|

Cryptocurrencies and related distributed technologies need a proper ecosystem to become a significant and meaningful part of the finance ecosystem Blockchain, ICOs and digital securities (e.g. cryptocurrencies) have become the new kids on the finance block – and of course opinion is divided. Some believe they will take over the entire finance industry in a few years and make all traditional finance instruments and institutions obsolete. Others see ICOs and cryptocurrencies as the biggest bubble and/or scam of our time – in the US, there are now plaintiff lawyers that only focus on ICO lawsuits. Maybe the reality is something between: these solutions have a lot of potential, but they need a proper ecosystem to become a significant and meaningful part of the finance ecosystem. It is easy to print money, but the real test is if you can use that money to buy something. Let’s look at some fundamental problems of these instruments and systems that point to a missing or weak ecosystem:

Historical precedentWe can compare this development to the history of crowd and p2p finance, starting with equity crowdfunding for early phase startups. I remember a venture capitalist said years ago, “I think this online crowdfunding is a great model, but why has it started with the most difficult asset class, startup equity?” This comment comes to my mind when I look at ICOs. P2p lending, online real estate finance, and later, stable-phase company equity have become more important markets than startup equity in the crowd and p2p finance market. Institutional capital and investors have also taken an important role in these markets, and often they represent greater than 50 % of the capital committed. These markets still also have their issues, where too many platforms try to be totally independent and just get their own deal flow and investor bases to work. But securitization, syndication and cooperation of different services have become important in this market. There has also been a lot of work done with regulation and regulators in the crowd and p2p market. There are platforms that don’t follow all regulations, but all significant platforms want to do it, and they must. In many countries there has also been quite constructive cooperation in developing key regulations. This is needed for the distributed finance solutions market as well. Missing ecosystem components The missing components in the ecosystem are essential new business opportunities. Let’s take a few examples:

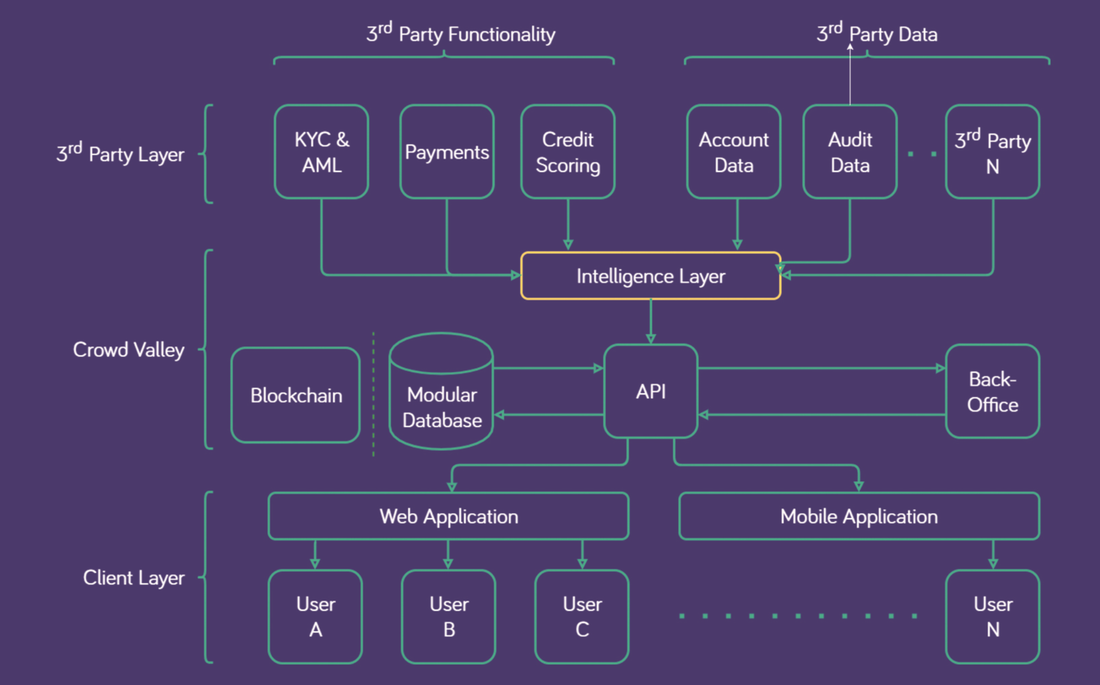

The article was first published on Disruptive.Asia. Photo: Crowd Valley's architecture for distributed ledger ecosystem integration.

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed