|

The Bank of Japan (BOJ) returns talking about the adoption of financial technology in their system in a seminar hosted at their HQ in Tokyo July 29. This comes after the central bank announcement this year in April to have established an in-house section at the BOJ in charge of fintech to explore the opportunities and to offer guidance to financial institutions seeking to step into the fintech market.

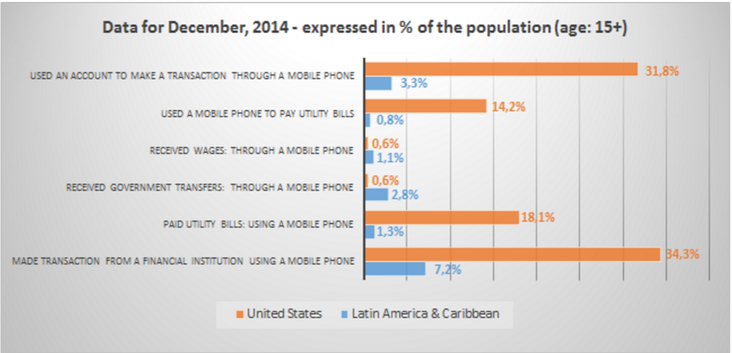

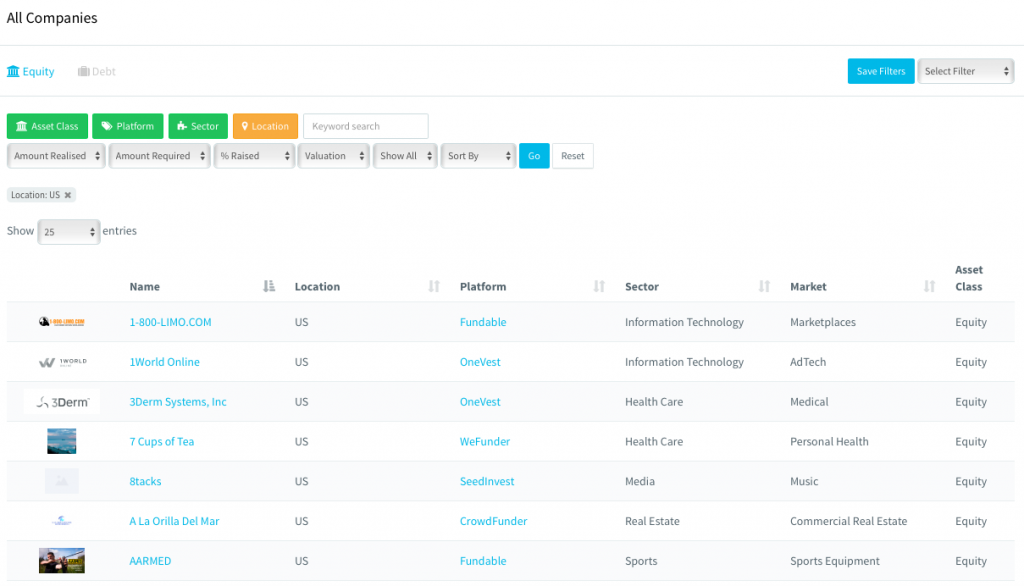

Haruhiko Kuroda, BOJ Governor, declared that the Japan’s central bank may apply financial technology to its operations in the future considering its rising importance of international payments and financial services, adding that “the BOJ is ready to make its best efforts to support the sound development of fintech to enhance the welfare of financial service users as well as economic activities”. According to Reuters, Japan is now as planning to ease investment restrictions aiming to increase the money invested in an economy that has an estimated $9 trillion of individuals' cash deposits and with Japanese banks now looking to increase their profitability through fintech. Read more at Crowd Valley News. According to the World Bank’s Global Financial Inclusion Database, only 51% of the population in Latin America and the Caribbean has a bank account. This figure varies greatly between countries, with more than 80% of the adult population remaining ‘unbanked’ in Nicaragua for less than 35% in Brazil and Costa Rica. Furthermore, it means that millions of people have to use cash for each transaction across the continent. With for instance, 96% of the population paying its utility bills in cash – which is more than 3 times the level than can be observed in the United States or the Euro Area. Likewise, half of the population receive its wages in cash and overall, almost 40% of all wages are withdrawn right away. Far from what can be observed in the West: only 10% of the wages are received in cash, and between 4% and 7% of all wages are withdrawn right away. With so much cash circulating, issues of safety inevitably arise, and without a bank account it becomes harder to invest or save for retirement. Something even more problematic in countries known for the fluctuations of their respective currencies. Beyond the way Fintech disrupts existing models in Latin America, it is also becoming a way to achieve financial inclusion in the region. Mobile money services, credit ratings based on alternative data, new ways of financing SMEs, personal lending…if different in nature, innovative financial technology services are ways to bypass regional issues, and ultimately grant people and businesses an access to appropriate financial products and services. At Crowd Valley, we are already actively working in the region and look forward to partnering with both established organizations and new innovators to provide more services and value to the end users as the financial services market continues its modernization in Latin America. Read the whole article on Crowd Valley News. The adoption of equity and debt crowdfunding has left most if not all policy makers and regulatory bodies challenged to find the right framework to properly regulate the array of platforms launching into the market. These platforms have given accredited and retail investors alike access to alternative investments they would not otherwise have. One area overlooked by most investors and now being addressed by regulatory bodies is investment liquidity.

The first regulatory commission to have an open sandbox discussion is the UK’s FCA. In the most recent “Call for Input”, liquidity was referenced a number of times within the review of lending based crowdfunding. Liquidity in equity crowdfunding has been a hot topic earlier in the year. This open conversation and eventual drafting of regulation will no doubt mirror how other countries solve this issue. Crowd Valley’s close cooperation with the FCA and UK crowdfunding market already sees its clients utilizing the secondary market API developed in anticipation of the markets needs and potential regulatory policy. Other crowdfunding pioneers like Crowdcube have recently committed to providing increased liquidity and access to a secondary markets for their investors. We anticipate other countries like the US, Singapore, Malaysia, Japan and Canada to adopt similar framework in the near future. This also opens up the opportunity for tertiary digital finance businesses to pair with existing platforms to aggregate their secondary market opportunities. There are already examples of data aggregators such as Deal Index in the market. With the personal view of great future opportunities in primary and secondary market deal aggregation being facilitated by the “API economy”. If you are looking to capitalise on collaboration within the fintech space, get in touch with us at Crowd Valley to leverage our full offering and industry leading Digital Back Office that bridge the gap into fintech. Read the whole article on Crowd Valley News. The Fintech O2O initiative began in 2015 as a monthly meetup in Hong Kong, co-organized by Cyberport and NexChange. The idea was simple – bring together like-minded professionals who recognize the impact of technology on traditional finance to network and discuss pressing topics. The initiative has welcomed 2,000+ professionals from 20+ countries. Now in its second year, the initiative has grown into a global series with events planned in New York, London, Toronto and Shanghai.

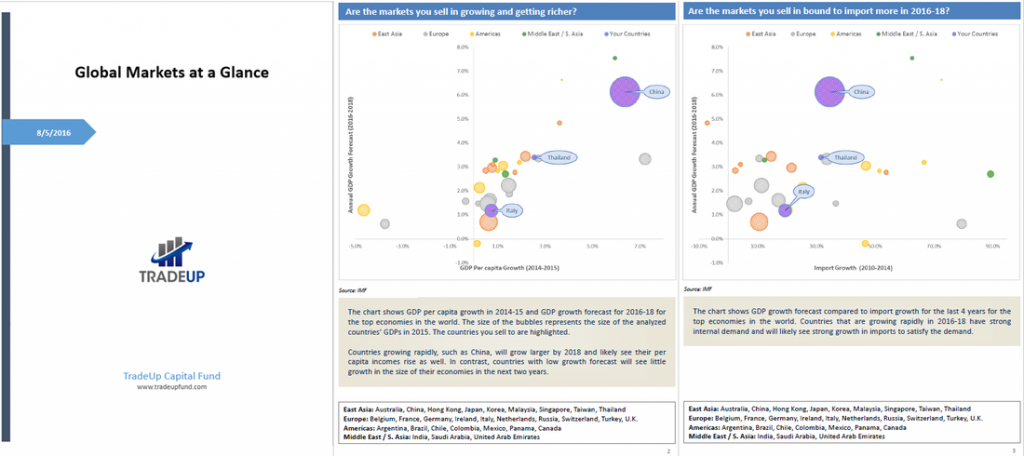

Grow VC Group Founder and Chairman Jouko Ahvenainen is a key note speaker in the event. His topic is "Bringing traditional finance and fintech together: Can’t Fight This Feeling Traditional finance and fintech don’t need to constantly be at odds. Can’t we all just get along?" Mr. Ahvenainen talks about digital hybrid finance models that combine fintech and traditional finance services, and make finance services more effective, transparent, and democratic. To continue to serve the community in Hong Kong and globally, Fintech O2O is setting the stage for its first multi-day conference. Register now to join 400+ professionals and 35+ speakers from 35+ countries! When: Tuesday, September 27, 2016 at 9:00 AM - Wednesday, September 28, 2016 at 4:00 PM (HKT) Where: Hong Kong Island - L3, Function Rooms 3, Cyberport 3 (Core F), 100 Cyberport Rd, Hong Kong, Hong Kong , Hong Kong Island, Hong Kong To see the list of speakers, the agenda and to register for tickets, click here. Sign up now for Global Markets at a Glance by TradeUp, a free tool for companies expanding abroad.

TradeUp is committed to helping SMEs and startups raise the growth capital they need to get into markets around the world.

Sign up for your free customized report here. Learn more here. The regulatory environment around P2P lending can be quite perplexing and can serve as a deterrent to many trying to enter the industry and launch a successful lending platform. Through this piece, we hope to clear some of the legal mist and provide clarity on the regulations that need to be adhered to.

It’s paramount to remember that P2P lending is interpreted as a sale of securities, and a broker-dealer license and the registration of the person-to-person investment contract is required for the process to be legal. The license and registration can be obtained at a securities regulatory agency such as the U.S. Securities and Exchange Commission (SEC) or the appropriate regulator in the appropriate jurisdiction. Unsure about the regulatory practices you may have to comply with in order to set up a platform for lending/investing? Look no further. Outlined here are the key federal statutes to which banks and non-bank credit providers may alike but subject to:

State Licensing Requirements:

(Source: State Licensing Requirements) Licenses are granted on a state-by-state basis. In some states the licensing process is fairly simple and straightforward; in other states it is quite complex. Similarly, in some states licenses can be obtained fairly quickly while in other states (e.g. California and New York) the process can take months. In addition to filing fees, license applicants may be subject to background checks and fingerprinting and may be required to submit business plans and financial statements. For additional details and discussion on the P2P regulatory environment, have a look at these links: P2P Lending Basics: http://www.mofo.com/~/media/Files/UserGuide/2015/150129P2PLendingBasics.pdf Read more read terms, regulation guidelines and the whole article on Crowd Valley News. Disclaimer: The information provided in this post is not legal advice, it’s presented here for informational purposes only. You should always consult with licensed counsel if legal issues are involved. Diversity is one of the many aspects of business life that makes the United States so attractive to investors. There is no shortage of investment options available; from stocks to commodities and from municipal bonds to mutual funds, investors can always add new financial instruments to their portfolios.

Even with all the regulated financial exchanges in the U.S., the small business community is mostly outside of the investment sphere. For all the attention that the financial news media gives to venture capital, investors do not usually find it easy to reach small business owners to inquire about investment prospects. Outside of Silicon Valley and the reality television series Shark Tank, small business funding is not generally exciting. For the most part, small business owners still believe that commercial loans from banks are their best hope for startup funding; this is despite the fact that American banks have sharply reduced this type of lending over the last few years. Thousands of entrepreneurs launch interesting startups each month, and yet only a few of them will make it past the first year of operations. Inadequate funding is one of the most common reasons behind the high rates of failure among American small business owners, and this can be blamed on the lack of diversity in terms of financing. With so many American businesses failing due to lack of funding, wouldn't it be great to have a marketplace where entrepreneurs and potential investors could interact with the benefit of regulation and oversight? Thankfully, that day has arrived. In 2015, the Securities and Exchange Commission approved a set of rules to govern equity crowdfunding; since then, investors and entrepreneurs have been meeting with some hesitation on a few online platforms while regulators observe the action and make adjustments. The adoption of equity crowdfunding is intrinsically tied to the legislation passed by Congress in the wake of the global financial crisis. As the situation stands these days, small businesses can raise up to a million dollars each year on crowdfunding platforms that have been vetted by the SEC. The new equity crowdfunding platforms add a layer of "free market democracy" for American investors, but what about small business owners? If you are an entrepreneur interested in equity crowdfunding for your business, you should become acquainted with the process of due diligence that is required by the online platform. Insuring your company should be the first step, but you should also become familiar with the financial statements that potential investors will be looking for. Equity crowdfunding does not have to be the final stage of capital raising for small American businesses. Venture capital firms are paying close attention to the Web-based crowdfunding platforms because it gives them a great opportunity to scout new investment projects. From within these platforms, startup companies may find angel investors who will one day take them to Wall Street. Read the whole article on TradeUp Blog. Grow VC Group companies are looking for new talented entrepreneurial people all the time. You can make an open application here.

At the moment, for example, our new entity, RE Bearing is looking for a key person to the core team to build the business and present to prospective customers. RE Bearing offers advanced data analytics tools for real estate investors. The company has the contacts and experience on the investor side and now it needs more resources with technical and analytical expertise to:

Skills:

Company Description: RE Bearing offers with its technology partner a software that analyses real estate investments. It integrates economic trends, historic data (35 years) to optimize the investment portfolio (future value, revenues, risks, new investments, etc). The software has been in use for the past 15 years, and used by multi-billion institutional clients. Now RE Bearing expands the market by offering the software-as-a-service tool also to all investors (target segment especially real estate investors with USD 5 million to USD 600 million portfolio). Customers types: Private investors, real estate developers, family offices, consulting firms and investments funds. You can leave your application here or send email to CEO Edward Cassels. Bank of Thailand (BoT) Governor Veerathai Santiprabhob at the C asean Forum's "Positioning Thailand's Fintech Ecosystem" event announced more regulation for the growing fintech sector in order to protect consumers, prevent systemic risk and help the development of the market. Following the path of Governments and regulators of the UK, France, Australia and Singapore the intention is to create a regulatory sandbox that can be used as a testing ground for fintech companies.

"Fintech is a new thing for the central bank and we have limited knowledge in this area. Therefore, having the regulatory sandbox will open opportunities for product experimentation and for the companies to ramp up their scale," said BoT Governor Veerathai Santiprabhob. This model is tested in other countries as well, with the intention of limiting the risk for consumer and the stability of the financial system, with a framework that should not be too stringent in order to let innovation flourish. The first step in building this sandbox should be for fintech firms to register with the central bank. But that’s not all. An amendment of the the law governing the National Credit Bureau (NCB), which is now waiting for the approval from Finance Ministry of Thailand, will allow P2P lenders to become members of the agency, giving them access to consumers’ credit data for loan risk assessment as part of longer term viability of the market. Considering the whole picture, the increased interest of governments and financial regulators is definitely positive for the financial technology industry, as it is still in its infancy and requires a good infrastructure in order to continue the significant growth seen in recent times. With Singapore and Malaysia pushing hard toward the growth of the sector, and with Thailand now quickly catching up, the outlook for fintech in Southeast Asia looks promising. Read the whole article on Crowd Valley News. By Jeremy Sutter, Business Writer

During the late 1990s, also commonly referred to as the dot-com era, it seemed all one had to do was have an office in San Francisco or Silicon Valley and have an idea for a website that would bring people together for an investor to throw money at it. Then came 2001 and the bottom fell out. Interestingly, the same hot trend of looking for the next big startup continues to keep charging on, but without all the fanfare and definitely without all the after-hour parties. Two things appear to be driving VC activity, particularly in the realm of extremely new, unheard of startups: the rise of managing and harnessing value from big data, and the demand for new ideas on how to design data infrastructure. Both are technical enough to filter out the fly-by-night chatter; only startups who truly have the engineering or data management background are going to get out of the starting gate with a viable product in these two fields. So startups are also coming up with new and previously unheard of ideas of how to move electronic data physically as well as digitally. Both scalability as well as speed matter tremendously and these new players are going places were tried and true systems can’t touch because they are locked into existing system protocols and paradigms. That makes for market disruption on a big scale. The market’s need for new database architecture has also influenced what VC firms are looking at for their next investment opportunities. They are recognizing the need for solutions that meet scalability demands as wells as run more efficiently without bogging down a network. Operating cost is a big factor as well, so those with ideas on how to do more with less are also getting VC attention. Read the whole article on TradeUp Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed