|

The holiday season is coming after the very exciting and hectic year in FinTech. This has been an excellent year for Grow VC Group and its companies, we have built new businesses and grown the existing ones.

Especially we like to thank all our customers, partners and supporters. We hope you have now time to take a break, spend time with love ones and also get fresh ideas for the new year. Season Greetings from Grow VC Group and its companies! Cryptocurrencies and related distributed technologies need a proper ecosystem to become a significant and meaningful part of the finance ecosystem Blockchain, ICOs and digital securities (e.g. cryptocurrencies) have become the new kids on the finance block – and of course opinion is divided. Some believe they will take over the entire finance industry in a few years and make all traditional finance instruments and institutions obsolete. Others see ICOs and cryptocurrencies as the biggest bubble and/or scam of our time – in the US, there are now plaintiff lawyers that only focus on ICO lawsuits. Maybe the reality is something between: these solutions have a lot of potential, but they need a proper ecosystem to become a significant and meaningful part of the finance ecosystem. It is easy to print money, but the real test is if you can use that money to buy something. Let’s look at some fundamental problems of these instruments and systems that point to a missing or weak ecosystem:

Historical precedentWe can compare this development to the history of crowd and p2p finance, starting with equity crowdfunding for early phase startups. I remember a venture capitalist said years ago, “I think this online crowdfunding is a great model, but why has it started with the most difficult asset class, startup equity?” This comment comes to my mind when I look at ICOs. P2p lending, online real estate finance, and later, stable-phase company equity have become more important markets than startup equity in the crowd and p2p finance market. Institutional capital and investors have also taken an important role in these markets, and often they represent greater than 50 % of the capital committed. These markets still also have their issues, where too many platforms try to be totally independent and just get their own deal flow and investor bases to work. But securitization, syndication and cooperation of different services have become important in this market. There has also been a lot of work done with regulation and regulators in the crowd and p2p market. There are platforms that don’t follow all regulations, but all significant platforms want to do it, and they must. In many countries there has also been quite constructive cooperation in developing key regulations. This is needed for the distributed finance solutions market as well. Missing ecosystem components The missing components in the ecosystem are essential new business opportunities. Let’s take a few examples:

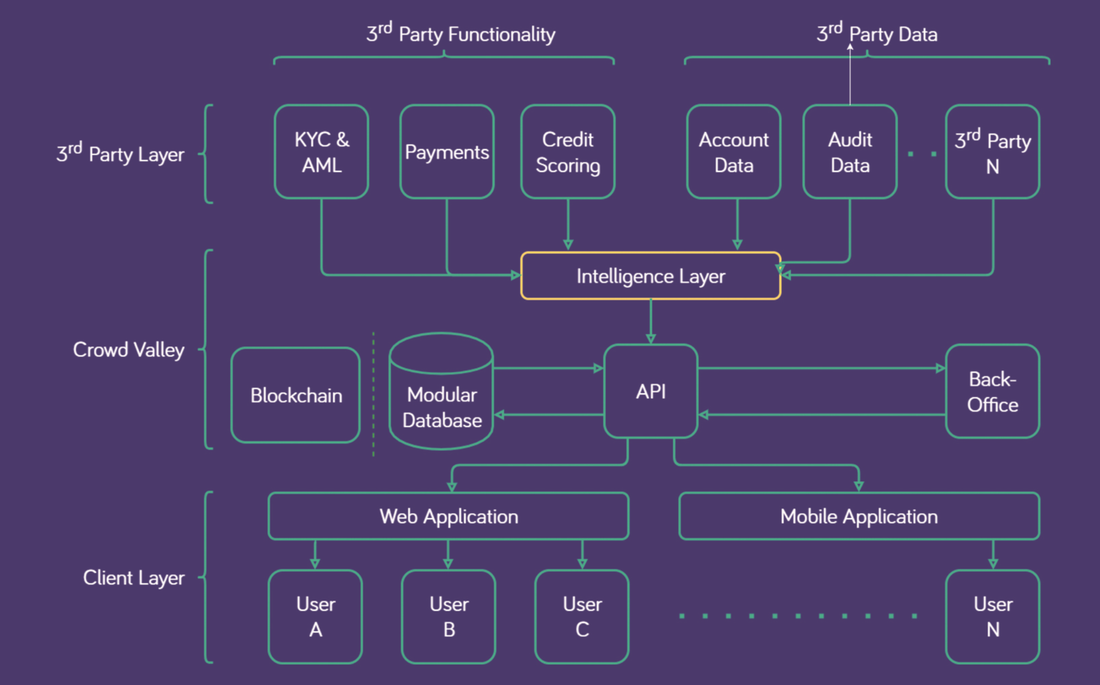

The article was first published on Disruptive.Asia. Photo: Crowd Valley's architecture for distributed ledger ecosystem integration.

Equifax’s data leak was truly monumental; it involved compromised information of 145 million people. An interesting part of the story was the hearing with former and current executives of Equifax, Yahoo, and Verizon at the US Senate Commerce Committee. In this hearing the interim CEO of Equifax Paulino do Rego Barros indicated that it is Equifax and other companies that own this consumer data, not consumers, and consumers have no control over it. This even when it emerged that several customers have had their data collected without their directly knowledge. How long can it continue like this?

Finance services and health care are two areas where companies have a lot of data from people. It is often also very sensitive information in nature. There are many companies in those industries, and people often use services from several companies. It is often valuable too for the consumer that companies can share information between them. For example, when you go to a doctor or hospital, it can help in your treatment that they know your medical history, and when you apply for a loan or use wealth management services, your finance history helps to find the right products and make decisions. But it must be consumer’s decision to share this data. We have had two parallel, but slightly opposite, developments with the internet. While each individual can generate more activity - for example publish his or her photos, articles and have their own e-commerce site - the data is concentrating more to some central places, such as to big companies, data aggregators, and data processors (for example Equifax or online marketing platforms). Now we can see developments that we could move to more distributed models with data too and individuals could get better control over their data. This technically is also linked to blockchain development that particularly has an impact on the finance industry. Blockchain basically distributes finance data, transactions and authority around the Internet, to individuals and their nodes. A person can have her or his own bitcoin and cryptocurrency wallet, which is not the account of a bank or finance institution. Now we will see solutions where people can have their own safebox for their finance, health care, and other data. Lawmakers will probably try to give further rights to consumers to control their own data; in some countries sooner, some later. But new distributed ledger and data models can empower consumers sooner to take control and impact the balance. In finance and data services we can see development that the control and databases will be distributed. It is not anymore a hierarchical centralized model to manage data, but it will be a distributed model with the consumers in control. Read the whole article at Prifina Blog. FinTech is disrupting the finance industry to the point where we’re likely to see quite a bit of M&A activity as a result. That activity could take several different forms, but one likely possibility is that FinTech or tech companies could acquire traditional finance names.

It appears the transition for banks to really utilize FinTech has been difficult. I wrote earlier how banks are stuck with their legacy organizations, processes and IT. Traditionally, mergers and acquisitions are a way to help that transition. However, many M&A activities fail to bring any real transition or realize results. The finance business is also a brand business. Retail banking, wealth management, private and investment banks have many well know traditional brands. Sooner or later, some new FinTech players will want to link themselves to old brands. They will also target licenses and regulated businesses, and one way to get them through acquisitions. We will see different kinds of M&A activities when FinTech really starts to have an impact on the finance business:

Who will be the tech and FinTech companies that will be big in the finance market? The easy answer is Google, Apple, Amazon and Facebook, all of which have a lot of users and many of them already offer some finance functions like payments, money transfer or lending. But the global picture is more complex. China is the leading FinTech country right now, and companies like Alipay and Tencent are already significant FinTech companies. Alipay processes up to 120,000 transactions per second, more than 10 times the numbers of Visa. Most probably we’ll also see new companies becoming significant players in the finance industry. Data, AI, and finance back-office services will become an important part of the market. This could mean that the consumer interface is quite fragmented, but there are important technology companies that empower many of those services. These services are also going to the cloud, which means that AWS, Microsoft, Google, IBM and Oracle will play a role in the finance ecosystem. FinTech can be one of the biggest new opportunities for cloud providers. They also might become interested in offering more back office functions for different consumer and end-user services. The finance market will probably see a lot of niche services. At the same time, there could be a few FinTech backbones that enable most those services. In principle, banks could emerge as those backbones with PSD2 and open APIs. But in practice, considering their capacity to adapt and current use of obsolete technology, it is hard to see how banks could win that game. The most probable scenario at the moment is that some bigger FinTech and technology companies will make acquisitions to offer more technology services to different finance end-user services. They want to expand their technology offerings to all finance services. End-user FinTech services will acquire brands and licenses of traditional finance that are valuable in their business. What that ultimately means is that banks are on the path of the telco – they can keep some heavily regulated finance services, but their margins will go down and soon you’ll be seeing some bank mergers. The article was first published on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed