|

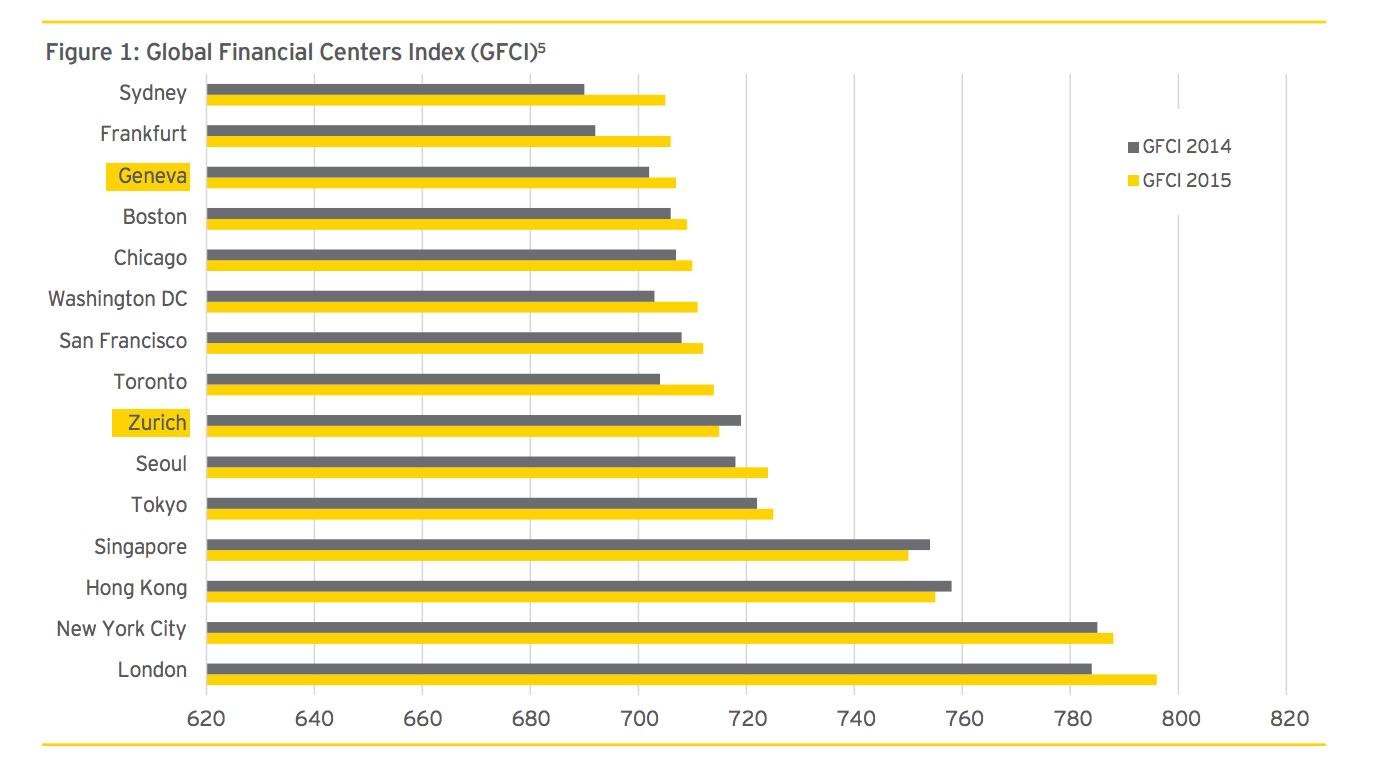

Switzerland, one of the most important global financial centers and home to more than 250 banks, is actually a small of nation of 8 million people, that you may associate with world class chocolate, luxurious watches, the stunning scenery of the Alps and lakes, as well as excellent education infrastructure and unrivaled living standards. Until a few years ago, Banking Secrecy was one of the main characteristics and key factors in the rise of the Swiss financial ecosystem, which boast not one but two cities considered among the top financial centers of the world (see chart below). According to the Global Financial Centers Index (GFCI), Zurich occupies the seventh position in the world, and it’s in the second position, just after London, in Europe. But a few places down, in 13th position, is another city flying the Swiss colors; Geneva.

Considering the loss of banking secrecy and the major commitment to technological development in other financial centers, like London, Singapore and New York, it is quintessential for Switzerland to adapt and innovate if the country wants to maintain the importance gained in the last century as a key financial center. The Swiss government and regulators are now trying to fill that gap with a package of new measures, approved on the 2nd of November, 2016 including what has been called a FinTech license. This license will simplify regulations for financial technology firms relative to those heavy requirements placed on banks and financial institutions. The package also includes a fintech sandbox, allowing companies to test new technologies in a safe space, as well as measures to boost crowdfunding. FinTech firms, with a minimum of 300,000 Swiss Francs (~ $297k) in capital, will be allowed to accept funds from clients, up to 100 million Swiss Francs (~ $99m) which remain outside the depositor protection scheme and are not subject to the same regulations, auditing and the capital requirements applied to banks. However the eligible Swiss financial technology companies won’t be able to make long-term loans, which remains exclusively for banks. The Swiss government has proposed to set a period of 60 days, where crowdfunding platform operators will be able to hold money from investors in settlement accounts. The government is also willing to remove the limit on the maximum number of people that can invest in a single fundraiser on a crowdfunding platform, with the current limit being 20. By removing the limit, it will be possible to have an unlimited number of investors participating in a fundraise through crowdfunding. Switzerland could be late on fintech but that is certainly not the case on overall innovation. The Global Innovation Index, prepared by INSEAD Business School, Cornell University and WIPO (World Intellectual Property Organization), ranked the country as the world's most innovative country since 2011, excelling in particular with its research systems and SMEs in-house innovation. Considering the strategic position of the country in Europe, both geographically and complemented by Zurich and Geneva as international financial centers, along with the new regulations and measures proposed to stimulate financial innovation, the fintech industry in Switzerland seems to have finally arrived and is poised to take advantage of excellent opportunities in the foreseeable future. If you’re interested in jumping into it before it’s too late, all you need to do is to contact us and we'll be glad to assist your entry into the Swiss FinTech ecosystem. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed