Los Angeles & Hong Kong, September 29, 2017 – Grow VC Group, the leading fintech technology and data holding company, has today officially sold its ownership in Los Angeles based TradeUp Capital Fund (TradeUp). TradeUp offers efficient services for export capital. The new owners will integrate the offering into their existing portfolio of export services. The acquirer sees that new finance services for export business are an important part of a service portfolio to support export companies. The companies have decided to not disclose the acquirer or price. The acquirer will announce its future services later on in the year. The Grow VC Group has been an owner in TradeUp since early 2014. TradeUp was the first online investment service that especially focused on companies that raise capital for globalization and export. Grow VC Group has been an owner and investor in several online investing and crowdfunding services since its inception in 2009, and over the markets maturity divested several ownerships, and focused on enabling technology and data in the fintech market, and increases its operations for blockchain, financial data and digital assets (including ICO) based solutions. Grow VC Group companies build businesses that enable digital finance services globally, by offering technology, data, finance instruments and competence to disrupt old finance models, and making it easier for anyone to implement new finance services, invest and get access to capital. Established in 2009 Grow VC Group is the global leader of fintech innovations, digital and distributed finance services, and digital infrastructures. Its mission is to make the finance services more effective, transparent and democratic. More information: Jouko Ahvenainen, Chairman, Grow VC Group, jouko@growvc.com, +1 646 363 6664 Grow VC Group and its companies will participate and speak in several FinTech events during the fall 2017. We listed here some events the group representatives will speak. The speeches focus especially on new digital finance services, data and data analytics, and enabling technology that disrupts finance services. Hong Kong FinTech Week is a leading FinTech event in Asia. It combines the development of FinTech in the traditional finance hub Hong Kong, in the leading FinTech country China and the latest development in Asian emerging markets. Grow VC Group Co-founder and Chairman Jouko Ahvenainen speaks in the event and focuses especially on data, data analytics and AI in FinTech. FinTech World event in Washington DC focuses on blockchain, digital currencies and new ways to have digital assets. This event gathers the leading digital currency and blockchain experts in the US. Grow VC Group's Jouko Ahvenainen speaks about data and AI for digital currencies and assets, and Crowd Valley's (a Grow VC Group company) Markus Lampinen about technology to build services, market places and applications for blockchain, crypto currencies and ICOs. World Funding Summit in Los Angeles has the leading experts of the funding market to talk about new funding models, online alternative finance and how digital currencies, assets and ICOs change the market. An important theme is also, how these new solutions can make the finance market more equal and democratic. Grow VC Group's Jouko Ahvenainen speaks, how new solutions, instruments and digital assets change the fund raising and investing.

In many industries – such as airlines, retail, and media – disruption has been linked to new low-cost, almost commodity-type services. Southwest Airlines and Ryanair paved the way for low-cost flights, online news has become a commodity, and retail chains like Walmart, Aldi and Lidl have created a new cheap-prices-always category. The common theme is: cheap basic things, with a better experience available for a premium. FinTech disruption is changing finance in the same way, and when basic finance services become a commodity, they will be integrated to other services.

Some finance services have, of course, been in this category for a long time already. For example, payments are a crucial part of all e-commerce services and brick-and-mortar check out processes. It has become natural that services use third-party payment solutions rather than develop their own. We will see the same development for many other traditional finance and banking services. Online lending, p2p lending and quick loans have been a fast-growing market. Those new lending services offer many benefits – sometimes a better price, but typically a much better customer experience. Sometimes they offer loans for people who cannot get a bank loan, and they might have more flexibility in terms and conditions. For many loan categories, bank loans are not a very attractive option anymore, especially when you factor in the customer experience, paperwork and time needed to get a loan. Ford Motor Company just announced that they are going to adjust their car finance process (read more on WSJ). They decided that the traditional credit-scoring model is not very effective or optimal nowadays, and that they could get more customers and sell more with new finance models. Basically, they plan to use more data from new sources to get a more accurate profile of customers and optimize their financing better. It’s worth noting they were forced to do this because alternative lending services are already doing it, and competitive finance is an important component in car sales. Car sales finance is just one example illustrating that companies outside the traditional finance sector need to develop better new finance solutions. FinTech makes it easier. The real estate sector has adopted a lot of new finance and investment models during the last five years, especially in the UK and the US – but now new real estate finance services are emerging globally. This means there are many new models available to invest in real estate – e.g. in development projects, rented apartments and commercial buildings, and new models to lend and borrow in real estate. Typically, this includes new finance instruments that are then offered through online finance services. These services are offered by some finance companies, real estate development companies and several startups. At the same time, more inexpensive technology – or even technology-as-a-service – is available to build finance services. You don’t need a $100-million-plus IT back office to set up an investment or lending service – you can get it as a service from cloud, and they can offer access to relevant data sources (including credit ratings and richer data). It is quite easy to develop the actual application and your own investing and lending models. We will see more:

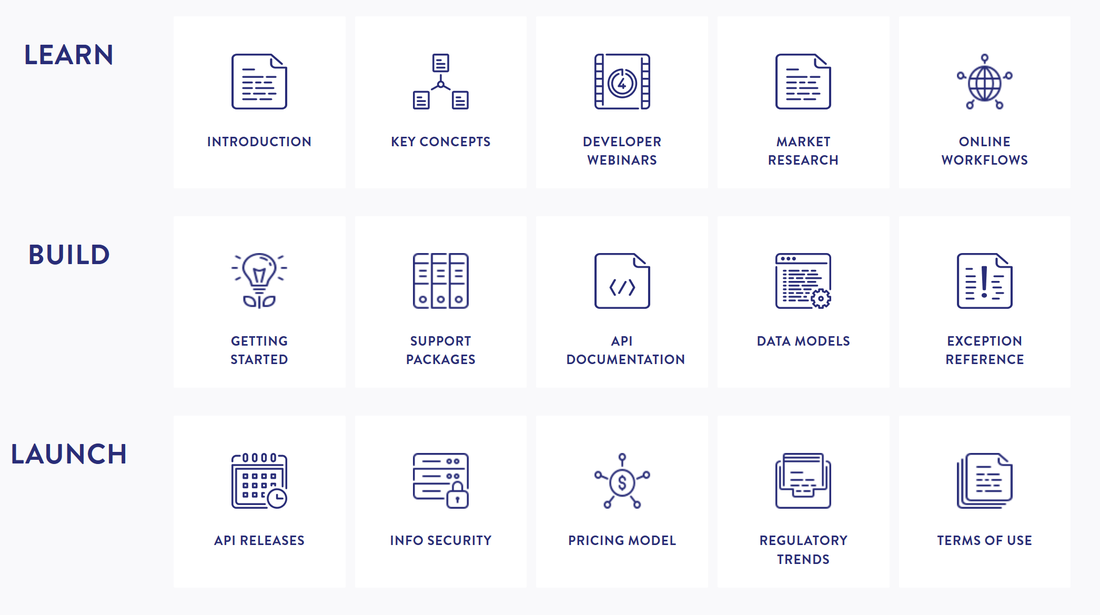

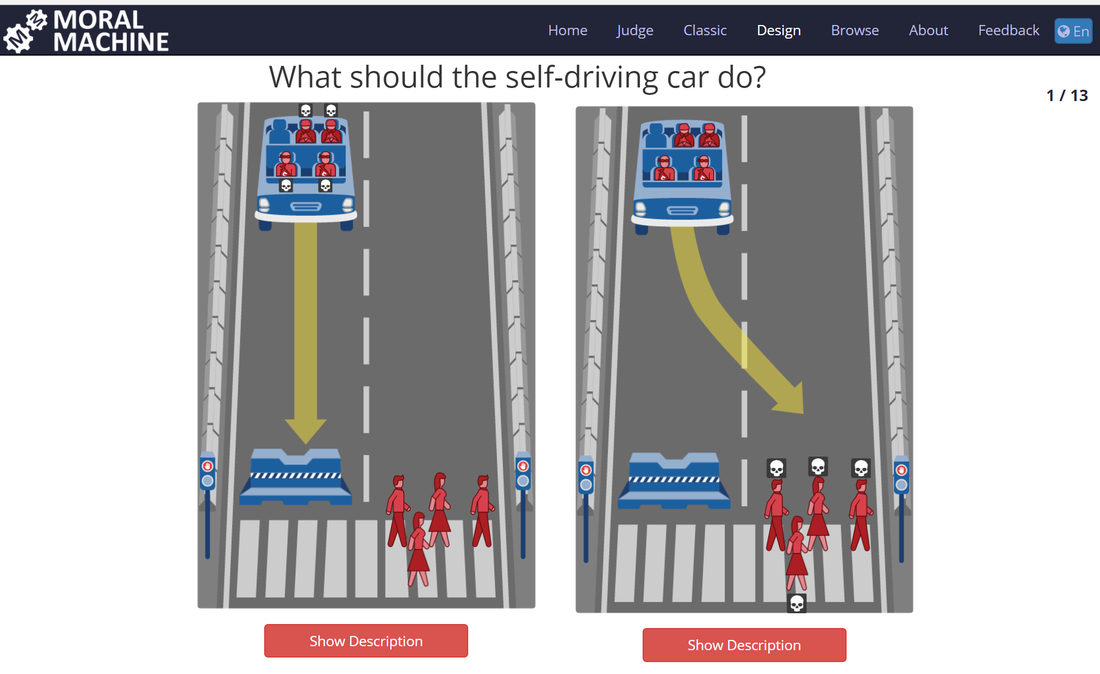

All this is a part of the overall development towards an API and platform economy. Finance is becoming an integrated component for many other services. It means more competition for banks. But it also means significant new competition for credit card companies that have had an important role in smaller online purchases, and their money has typically been expensive. When we think about FinTech and its impact, it is easy to focus only on the traditional finance sector. Certainly there will be significant impact on the whole finance value chain, as I have written earlier. At the same time, however, finance is shifting to a platform economy, and it is fundamental to adapt to the requirements of that business model by building the business network, offering APIs and utilizing data. After a few years, we will think about the old-fashioned bank loan process, with all these paper forms, and laugh as we do now at the thought of sending a fax or buying printed flight tickets. This post originally appeared on Disruptive.Asia. Artificial intelligence (AI) and machine learning (ML) are becoming an infallible part of the development of present-day technology. Yet the public discussion often centers around a notion of a ‘human-like’ robot and my concern is that the impact gets downplayed. How then should we look at the future with AI? One way which may be helpful is examining the aspect of morality and consciousness, or rather, the lack of both in decision-making in a new paradigm. Humans have evolved based on a complex process of long-term trial and error. Our biological machinery has been honed over thousands of years to optimize (mainly) for survival and procreation and for these tasks, the human mind is highly advanced. However, we have to realize that the subjective aims of the human mind are the primary reason and motivation for all decisions made. Morality is a key element in the support of sustaining these two goals of the human species, and has successfully introduced a human-wide consensus to better our chance to achieve our goals. As we look at crafting AI for better data-driven decision making in critical processes – such as optimizing far-reaching and complex value chains, making real-time decisions in applications such as self-driving cars and many more – we should recognize that without coded in morality, AI will actually act without the concept of morality or human subjectivity. In short, it will optimize any and all decisions based on the rational best outcome for the desired parameters rather than what ‘a good person would do.’ A Future with Less Morality May Be One Humans Find Uncomfortable Looking at the grinding, long process of trial & error humans have undergone to evolve, we could expect AI to dwarf this process and undergo a rather rapid process of trial & error. Especially with the concept of connected machines and the vast availability of real-time data, we can expect the process to be fundamentally fast and unlike anything that has ever been seen before. The entire human species has used a moral compass in guiding development and uniting humanity behind a broader direction. For the first time in history, we may have a future chapter of innovation written and executed by a new kind of decision-making and at that, entirely non-human. However, we should not be blind in assuming this future is far off. As authors in Moral Decision Making Frameworks for Artificial Intelligence point out, AI is already used in highly complex ethical fields of decision making such as organ transplants and waiting lists, deciding effectively who lives a little longer and who does not. Yet one does not even have to go to medical fields to find life-altering decisions made by non-humans, where AI is already far-used in determining eligibility for receiving and underwriting credit decisions including loans, which will determine who has an opportunity to access finances for a specific reason and again, who does not. This too has far-reaching consequences. We’re already far along in introducing an objective decision maker into situations that truly matter, yet humans make a vast number of decisions each day with limited information and most importantly, limited objectivity. We shouldn’t write off the human brain however – it is truly a cognitive miracle that derives information from all senses in real time and through conscious and unconscious steering, shapes our thoughts & actions. Yet a lot of human morality centers around the concept of self-protection in complex decision making and a lot of the information accessible to humans, is a fraction of what AI will be able to tap into and process. Well Then – Can We Introduce Human Morality Into Technology? It’s certainly a possibility and one that several leading researchers and authors of our future are pursuing. For example, Future of Life Institute and Duke University have been active in the foray of introducing ethical engines into artificial intelligence and decision making by interesting applications of game theory. Researchers often look at the now-infamous examples such as the self-driving car and an unavoidable pedestrian accident and attempt to find very tangible ways of introducing intended morality in a way that is actionable and clear. It is a complex task which involves classifying actions as morally right or wrong in a universal and generally accepted way. The establishment of a pre-written ‘moral compass’ would allow an element of human decision-making to be codified and carried on into applications that will learn on their own at some point. We can generally think of the concept in different phases:

We can argue that we currently find ourselves in the first phase with the question of whether we’ll ever reach the third phase at all. Morality as a Lens for Future Outlook The future of technology and AI will likely be a series of events, some controlled and pre-planned, and others the result of unintended consequences. Morality will be a key component in determining how the future looks and the exercise of considering the absence of morality may be useful in understanding why the field’s importance is so profound. If we indeed never come to the third phase, we will also be looking at a future derived largely by a presence lacking consciousness. These elements may be impossible to imagine ahead of time, yet their implications are likely to be paramount. Written by Markus Lampinen, CEO of Crowd Valley, Inc. This post originally appeared on Let's Talk Payments. Photo: MIT Moral Machine.

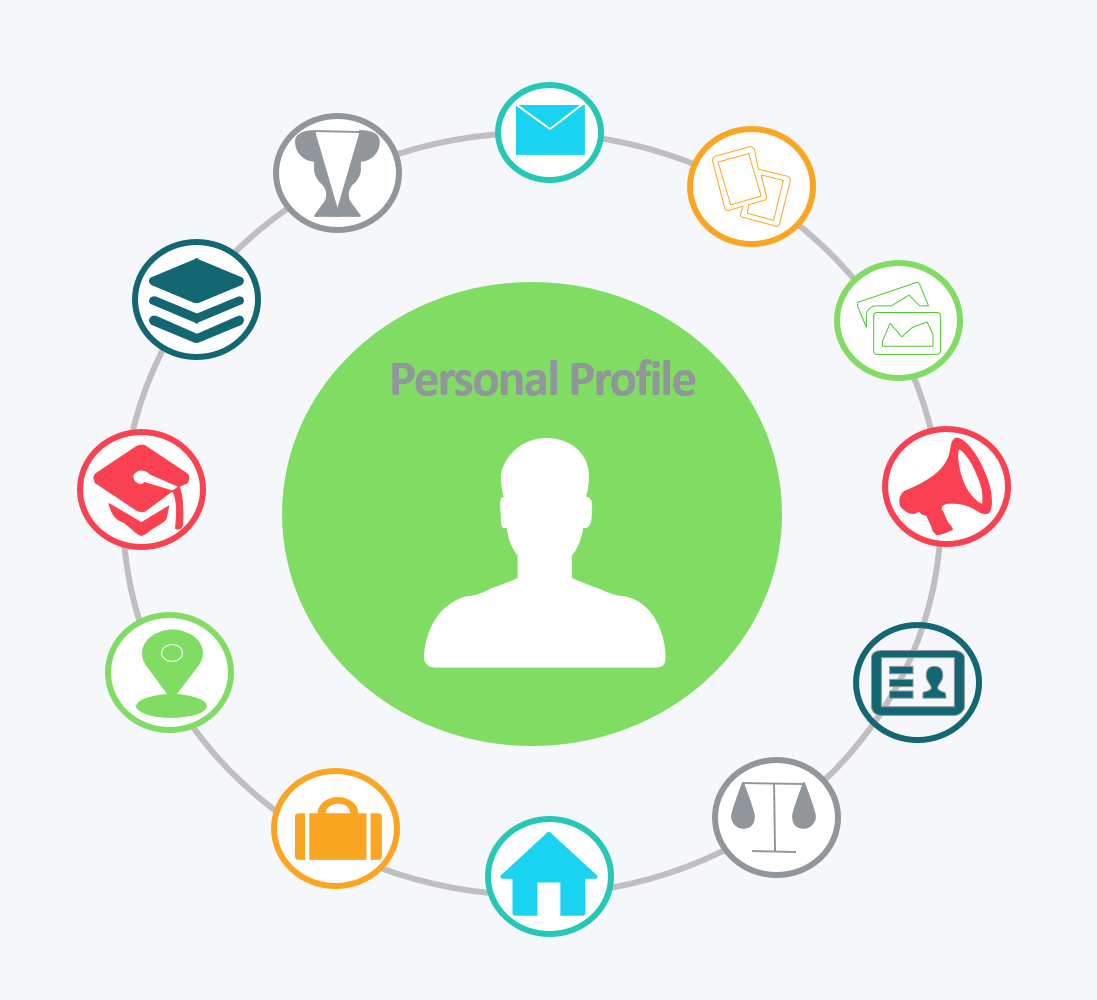

"We need new solutions for collecting and using data that strikes the right balance between consumer benefits and control over their own data." I was looking for the opening hours of a local supermarket in San Francisco from Google Maps. When I found them, Google also told me an interesting additional detail: “You visited this place 17 hours ago.” In fact, yes, I did. It reminded me that my Android phone indeed collects my every movement and location. (You can check your history at https://www.google.com/maps/timeline, when logged into your Google account.) Here’s another example of the same thing: an insurance technology (“insurtech”) company recently demonstrated its app to me, and it had a full history of drivers’ driving data, including each acceleration, braking and speeding, on the map. The insurance company collects all that data, which it can then use to try to influence driving habits, and adjust premium prices. Yet another example: new credit rating agencies that not only collect your income and loan payment history, but also try to utilize all data about you available on the Internet –including location, social network and payments – to evaluate the risk in lending you money. We are really starting to live a new type of public life, although we don’t always know it. It is not breaking news anymore that mobile, Internet services and social media collect a lot of data from us. It has been used for marketing and advertising for years. But now there are more and more ways to use it – for example, recommendations, financial services, political marketing, and personalized customer experiences. Many parties and people are very worried about this. They see that companies can now know perhaps too much about individuals, sensitive data can leak into the wrong hands, and we cannot know how the data is used in the future if ‘bad forces’ take over. That’s why governments are developing new laws and regulation for collecting, storing, processing and utilizing data – perhaps the most well-known example right now being the EU’s General Data Protection Regulation (GDPR), which takes effect in May next year. Naturally, we also hear many horror stories how this all can get worse in the future. When your phone, TV and digital assistant are listening to you speak, they can collect everything that is said in your home. Services could analyze all your communications, including emails, calls, and chat messages. There are totally new opportunities here to create intelligence gathering services much more effective than the East German Stasi ever were. And we know many government intelligence services already collect this data, or are trying to. But the flip side is the potential benefits of all this data collection. Big data analytics can make many services better. Isn’t it fair and good that your driving habits have a positive impact on your motor insurance premiums (provided you’re a good driver, of course)? Or that your life habits can determine the cost of your health and life insurance? Or your money management behaviour and spending habits can be used to evaluate the risk and price for your loan? Or services can personalize your experiences and tailor them especially for your needs and behaviors? People usually find data collection stories scary because they have no control over who gets to collect data and where and how it’s used – therefore, the simple answer is to give them control, to include the ability to forbid use of data and even to have the data deleted. In practice, of course, this is far from simple. According to different studies, the majority of people believe they had lost the control of their data. So many services collect and use data, and users are not always able to follow or control this. Companies also sell and buy data. This is a new complex area for authorities to monitor and control, although we have also seen that some Internet companies are more interested in protecting privacy and use of data than some governments. We can conclude, then, that while there are threats and risks to collecting and utilizing user data, at the same time this data is fundamental to making many services better for users, as well as more affordable. There is definitely a need for new solutions where people can manage their own data and ensure it is used to suit their needs. For example, if a person has all his or her own verified data, it would not be necessary to reveal all data for a loan application, motor insurance application or location-based service – only profile-level data that is relevant for the service in question. Today, companies are the ones collecting all the user data they can – in the future. each person should be able to collect and use their own data. At least, people should have their own copies of their data to verify that it is true. It is clear we have a need for totally new solutions to utilize data so that privacy and user control can live together. Governmental and legal control alone is not enough to handle the fundamental problems involved in data collection. (Governments can even be part of the problem of data misuse.) Instead, we will soon see a new era of data analytics that is based on fundamentals to combine personal data management, profiling and targeted utilization of profiles. The article was first published on Disruptive Asia. Check Prifina - a new way to manage your finance data. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed