|

The regulatory environment around P2P lending can be quite perplexing and can serve as a deterrent to many trying to enter the industry and launch a successful lending platform. Through this piece, we hope to clear some of the legal mist and provide clarity on the regulations that need to be adhered to.

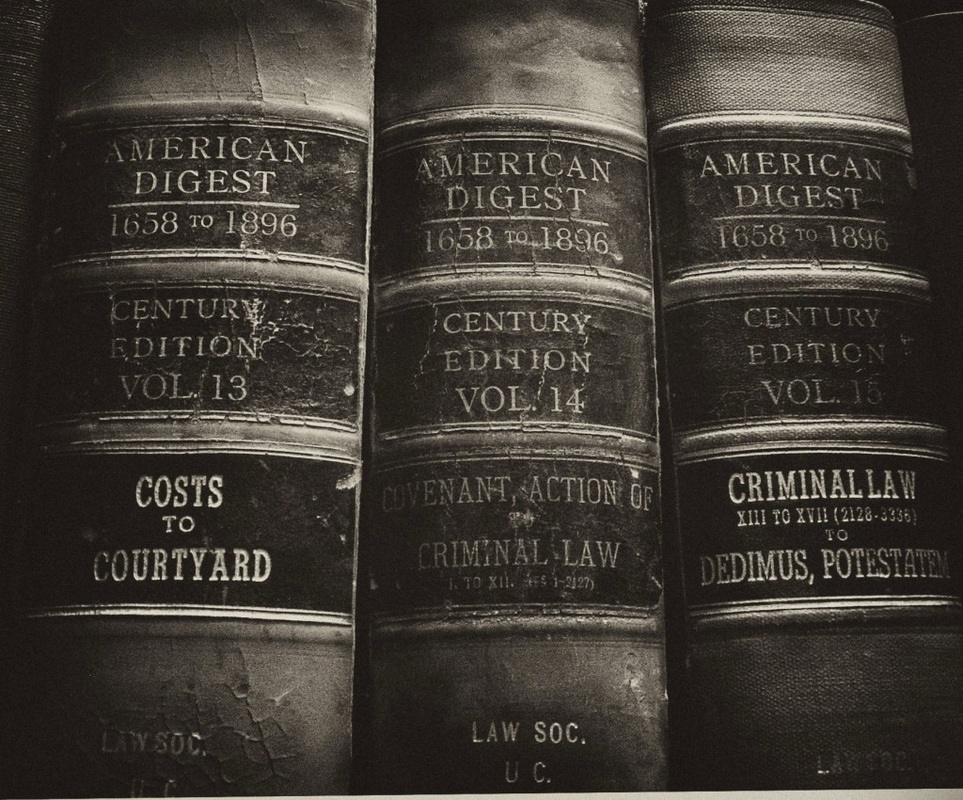

It’s paramount to remember that P2P lending is interpreted as a sale of securities, and a broker-dealer license and the registration of the person-to-person investment contract is required for the process to be legal. The license and registration can be obtained at a securities regulatory agency such as the U.S. Securities and Exchange Commission (SEC) or the appropriate regulator in the appropriate jurisdiction. Unsure about the regulatory practices you may have to comply with in order to set up a platform for lending/investing? Look no further. Outlined here are the key federal statutes to which banks and non-bank credit providers may alike but subject to:

State Licensing Requirements:

(Source: State Licensing Requirements) Licenses are granted on a state-by-state basis. In some states the licensing process is fairly simple and straightforward; in other states it is quite complex. Similarly, in some states licenses can be obtained fairly quickly while in other states (e.g. California and New York) the process can take months. In addition to filing fees, license applicants may be subject to background checks and fingerprinting and may be required to submit business plans and financial statements. For additional details and discussion on the P2P regulatory environment, have a look at these links: P2P Lending Basics: http://www.mofo.com/~/media/Files/UserGuide/2015/150129P2PLendingBasics.pdf Read more read terms, regulation guidelines and the whole article on Crowd Valley News. Disclaimer: The information provided in this post is not legal advice, it’s presented here for informational purposes only. You should always consult with licensed counsel if legal issues are involved. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed