|

Commenting on the announcement that the OCC intends to design standards that will allow fintech companies to be chartered as special-purpose national banks, Controller of the Currency Thomas Curry said: “More than 85 million young adults in America are entering the financial world with the majority of their financial lives still ahead,” he said. “They want technologies and services that provide better, faster, more accessible products and services, and they are willing to switch providers or use multiple providers to get what they want.”

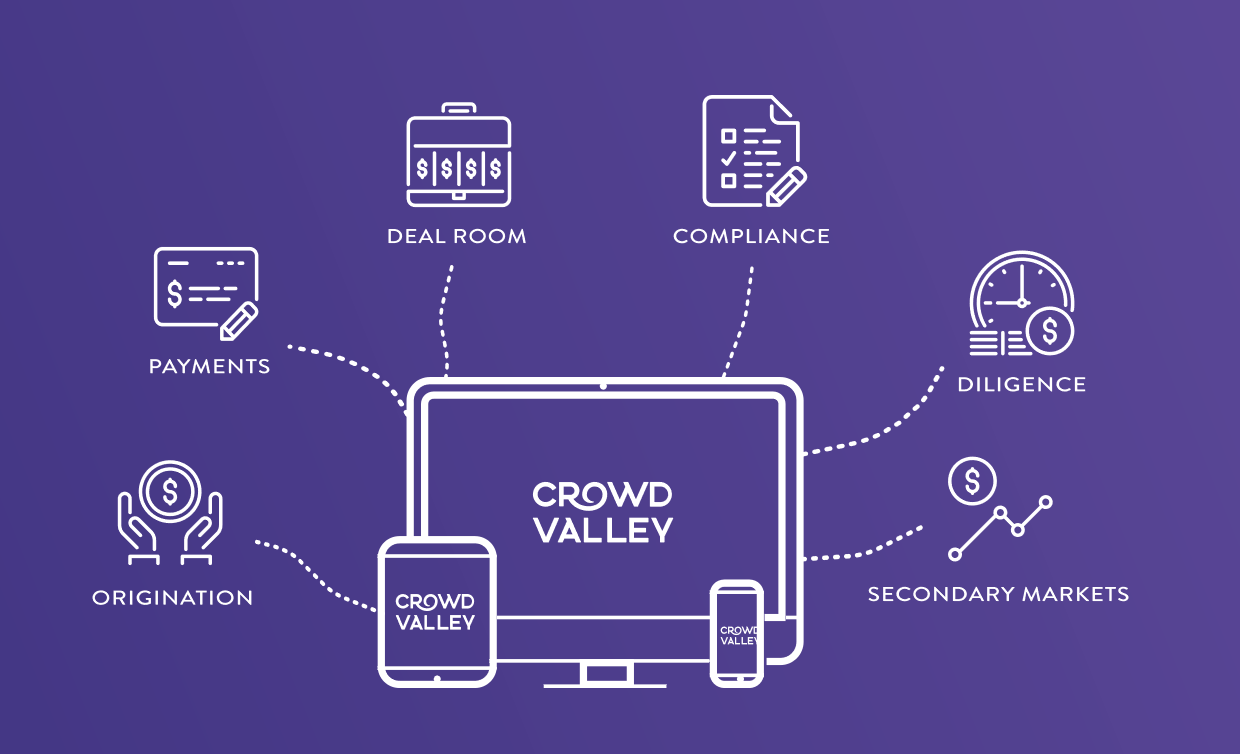

To get on the radar of this new customer base, credit unions should take advantage of technological innovation to increase focus on efficiency and the end user experience. That does not mean grabbing the latest fad off the market and implementing it with hope to seem “up-to-date”, but rather having a solid core platform in place with the option to allow third parties to utilize the platform to innovate and develop new applications on top of the credit union’s own solutions. A project to either digitize existing processes or launch new ones will never be the same for every credit union, however, there are several areas that need to be addressed before the implementation phase: 1. Setting up strategic goals and corresponding solutions. Depending on what issues a credit union wants to address via technological upgrade, the process can significantly vary. 2. Considering upgrading core processes first. Consider improving services critical to your members and revenue generation, such as lending. 3. Involvement of the legacy system. IT infrastructure in place is commonly found to be several years old and might not be suitable for current business needs. 4. Choosing a platform. Keeping in mind that high pace of innovation makes it more likely that we’ll witness new services and corresponding customer expectations emerging in the near future, it is worthwhile to consider open APIs (application programming interface) and a Cloud Back Office to keep all components in one place. 5. Finding developers. If the API provider offers a “sandbox”, the developers can test the platform to ensure a seamless operation process for the applications. 6. Reviewing fringe offerings. While traditional banking services – lending and taking deposits – remains at the core of credit union services, the open API enables other options. Read the whole article and more details on Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed