|

It is again the time to make predictions and resolutions for the new year. It is not difficult to predict that the fintech market will grow in 2017 and there will be many new services available to change the finance market. It is more difficult to predict, which are exactly the key technogies, services, and business models that are the most successful in 2017. We have collected some predictions to help to navigate in fintech in 2017.

Crowd Valley (a Grow VC Group company) has evaluated the key trends of the fintech and made a prediction of the 5 top trends in the next year. You can read about those trends on Crowd Valley News. Jouko Ahvenainen, Grow VC Group Founder and Executive Chairman, has made his fintech 2017 predictions especially for the Asian market. We can expect that Asia is the most important fintech market in the future and it is coming more important to set international trends too. You can read Jouko's predictions on Telecom Asia Vision 2017 publication. Grow VC Group wishes prosperous New Year 2017 for all fintech people and companies! Grow VC Group thanks all its partners, customers, and friends for this year and we wish you a very happy holiday season and a peaceful and prosperous New Year 2017.

We are approaching a phase where online companies are harnessing physical components to complement their online service – and this is being driven by Internet companies offering offline components, not brick-and-mortar businesses that offer online services. Uber, airbnb and Amazon Go (stores) are already examples, where the combination of online and physical service components is crucial.

FinTech offers now more effective services than brick-and-mortar banks and finance services. But also in fintech can soon start to see services than include physical components. We can have, for example, FinTech services that still need some physical components that could be delivered to the customer’s home. Perhaps we will see crowdfunding and p2p lending corner shops, or InsurTech (Insurance Techology) services that include health care and life quality services. We are approaching a phase where online companies are harnessing physical components to complement their online service – and this is being driven by Internet companies offering offline components, not brick-and-mortar businesses that offer online services. The difference is significant because these new services have really been designed to combine online, mobile and offline experiences and components in an optimal way. They are also much more data-oriented, and designed to use physical resources only when needed, and optimize the use of those resources. Read an article about the mix of online and physical services on Disruptive.Asia. It’s no secret that markets gravitate toward greater efficiency with financial services being no different. As we often cover market segments ranging from peer to peer lending, wealth management / robo advisory and online syndication / crowdfunding marketplaces, the innovation emerging is multifaceted and rapid. It’s directed towards reducing friction and better overall service quality or user experience in financial services contexts. But what does this really mean - a future where software developers replace bankers as the architects of financial services?

The Federal Reserve of the United States recently announced the plan to allocate banking licenses for upstarts. Today you can bring a comprehensive online financial services platform to life in a matter of months, at least as far as the technological infrastructure. What do these trends mean for the future? The age old adage of relationships and their importance is deeply rooted in financial services, reflected in corporate banking, investment banking and trading. However, there are strong arguments that ultimately relationships will give way to efficiency in various sectors regardless of the importance of the relationship, it will become secondary to the cost of the transaction. We are not advocating for the extinction of relationships and their value. However, it can be argued that relationships play a smaller role in market segments than what is often thought. In the future people will likely pay a premium for that relationship and human attention, rather than the efficiency of the standard model and service roles will become more specialized around clients service needs. Its important to not get stuck in a fallacy, where existing services are modernized in the future and ‘solved’ through a magical solution. Financial services are a complex segment, with regulatory policy playing a large part on them, and any development is going to take time to mature. The future is full of opportunity, and it is up to each and every organization to build the services that supercede others for the most efficient and best user experience. This is where the profit will be found, yet the implications may be far different than what we had imagined. For example, take a sector such as life insurance industry becoming more ‘user friendly’. What does this mean in practice, who actually wants to hear from their life insurance company and what on earth would you like them to communicate to you? What we do know is that the modernization of services and financial inclusion will continue to dominate the discussion, and will reign in a new wave of financial services that are more efficient and transparent. These traits will be transformational for the financial services industry as the software banker takes hold and dictates the relationship with your financial portfolio. Read the whole article on Crowd Valley News. Launching a digital finance portal for the first time can be difficult. From our experience, we understand there are many moving parts to this venture so, at a high level, we have outlined the main considerations when starting such an undertaking.

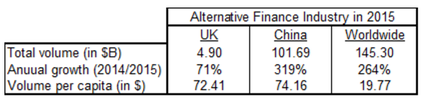

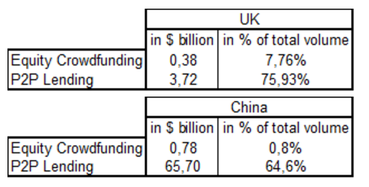

1) Resourcing This will be the most important area both pre and post launch of your real estate crowdfunding portal. Resourcing for the venture can be broken into two categories a) Internal and b) Monetary. Using the Crowd Valley framework our clients have successfully entered the market varying degrees of each. 2) Regulation Regulation is beyond the scope of a platform operator’s control but it's a fundamental aspect to be aware of. Working through and setting up a regulated portal will require significant time and resourcing and, depending on where the platform is based/launched, specific regulation addressing crowdfunding may or may not have already been drafted, requiring the platform operator to use existing securities or banking laws. 3) Ecosystem The crowdfunding ecosystem will be directly influenced by which regulatory body you are working under. The US, UK and EU have strong ecosystems to support the automation of payments, compliance, document management and external data sources (to help with such areas as underwriting). Each country tends to have their own bespoke requirements for the above. Crowd Valley (a Grow VC Group company) is committed to future changes in digital finance with a proven track record in helping our clients identify opportunities and enter new markets in a meaningful way. If you are looking for more insights and best practises to capitalise on collaboration within the fintech space, get in touch with Crowd Valley. Read the whole article and more details on Crowd Valley News. On November 10, 2016, the UK and China announced a joint initiative to provide their domestic investors with new investment opportunities while further opening their respective markets to foreign capital. Named the London-Shanghai Stock Connect, it focuses on eight key areas and ultimately aims at easing cooperation and boosting market access. Those areas range from traditional sectors such as banking and asset management but also include socially important ones, for instance financial inclusion or green finance.

Another area of interest for the signatories is financial technology, better known as fintech. Indeed, an agreement was signed between the People’s Bank of China and UK’s Financial Conduct Authority in order to establish a UK-China Fintech Bridge. In the words of Andrew Bailey, Chief Executive of the FCA: “The Co-operation Agreement will allow us to share information about financial services innovations in our respective markets, including emerging trends and regulatory issues”. Britain’s decision secede from the European Union leaves British fintech firms likely to face regulatory challenges due to ‘passporting’ limitations that may come into effect once the UK actually triggers Article 50 and completes their secession from the EU. This creates a window of opportunity for other European financial centres to establish themselves as major FinTech hubs as the attractiveness of London’s financial center possibly diminishes in the wake of Brexit. Meanwhile, the Chinese alternative finance industry is thriving. Thousands of firms are aiming at providing innovative solutions to the country’s 1.3 billion inhabitants, and they are often backed by the government in this endeavor. Those circumstances led to the creation of fintech giants, but today even the world’s most populated country seems too small to ensure those firms a sustainable growth. In light of this, the agreement that was reached between the two countries illustrates the need for cross-border collaboration in order to harmonize the business models and regulatory requirements worldwide. Likewise, the increasing involvement of institutional actors seems to be paving the way for globalization of the alternative finance industry. Read the whole article on Crowd Valley News. Organized by P80 Group Foundation (P80), the Global Technology Deployment Initiative (GTDI) and the Global Cleantech Cluster Association (GCCA), who are convening the Global Solutions Summit (GSS) around the theme of “Daunting Challenges and Dazzling Opportunities: Scalable Technology Deployment for Sustainable Development,” the Summit will convene on December 13-14, 2016 at the William J. Clinton Presidential Library in Little Rock, Arkansas. Crowd Valley (a Grow VC Group company) has been invited to speak at this event held in collaboration with the Club de Madrid (CdM), an organization comprised of more than 100 former Presidents, Prime Ministers and Heads of State. Crowd Valley’s CEO, Markus Lampinen will discuss the democratization of capital and investable asset classes, as well as the opening up of financial access to audiences that have not held it before (non-accredited investors but also non domain experts). For further information on the event, please have a look at http://www.globalsolutionssummit.com/ . Read more on Crowd Valley News. Photo: Wikipedia.

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed