|

Since its implementation in November 2007, the Markets in Financial Instruments Directive (MiFID) has been the cornerstone of capital markets regulation in Europe. However, since its inception, not all benefits have been fed down to the end investor as envisaged. MiFID II is aimed to address the shortcomings of the original MiFID release and has been amended with measures as a result of the lessons learned from the financial crisis. In addition to upgrading the current regime for equities markets, the second Markets in Financial Instruments Directive proposes to extend this revised regime to a far wider range of product classes, including over-the-counter (OTC) derivatives and fixed income products. MiFID II will most certainly have a profound impact on the operations of financial institutions that distribute and trade financial instruments not only in the EU but globally as well due to the many cross-border implications of the directive. In fact, this legislation, which seeks to protect investors by significantly raising the standard for transparency on investment houses, will likely confound even well-intentioned trading organizations doing their best to comply with the directive, much like we are seeing with the EU's General Data Protection Regulation (GDPR). At the highest level, MiFID II requires firms to prove they have acted honestly, fairly and professionally in accordance with the best interests of their clients at all times. If questions about a trade arise, or regulators field potentially credible complaints of malfeasance, investment banks must show that they:

Article 16 of MiFID II indicates that firms must capture all communications that lead to a transaction, including all electronic communications—email, social media, telephone calls, etc.—as well as, interestingly enough, face-to-face meetings. Firms must also “take all reasonable steps” to ensure that communications do not occur on channels that cannot be captured. Most importantly, MiFID II is not just a compliance exercise. There are major strategic implications that could bring market opportunities and competitive advantage for those who start to plan in advance or potential revenue loss for those who fail to react. MiFID II must be aligned to a number of other regulations that are being implemented at a global, European and local (domestic) level. Therefore, many firms are responding by considering multiple related regulations, as for example aligning Dodd Frank, Basel III and Capital Requirements Directive (CRD) IV, European Market Infrastructure Regulation (EMIR), Market Abuse Directive (MAD) II and MiFID II under one regulatory change program with thematic workstreams across regulations. According to a PWC report, over the coming months, affected firms and businesses should conduct the following activities:

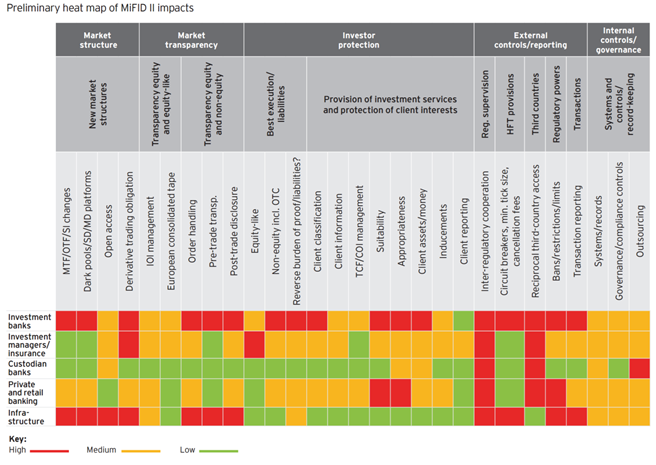

MiFID II will also command significant changes in business and operating models, systems, data, people and processes. As a result, a fundamental transformation will emerge. The biggest impact will be experienced by banks, broker dealers and trading venues. Additionally, investment managers, insurance firms, independent financial advisors (IFAs), custodian banks and other asset servicing entities will also need to undertake a substantial effort. One may certainly expect the UK’s financial services industry to be impacted by Brexit+MIFID implementation. However, the nature of the impact is quite debatable and as yet unknown and will depend on what model is eventually negotiated for the relationship between the UK and the EU in place of the UK’s current position as a full member of the EU. The general consensus is that the UK’s exit from the EU will not see major changes to UK financial services legislation deriving from the EU. The FCA made it clear in a statement in July 2016 that, as far as they are concerned, it’s business as usual for now. Read the whole article and more details on Crowd Valley Blog. Source: EY Report: Capital Markets Reform: MiFID II

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed