|

People are living and working more and more in digital environments. COVID-19 has accelerated the transition to more virtual and digital interactions. Security is a concern in many services. But part of the problem is that security experts, companies addressing customer concerns and even governments focus on negative messages and want to offer restrictions and hard to use tools instead of focusing on opportunities and making the internet a more trusted environment. The thinking is often too technical and theoretical, not based on human behavior or user experience.

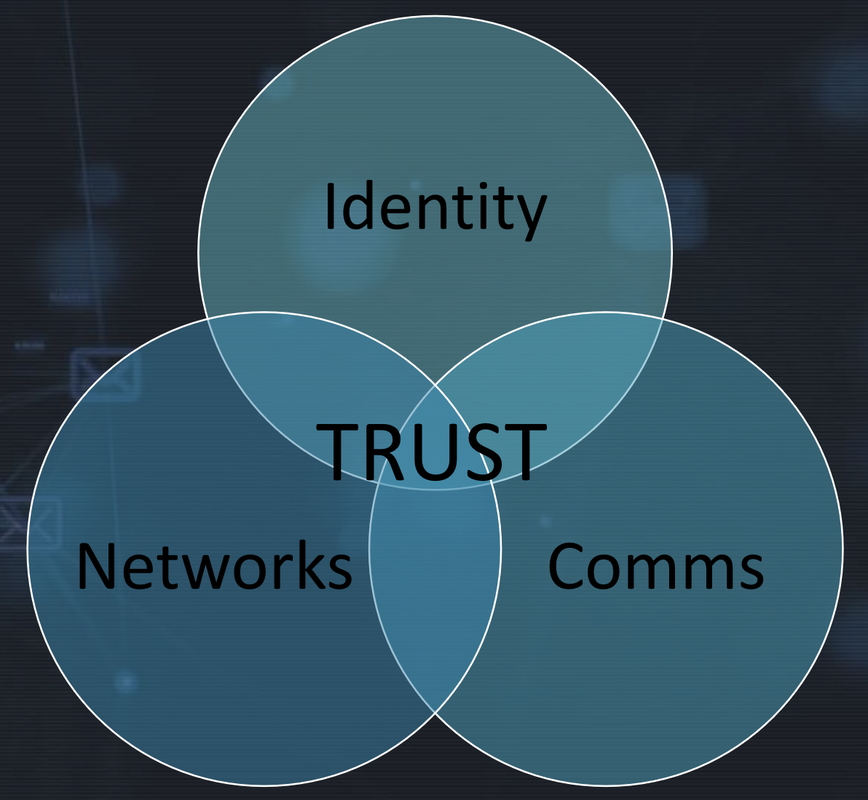

Trust is a fundamental basis for societies and businesses. Countries where people trust each other typically work better than countries with shallow trust. It is hard to make a country or city safer just by adding more police officers or restrictions. If business parties cannot trust each other, they just try to focus on short term quick wins and don’t want to create long term commitments and investments. We have the same situation in the digital environment, but many parties still believe that added restrictions, more policing tools, and trendy, trustless transaction solutions would make it better. We can see this on many levels. In many companies, security officers and experts tell us what must not be done, how risky everything is and creating all kinds of rules for the organization. Governments also sometimes adopt very simplified models to use. Some countries even restrict what people can see and do on the internet. But even the US and UK want to move to more populist models like forbidding end-to-end encryption in the fight against terrorism or protecting children. Of course, it is a totally unrealistic request and doesn’t do much to make the internet a safer or better place. We all know how complex it can be using digital banking apps, identification and signing services. These are usually built from a very technical perspective, making something technically bullet-proof. Still, they are not lazy-user-proof when users don’t use the service or forget the security recommendations while using the service. The Financial Times organized its annual European Financial Forum in early February, and one crucial topic was digital finance services. Several speakers emphasized digital trust as a critical component for developing digital services. Nowadays, many things are done online, with email and messaging services, video calls and digital signatures. If parties cannot trust each other, it is quite impossible to conduct digital business. Facebook deletes billions of fake profiles annually, we all get loads of suspicious emails daily, and companies create bots and fake profiles on LinkedIn just to generate contacts to sell more. Companies use solutions to secure communications and information sharing internally. Still, more and more business is being done across organizations, and most often, email, Zoom and WhatsApp are the typical tools, simply because they are the easiest to use. It is quite evident that better trust solutions are needed. But they should be built on natural human behavior and somehow generate trust built up over generations in societies and communities. Cryptography experts cannot create digital trust. Typically, trust is built up step by step with human interaction. You may be in the same class in school, study together at a university, work together, or live in the same neighbourhood or have the same hobbies. Or you know someone you trust, and they introduce you to someone else, and you immediately trust them by inference. Trust is not black and white. You build it over time, it depends on the context, and you can lose trust quickly. And trust is not based on a set of rules and restrictions; it is based primarily on positive experiences with someone. We are stepping into a new era of digital trust. Then pandemic has accelerated the need to do this. We need new solutions to build and manage digital trust, and they will need to include both social and technical innovations. And they will also need to work with our daily digital tools, like email, chat, video calls, and data sharing. As trust in society is based on positive experiences and opportunities, we need digital trust tools based on positive experiences, mutual learning and finding more opportunities. The article first appeared on Disruptive.Asia. Companies have been collecting data for years. Useful data can offer competitive advantages and be the basis for many services and better customer experience. There have also been many companies that have wanted to become data aggregators, collecting and selling data. But the big data success stories are not in selling data. Sometimes data is almost a toxic asset. What can we learn from the ways that data has been best utilized and monetized? We now have the same question with personal data, and many parties want to repeat the same old mistakes.

Fifteen years ago, in one of my earlier startups, we developed a marketing slogan: Data – the black gold of the 21st century. It was and is still a relevant comparison, but to make money from data is very different from the oil business. There you have separate business lines to drill and refine oil and then sell refined products. We can see something similar in the data business, but making big money in the value chain is very different in the oil and data business. Google, Facebook and Amazon are the superpowers of the data market. They primarily collect and then build services that utilize data. They might buy some third-party data, but it is not their primary way to get data, and they don’t actually sell data. The reputation of companies that focus on trading data is nowadays quite shaky. As a person who runs data operations for a Silicon Valley giant once said to me, they are more and more skeptical about buying data when they don’t know its sources, how accurate it is, how those companies that are selling it got hold of it and how they conduct their businesses. Don’t get me wrong, some companies make significant revenue by selling data, and some companies spend hundreds of millions buying data. But it hasn’t been an area to build unicorns and companies that shape the world as was expected maybe 10 or 15 years ago. Then there were a lot of expectations for data exchanges and other creative data trading business models. Today data is traded more like a commodity than a unique source of value add. Companies buy outside data to enrich their data and help their solutions to utilize data better. The real value is achieved when companies build solutions to use data in marketing, sales and operations. One could even claim, the winner doesn’t have the most data, but the best tools to utilize the data. Of course, the Internet giants have heaps of data. Still, banks, telecom carriers and retailers have lots too (and the opportunity to collect more), but they have generally been slow to utilize it. Those successful companies also offer the data’s value to their users, like Google search, maps and other services, and Amazon’s better customer experience. We are now seeing early days of personal data, i.e. how people can utilize their own data. Some initiatives and companies want to build solutions based on ideological views; people have moral rights to own and control their data. Those haven’t done too well; only a small set of people are interested in these ideological projects. Then there are those companies that want to help people collect their data and sell it. This has many practical challenges, including how to get a data market to work with enough demand and supply. Pricing is also a complex challenge, as are the associated terms and conditions, whether you sell your data for one purpose and how to track its use. It is not easy to get this personal data market working correctly. The user value promise is often disappointing, like being paid a few dollars monthly to watch ads. The most obvious option that has worked with the big data businesses for over ten years is forgotten. Why not offer people better tools to collect and utilize their data. When some companies want to help people to control and use their data by selling it, it is similar to recommending Google, Amazon and Facebook to sell all data they collect. Those companies have achieved their current position and power by having top tools to utilize the data they get. It is the same with individuals. If you want to empower them with their data, you need to offer the best tools to utilize that data personally. Utilizing personal data will include many concepts, and we don’t know them all yet. We need an open market to innovate and develop those tools. But it can have, for example, tools to plan better personal finance, find the best prices, manage better health and wellbeing, and get help in all kinds of daily needs and activities. The longer-term vision is to build personal AI that offers a dashboard to guide all daily activities. As with data businesses, personal data could also be enriched with external data sources. For example, public data like price comparison, traffic, public health and map data combined with personal data making it more powerful. Data model training for Machine Learning and AI improves when it can use data from many users. In many ways, the best way to utilize personal data is similar to what the leading data companies have done for years. But it seems that with a new business opportunity, many parties first go to very complex models, like justifying data with ideological thoughts or wanting to build a blockchain-based data exchange with digital rights management systems. Often the simplest and best solution is to copy one that has worked earlier elsewhere. The article first appeared on Disruptive.Asia. Artificial Intelligence (AI) is popping up everywhere, at least in discussions. Intelligent systems are being used in many places, and they are becoming smarter. But the real bottleneck is not the intelligence or ‘brains’ of the systems; it’s that AI also needs ‘hands’ to do things.

AI has become a very popular keyword over the last five years. Most company management groups and boards want to see some AI development in their organizations. Unfortunately, the reality, and actual use cases and expectations are not always in line. The biggest problem is not having smart enough machine learning (ML) or AI models to analyze data, handle tasks and make decisions. Let’s take a simplified AI task. A system collects data, analyzes the data, makes needed conclusions and decisions and sends the results for operative use. If a whole system is built to work around AI, like a self-driving car, the capability to analyze the data and make decisions can be the bottleneck. But most systems are different. We can take another example utilizing AI – automating insurance claim processing. We have the same phases, but data and interactions with other systems are much more complex:

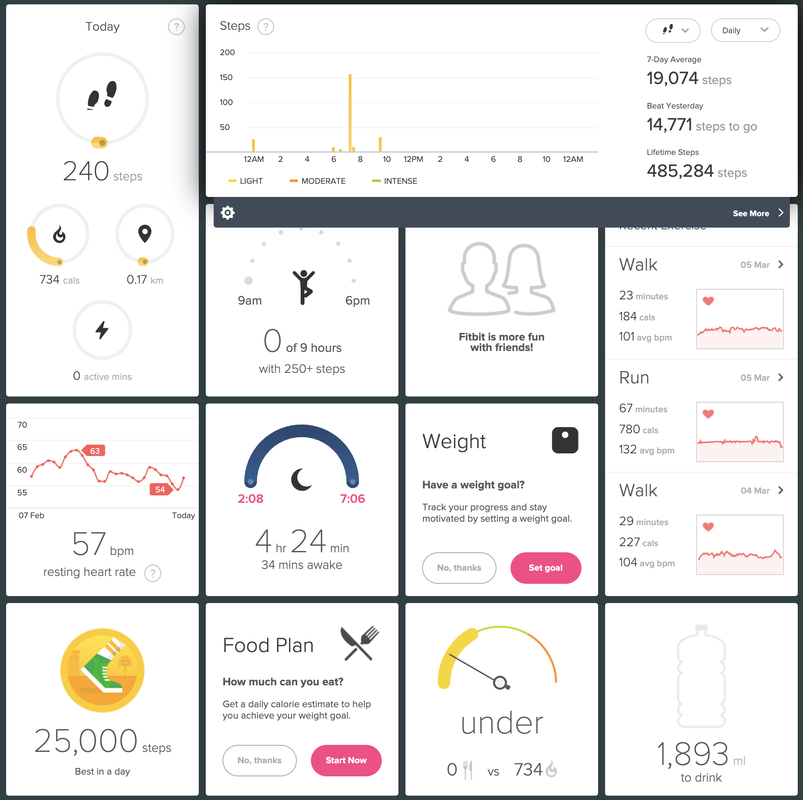

In this example, we can see that the data analytics and decision-making is a small part of the overall process flow. There are many other parts, especially getting data from several sources, formatting the data, entering decision data to other systems and triggering actions in different systems. And what makes this even more complex is that typically the data is in many different formats and a part of the information is missing or is inaccurate (just think the claim form the policyholder fills and add attachments). Even the case of a data value being “null” needs to be handled, “null” is not “zero” and depending on the data set, it can have meaning or not. There are many handlers needed. One of my companies implemented this kind of system several years ago. Although it was quite a digitally advanced insurance company and environment (Scandinavia), there was still a lot of work to be done. A typical rule of thumb in the data business is that 60% to 80% of the work is to pre-process the data. This is reality when you try to implement AI in any enterprise with many existing systems, and some of them can be quite old-fashioned. Just think SAP, Netsuite and links to banking systems. We can even think of a more modern solution to get data from several wearable devices (Apple Watch, Fitbit, Withings, Garmin, Oura, etc.) to one place and bring it into a format that you could build ML/AI solutions on top. Even to collect all that data is not as simple as you would think, even when people talk about open APIs. APIs are still not so common, and while an API will be structured, the quality of data included can vary from one source to another. A term I have started to like is ‘AI hands’. It means solutions, how to get data collected from many old and new systems, format them in one place and then get the processing results to operative use in other systems. Companies often forget or ignore the development of ‘hands’ when it is fancier to talk about the latest innovations for the ‘brains’. As always, great thinking is rarely enough; you must collect and organize information first and then get things done based on your thoughts. In reality, these ‘hands’ are like software robots (RPA) that can work with different systems and devices. These include additional software components (e.g. OCR, NLP, data cleaning, APIs) to get the data and trigger actions (e.g. sending emails, start payment, start delivery). Other useful tools are webhooks that can trigger background tasks, for example, in the serverless environment and such as verifying data and running NLP. This means the capability to work with a vast number of different systems and formats. Open source is often the best way to support many kinds of needs from small and rare systems to major systems. There are many data formats and even unformatted data that no company can implement in their proprietary system. Here, open source is the only option. These ‘hands’ and ‘brains’ should be based on commonly used and widely available programming languages (e.g. Python) that help get ‘brains’ and ‘hands’ work together utilizing open source components. To get more AI and ML use, we need more and better ‘hands’ for AI. Management groups must also invest in these capabilities if they want to implement and utilize AI. And it is the same with consumer services, someone must offer the solutions where the data is available in a usable format, and there are tools to get results in real use. In last year’s Gartner Hype Cycle, many AI solutions were on the hype peak. AI ‘hands’ are needed to improve productivity. The article first appeared on Disruptive Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed