|

Diversity is one of the many aspects of business life that makes the United States so attractive to investors. There is no shortage of investment options available; from stocks to commodities and from municipal bonds to mutual funds, investors can always add new financial instruments to their portfolios.

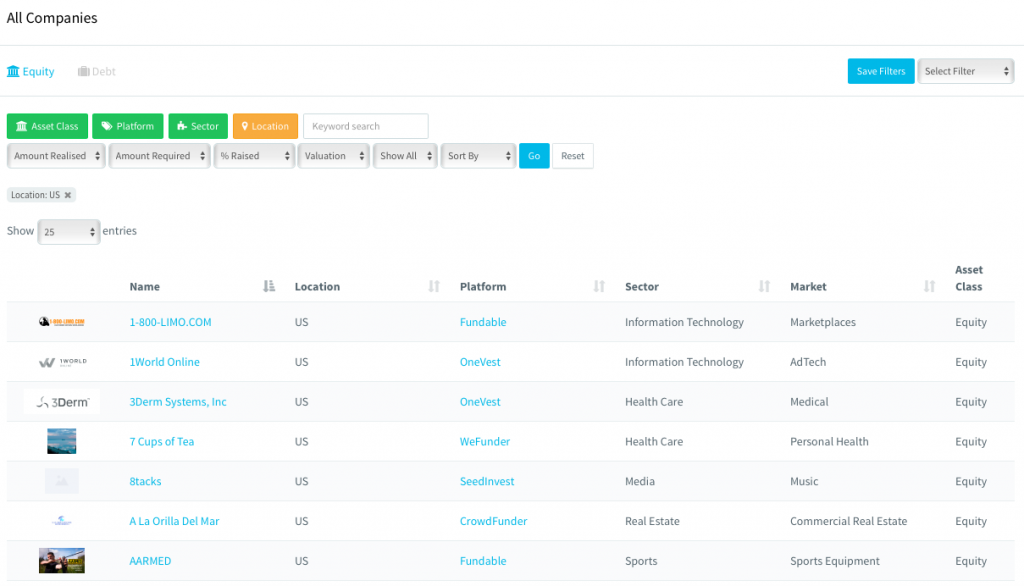

Even with all the regulated financial exchanges in the U.S., the small business community is mostly outside of the investment sphere. For all the attention that the financial news media gives to venture capital, investors do not usually find it easy to reach small business owners to inquire about investment prospects. Outside of Silicon Valley and the reality television series Shark Tank, small business funding is not generally exciting. For the most part, small business owners still believe that commercial loans from banks are their best hope for startup funding; this is despite the fact that American banks have sharply reduced this type of lending over the last few years. Thousands of entrepreneurs launch interesting startups each month, and yet only a few of them will make it past the first year of operations. Inadequate funding is one of the most common reasons behind the high rates of failure among American small business owners, and this can be blamed on the lack of diversity in terms of financing. With so many American businesses failing due to lack of funding, wouldn't it be great to have a marketplace where entrepreneurs and potential investors could interact with the benefit of regulation and oversight? Thankfully, that day has arrived. In 2015, the Securities and Exchange Commission approved a set of rules to govern equity crowdfunding; since then, investors and entrepreneurs have been meeting with some hesitation on a few online platforms while regulators observe the action and make adjustments. The adoption of equity crowdfunding is intrinsically tied to the legislation passed by Congress in the wake of the global financial crisis. As the situation stands these days, small businesses can raise up to a million dollars each year on crowdfunding platforms that have been vetted by the SEC. The new equity crowdfunding platforms add a layer of "free market democracy" for American investors, but what about small business owners? If you are an entrepreneur interested in equity crowdfunding for your business, you should become acquainted with the process of due diligence that is required by the online platform. Insuring your company should be the first step, but you should also become familiar with the financial statements that potential investors will be looking for. Equity crowdfunding does not have to be the final stage of capital raising for small American businesses. Venture capital firms are paying close attention to the Web-based crowdfunding platforms because it gives them a great opportunity to scout new investment projects. From within these platforms, startup companies may find angel investors who will one day take them to Wall Street. Read the whole article on TradeUp Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed