|

It’s no co-incidence J.P. Morgan is referring to its “robo-advisor” as an “automated advisor” over the more common buzzword pair. Goldman Sachs has modeled its consumer loans platform “Marcus” as a helping hand for those in need and named it after founder Marcus Goldman, who ventured forth into banking over a century ago. Fintech is indeed getting to a more mature stage in the market and soon we’ll forget the buzzwords, and be used to transacting on new technologies that hide in plain sight.

If you take a look at ‘Marcus’, you’ll be struck by its simplicity. It’s customer centric, clear and straight-forward. Could it be that this is exactly what a retail borrower wants out of the experience, no hidden fees, no complexities and trip wires, just the service they are after? Who would have guessed, right? I’ve earlier stated we are entering a practical era of fintech where what matters is providing the best service for the end client and it truly seems the customers preferences are shining through. Yet what’s fascinating is the fact that as we focus on customer experience and service, we also are less distracted by buzzwords and hype. I would argue that’s exactly where we should be and the ocean of buzzwords merely serves as a distraction. If we’re able to lower the cost of a transaction by a few basis points will that be the most important message, or the fact that the transaction happened on a blockchain? We’re entering a time where technology adoption in finance is being hidden in plain sight. Creating a new account onboarding process that empowers the individual user, yet lowers the human capital on the organization side, will likely be well received by the user and encourage them to go the extra mile due to well thought out user experience. At the same time, this process could well boast a sophisticated series of automated anti-money laundering (AML) checks and know-your-customer (KYC) questionnaires, all powered by an artificial intelligence (AI) engine that takes user input based on which it then decides exactly what calls to make and which databases to crawl. The user would never see this, but the experience wouldn’t be possible without this invisible layer. This follows how technological adoption works across markets. Automatic braking systems, ticket pricing for flights, Google searches all function with sophisticated uses of narrow artificial intelligence. Does the user actually realise this and further, do they need to? Similarly when applying for an SME loan through a mobile app, granting access to financial and behavioral data, will the end user marvel at the underwriting process or at the competitive rate they’ve just been offered in minutes? If we’re able to use Artificial intelligence (AI) in order to empower the consumer to utilise their data on their terms for the best product, they are likely going to remember the mortgage and how they got their dream home. What are we going to see going forward? My hope is much more data driven decision-making in design of services on an organizational level, where end users can truly have a voice in how they want to acquire their services. It will be interesting to see what direction J.P. Morgan takes with its automated financial advisor and I suspect it will be telling of their take on the current state of affairs at the intersection of finance and technology. Given their history in retail services it may offer an added depth in services to other solutions in the market. Adopting a user-centric research and development process requires large organisations to be able to adopt a rapid prototyping process, in order to bring feedback loops close enough to the production line so they are able to stay current with their offerings. Whether this fits in the corporate hierarchy or at innovation labs that have more freedom, the pace of technology is increasing so fast that the process for innovation itself is becoming much more central. Today’s technology will be outdated in a few years. How can services keep re-inventing themselves in order to maximise end user value and user experience? We’re at the cusp of a user experience revolution in finance, not just in retail services, but across the board. How can we truly convince the borrower landing on ‘Marcus’ by Goldman Sachs, that the bank, which has historically shied away from retail services, now truly cares about that particular individual’s credit card debt? It will come down to creating a unique experience and messaging, and powering it with the right underlying technologies that complement that experience. Maybe that’s where we will see the modern John Pierpont Morgan emerge. This article was first published on altfi news. Over two billion working-age people have no access to ordinary finance services, like bank accounts, payment cards or loans. These people are especially in developing countries and emerging economies. But not only there, for example, in the UK two million people cannot open a bank account. Finance services are key for many other things in life, without them people are outsiders. Fintech and mobile can change all of this. People don’t need a credit card, they need credit. People don’t need a bank account, they need a safe place to keep their money, an easy way to receive money and make payments. When we think about solutions for financial inclusion, it is not about a focus on old finance services, but how to utilize technology and directly embrace the next generation solutions. Financial inclusion is not only about tools to handle money. Financial data is a very important part of inclusion. Know-your-customer (KYC), credit ratings, and finance history are crucial elements in most of finance services. Without financial data a person is not able to benefit from most of financial services. Many companies are now developing services that enable excluded people to receive their salary into an online account, make payments, transfer money to the family, and even apply for loans. Those solutions definitely help these people. It helps also economies, when for example the solutions can help collect tax information and pay taxes. But they are only the first steps. Especially finance data and creditworthiness needs further solutions. It is also important that people are not tied to one service alone and its own customer history, but people are able to use different services, compare them and prove their history there too. Traditional credit rating is missing or inadequate in many developing countries. At the same time we see many problems in credit ratings in the most developed countries too. It can be problematic especially for young people and immigrants, who start from scratch. At the same time there are privacy concerns. Circumstances of people nowadays can change rapidly, when there are societal changes in working relationships and even family relationships compared to earlier. All this means we need new solutions for financial data and ‘finance-ability’. The need exists in the developing and developed countries. Actually, it is not only for people, but SMEs too. SMEs encounter the same problem, and sometimes it’s even worse. It is difficult to open a bank account with all regulatory requirements for banks, and acquiring debt capital for an SME is particularly cumbersome. We need totally new angles to solve this problem. The relevant data is not necessarily only data from finance services, but many other data points to help address requirements around knowing the customer and also considering his or her creditworthiness. This is a significant opportunity for fintech companies, but also for other parties, for example, mobile carriers can have a role in this. Most probably it doesn’t make sense for carriers themselves to enter the finance data business, but opportunities for partnerships are emerging in these services. Financial inclusion is one of the biggest fintech business opportunities. But it is not only a business opportunity; it enables a normal life and equal opportunities for now excluded people. It is also important for countries and economies, when all residents are included properly in the economy and also pay taxes. Financial data and finance-ability is an important part of this and it requires cooperation of many parties that offer data and develop data solutions. In practice, it means, for example, cooperation of fintech companies, mobile carriers, retail companies and governments. This article was first published on Telecom Asia. Prifina (a Grow VC Group company) develops new solutions for financial inclusion data management. Since its implementation in November 2007, the Markets in Financial Instruments Directive (MiFID) has been the cornerstone of capital markets regulation in Europe. However, since its inception, not all benefits have been fed down to the end investor as envisaged. MiFID II is aimed to address the shortcomings of the original MiFID release and has been amended with measures as a result of the lessons learned from the financial crisis. In addition to upgrading the current regime for equities markets, the second Markets in Financial Instruments Directive proposes to extend this revised regime to a far wider range of product classes, including over-the-counter (OTC) derivatives and fixed income products. MiFID II will most certainly have a profound impact on the operations of financial institutions that distribute and trade financial instruments not only in the EU but globally as well due to the many cross-border implications of the directive. In fact, this legislation, which seeks to protect investors by significantly raising the standard for transparency on investment houses, will likely confound even well-intentioned trading organizations doing their best to comply with the directive, much like we are seeing with the EU's General Data Protection Regulation (GDPR). At the highest level, MiFID II requires firms to prove they have acted honestly, fairly and professionally in accordance with the best interests of their clients at all times. If questions about a trade arise, or regulators field potentially credible complaints of malfeasance, investment banks must show that they:

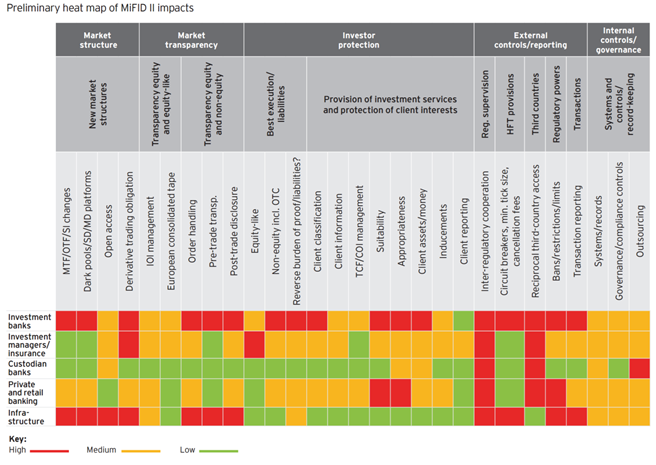

Article 16 of MiFID II indicates that firms must capture all communications that lead to a transaction, including all electronic communications—email, social media, telephone calls, etc.—as well as, interestingly enough, face-to-face meetings. Firms must also “take all reasonable steps” to ensure that communications do not occur on channels that cannot be captured. Most importantly, MiFID II is not just a compliance exercise. There are major strategic implications that could bring market opportunities and competitive advantage for those who start to plan in advance or potential revenue loss for those who fail to react. MiFID II must be aligned to a number of other regulations that are being implemented at a global, European and local (domestic) level. Therefore, many firms are responding by considering multiple related regulations, as for example aligning Dodd Frank, Basel III and Capital Requirements Directive (CRD) IV, European Market Infrastructure Regulation (EMIR), Market Abuse Directive (MAD) II and MiFID II under one regulatory change program with thematic workstreams across regulations. According to a PWC report, over the coming months, affected firms and businesses should conduct the following activities:

MiFID II will also command significant changes in business and operating models, systems, data, people and processes. As a result, a fundamental transformation will emerge. The biggest impact will be experienced by banks, broker dealers and trading venues. Additionally, investment managers, insurance firms, independent financial advisors (IFAs), custodian banks and other asset servicing entities will also need to undertake a substantial effort. One may certainly expect the UK’s financial services industry to be impacted by Brexit+MIFID implementation. However, the nature of the impact is quite debatable and as yet unknown and will depend on what model is eventually negotiated for the relationship between the UK and the EU in place of the UK’s current position as a full member of the EU. The general consensus is that the UK’s exit from the EU will not see major changes to UK financial services legislation deriving from the EU. The FCA made it clear in a statement in July 2016 that, as far as they are concerned, it’s business as usual for now. Read the whole article and more details on Crowd Valley Blog. Source: EY Report: Capital Markets Reform: MiFID II

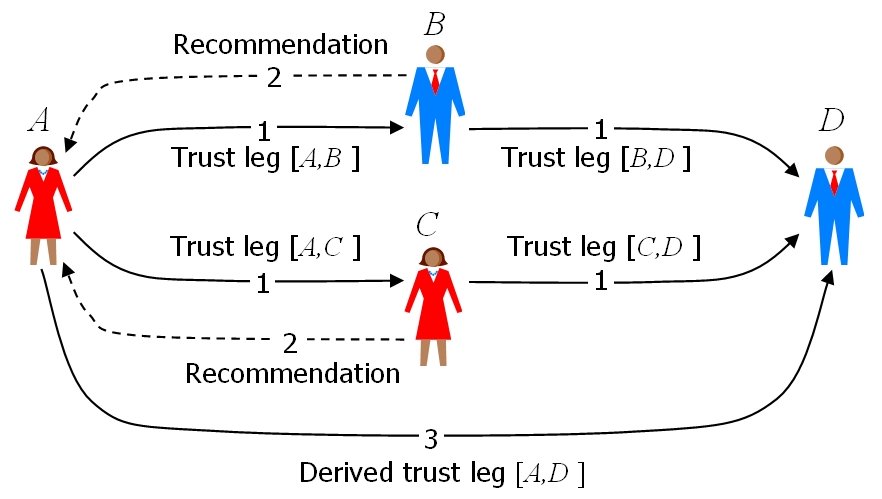

Private transactions have since long been conducted directly between the transacting parties – for example, the investor and a private company. This process has largely been manual and cumbersome, and a large amount of diligence has had to occur in order for the parties to trust one another enough to undertake the deal. We’re seeing part of this transaction be made much more efficient by the transition to process trust. There are different types of trust and therefore, diligence needs in a transaction, effectively at least: 1) the diligence on the actual investment merits, Ex.: Is the private company and its plan any good and 2) on the transaction itself – that by engaging in this transaction, can you trust that the execution, and if the paperwork and process itself is sound. Keep in mind that in private transactions, this latter type of trust has often been accomplished by referrals from private networks, robust agreements, and a long-winded process. Compare this to exchange-traded products. How much time is spent evaluating if the transaction itself is robust? Arguably very little or none even. There exists a robust underlying trust in the process, which we can call “process trust.” With new online distribution models for securities deals as well as end-to-end investing and lending marketplaces, we can argue that this process trust is making its way into private transactions and changing the way we look at the actual deal-making. Due to the efficient nature of these marketplaces and the technological development, this shift may have a larger impact on how deals are put together than often thought today. Data is also driving new possibilities given that the public disclosure of private information and private transactions is being marketed much more openly than earlier. This data that is now becoming public for the first time in private transactions makes available many new possibilities than before and will undoubtedly play a significant role in establishing trusted transaction value chains. Take the notion of distributed technology (including blockchain) with its lack of a central trusted authority. Combine that with seamless digital user experiences, an airtight audit log, and reporting. It’s easy to understand why novel new models such as Angelist’s private syndicates gather millions or tens of millions of dollars in backing. There is a discussion to be had around deal merits (let alone signaling and herding mentality), which we can save for another time. But if you compare putting together all the paperwork from scratch, chasing signatures, personal details, doing countless in-person meetings, etc., it’s simply quite convenient when a systematic process can run through the entire chain of events. As private transactions become more and more public, we will see a convergence of ‘private’ deals and ‘public’ deals. Process trust is one dimension that will get built out – with robust infrastructure – to exemplify process trust in private transactions. Over time, the fragmented market will gravitate toward best practices and uniformity, so all the checks in the book can be completed to a T. In addition to standardization, the public market offers liquidity. Private transactions, by nature, often lack liquidity and lock their owners in for a long time, but secondary markets for private P2P loans, for private equity crowdfunding transactions and SME loans are being implemented to offset one of the core strains of the private market. Some regulatory environments are more favorable to secondary markets, for example, the Financial Conduct Authority (FCA) in the UK; some are more hesitant, often with existing mandates as barriers. Process trust may indeed establish credibility to deals that have long been opaque and littered with information asymmetry. The extent to which this allows the asset class to blossom in the retail market remains to be seen, but one can argue that with a retail distribution becoming more and more mainstream, an underlying process trust must be established – otherwise, the transition will not achieve anywhere near a comparable level to efficiency as the public market. This article was first published on Let's Talk Payment. Picture source: Wikipedia.

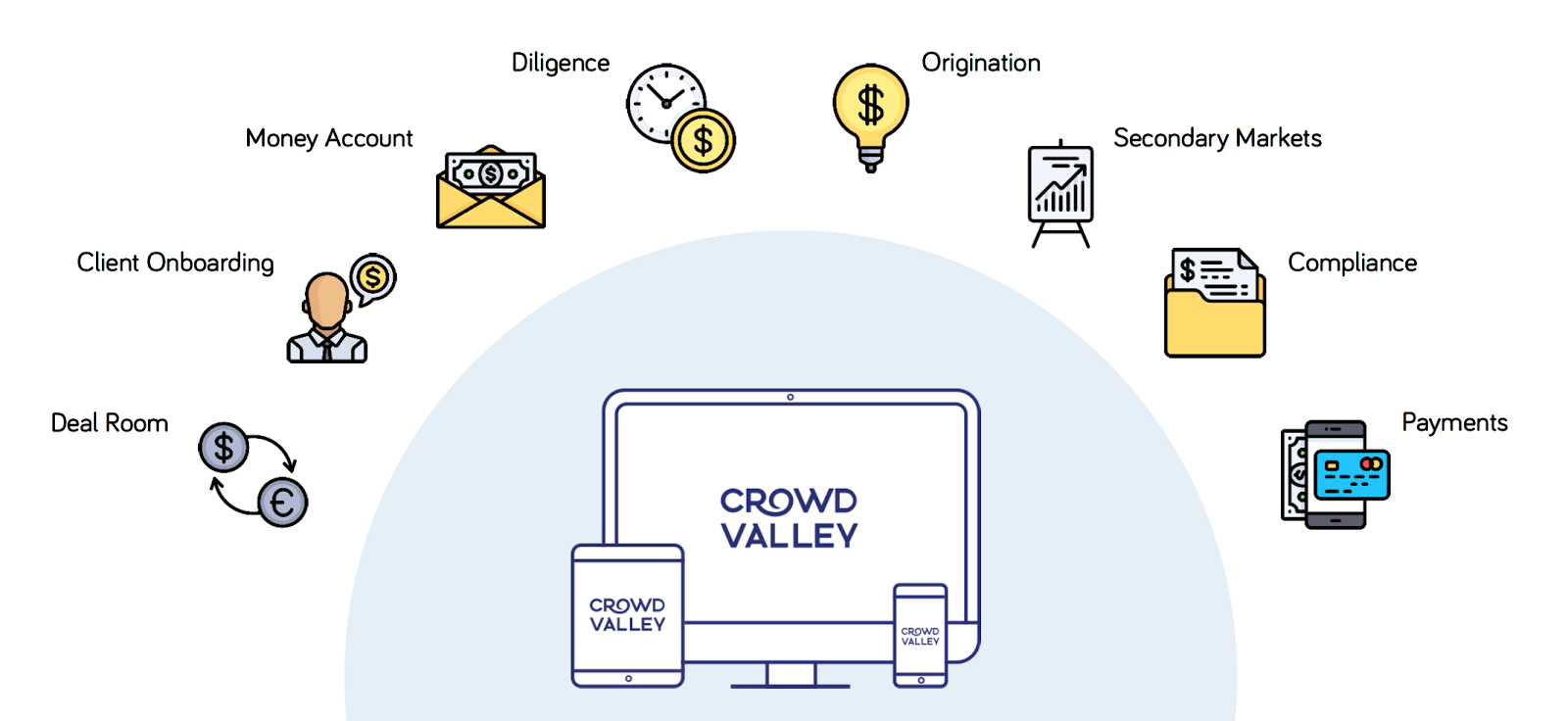

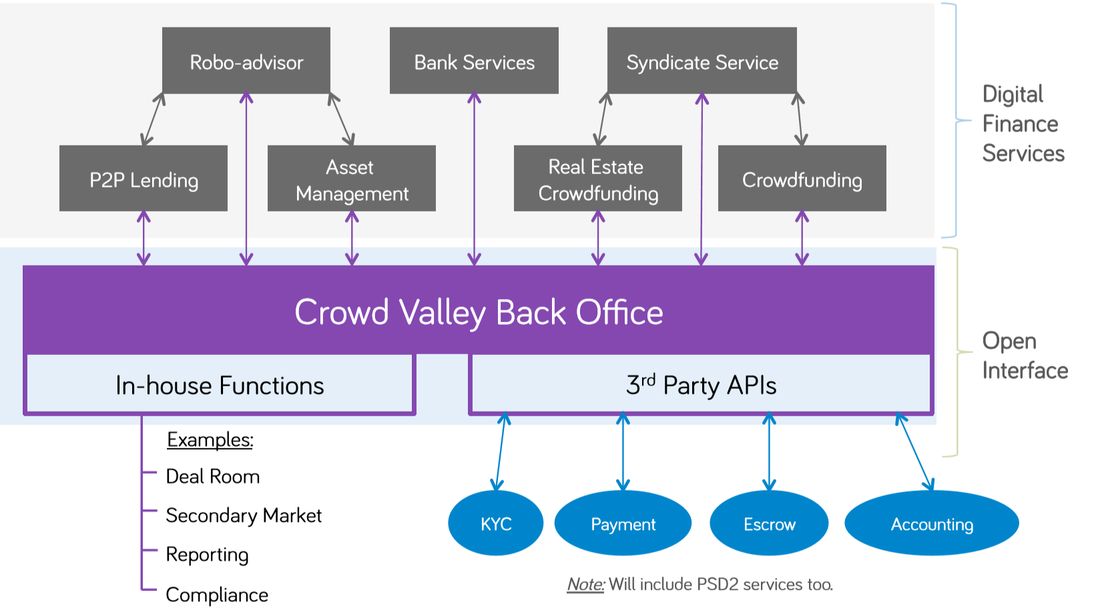

Different as they might be, marketplace platforms have something in common: their purpose is to match investors with the right issuers, and vice versa. Regardless of the nature of those transactions, platform operators can ease the sometimes lengthy process that consist in onboarding its different categories of users while meeting regulatory requirements.

Before further describing the onboarding process, we’ll make a distinction between the different categories of users that interact through marketplace platforms:

Depending on the type (disposable income, nationality, etc.) of investors that the platform operator is aiming to onboard on its platform, different regulatory requirement have to be met. By having 3rd party service providers integrated in its platform to process ID verifications (for instance to meet Know Your Customer and Anti-Money laundering requirements), platform operators can easily approve or reject potential investors before allowing them to open an online-wallet or to invest directly. Similar to the investor onboarding process, platform operators need to verify the adequacy of issuers to their platform’s standard. Both personally, and regarding the overall viability of their projects. In order to efficiently achieve this, credit scoring partners can automatically assess the solvability of an issuer and integrated deal rooms are used to gather and validate all relevant information before submitting an offering to potential investors. Once the platform’s basic workflows are established, it is then easy to adapt its settings to the evolving expectations of its users. To do so, a platform operator can easily set and update ‘triggers’ that automatically notify a user when a given event occurs on the platform. Practically, it means that an investor could be automatically aware of investment opportunities that match his criteria once they’ve been verified by the platform operator. It could also be used to automatically notify an operator once an issuer has provided the required documentation, who could then approve the offering and automatically notify investors that already registered their potential interest for this type of offering. From the onboarding of users to the settlement of transactions, Crowd Valley’s framework enables platform operators to tailor their online finance workflows to the needs of their users. Any interested party shouldn’t hesitate to contact us. Read the whole article and more details on Crowd Valley's Blog. Deloitte has just published a new report about FinTech hubs [PDF]. There are many other FinTech city ranking reports besides this one, but many of these reports seem to be based on very traditional finance business premises. FinTech exists to disrupt traditional finance, and old premises are not necessary relevant. FinTech also includes so many different areas, so it is not easy to make assumptions on general competence, market and regulation.

The top-ranking cities in the Deloitte report are the usual suspects: London, Singapore, New York and Hong Kong. Their index includes variables such as government support, innovation culture, proximity to expertise, proximity to customers, foreign startups and regulation. Basically, we can say it is a combination of startup hub and finance services indices. Competitiveness and startup hub indices are always hard to calculate. There are countries that – based on official numbers – are rated the best places to innovate, create new businesses, and acquire top talent, but in reality we don’t see so many success stories from those places. The pole position doesn’t mean you actually won the race. Theory and reality in business, especially for startup businesses, are often different. When you throw FinTech into the mix, one issue is that there are many kinds of FinTech services. Some, like robo-advisors, crowdfunding and p2p lending, are services for consumers and enterprises. Then there are technical services that enable finance services and instruments, such as finance back office functions (e.g. KYC, payments, compliance and online accounts). There are also services and technologies that are not directly linked to finance services – such as data analytics and AI – that can be the basis for many kinds of services. I’ve written previously on how FinTech can actually have a bigger influence in money distribution and value chains than the end-user interfaces. There are also significant differences in finance hubs. For example, Singapore and Hong Kong have small domestic markets, but they offer services internationally. London has been the finance hub of Europe with global contacts, but Brexit is changing its position in Europe. Then we have emerging financial centers, especially in developing countries that have an important role in domestic finance business, and also more global contacts. A couple of months ago I talked with a person who used to lead Asian commercial banking functions for a leading global bank. He had left his banking job because he felt banks are not able to adapt FinTech and the new reality of finance services. He particularly felt this is the case for established finance centers, where incumbent finance institutions and regulators are significant stakeholders in old finance models. For example, he evaluated countries like China, Indonesia, Vietnam and Malaysia that could be in a good position to go directly to the next phase of digital finance services, while the old business and services are liabilities for Singapore and Hong Kong that make their progress slower. Finance vs technology There are many ways to measure the size of the FinTech market. China typically ranks at the top because it has the biggest market size, the biggest FinTech unicorns and biggest customer numbers. The US also has a big market and many unicorns. Some countries like the UK seem to have more local FinTech services, while other countries have more international services. For example, German neo-banks N26 and Fidor offer services in many countries in Europe. As the buzzword implies, FinTech includes finance and technology components. Some FinTech companies are more “Fin” and some more “Tech”. It is not easy to categorize companies, but there is evidence that the tech-focused companies are more disruptive – for example, they offer things like digital currencies, distributed ledgers, software to replace finance instruments, and AI to replace finance professionals. The “Fin” companies are often founded by former finance professionals who then try to utilize technology to make traditional finance services and instruments more cost-effective and scalable – they believe more in evolution than revolution. FinTech already has an important role in finance services in developing countries. For example, mobile money transfers, payment services and micro-lending are important in many places in Africa and Asia, where financial inclusion is also very important – not only as a business opportunity, but also politically and economically. In these places, FinTech services can become the backbone of the finance market. When we talk about innovations and new services, we must also mention that this requires the right environment to attract talented people and creative thinking. For example, some finance hubs might offer relaxed regulations, but they are otherwise quite totalitarian regimes. Immigration and culture are also important to attract young talent. An apartment renting service, Nestpick, ranked the cities where Millennials want to live – at the top of the list (in order) were Amsterdam, Berlin, Munich, Lisbon, and Antwerp. Complex realities The points above are not an attempt to create a new FinTech hub ranking methodology. They are more random observations about how it is not so easy to categorize, compare and rank FinTech hubs. It’s important to remember that FinTech exists to disrupt the finance industry – it’s too simplistic to conclude that the old hubs are a good starting point. Deloitte’s report is a good attempt to measure some potential success factors for FinTech. But it doesn’t really consider the many different aspects of FinTech, it doesn’t really take into account emerging markets like China, India or even Africa, and it looks like it measures straight evaluation and good intentions than disruption and markets for new services. To be clear, there is no right and wrong ways to evaluate the FinTech markets. It is always nice to publish rankings – people like to talk about them, they are marketing tools for consulting firms and they can have political and business purposes too. But when companies, entrepreneurs and customers look at the real market and opportunities, the picture is always more complex in practice. I have seen in many industries – e.g. mobile, media, advertising, retail – how easy it is to predict the incumbents have the best position to make new services. But often the disruptive challengers are finally the winners, and the market looks very different than the consultants expected. It will likely be no different with FinTech. This article was first published on Disruptive.Asia. As Fintech continues its progress around the world, new platforms emerge on a daily basis. Crowdfunding for Real Estate, peer to peer with asset backed loans, sponsor led syndicates. You’ve seen the statistic, there’s hundreds or thousands in different verticals and segments. Some represent novel new upstarts with their new niche or focus and some represent incumbents digitalizing their value chains using online tools. It's easy to think, that there are too many platforms.

At the same time, a competing concept is the lack of connectivity and dominant isolation. Deals are often done in silo’s, syndication and deal sharing are rare and confined to whats in the proximity and cooperation and specifically its expansion is often a lesser priority, than getting the deal done. This isn’t the way a mature market works and is a characteristic of where the current market situation stands. More Platforms, Less Silos We believe deal makers from each asset class and asset strategy will become enablers in entering the digital market and find a broader ecosystem to access for more efficient deal making for their long term strategies. The concept of this ‘platform’ as an enabler fits directly as a core in businesses strategies, and sits at the very heart of deal making. The ‘platform’ is not a strategy in itself, at the end of the day it is a tool and an enabler for the company’s overall vision, making transactions and matches happen in the best way with the best outcome. Stage of the Ecosystem - Beyond Silo’s to Collaboration Stage 1: The first stage for many is the rollout of a new market model and attain a certain level of success using that model in the market. This requires adaptation from the company’s operating models and maybe more importantly a change in mentality in approaching the market. Stage 2: In the second stage, we will see more cooperation and partnerships also replicated with digital tools online. From deal sharing and syndication, to shared knowledge tools and market insight, existing partnerships will find ways to leverage their cooperation also in the digital domain with more efficiency and resiliency in their approach. Stage 3: In the third stage, we will see new, digitally native partnerships emerge where the partnership itself originates in the digital domain. This stage is longer term and after a digital integration of new business models, however it will have lasting and profound impact on the market models where cooperation will allow for new types of mechanisms around shared or partly shared origination and syndication. A Word on Trust Trust often comes up in online transactions. This is what I believe it will come down to, online tools offering a new way of making deals happen better than before where the concepts of trust are even more crucial than before and established using new technologies and tools. What’s the Missing Link? It’s not a question of too many or too few silos, it's ultimately a question of connectivity and volume. As more deal makers and finance companies choose to embrace and adopt digital tools, they will get to leverage the connectivity between deal makers of various kinds and ultimately close deals in a new and more efficient way. More deal makers, more networks and more connectivity brings the world one more step closer and shortens the distance for parties to find one another and execute on mutually aligned deals and strategies. Read the whole article on Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed