|

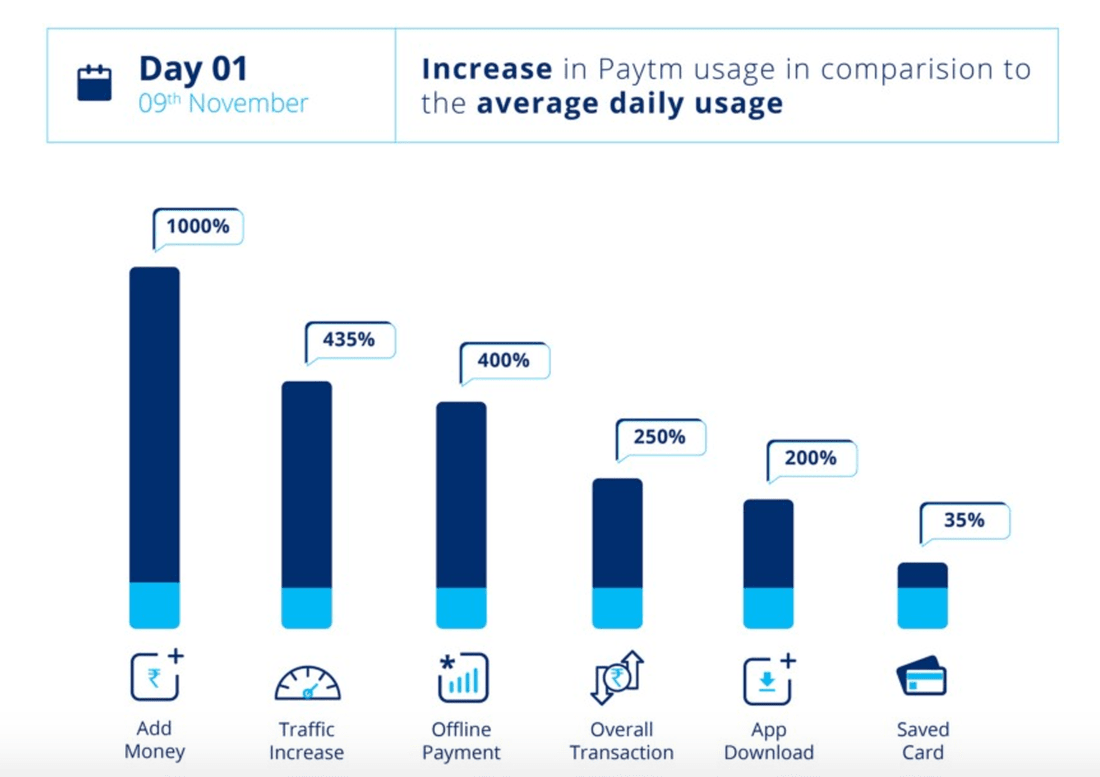

With the recent implementation of the demonetization rules by the Government of India, a lot of interesting events have taken place in the day-to-day life of the Indian masses. With the largest denomination bank notes of Rs. 500 and Rs. 1,000 taken out of circulation, that accounted for about 86% of India’s cash circulation by value, people were forced to explore alternative routes like online banking and e-wallets as their cash alternatives. For those without any bank accounts or access to internet/online services, this event triggered additional hardship to deal with as they’d face long queues at banks to get their currency deposited or exchanged. Even with the inconvenience caused, this decision is largely welcomed by the masses in a bid to curb the counterfeiting and proliferation of black money that has plagued the Indian economy for a long time. In one of his recent rallies, the Prime Minister of India, Narendra Modi, encouraged the country to adopt a cashless economy by using digital payment options like wallets, online banking, debit and credit cards, etc. He also urged the business traders to take this opportunity to join the digital world. Demonetization has certainly sparked a surge in adoption of cashless alternatives but the uptake for the majority of the masses seems lukewarm. For India to go truly cashless and sustain that kind of economy, we need to look at the various aspects required to support its digital infrastructure. According to the Telecom Regulatory Authority of India (TRAI), the total internet users in India are around 350 Million (approx. 27% penetration), surpassing the US and is only second to China. According to Counterpoint Research firm, India currently has over 700 Million mobile phones, out of which 250 Million are smartphones. NASSCOM estimates 50% of travel transactions in India will be made online by 2020. Also, according to Worldpay’s projections, the Indian e-commerce market is predicted to reach $63.7 Billion by 2020 and overtake the US by 2034, becoming the world’s second largest e-commerce market. According to the Reserve Bank of India report, there were 1.46 Million PoS (Point of Sales) machines in use in India, which means 856 machines per million people. To incentivize banks and manufacturers of PoS terminals, the government has waived-off some percentage excise duties on these machines. India’s Fintech market is expected to grow by 1.7 times between 2015 and 2020, according to this report. According to the Reserve Bank of India (RBI), at present, the financial inclusion in India is low, where 145 Million households still do not have access to banking services. RBI has come up with a plan for financial inclusion, which aims to set the path for 90% financial inclusion in India by 2021. In a report by Statista, the transaction value for the Indian Fintech sector is estimated to be approximately $33 Billion in 2016 and is forecasted to reach $73 Billion in 2020 growing at a five-year CAGR of 22%. As per KPMG, the Fintech investments in India increased mani-fold from $247 Million in 2014 to more than $1.5 Billion in 2015. With the reducing costs of internet data plans and smartphone prices, and with the Digital India and Smart Cities initiatives by the Government to promote digital infrastructure development in the country, the driving force behind adopting a cashless economy looks promising in the coming years. Crowd Valley (a Grow VC Group company) is committed to transform the financial services landscape with its API framework and is keenly interested in helping the Indian Fintech ecosystem grow. Read the whole article on Crowd Valley News. Image source: Paytm Blog

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed