|

VanFUNDING 2017 was a BLOCKCHAIN and FINTECH FUNDING conference that pushed boundaries to discuss the latest developments, educate, inspire, and connect ‘You and your vision’ with leading innovators, entrepreneurs, investors, vendors, thought leaders and policy makers in the quickly emerging sectors of fintech, P2P, crowdfinance, blockchain ICOs, digital currencies and alternative finance.

Grow VC Group made the closing keynote about FinTech and blockchain ecosystem. He emphasized especially that all parties should together develop a well working distributed finance ecosystem, not only individual services. You can also read more his thoughts about the ecosystem needs and opportunities here. The conference includes presentation and discussions especially about blockchain, ICOs, and regtech. The panels shared very different point of views and opinions from ICO bubble to models how distributed models can take over the whole finance industry. The regulation and regtech are also very important parts to get the ecosystem really work.

Photo: Interview to a business TV channel.

Photo: Panel about blockchain globally.

Photo: Vancouver downtown.

Photo: Grow VC Group keynote.

Photo: Regulation panel.

Cloud services are often seen only as server capacity, but we are now entering the phase of serverless cloud services (read more here ). We also see services from cloud companies, like Google Apps, Microsoft Office and IBM Watson. In the future cloud companies probably offer more services, not only apps but APIs, too. One area where cloud companies are getting more active is fintech.

We can simplify and divide cloud services into three categories: 1. Infrastructure as a Service, IaaS, that is pure virtual computing resources, 2. Platform as a Service, PaaS, that offer a platform where software can be developed and run, 3. Software as a Service, SaaS, offers an application on servers to users. We have seen a lot of IaaS offering as AWS, Microsoft Azure and IBM Cloud. We have also a lot of SaaS offerings, starting from Salesforce’s CRM to Microsoft Office and millions of other services from small and big software companies. PaaS business has been smaller, but can be expect that especially PaaS is a growing segment with vertical cloud solutions? AWS is often seen as the leading cloud company, but if we include all these categories, actually Microsoft is the biggest cloud company. Especially on IaaS we have also seen differences between services in terms of how ‘pure’ server capacity they are, but nowadays most of them offer pure capacity and now they go for serverless Function as a Service. The emergence of FaaS and serverless actually also means we are coming closer to PaaS models. It means that we have a development environment that offers some back functions and pieces of software code to developers. The interesting question is if we will start to have more of these functions and e.g. service industry vertical functions. For example, we can see especially finance industry specific functions, when FinTech services are really coming to cloud services. This development probably also brings different back-end services to clouds. It can mean we have back-end functions to easily create finance, IoT and mobile location based services. Then we really have a significant model and business between IaaS and SaaS. We can already see; the cloud companies have realized this opportunity. FinTech is an interesting segment to observe this development in. Most finance institutions have traditionally had their own servers and infrastructure, and only most recently have they started to use or at least consider cloud services. It means many kinds of cloud models, public cloud components, private clouds, hybrid models and also the building out of their own cloud. Then PSD2 and open APIs to bank services actually could be a kind of SaaS or PaaS model, although the obsolete legacy banking IT doesn’t really offer a basis for that. Banking IT has been a very important customer to many IT companies, including IBM, Oracle and finance sector focused solution providers. Now these companies are facing challenges as banks also consider new, more cost effective moderns solutions. New FinTech services definitely don’t use legacy services. This means that companies like IBM, Oracle, Microsoft and those finance solution providers consider what can they offer in the future and how. One solution is to take a more cloud based approach, but not only offer virtual server capacity, but back-end services too, i.e. a kind of PaaS or FinTech-FaaS for finance services. This can mean a real revolution for finance IT solutions. But as in with any revolution, it is not clear who will win and who will survive. New players for finance services can also take this market, as it has happened in disruptions in many industries. Of course, companies like AWS and Google are newcomers to the finance industry and can become important. We already have huge Chinese players like Alipay (that processes payments more than anyone else in the world) and Tencent. But then we have totally newcomer startups that offer FinTech platforms and back-ends. Data and AI are also becoming a critical part of finance services. This means new requirements for applications and platforms. IBM, of course, emphasizes their Watson as a solution, but many customers still feel it would give too much control to IBM with their data, and they really want to have services in their own hands. This also means that it should be more like a PaaS or FaaS model. We can assume the cloud business grows strongly also in the near future. At the same time, we can start to see more variation in the cloud offerings and also vertical back-end functions that offer special value to use a cloud in a specific industry or solution. This probably also mean mergers and acquisitions in the market. Software companies also want to offer infrastructure and infrastructure companies back-end services. The big game in clouds is just starting. This post originally appeared on Telecom Asia. Grow VC Group's Co-founder and Chairman Jouko Ahvenainen make the closing keynote at VanFUNDING 2017 in Vancouver on November 28. He will speak about FinTech and blockchain ecosystems. Blockchain enables distributed finance and data solutions. Combined with other FinTech solutions it is highly disruptive to the finance industry as a whole. It is important to understand the whole ecosystem and impact on value chains. In the future, these new technologies have the potential to make parts of the value chain irrelevant while replacing new emerging solutions/roles to global value chains and ecosystems. No financial service can be totally independent.

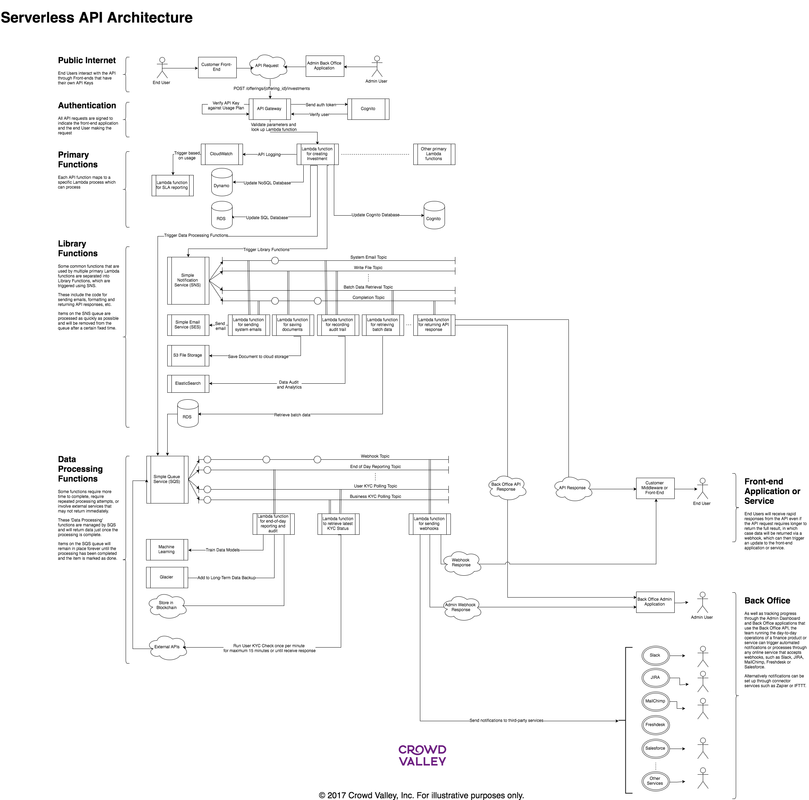

Successful financial services will be those that work with other services and help to build new services. The development of new financial services cannot focus only on its own function, but must figure out its role, interface and add value to the ecosystem and value chain. Read Jouko's new column about blockchain ecosystems. VanFUNDING 2017 is a not to be missed BLOCKCHAIN and FINTECH FUNDING conference that pushes boundaries to discuss the latest developments, educate, inspire, and connect ‘You and your vision’ with leading innovators, entrepreneurs, investors, vendors, thought leaders and policy makers in the quickly emerging sectors of fintech, P2P, crowdfinance, blockchain ICOs, digital currencies and alternative finance. Grow VC Group and two of the group companies, Crowd Valley and Prifina, participated in World Funding Summit in Los Angeles. The two-day event included many fintech business and thought leaders in its keynotes and panels. Grow VC Group Co-founder and Chairman Jouko Ahvenainen talked especially about needs and solutions to develop ecosystem for alternative finance solutions, including online finance platforms, ICOs and blockchain based solutions. Crowd Valley offers a cloud based finance back office as a service. It enables anyone to implement easily online and mobile regulatory compliant finance services, including blockchain based solutions. Its back office offer solutions for all necessary functions like e-KYC, AML, payments, investing and lending models, secondary market and AI. Prifina offers a fundamentally new model for finance data; consumers can control and use their own data in finance services. Prifina's solution is based on blockchain type functionality to manage data access and transactions, distributed cloud based data nodes, open APIs and high security encrypted data models. ICOs and blockchains were the hottest topics in this year event. We see many new ICOs every day globally. At the same the market is still in an early phase, and many ecosystem components are missing. FinTech, now also with distributed technology, is changing the finance industry. But in order to have a real impact, it requires systematic development, getting different services to work together and offer reliable finance instruments. Photo: Crowd Valley's Markus Lampinen (left) and Ron Buschur (right) and Jouko Ahvenainen (middle). Photo: Jouko Ahvenainen introduces Prifina's models to manage finance data.  Photo: A panel about global perspective to new finance models. Photo: Los Angeles downtown.

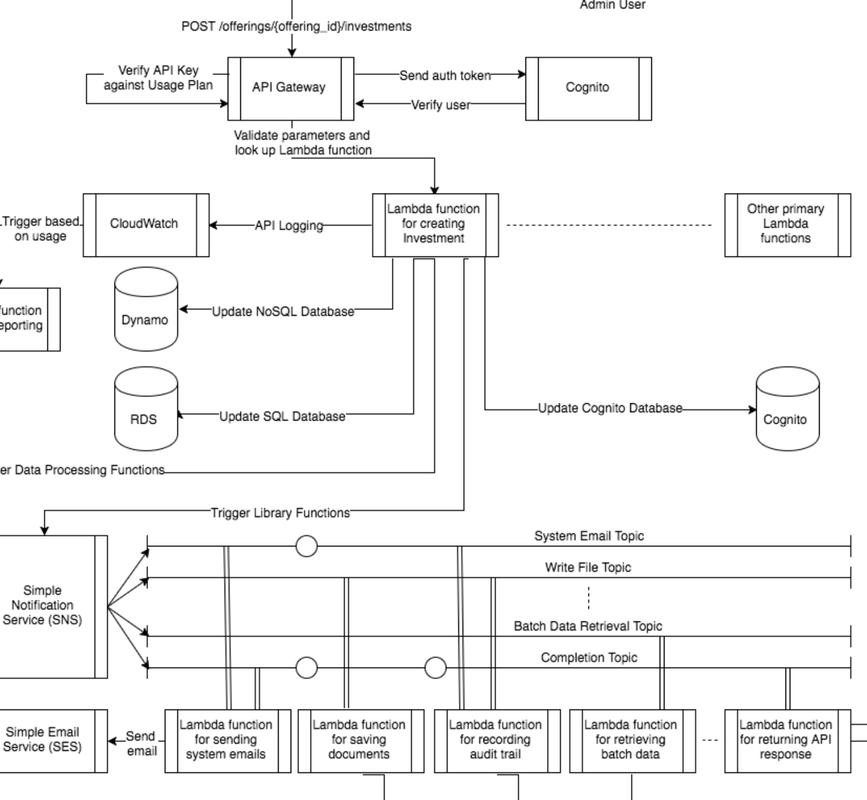

As we’ve followed the trends in server-side applications over the past few years, one of the most significant innovations that is now being promoted heavily by all the major cloud service providers is the concept of “serverless” architectures. Having spent some time over the past few years testing this new approach Crowd Valley’s newest API version, which is being rolled out to selected customers and partners at the moment, will be fully serverless by benefitting from such cloud services as AWS Lambda and Microsoft Azure Functions.

There are at least two clear DevOps advantages of this approach. First, it removes the requirement for you to control your own application servers; and second, it enables the parallelisation of your development and release processes. The joy of relinquishing control Running an API that uses a serverless architecture does not of course mean that there are no servers involved; rather, the servers that run your API code are no longer your problem. Instead, your application is broken into multiple functions, each of which run somewhere in the cloud in a way that makes the function available as and when it is needed. Immediately this is a huge advantage if you are moving from the paradigm of server applications running on managed servers, even if you use Docker containers. Primarily it means no longer need to concern yourself with specific server failure: the servers that actually run your serverless function code are managed by the cloud service provider so a server that fails is replaced without any impact on the availability of your function, and any necessary software upgrades or operating system depreciations are silently handled in the same way. As long as your function code fits the format that is required by the cloud service provider then the provider essentially guarantees that it will be available, usage limits notwithstanding. Similarly, scaling up your service no longer means that you need to know or care about how many servers are required because the scaling happens behind the scenes as and when your function is invoked at higher volume. Anyone involved in DevOps has seen how complex it can be to manage large deployments of servers with occasionally unpredictable usage levels, and by accepting the offer that is now made by cloud service providers to make it their problem – for which, it goes without saying, they have far more sophisticated tools and processes than most of their customers – engineers can really focus on the minutiae of deploying and scaling functions rather than on the boxes that contain them. Developers don’t need to talk With standard server-based or containerized applications the notion of a development ‘sprint’ is vital to ensure that you can stick to a regular release schedule. A sprint is the list of bug fixes or new features that are allocated to a given release, and once everything in the list has been completed and tested then the release package can be made and subsequently deployed. Since a release deployment updates the whole application, some organization is required here to ensure that all the various features and updates are in sync at the end of the sprint. In other words, since every bug fix or new feature is just one part of the whole application, and since on each release the whole application is deployed, if one small feature is not quite working or only partially finished at the end of your sprint then it can hold up the entire release. With a serverless architecture, every function of your API runs independently. There is no central application that deploys every function at the same time, and so a bug fix in one function can be developed, tested and deployed with literally no effect on any other function in your service. As a result, developer teams can organize around specialist areas of your service, with their own sprints and deployment processes, safe in the knowledge that the other teams will not be affected (obviously, solid test routines remain a good idea). This means that bug fixes can be deployed to production faster because they do not necessarily need to be part of a fixed release schedule, and longer-term, so-called ‘epic’ product innovations can have their own schedule that is entirely independent from the normal weekly or monthly release plan. Beyond the basics We would expect the majority of development teams to see at least these two advantages when moving to a serverless architecture, and there are certainly many more that we are finding every day thanks to the particular setup that we have implemented at Crowd Valley. We see this evolution as part of the technology industry’s inexorable move towards a better and more stable online service architecture, and at Crowd Valley we are excited to be building on top of it to create a finance infrastructure that will be the foundation for the new generation of online finance products and services. Written by Crowd Valley CTO Paul Higgins, originally published on Crowd Valley Blog. Read more about Crowd Valley's cloud based finance back office as a service here. Grow VC Group Chairman Jouko Ahvenainen spoke and lead a panel at FinTech World event that focused on blockchain, ICOs and digital assets. Distributed finance solutions are developing rapidly and have a significant impact on the whole finance industry. At the same time, the regulation, business models and ecosystem have still many open questions. Blockchain technology, too, is still under development, implementations vary, and especially performance and efficiency still need development.

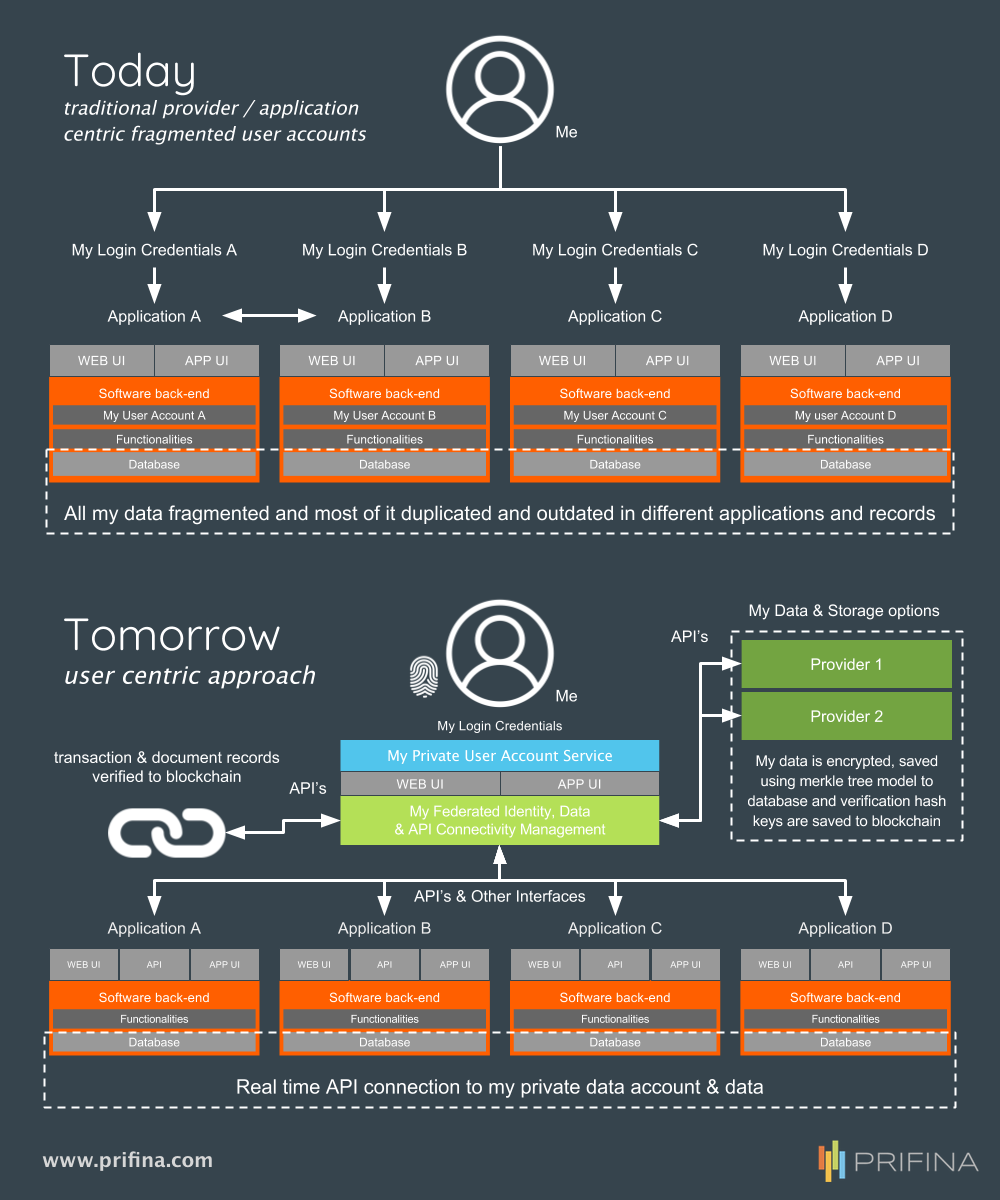

Two Grow VC Group companies are currently working with distributed finance solutions. Crow Valley offers a leading cloud based finance back office as a service, and it offers support for blockchain and ICO implementations. Prifina develops now models for consumers to control, manage and use their own finance data. Everyone today knows data has a lot of value. Ten years ago, we developed a market slogan for our then data analytics company - “data is the black gold of the 21st century.” Nowadays, almost all companies share that sentiment. But it is not so simple. Oil became the black gold because it enabled freedom. The data business must achieve the same.

“We try to collect all possible data, and then we find a model to monetize it, maybe sell to advertisers,” is a common sentence in many business plans. “We help companies monetize their data,” is another typical value promise. “Let’s offer our solutions for free, if we can get the data,” is a ‘sales strategy’. Is it so simple that you offer software, apps, and services to consumers and companies, utilize their data and create a big business? It really isn’t that simple anymore, because

Let’s think about some examples. Media companies and their analytics partners seem to be very keen to utilize all data they have from their subscribers and online visitors. Then they use this data to target their own marketing activities, but especially offer better targeting to advertisers. This is mainly outside the consumer’s control, and media companies possibly try to claim that the value the consumer gets is more relevant advertising. But I wonder how many consumers really feel they are provided value by getting more targeted boring banners or an ad video. No wonder consumers hate it when these media companies talk about monetizing their data. Retail loyalty program analytics became popular globally particularly based on Tesco’s success story in the UK. Tesco doesn’t do so well anymore, and its competitive advantage based on loyalty program analytics has disappeared, when many others do the same and when competitors offer lower prices always to everyone; why would you follow personalized discounts? Finance institutions and credit scoring companies collect data specifically to manage risks, for example, to decide, if a customer is allowed to get a loan. There are several new credit scoring companies, especially in the emerging market, but also in developed countries, that collect much richer data, e.g. social media, mobile and finance apps data. Typically, consumers don’t even exactly know what data is collected and how it is used. Or the consumer learns about the data when hackers steal it, like from credit rating agency Equifax. One could also say that the use of this data is very one-sided. Finance institutions use this to make decisions about customers and product offering for them, but it doesn’t really help customers to find the best deals. Read the whole article on Prifina Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed