|

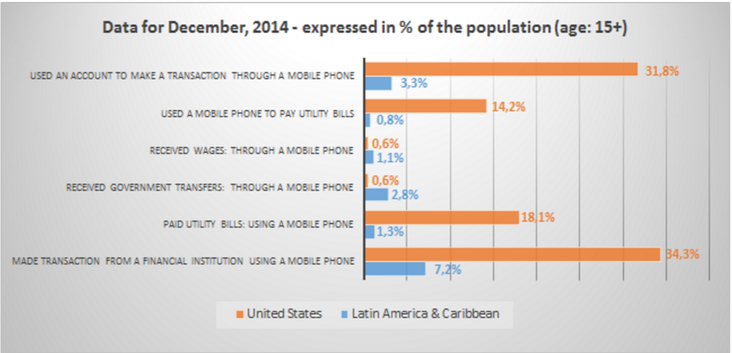

According to the World Bank’s Global Financial Inclusion Database, only 51% of the population in Latin America and the Caribbean has a bank account. This figure varies greatly between countries, with more than 80% of the adult population remaining ‘unbanked’ in Nicaragua for less than 35% in Brazil and Costa Rica. Furthermore, it means that millions of people have to use cash for each transaction across the continent. With for instance, 96% of the population paying its utility bills in cash – which is more than 3 times the level than can be observed in the United States or the Euro Area. Likewise, half of the population receive its wages in cash and overall, almost 40% of all wages are withdrawn right away. Far from what can be observed in the West: only 10% of the wages are received in cash, and between 4% and 7% of all wages are withdrawn right away. With so much cash circulating, issues of safety inevitably arise, and without a bank account it becomes harder to invest or save for retirement. Something even more problematic in countries known for the fluctuations of their respective currencies. Beyond the way Fintech disrupts existing models in Latin America, it is also becoming a way to achieve financial inclusion in the region. Mobile money services, credit ratings based on alternative data, new ways of financing SMEs, personal lending…if different in nature, innovative financial technology services are ways to bypass regional issues, and ultimately grant people and businesses an access to appropriate financial products and services. At Crowd Valley, we are already actively working in the region and look forward to partnering with both established organizations and new innovators to provide more services and value to the end users as the financial services market continues its modernization in Latin America. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed