|

Telecom carriers have looked for a role beyond the bit-pipe for years. Now it looks like the evolving TV and content business is a new game that they want to participate in. Netflix and Amazon are leading the streaming business globally and have stepped to produce their own content too. Now there are signs that some carriers want to enter this business. But consequences can be complex to evaluate.

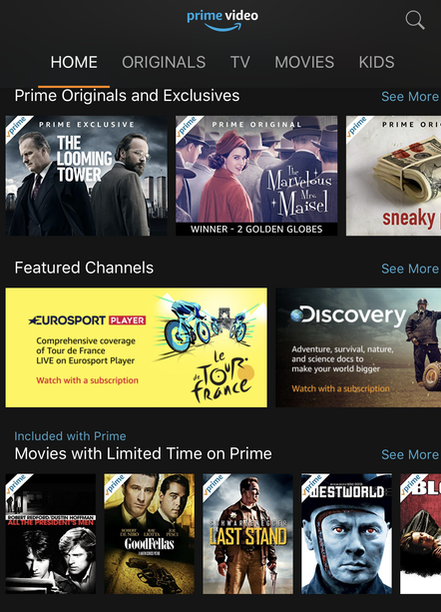

In the US AT&T has tried to merge with Time Warner, but the merger is now a legal battlefield. There are also other similar activities around the world. Maybe the latest one is that Sweden's Telia is talking to acquire Bonnier Broadcasting that owns TV channels and production in Nordic countries. Vodafone just acquired cable networks in Central and Eastern Europe from Liberty Global. Some operators are also in the pay-TV business and even started to produce their own content. The timing is interesting for both parties. Carriers are still looking for value-added services. At the same time broadcast media companies have really started to feel the impact of Netflix and Amazon and other content from the internet. They lose viewers, and advertising money follows. For a longer time it has looked like streaming content is one interesting business opportunity for carriers. People are now ready to pay for good content. An additional opportunity is to bundle data and content, such as by offering ‘free data connections’ for a carrier’s own content services. It is a way to tie in customers. In principle, this sounds good. But as the AT&T and Time Warner case also demonstrated, this kind of vertical mergers can be complex for competition and consumers. We have several questions, like:

How well carriers are able to run this business in practice is its own question. Carriers’ track records in expanding to other businesses is not very promising, and often they ramped down or divested non-core activities. Carriers must at least accept that the media business is very different business from the network infrastructure business. Globally it looks like there will be strong global content companies, like Netflix and Amazon. At the moment, it looks like the vertical mergers are not really a threat to them, they are strong enough. The media and carriers' mergers can be a bigger threat locally and, for example, in certain language areas. At the same time, someone can argue that Netflix and Amazon could become globally dominant players, and it is actually good to get serious competition from Media-Carrier firms. Disney’s acquisition of 21st Century Fox is another example of media consolidation. The competition authorities have commented that horizontal deals are not such a threat as the vertical ones for the competition. But it also indicates that media and content firms are preparing for a new era of competition. There is an old saying that the TV content and distribution business is an example of how one strategy can work only for some time. The past has shown that if a winning strategy seems to be to own cables to customers, then a distributor gets the rights to such a content that every one wants and they start to dominate the value chain, until the best content producers start to dominate it by dictating the terms of the market. So, it is a never-ending pendulum in the value chain. But if you own the whole value chain, which can be the result of vertical mergers, it will be very different game, or no game at all. The article was first published on Telecom Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed