|

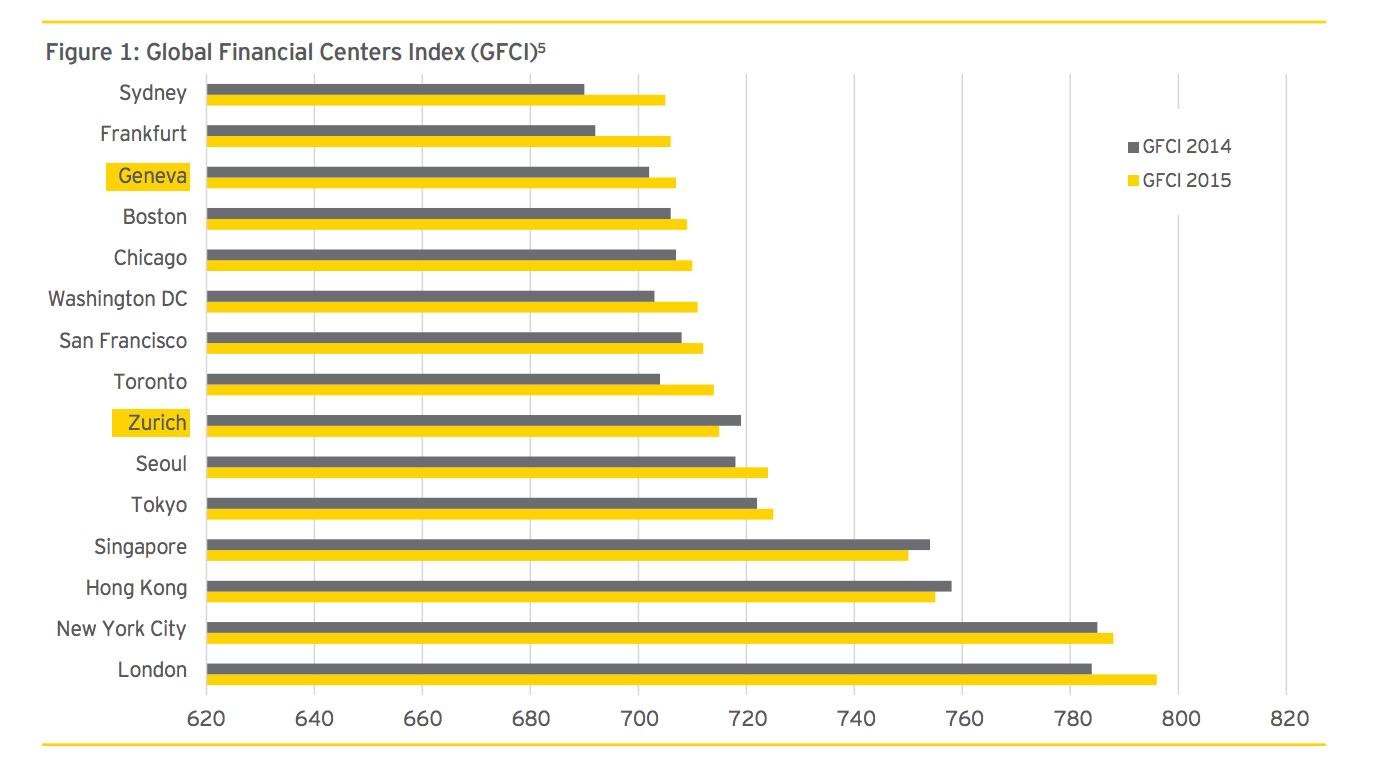

Switzerland, one of the most important global financial centers and home to more than 250 banks, is actually a small of nation of 8 million people, that you may associate with world class chocolate, luxurious watches, the stunning scenery of the Alps and lakes, as well as excellent education infrastructure and unrivaled living standards. Until a few years ago, Banking Secrecy was one of the main characteristics and key factors in the rise of the Swiss financial ecosystem, which boast not one but two cities considered among the top financial centers of the world (see chart below). According to the Global Financial Centers Index (GFCI), Zurich occupies the seventh position in the world, and it’s in the second position, just after London, in Europe. But a few places down, in 13th position, is another city flying the Swiss colors; Geneva.

Considering the loss of banking secrecy and the major commitment to technological development in other financial centers, like London, Singapore and New York, it is quintessential for Switzerland to adapt and innovate if the country wants to maintain the importance gained in the last century as a key financial center. The Swiss government and regulators are now trying to fill that gap with a package of new measures, approved on the 2nd of November, 2016 including what has been called a FinTech license. This license will simplify regulations for financial technology firms relative to those heavy requirements placed on banks and financial institutions. The package also includes a fintech sandbox, allowing companies to test new technologies in a safe space, as well as measures to boost crowdfunding. FinTech firms, with a minimum of 300,000 Swiss Francs (~ $297k) in capital, will be allowed to accept funds from clients, up to 100 million Swiss Francs (~ $99m) which remain outside the depositor protection scheme and are not subject to the same regulations, auditing and the capital requirements applied to banks. However the eligible Swiss financial technology companies won’t be able to make long-term loans, which remains exclusively for banks. The Swiss government has proposed to set a period of 60 days, where crowdfunding platform operators will be able to hold money from investors in settlement accounts. The government is also willing to remove the limit on the maximum number of people that can invest in a single fundraiser on a crowdfunding platform, with the current limit being 20. By removing the limit, it will be possible to have an unlimited number of investors participating in a fundraise through crowdfunding. Switzerland could be late on fintech but that is certainly not the case on overall innovation. The Global Innovation Index, prepared by INSEAD Business School, Cornell University and WIPO (World Intellectual Property Organization), ranked the country as the world's most innovative country since 2011, excelling in particular with its research systems and SMEs in-house innovation. Considering the strategic position of the country in Europe, both geographically and complemented by Zurich and Geneva as international financial centers, along with the new regulations and measures proposed to stimulate financial innovation, the fintech industry in Switzerland seems to have finally arrived and is poised to take advantage of excellent opportunities in the foreseeable future. If you’re interested in jumping into it before it’s too late, all you need to do is to contact us and we'll be glad to assist your entry into the Swiss FinTech ecosystem. Read the whole article on Crowd Valley News. Anyone paying attention to the latest news from financial markets would agree that blockchain has been welcomed as the next “big thing” by many professionals due to the new opportunities it presents in terms of business scenarios.

Blockchain comes second only to the invention of the web, experts claim, in its disruptive power which seems to be reshaping every aspect of human activity, spanning from business to law to entrepreneurship with society, at large, ending up being assimilated confirming that blockchain is a real game changer which, sooner or later, will revolutionize also the way we all think. Finding its roots in the anarchic computing subculture that emerged in the aftermath of the 2008 global recession, researchers refer to the rise of Blockchain as the end of the managerial capitalism era since the decentralization it brings to the system will be able to resolve pertinent issues like the principal-agent dilemma which jeopardizes business performance. The innovative nature of blockchain resides in the fact that it acts as a digital form of structuring data which enables the sharing of a digital ledger (book-of-records) across a verified computer network without the need for a central authority with transparency and trust being key to the functioning of the system it creates between peers. As a survey on millennials points out, this “loyalty challenge” is driven by a variety of factors. For example, one of the pivotal findings of the research is that they feel that most businesses have no ambition beyond profit, and there are distinct differences in what they believe the purpose of business should be and what they perceive it to be. As a consequence of this, they tend to be loyal just to their personal values, a study in the Harvard Business Review confirms this, with 71% of American millennials that are either not engaged or are actively disengaged at work, ending to be job hoppers. This may imply that, in addition to career opportunities and growth, millennials look for ethical companies, as supported by research in the Journal for Education in Business. In particular, the incorporation of social responsibility into a company’s strategic plans seems to play a crucial role in the ability to attract and retain Millennials as employees. Millennials argue that this is true not only from an employment perspective but a general consumer perspective in distrust of advertising and a desire for authenticity in brands before purchasing a product. Thus, with loyalty assumed to be the backbone of every successful business both from a producer and a consumer point of view, it is quintessential for companies to be mindful of this gap. but how? One way to proceed as discussed earlier, is in codifying, for example, a smart contract to be placed on the blockchain so that decisions, progresses, or even incentives should be transparent and reached by consensus, as Don Tapscott and Alex Tapscott argue in their book Blockchain Revolution. They contend that the fundamental idea here is that the blockchain economy extends beyond mere technology and it has to do with the need for a new understanding of management systems. Putting this in their own words, “there is an inclusive principle according to which economy works better when it works for everyone, which means creating platforms for distributed capitalism, not just a “redistributed” one”. Read the whole article on Crowd Valley News. TradeUp (a Grow VC Group company) founder Kati Suominen was honored to deliver the keynote address at the Global Trade Review's West Coast Trade and Working Capital conference on 17 November in San Jose, CA. Suominen spoke about the future of trade in light of digitization of trade and finance, rise of small businesses to drive world trade, and the recent U.S. election on trade and economic policies.

Suominen also joined a panel on SME trade finance at the Bankers Association for Finance and Trade (BAFT) on 28th October in Chicago, where she discussed the future of small business credit and digital finance and P2P platforms. From Friday the 11th to 13th of November, Crowd Valley (a Grow VC Group company) joined professionals from EY, Capital One, Addepar and CoVenture as well as students from institutions such as Cornell, NYU Stern and Columbia for Cornell’s annual Fintech Hackathon held at their Cornell Tech location in New York City. The focus of the event was to promote the innovation of applications and technology for two verticals: Financial Inclusion and Anti Money Laundering (AML). With $5000 in cash prizes, the event featured a large student turnout filled with exciting ideas to bring to fruition.

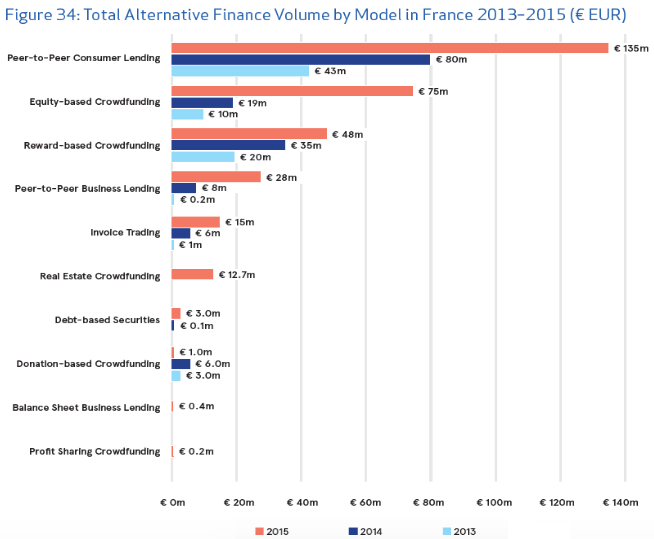

Crowd Valley was represented by Adit Vaddi, from our Business Development team in New York who introduced the Crowd Valley API to the students as a resource to use for their “hacking” and went on to discuss the capabilities that the API and the Digital Back Office offered in supporting the ideas generated in the Hackathon. Adit was joined by Michael Maloney, from EY who provided the keynote address for the event and discussed in the detail aspects of AML, Bitcoin and financial inclusion. With the conclusion of the key note by Friday evening, students dispersed to network, form teams and brainstorm their innovations to be presented to judges on Sunday, November 13th. After all the hard work and strain of Saturday came Sunday - Demo Day. Crowd Valley was joined by Tony Barnes from Capital One and Brian Stuckey from CoVenture to judge the ten teams and score their innovations based on the Product, Novelty, Scale of Impact and Viability of Business. All the ideas presented were very thought out and addressed financial inclusion as well as money laundering with the final results being: Read the whole article and more about the event on Crowd Valley News. France Enhance Alternative Finance with Updated Regulations for Crowdfunding and P2P Lending11/18/2016 The alternative finance sector in France is experiencing great momentum. It’s the second largest market in Europe after the UK, with a volume that has more than doubled between 2013 and 2014 (+103%) and then again between 2014 and 2015 (+107%), reaching €319 million in the past year. France is also home to nearly half of the largest banks in Europe. The updated regulations, published in the Journal Officiel the 30th of October 2016, could be what is needed to allow the market to take off and reach the next level.

In France the entire alternative finance market is experiencing significant growth, but it is the equity crowdfunding sector that have seen the biggest growth in the past year, with the volume of investments passing from €19 million in 2014 to €75 million in 2015, with a +298% growth year on year. Peer-to-peer consumer lending remains the the most popular model in the country, accounting for 42% of the total market in 2015, with a 68% growth year on year. All in all the alternative finance sector in France is in good shape at the moment and these enhanced regulations make us even more optimistic about the future developments. From equity and real estate crowdfunding to P2P consumer and business lending, as well as invoice trading, the investment volumes have growth at a significant pace in the recent years. Now looking at the current trends, with investments in technology firms that increased by 200% in Q3 2016 from the previous quarter, and taking in consideration also the UK’s vote to quit European Union, there are few good cards to play for France, and for Paris in particular, to get a bigger role in the financial technology industry. More information about the updated regulations for equity crowdfunding and P2P lending can be found here, while the full decree (in French) can be downloaded from this link. If you have questions about the best opportunities to focus on and how to get the most out of our digital finance infrastructure to enter the market you just have to get in touch with us and we will be glad to assist you. Read the whole article and more about regulation and alternative finance services at Crowd Valley News. Protektr (www.protektr.co) is developing insurance products to deliver better transparency and protection for investors, platforms, and business people within the alternative finance space. As regulation continues to strengthen in the crowdfunding, crowd investing and p2p lending arenas, we are looking to partner with international governments and insurance providers, to offer better security in this fast growing sector.

Protektr is part of the Grow VC group (www.group.growvc.com). Grow VC was established in 2009 and has been a visionary within the crowdfunding industry since. An umbrella group, Grow VC provides a spectrum of services across the crowdfunding industry - providing better protection to crowdfunding investors is the next stage in its evolution. Requirements We are looking for a highly-motivated individual with an excellent background in sales / relationship management / business development. This person will be tasked with

Important Skills

The compensation is agreed based on competence, experience and commitment. This is a key role in the company and candidates must be ready to commit as a founder to the company and participate to work to build the company and business. The business founders are based in London but for the right candidate we would be open to a remote set-up. Contact info: Application form: http://www.protektr.co/join-us.html E-mail: [email protected] Website: www.protektr.co The US presidential election and Brexit vote were indicators of strong anti-establishment feeling among voters. There are similar signs in many other western countries. Financial institutions are strongly linked to the establishment. As a small detail we can think of how the speeches of Hillary Clinton at Goldman Sachs were harmful for her bid. The establishment has also been slow to make things better, and it is definitely a time in the finance sector to act to again earn the respect of customers and people.

The Grow VC Group was started in 2009, our first business was the worlds first equity crowdfunding service. It was the time of the finance crisis. It was the time people really started to lose respect for banks and finance institutions. Or should we say, they started to hate banks and bankers. During the last 7 years we come a long way from the first crowdfunding platforms to much bigger revolution in with digital finance services and fintech. Now we are at the point that these new services start to have an impact on all finance institutions, including banks. Many digital services, from payment processing and money transfer to lending and wealth management, already take business and profit from banks and other finance institutions. At the same time finance institutions have also started to plan how they can utilize fintech and digital services better. We have now talked about hybrid digital finance. It means how to utilize fintech in the traditional finance institutions, build new finance instruments based on fintech, and find models how fintech and traditional finance services can amplify each other. You can read more about this, for example, from this presentation. At the same time it is fundamental to understand it is not enough to utilize new technology to re-earn the respect of people. It is to develop the whole business, processes, pricing and especially attitude. Services and pricing must be transparent, companies must respect all kinds of customers and the finance sector cannot behave like a private club. The attitude change is most often the most difficult to pull off. And it is also about communications, it is not enough anymore to broadcast fancy marketing campaigns, it is to interact with people. Open API ecosystem sounds quite technical, but it is actually a fundamental part of this. Its philosophical idea is that all parties, big and small, can easily work together, complement each other services, innovate new services, offer better transparency and competitive pricing. Finance services cannot be anymore huge (or ‘yuge’ as Trump would say) black box. We have seen changes in lending and investing services, also areas like online wealth management services and real estate crowdfunding are emerging. We can also expect this spread to many other services from digital investment banking services to automated digital funds and how LPs can make investments in new ways. We hope all finance companies, from small fintech startups to big banks, can join us to change the image and respect of the finance services. We hope it is not a demerit in the future for a politician or anyone to talk or work with finance companies. And especially we hope people can feel finance services are to serve and help them in their life. Good finance services should be something everyone is proud of. They are an enabler for economies and businesses to grow. We now have all tools to build this new finance sector, we just need the right attitude, hard work and execution to make it happen. Protektr (www.protektr.co) is developing insurance products to deliver better transparency and protection for investors, platforms, and business people within the alternative finance space. As regulation continues to strengthen in the crowdfunding, crowd investing and p2p lending arenas, we are looking to partner with international governments and insurance providers, to offer better security in this fast growing sector.

Protektr is part of the Grow VC group (www.group.growvc.com). Grow VC was established in 2009 and has been a visionary within the crowdfunding industry since. An umbrella group, Grow VC provides a spectrum of services across the crowdfunding industry - providing better protection to crowdfunding investors is the next stage in its evolution. Requirements We are looking for a highly-motivated individual with an excellent understanding of the infrastructure requirements in an early-stage fintech / insurtech startup. This person will be tasked with

Important Skills

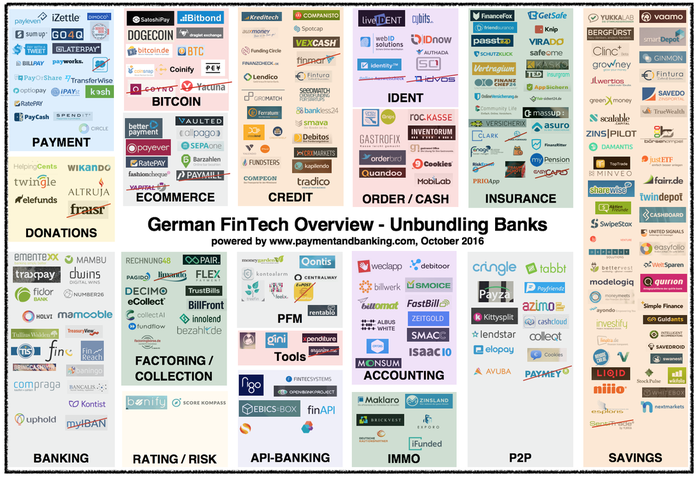

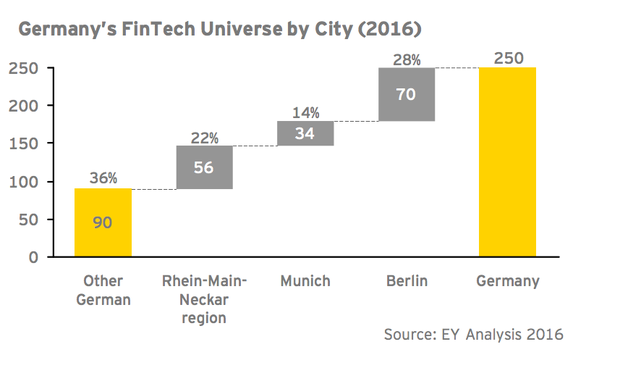

The compensation is agreed based on competence, experience and commitment. This is a key role in the company and candidates must be ready to commit as a founder to the company and participate to work to build the company and business. The business founders are based in London but for the right candidate we would be open to a remote set-up. Contact info: Application form: http://www.protektr.co/join-us.html E-mail: [email protected] Website: www.protektr.co London may still be the fintech capital of Europe but in the wake of Brexit and significant growth and development in its peer nations, the German fintech ecosystem is emerging as a major player in financial technology globally. While, for some time, the domestic fintech scene was not commonly known for its breathtaking speed of innovation, things are changing rapidly. The financial services sector in Germany is facing unprecedented change. Startups and other attackers are jostling for their place in the market, backed by new technologies. While across Europe, overall fintech investment more than doubled between 2014 and 2015 (+120%), investments in German fintech ventures grew by a staggering +843% over the same period. Germany overtook Britain as the fintech funding capital of Europe in the second quarter of 2016, with German startups pulling in $186 million (£142 million) compared to $103 million for British businesses. The three largest fintech funding deals in Europe in the second quarter of 2016 were all in Germany: marketplace lender Finanzcheck raised $46 million; digital-only bank N26 raised $40 million; and payment provider AEVI raised $34 million. KPMG and CB Insights say the findings "suggests Germany as a whole is well positioned to attract fintech investors that may be hesitant to invest in the UK post-Brexit." In Germany, the disruption may jeopardize around a third of all bank revenues over the next few years (McKinsey). German fintech activities and the development of a fintech ecosystem have started later compared to other global regions. Unlike the United States and the majority of the EU, the fintech ecosystem in Germany is a highly decentralized ecosystem with Berlin, Munich, Hamburg and Frankfurt as independent thriving hubs for fintech innovation and growth. The development of the fintech infrastructure is further fuelled by Berlin’s entrepreneurial culture as well as Germany’s strong economy. The test now is whether it and other German cities including Munich, Frankfurt and Hamburg can sustain the recent high level of investor interest. According to Mariusz Bodek, Head of Comdirect Start-Up Garage, a technology incubator in Hamburg, Germany, “the German fintech ecosystem is strongly driven by the regulatory environment and the need to get access to customers. Compared to other countries it is much harder for startups to achieve market maturity. That’s why the majority is seeking cooperation with established banks – a) because they often need a kind of liability umbrella and b) they would like to sell on established customer bases in order to avoid regular customer acquisition costs. Although some characteristics of the German market seem to be tougher than elsewhere, the German fintech landscape is exploding right now. More and more use cases are attacked by startups and that is what drives innovation on both sides – the banks and competing fintechs.”

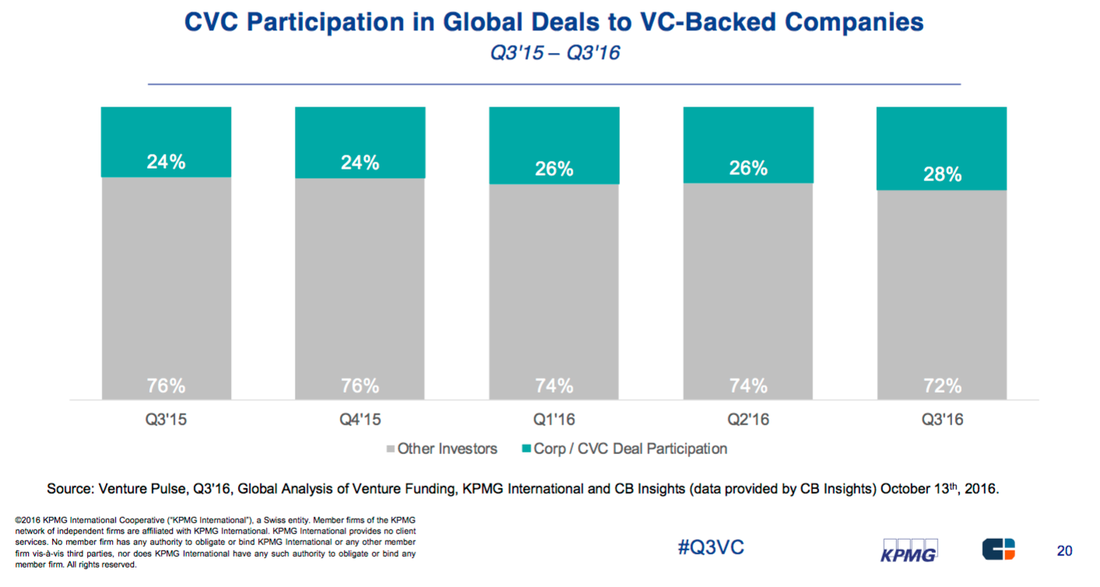

In this regard, the German Banking Act (Kreditwirtschaftsgesetz) offers numerous advantages (McKinsey). For example, fintech startups in Germany are only allowed to offer loans if they collaborate with a partnering bank. This could lead to new business partnership opportunities which contrasts with the increasingly competitive environment that is prevalent in Europe (see graph below). The german market is one of constant upheaval with customers in Germany open to change as never before. Companies that have a compelling customer proposition with transparent products and superior service will continue to succeed complemented by the strong engineering centric infrastructure and backed by the economic powerhouse Germany is. Crowd Valley (a Grow VC Group company) is committed to the German market and sees its importance increasing in the near term for financial institutions and fintech innovation in Europe. We invite like-minded company to reach out and work together with our ecosystem, in realizing a material vision for fintech across the European continent. Read the whole article on Crowd Valley News. The latest CBI Insights report goes to the heart of TradeUp's work to connect companies not only with financial investors (funds etc.), but also with corporate strategics.

The report shows that corporations have ramped up their private markets activity, with more large players are either establishing CVC (Corporate VC) arms or investing directly in VC-backed companies. In Q3 of 2016, corporates and CVCs participated in 28% of all deals, a 5-quarter high. See more here - and connect with us if you too would like to raise capital from some of the leading CVCs. Read more about growth capital for global business at TradeUp Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed