|

Borderless Finance is quickly changing the landscape for international financial flows asking more of the competitive players in this market while pushing for a reduction of the costs. Amidst this disruption, the consumer and entrepreneur continue to emerge as the beneficiaries.

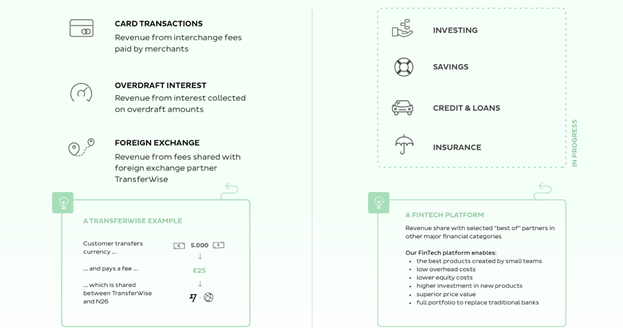

Institutions emerging in this space are representative of a large wave of technological advancement that is sweeping across a range of different institutions and asset classes, introducing new models and ways to monetize assets in a more efficient, accessible and inclusive manner for the entrepreneur, consumer and average investor accompanied by the complementary rise of infrastructure provider pushing the bounds for innovation. German Fintech startup, N26 has brought borderless banking to mainstream consumers with a focus on a comprehensive mobile experience. Customers can open a bank account – linked to a MasterCard – from their smartphone, and complete the process within eight to ten minutes. The MasterCard can be used worldwide without any fees at all. Valentin Stalf, Founder and CEO of N26, stated: “Our vision from the start has been to build Europe’s first bank account for the smartphone. We see traditional banks as having failed to adapt to the demands of the digital generation. The response to Number26 has been fantastic and we’re thrilled to expand to further markets.” N26 account holders can make transactions and withdraw cash anywhere around the world without ever being charged for the service. Your entire banking needs are catered for through the app, even setting up of your account, something which is a painful process in any regular bank around the world. Your account is setup via a video call from your phone during which you will be asked to present identification for scanning. In terms of a business model, N26 offers free ATM withdrawals globally by taking on the withdrawal fee that their customers would conventionally bear. Considering the above listed revenue model, N26 is able to cover the fees that would be traditionally covered by customer from the earned revenues. Digital Finance/borderless institutions such as N26 are able to do so as result of there being a relatively low overhead operating cost. This did, however, lead to complications when a number of customers would use their free account exclusively for a large number of monthly withdrawals. This is because N26 utilizes a “attract customers with one thing, then sell them another” whereby customers are monetized via extra products and services around the base account such as international transfers or overdraft and in the future savings or investment products, etc. N26 is not alone in pursuing this model with Fidor, Revolut and Tandem utilizing similar models or set to incorporate it in the near future. As to how this business model addresses market demand and consumer sentiment, there does seem to be some discrepancy with regards to the assumptions employed in the novel business models, especially with regards to consumer behavior. While initially offering a free service for the offerings other than for a credit card and USD debit/credit card, Revolut introduced a "fair usage" clause that charge some fees above certain thresholds , such as a 2% levy on ATM withdrawals above £500 a month. This seems analogous to the response N26 had when their consumer base took undue advantage of their free cash withdrawal feature resulting in N26 bearing too high of a cost in covering the withdrawal fees. N26 had originally decided to cover this fee with the assumption that most customers would use their accounts and this benefit, reasonably. Hence now, they charge a fee for monthly withdrawals over 500 Euro. Sound familiar? Another major player in this space is TransferWise, who originally launched the ability to make international cross border transactions at a fraction of the price offered by banks and other traditional financial institutional and service providers. It remains to be seen whether TransferWise has found a longer term sustainable model but considering that TransferWise doesn’t actually bear the costs on behalf of its users and that they have captured a large share of the cross border transaction market from the banks is perhaps indicative of the fundamental strength of their venture. The company manages to offer its services so cheaply by matching up payments with those going the opposite direction using sophisticated software. So "your" money never actually leaves the country — it's rerouted to someone who's being sent a similar amount by someone overseas. Your foreign recipient, meanwhile, receives their funds from someone trying to send money out of their own country. So in actual execution, there is no cross border transaction taking place but the system is actually an efficient reallocation of funds within the ecosystem of fund transfers. The new borderless bank accounts are built upon this fundamentally simple infrastructure. Transferwise has local banking partnerships and a global network of banking accounts which, when coupled with their cross border money transfer system, allow funds to be deposited into local bank accounts in the local currency utilizing the efficient reallocation that was their original product. Essentially, they’ve added end points or deposit points to their original system which is why they can continue to grow and offer their services at such a low cost. Where their money comes from is similar to the business model utilized by N26, wherein customers are monetized by the additional services and products to the base account. In TransferWise’ case, the only times you are charged are when you convert money between currencies in your Borderless Account, send money to a bank account in the same or a different currency. They can just as easily integrate third party services such as auto loans and mortgages to truly capture the banking space. The fees charged are fairly low and the logic behind is very transparently conveyed to the customers. This facility is a true catalyst in facilitating international flow of skills, services and goods with firms placed anywhere in the world now able to easily acquire and remunerate their suppliers and employees locally, reducing the monetary and logistical speed-bumps that may prevent the most efficient utilization of skills or service providers across international borders. if you move money from one TransferWise country account to another or any of the 15 internal currencies supported, or if you make an international money transfer, you will only ever be charged the standard TransferWise ‘mid-market’ exchange rate and commission, with no minimum fee, which works out much more competitive than incumbent banks. Initially the new service will only be available for small businesses, sole traders and freelancers in the UK, Europe and — from June — the US. But TransferWise plans to make it available to consumers in the three markets later in 2017. Such innovation while advertised as a borderless account actually breaks down borders that exist between different business communities and allow for easier cooperation and synergy globally. When TransferWise does launch a card, however, it puts the Fintech unicorn squarely in ‘neobank’ territory and in competition with a slew of startups offering a banking experience, including Revolut, whose banking account is built on the promise of low exchange rates and targets consumers with a “global lifestyle”. TransferWise’s main target here, however, is undoubtedly the incumbent banks, and initially the rather neglected SME or sole trader market, for which the need to receive and make payments in multiple currencies and to and from different countries is increasingly a requirement. The impact of borderless banking of this sort is significant in enhancing the purchasing power of the global consumer base in mitigating the obstacle of service and product provider not accepting an international bank. TransferWise shares this borderless finance space with Revolut that launched in July 2015 allows conversion of currencies at the interbank exchange rate utilizing a prepaid MasterCard. Like TransferWise they also offer multi-currency business bank accounts and now international money transfers for free up to 5000 pounds. Another example of such forces at work is, the partnership of the Estonian e-residency program with the Finnish Fintech company Holvi allowing a completely borderless digital banking experience for entrepreneurs in the EU. This means a EU company with complete EU business banking and payment card can be established entirely online. This provides the perfect catalyst for large scale business growth with low start-up costs for establishment of a potentially thriving business. Such environments break down bureaucratic costs that deter small business owners with ideas as well as allow individuals to navigate roadblocks such a reluctance to work within certain emerging markets. While the response to institutions such as N26, Revolut and TransferWise has been fantastic, it is impossible to void the legacy banking system. Despite persistent issues around inefficiency, exclusivity and high fees, there continues to be a strong inclination for the brick and mortar institution which can be attributed to a preference for a more tangible and face-to-face human experience highlighting the value consumers see in human interaction. At the same time, the borderless finance institutions discussed in this piece are able to offer attractive fair alongside a range of base free services due to innovative technological models and minimal operating costs. However, taking into account statistics like the ones below it can be inferred that these institutions, at least in the immediate term, do lose out on elements and value of the conventional institution:

The borderless digital finance revolution changes the playing feeling with a dynamic approach to financial inclusion and consumer experience. N26 users can now get a credit line in under 5 minutes. As mentioned earlier, the Estonian e-residency program’s partnership with Holvi is a major catalyst for small business growth across the EU. The proliferation of services that continue to evolve with the consumers’ needs is reaching a point of disruption for the banking sector where the incumbent institutions are being forced to commit time and resources to change the way they interact with consumers and consumer data but are bogged down by their legacy systems and massive scale. But as borderless FIs continue to make moves to tackle consumer and business issues such as exclusive and outdated credit models, expensive cross border business transactions, for goods, services and labour, and obstacles for business growth and personal investment, the scales and statistics are sure to tip in favour of the new kids on the block, complemented by increasing global digital, Fintech and internet adoption. To top it off, the unpredictable innovation that has been borne out of the great recession has found answers to pain-points every step of the way so it is likely that the brick-and-mortar human element will be addressed soon enough down the line. And as iterated in the first paragraph of this piece, whether it’s the spread of the borderless finance revolution or the reformation of the traditional banking sector, it is the consumer and the business owner that wins. Crowd Valley prides itself in its commitment to supporting both consumers, investors and institutions bridge the gap that exists between in the lending, borrowing and alternative finance space by optimizing tools that work at the fundamental level of financial services and would be more than happy to discuss how our infrastructure can support your ideas and entry in the digital finance space. This article was first published on Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed