|

On November 10, 2016, the UK and China announced a joint initiative to provide their domestic investors with new investment opportunities while further opening their respective markets to foreign capital. Named the London-Shanghai Stock Connect, it focuses on eight key areas and ultimately aims at easing cooperation and boosting market access. Those areas range from traditional sectors such as banking and asset management but also include socially important ones, for instance financial inclusion or green finance.

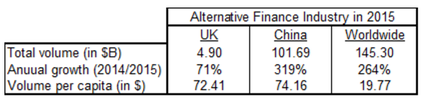

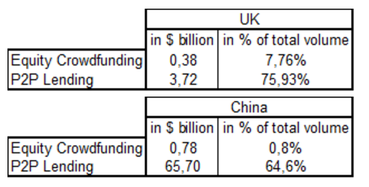

Another area of interest for the signatories is financial technology, better known as fintech. Indeed, an agreement was signed between the People’s Bank of China and UK’s Financial Conduct Authority in order to establish a UK-China Fintech Bridge. In the words of Andrew Bailey, Chief Executive of the FCA: “The Co-operation Agreement will allow us to share information about financial services innovations in our respective markets, including emerging trends and regulatory issues”. Britain’s decision secede from the European Union leaves British fintech firms likely to face regulatory challenges due to ‘passporting’ limitations that may come into effect once the UK actually triggers Article 50 and completes their secession from the EU. This creates a window of opportunity for other European financial centres to establish themselves as major FinTech hubs as the attractiveness of London’s financial center possibly diminishes in the wake of Brexit. Meanwhile, the Chinese alternative finance industry is thriving. Thousands of firms are aiming at providing innovative solutions to the country’s 1.3 billion inhabitants, and they are often backed by the government in this endeavor. Those circumstances led to the creation of fintech giants, but today even the world’s most populated country seems too small to ensure those firms a sustainable growth. In light of this, the agreement that was reached between the two countries illustrates the need for cross-border collaboration in order to harmonize the business models and regulatory requirements worldwide. Likewise, the increasing involvement of institutional actors seems to be paving the way for globalization of the alternative finance industry. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed