|

As Fintech continues its progress around the world, new platforms emerge on a daily basis. Crowdfunding for Real Estate, peer to peer with asset backed loans, sponsor led syndicates. You’ve seen the statistic, there’s hundreds or thousands in different verticals and segments. Some represent novel new upstarts with their new niche or focus and some represent incumbents digitalizing their value chains using online tools. It's easy to think, that there are too many platforms.

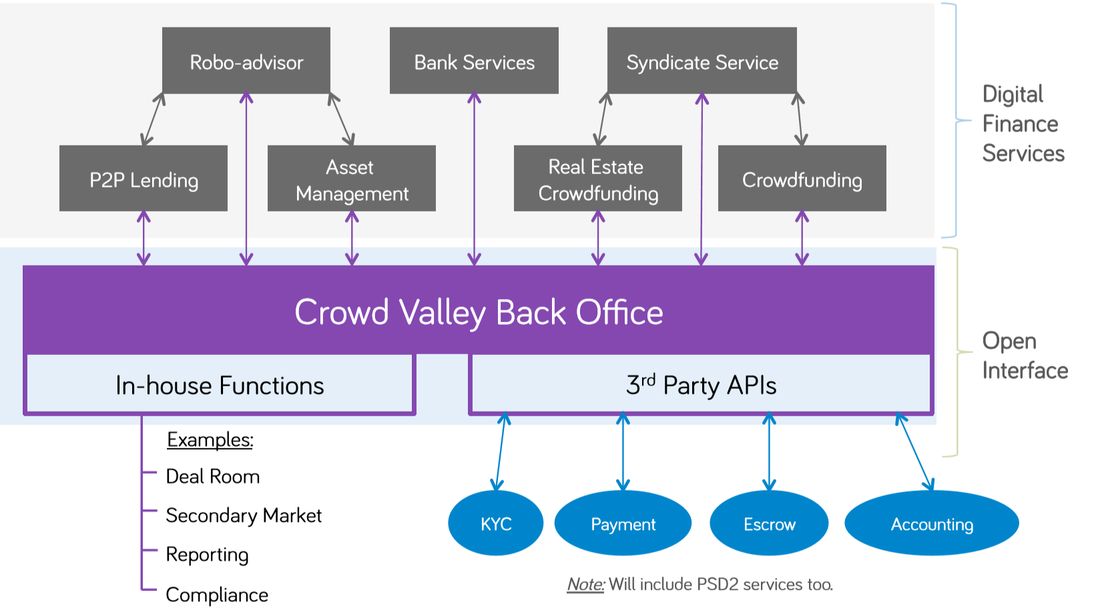

At the same time, a competing concept is the lack of connectivity and dominant isolation. Deals are often done in silo’s, syndication and deal sharing are rare and confined to whats in the proximity and cooperation and specifically its expansion is often a lesser priority, than getting the deal done. This isn’t the way a mature market works and is a characteristic of where the current market situation stands. More Platforms, Less Silos We believe deal makers from each asset class and asset strategy will become enablers in entering the digital market and find a broader ecosystem to access for more efficient deal making for their long term strategies. The concept of this ‘platform’ as an enabler fits directly as a core in businesses strategies, and sits at the very heart of deal making. The ‘platform’ is not a strategy in itself, at the end of the day it is a tool and an enabler for the company’s overall vision, making transactions and matches happen in the best way with the best outcome. Stage of the Ecosystem - Beyond Silo’s to Collaboration Stage 1: The first stage for many is the rollout of a new market model and attain a certain level of success using that model in the market. This requires adaptation from the company’s operating models and maybe more importantly a change in mentality in approaching the market. Stage 2: In the second stage, we will see more cooperation and partnerships also replicated with digital tools online. From deal sharing and syndication, to shared knowledge tools and market insight, existing partnerships will find ways to leverage their cooperation also in the digital domain with more efficiency and resiliency in their approach. Stage 3: In the third stage, we will see new, digitally native partnerships emerge where the partnership itself originates in the digital domain. This stage is longer term and after a digital integration of new business models, however it will have lasting and profound impact on the market models where cooperation will allow for new types of mechanisms around shared or partly shared origination and syndication. A Word on Trust Trust often comes up in online transactions. This is what I believe it will come down to, online tools offering a new way of making deals happen better than before where the concepts of trust are even more crucial than before and established using new technologies and tools. What’s the Missing Link? It’s not a question of too many or too few silos, it's ultimately a question of connectivity and volume. As more deal makers and finance companies choose to embrace and adopt digital tools, they will get to leverage the connectivity between deal makers of various kinds and ultimately close deals in a new and more efficient way. More deal makers, more networks and more connectivity brings the world one more step closer and shortens the distance for parties to find one another and execute on mutually aligned deals and strategies. Read the whole article on Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed