly overnight by directly addressing: 1. Correct Segmentation and Client Profiling. Higher quality segmentation means you can take better risks. 2. Data consolidation. Collateral data is a good example of how managers of non-performing loan portfolios can better reduce losses. 3. Collaboration. Data collaboration between teams ensures there is no value leakage. 4. Early Warning Triggers. Combining data sources and internal underwriting policies, early warning systems and forward looking models are created to provide portfolio managers with visual insight into portfolio quality. If you are looking to capitalise on operational efficiencies within the fintech space, get in touch with us at Crowd Valley (a Grow VC Group company) to leverage our industry leading Cloud Back Office. Read the whole article with more details on Crowd Valley News. Photo: Wikipedia

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed