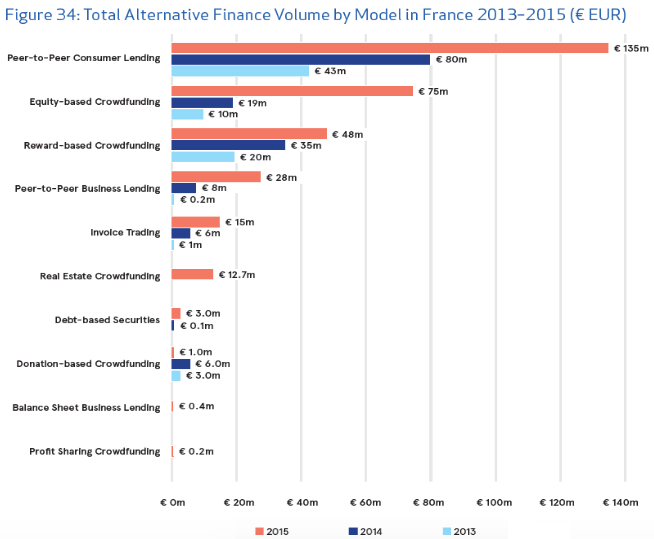

France Enhance Alternative Finance with Updated Regulations for Crowdfunding and P2P Lending11/18/2016 The alternative finance sector in France is experiencing great momentum. It’s the second largest market in Europe after the UK, with a volume that has more than doubled between 2013 and 2014 (+103%) and then again between 2014 and 2015 (+107%), reaching €319 million in the past year. France is also home to nearly half of the largest banks in Europe. The updated regulations, published in the Journal Officiel the 30th of October 2016, could be what is needed to allow the market to take off and reach the next level.

In France the entire alternative finance market is experiencing significant growth, but it is the equity crowdfunding sector that have seen the biggest growth in the past year, with the volume of investments passing from €19 million in 2014 to €75 million in 2015, with a +298% growth year on year. Peer-to-peer consumer lending remains the the most popular model in the country, accounting for 42% of the total market in 2015, with a 68% growth year on year. All in all the alternative finance sector in France is in good shape at the moment and these enhanced regulations make us even more optimistic about the future developments. From equity and real estate crowdfunding to P2P consumer and business lending, as well as invoice trading, the investment volumes have growth at a significant pace in the recent years. Now looking at the current trends, with investments in technology firms that increased by 200% in Q3 2016 from the previous quarter, and taking in consideration also the UK’s vote to quit European Union, there are few good cards to play for France, and for Paris in particular, to get a bigger role in the financial technology industry. More information about the updated regulations for equity crowdfunding and P2P lending can be found here, while the full decree (in French) can be downloaded from this link. If you have questions about the best opportunities to focus on and how to get the most out of our digital finance infrastructure to enter the market you just have to get in touch with us and we will be glad to assist you. Read the whole article and more about regulation and alternative finance services at Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed