|

Globally many financial institutions have rolled out their digital products and services, such as Goldman Sachs Marcus platform. These act as digital store fronts for these financial services firms, providing a digital native experience at the users terms. Having created one digital channel product, can be seen to add to the urgency of ushering in a digital overhaul of other channels. Let me give you an example. A client of ours had launched their digital offering a few years ago, on boarding tens of thousands of clients and generally adopting a successful platform strategy. What happens then, when this digital channel successfully adopts these clients, is that it sets expectations for these users. When they have further needs, such as a new service they are in the market for, what do they expect? They expect the same client centric, smooth user experience they were initially met with. Often times however, what they get is a cold shower. The starkest example of this, is initially having the full service delivered completely on the users terms and then later, having to set up a phone conversation where no channels (chat, mobile, even email) are available to the user. And the first phone conversation often ends up being a person who on boards the user, to figure out who to pass them to next. Walking into a branch and doing things in person at this stage, will seem the simpler option, which is by no means a compliment of the process. When we set the expectations for users, they (and rightly so) expect those expectations to be met in the future as well. And when we do not meet them, we create a bad user experience. The Opportunity of Digital Sales Channels Cross selling is second nature to large enterprises, yet when digital channels become the norm, that comes with its own set of rules.

Domino’s It’s completely natural that digital transformation starts in vertical segments, solving very clear client problems that drive value. It’s also natural that the next stage becomes relevant when connectivity and communication between new vertical products and old systems start to be warranted. This may happen far quicker than many enterprises realize, given clients will translate one positive client experience to the next and want to explore what other value the service can create for them. This is the ideal situation however, a real opportunity to client lasting client relationships! The reality as well, is that for true adoption of digital channel strategies, volume will come from translating and integrating existing services to be distributed through efficient conduits. By distributing existing products through efficient sales channels, margins will rise and competitiveness will be driven at the same time as client value. The Digital Overhaul May Appear Massive, but it’s the Clients Direction It may seem like a wave that crashes on the organization, but as with most trends driven by client value and demand, the direction is the right one. Client centricity is at the heart of digital transformation and clients will show the way for the services they want, and how they want to consume them. Listen to them. The article first appeared on Difitek Blog. Digitization has been talked about for years. It is hard to count how many industries talk about it, how many consulting projects plan it, and how many new services and processes have been created based on it. Of course, a lot of data is now digital, there are lots of online services, and IT is somehow involved in most processes. But is this enough to count as real digitization? Or is it actually more the case that most companies just add digital data and computers to very old processes instead of planning their operations and customer experiences based on digital models?

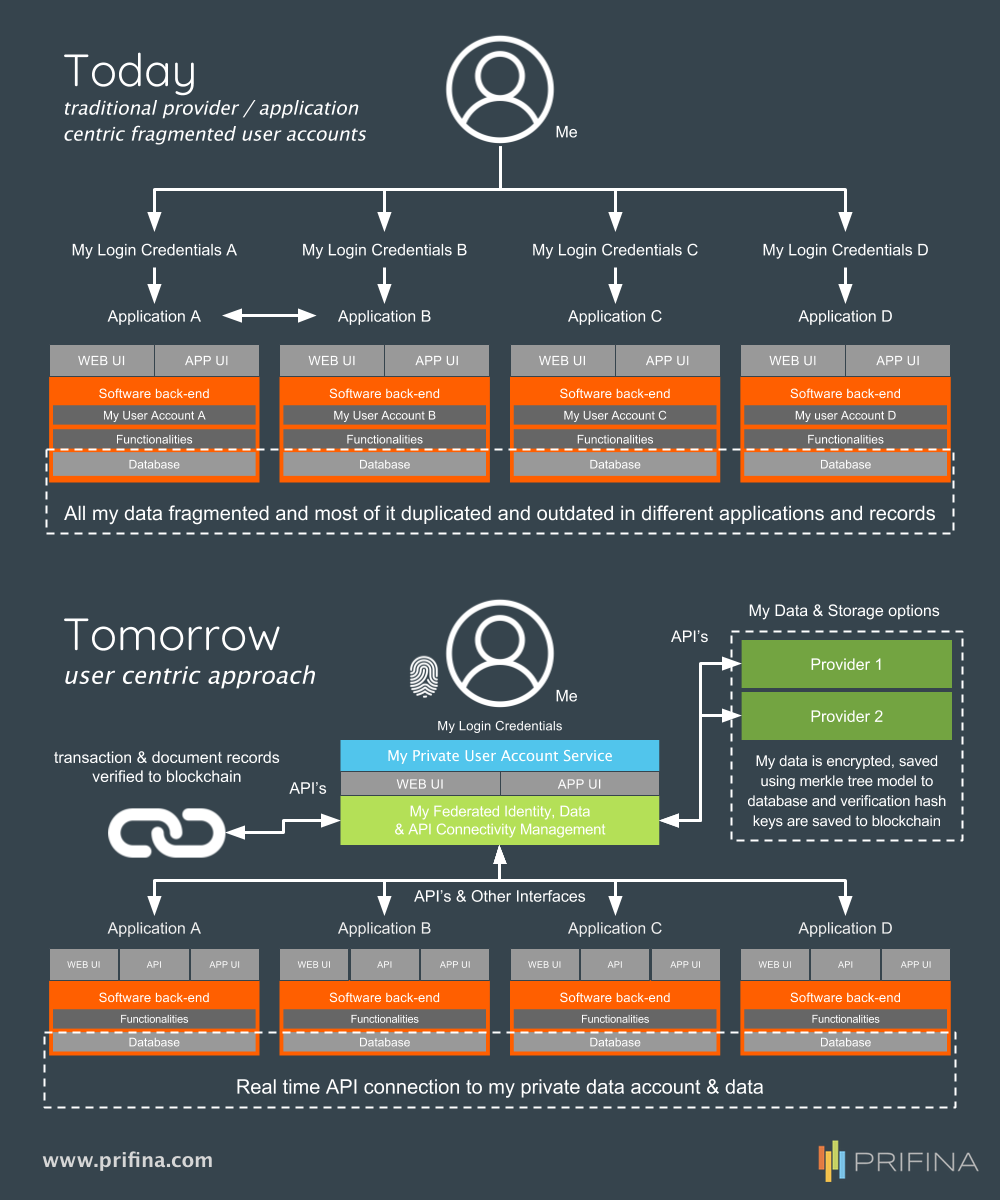

It is typical to hear stories how a customer-facing employee cannot do what the customer wants because “our IT system works like this.” Management and process consultants are selling expensive consulting packages to create new processes and educate employees to follow them, but many employees have doubts about whether this really helps their business. Many employees feel it is hard to find internal company information and use internal systems. At the very least, it takes a long time for any new process to see real use. Does it really have to be so difficult? Of course, we can say it always takes time to get employees to unlearn old things and pick up new things. At the same time, these employees are also everyday consumers who learn quickly to use new things like social media, chat apps, online shopping and streaming video services (and combinations therein). Why is it that these same people are often frustrated with their employer’s IT systems and services – sometimes to the point of using commercial services they understand as a workaround to their company’s internal processes? Designed for digital We can see that many successful digital services offered by companies such as Amazon, Facebook, Google, Netflix and Tencent are designed for the digital era. They have successfully leveraged the internet in ways no one could have imagined when the internet emerged as a commercial entity in the mid-1990s, and have out digital technology at the core of their business models. Many other companies – including media companies, telco carriers, and retailers – have tried to adapt to this new environment. Some of them have died, some of them have survived, but none of them have really been able to replicate the success or even the business models of the digital giants. Which begs the question: is it simply impossible to modify an old company to make it compatible with digital reality? Most startups are built on digital technology today. Many incumbent companies have tried to learn from them and even acquire them. Very often the outcome is that startup activities are isolated to a corporate VC or innovation unit. IT is still often seen as something that lives its own life inside the IT unit. New models or digitalization don’t exist at the core of these companies – they are just wingman functions. We have seen this in the media, telco, advertising and retail businesses for some time. Now we are seeing it in the finance and banking business. We cannot blame these companies too much, because it hard to get to real digitalization to work in practice. Sometimes, digitalization requires you to shred your entire legacy IT, destroy all old processes, and demolish your organization. It sounds like you’re being asked to drag your company through chaos with no guarantee of success or even survival. At the same time, if you don’t do it, you are probably doomed and will disappear from the market sooner or later. Customer experience is the heart of digitization We have seen a lot of hype about startups and digitization. Corporate people show up at startup events in ripped jeans, they acquire fancy new services, and management consultants charge huge fees during the transition process. But isn’t there a way to skip all that and just start to build businesses and services on new digital technology? Certainly this may still require consultants and external help, but the result would be the ability to really operate in a new way, rather than simply buying time to stay in your comfort zone. One key thing about new businesses built digital from the ground up is that the whole design process is based on customer experience – as it must be. Whatever mandatory internal or regulatory processes are in place, in the end it all exists solely to offer value to the customer. This sounds like a simple guideline. But it’s actually far more complex. In fact, it takes a lot of courage and concentration to work like this. And it’s especially difficult for existing big organizations encumbered with legacy IT, organizations and processes, internal politics and a lot of people in their own comfort zones who would very much like to stay there. Now that the hype phase of startups and digitization looks like it will be winding down soon, it’s now time to think in a more mature way about how to do new things. There’s nothing wrong with startup and digitization models, but we have seen many failings and gaps when they are adapted directly in corporations. We particularly need bold leaders in corporations that are ready to shred old things, cannibalize old businesses and build totally new models. New, truly digital processes might actually be easier to implement than these ineffective intermediate models if they are based on customer experience and made as easy for employees to use as Google, Amazon and Facebook without having to call in expensive consultants. The article first appeared on Disruptive.Asia. Since Web 2.0 became important, many companies have wanted and claimed to create Web 3.0. The label has mainly been artificial. For example, the semantic web has been a candidate for this role, but we haven’t really seen it or what it might mean in practice. Now we again have a strong candidate for this role: a blockchain-based distributed web.

Web 2.0 means especially more interactive web services, user generated content and social media. It changed internet services significantly from the broadcast model to real interaction between people. Those interactive social media type services now make up a significant part of web services usage time. We can really say Web 2.0 was a change and it was easy to notice this change, although Web 2.0 hasn’t really had an official specification. The problem with Web 3.0 has been that many companies and people have tried to use it for marketing purposes. It is nice to include it into a business plan covering how to disrupt internet services and pave the way into a new phase. Despite its wide use in marketing, users and service providers haven’t been able to see these changes. The Web 3.0 label has been put on Semantic Web where computers can understand content, always-on mobile internet, or virtual world web services. The World Wide Web Consortium, W3C, has even created a Semantic Web standard. But it is probably based more on technological dreams than what the users really see and can use today. Together with blockchain we now see more services and, at least plans, to offer more distributed services. Cryptocurrencies are, of course, an example of these. They are based on models that don’t require a centralized organization or technology to manage and authorize transactions. Now we see more evidence that these models are not only for cryptocurrencies. Smart contracts are bringing distributed models for many kinds of transactions from buying real estate to managing digital rights for movies and songs. These services are not only going to change web services, but also the role of central ‘authorities’ like notaries, banks and rights owners. We can even see they might challenge governmental services and the role of governments. At the same time, we see development towards more distributed data on two levels, physically and logically. Physically distributed data means, for example, a local device with AI functionality keeping data locally for several reasons like availability, latency and privacy (read more on MWC2018 on distributed models). An example is self-driving cars that must be independent enough. The logically distributed data means that, for example, users can own their own data, although it is physically in centralized clouds. This year privacy issues and the rise of blockchain have made distributed data models more relevant. We don’t necessarily need a centralized social media that keeps our data, we can have a service that only shows the data we wish to share to our friends, but we keep it on our own servers (that can be on our account in a cloud). We don’t need a bank or hospital to retain our data, if we can keep our own verified data and use it in services when needed, granting and revoking access on a need-to-know basis. Timing is always the difficult part to predict. We can be quite sure; the distributed Web is coming. But it is hard to give an exact timetable for it. A breakthrough always requires that several things click at the same time, like availability of technology, the price of technology and user experience. The final breakthrough then might need some lucky coincidences, like one very successful service. After that changes can happen truly rapidly. It is more difficult to say if the distributed web is the Web 3.0. And does it really matter? Logically, Web 3.0 should be any big change in the internet services that comes next and really changes the user experience, business models and dominating internet services. In that way, the distributed web is the most promising candidate at the moment for that role. The articles was first published on Telecom Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed