|

Grow Advisors (a Grow VC Group company) publishes its daily insight into the world of alternative finance and fintech. Here are some highlights:

The fast growing European Alternative Finance Market France, Germany and the Netherlands are the top three countries for online alternative finance by market volume in Europe, excluding the United Kingdom. The French market reached €319m in 2015, followed by Germany (€249m), the Netherlands (€111m). The Nordic countries collectively pulled in €104m, while Eastern & Central European countries registered a total of €89m. The UK still dominated the European online alternative finance landscape, increasing its overall market share of Europe to 81% in 2015 with €4,412m. 5 Themes Driving Digital Transformation in Banks

How organisation design can boost digital execution A common management expression you may hear in many operational situations is ‘execution trumps strategy’. In the digital world, we have seen this expressed as ideas are worthless; execution is priceless. Read more at Grow Advisors Blog. This is not a soft question, it’s actually the most challenging one you could ask. It could be the key to creating a sustainable and thriving business. This question is relevant also for fintech services. Head of Vision at Grow VC Group, Alan Moore,is bringing his experience of how to craft beautiful businesses, when he helps companies to develop better business.

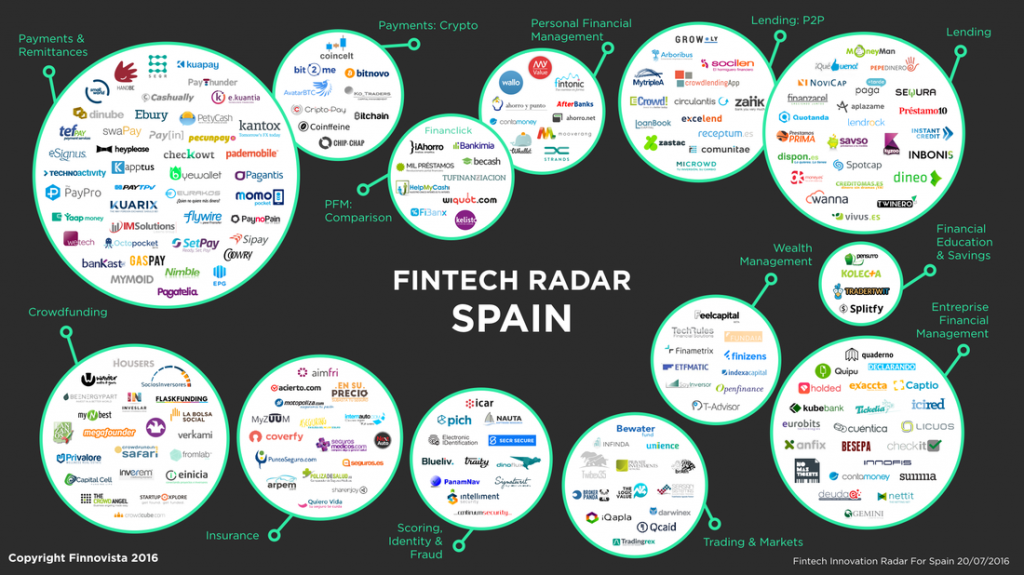

The challenge to embrace what is real The search for beauty challenges you to see more deeply. By focusing on beauty you are not being soft or touchy-feely; on the contrary, you are demanding rigour and discipline. As philosopher poet Ralph Waldo Emerson put it, “Beauty gets us out of surfaces and into the foundation of things”. It’s not an escape from reality, but an intimate embrace of it. If your business were more beautiful… What would be different about its culture? Is it possible for a business to do workaday, mundane things, but still in a beautiful way? How would leadership work in a more beautiful version of your business? These are the sort of questions Alan is asked as he tours with his book - Do Design. Why beauty is key to everything. The book explores how the idea of beauty applies to businesses from high tech to axe-making. If you find these questions intriguing, please join us and others who do so too. We’ll be gathering to enquire, explore and create, together. You might be stuck in working out what direction to go in. Or seeking a more inspiring vision. Or trying to find new ways to make money. Or working out what your new technology can truly give to the world. You might be launching a precious new business, or working to rebuild an old one. Or a thousand other things besides. Read more and register here for a gathering in a beautiful old church in Bishopsgate, London. Fintech has not been on the radar in Spain long, it was long not known by most of the people and with just 50 financial technology companies, and with few successes. But things have improved quite rapidly and accordingly to Fintech Radar Spain 2016, prepared by Finnovista, the sector can now count 208 startups, with a 400% increase in just three years, and few players that are making waves.

The fintech industry has growth at an impressive rate, not just in Spain but also in other parts of the world, presenting an opportunity for the country to modernize the financial sector and the banking system. What’s interesting about Spain in particular is that it has seen a growth in the whole technology sector, despite the economic crisis that has gripped harder than in most of other countries, and the confused political situation. But it’s not only the recent successes and the abundance of talent that makes Spain well positioned with Fintech, it’s also about the role that it can play with the LATAM countries, on which its connections are always strong. With 208 startups, Spain is now the largest fintech market in Ibero-America, followed by Brazil with 130, Mexico 128, Colombia 77 and Chile with 56 financial technology ventures. With 80% of fintech startups offering products and services for consumers (B2C), this presents a clear threat or opportunity for those ready to take it, for Spanish banks. Some banks are leading the way, for example BBVA that has created a $250 million fintech fund, and bought two financial technology companies in the last year - Simple, an American online-only bank, for $117 million, and Holvi, another digital bank this time from Finland, for an undisclosed amount - it seems clear that most traditional financial players still have to realize the big opportunity they now have with this new wave of innovation. More cooperation, partnerships, and acquisitions are in sight, not only in Spain but also elsewhere, as banks, insurance companies and more in general all the traditional financial players, are on a steep learning curve. Think for example about the 600 bank branches that have been closed down in Spain in 2015 alone, that the sector has no alternative but to embrace technology and innovation for more growth. Read the whole article on Crowd Valley News. In a post published on our blog last year, we described Islamic Finance as 'one of the next frontiers of crowdfunding', saying that we could certainly expect to see more and more ‘digital investing conducted under Islamic Finance principles’.

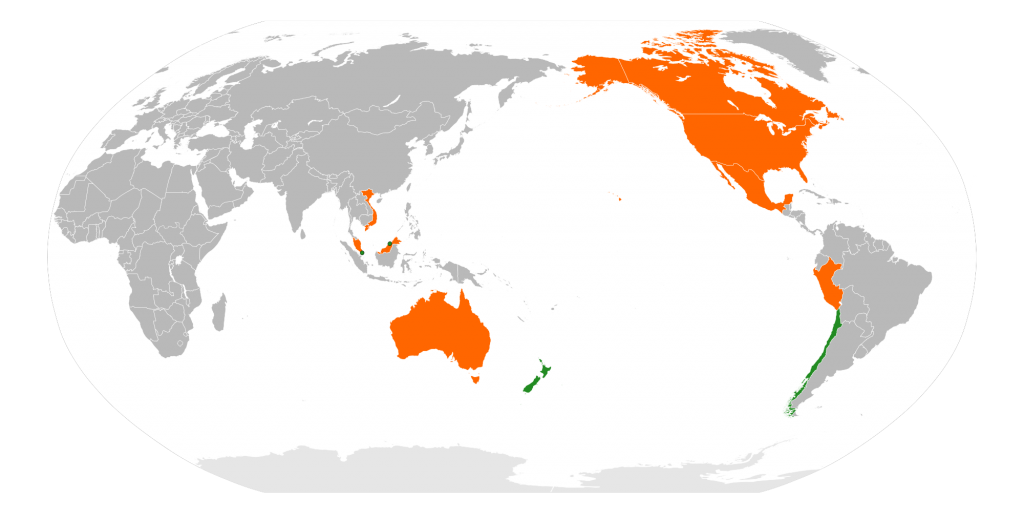

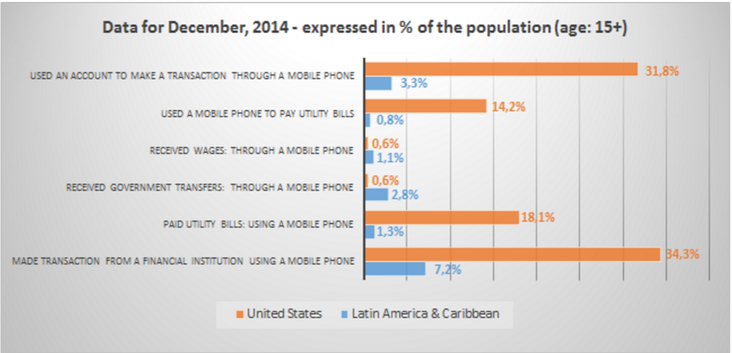

Striking as it is, the utilization of financial technologies to enable the growth of a millennial sector shouldn’t come as a surprise: looking at the history of Islamic Finance, the sector has always benefited from financial innovations - sometimes even pioneering them. The Suftajah for instance was an answer to the need to secure the integrity of money transactions. This form of bill of exchange or letter of credit later became the foundation on which many other financial instruments in use today were developed. According to the IMF, Islamic finance assets grew from $200 billion in 2003 to $1.8 trillion at the end of 2013, making it one of the fastest-growing sector within the financial industry. And yet, Islamic Finance still represents less than 1% of the global financial industry, which leads analysts to predict this market to reach a stunning $3.4 trillion by the end of 2018. Today, 5 countries (Malaysia, Saudi Arabia, the UAE, Kuwait, and Qatar) hold more than 60% of the global Islamic Finance assets with a clear gap between the top two (Malaysia and Saudi Arabia) and the rest. Indeed, both countries respectively own more than 20% of all Islamic Finance assets. The vast majority of those assets can be found in Islamic Banks (this segment representing more than 75% of global assets), but other fast-growing segments are of significant importance. The Sukuk market for instance: representing 18% of global assets, Sukuk is a product similar to asset-backed securities, except that it doesn’t pay interests and its performance is entirely linked to the one its underlying assets. In that spirit, the first Islamic banking internet-based platform that combines the expertise of Islamic banks and the efficiency of technology was created in Malaysia. The Investment Account Platform is backed by six Malaysian Islamic banks, and its purpose is to become a central marketplace to finance SMEs whose activities fall within the Islamic law. In the words of Muhammad bin Ibrahim, governor of the Central Bank of Malaysia, this initiative “opens up new possibilities for improving efficiencies, reducing wastage and enhancing the customer experience”. Ultimately, it will provide “opportunities for industry players to radically transform operational models by adopting digitization strategies that will be able to deliver much greater scale”. At Crowd Valley, we look forward to partnering with both established institutions and new innovators to provide more services and value to the end users as the financial services market continues its modernization in the Islamic Finance sector. Read the whole article on Crowd Valley News. There has been no shortage this presidential election of talk of the effects of international trade agreements, and specifically the Trans-Pacific Partnership (TPP). The TPP has long been a priority of President Obama and is currently awaiting ratification. Congress granted the President "fast-track" authority, meaning lawmakers can only reject or ratify the finished product without any additions or amendments. But what is exactly is the TPP? The TPP is regional trade agreement with the aim of lowering tariffs and fostering trade among the 12 member nations, including: The US, Mexico, Canada, Peru, Chile, New Zealand, Brunei, Sinapore, Malaysia and Vietnam. Around 18,000 tariffs will be affected in some way after ratification. This includes a large perecentage of manufactured goods and almost all US farm products. It is still largely up in the air whether or not the TPP will be ratified under President Obama or if lawmakers on both sides of the aisle will elect to wait until after the November election. Read more on TradeUp Blog. The Global Fintech Hubs Federation (GFHF), has been announced on August 25, 2016, on initiative of Innotribe and Innovate Finance, to foster innovation across the world’s financial services industry and help startups and institutions gain visibility into new markets. Stakeholders from more than 20 cities around the world, including London, Shanghai, Frankfurt, Istanbul and Nairobi, have already decided to join the federation, with more groups to come. The declared mission of this new federation, that will be formally launched next month at the Sibos conference in Geneva, is to foster engagement amongst the global fintech ecosystem, share best practices and standardize knowledge and build bridges for greater collaboration between fintech hubs. The hubs will be ranked taking into consideration various criteria, including the amount of capital available, the ease of starting business, the talent pool available in the area, and how financial technology is regulated. The aim of this should not be to make them compete with each other, but to benchmark the best practices in order to grow the entire federation. GFHF will be funded with sponsorship from professional services firms and every member will potentially have the possibility to lead the federation as the plan is to have an annual revolving chair. Read more on Crowd Valley News! According to the World Bank’s Global Financial Inclusion Database, only 51% of the population in Latin America and the Caribbean has a bank account. This figure varies greatly between countries, with more than 80% of the adult population remaining ‘unbanked’ in Nicaragua for less than 35% in Brazil and Costa Rica. Furthermore, it means that millions of people have to use cash for each transaction across the continent. With for instance, 96% of the population paying its utility bills in cash – which is more than 3 times the level than can be observed in the United States or the Euro Area. Likewise, half of the population receive its wages in cash and overall, almost 40% of all wages are withdrawn right away. Far from what can be observed in the West: only 10% of the wages are received in cash, and between 4% and 7% of all wages are withdrawn right away. With so much cash circulating, issues of safety inevitably arise, and without a bank account it becomes harder to invest or save for retirement. Something even more problematic in countries known for the fluctuations of their respective currencies. Beyond the way Fintech disrupts existing models in Latin America, it is also becoming a way to achieve financial inclusion in the region. Mobile money services, credit ratings based on alternative data, new ways of financing SMEs, personal lending…if different in nature, innovative financial technology services are ways to bypass regional issues, and ultimately grant people and businesses an access to appropriate financial products and services. At Crowd Valley, we are already actively working in the region and look forward to partnering with both established organizations and new innovators to provide more services and value to the end users as the financial services market continues its modernization in Latin America. Read the whole article on Crowd Valley News. The adoption of equity and debt crowdfunding has left most if not all policy makers and regulatory bodies challenged to find the right framework to properly regulate the array of platforms launching into the market. These platforms have given accredited and retail investors alike access to alternative investments they would not otherwise have. One area overlooked by most investors and now being addressed by regulatory bodies is investment liquidity.

The first regulatory commission to have an open sandbox discussion is the UK’s FCA. In the most recent “Call for Input”, liquidity was referenced a number of times within the review of lending based crowdfunding. Liquidity in equity crowdfunding has been a hot topic earlier in the year. This open conversation and eventual drafting of regulation will no doubt mirror how other countries solve this issue. Crowd Valley’s close cooperation with the FCA and UK crowdfunding market already sees its clients utilizing the secondary market API developed in anticipation of the markets needs and potential regulatory policy. Other crowdfunding pioneers like Crowdcube have recently committed to providing increased liquidity and access to a secondary markets for their investors. We anticipate other countries like the US, Singapore, Malaysia, Japan and Canada to adopt similar framework in the near future. This also opens up the opportunity for tertiary digital finance businesses to pair with existing platforms to aggregate their secondary market opportunities. There are already examples of data aggregators such as Deal Index in the market. With the personal view of great future opportunities in primary and secondary market deal aggregation being facilitated by the “API economy”. If you are looking to capitalise on collaboration within the fintech space, get in touch with us at Crowd Valley to leverage our full offering and industry leading Digital Back Office that bridge the gap into fintech. Read the whole article on Crowd Valley News. The Fintech O2O initiative began in 2015 as a monthly meetup in Hong Kong, co-organized by Cyberport and NexChange. The idea was simple – bring together like-minded professionals who recognize the impact of technology on traditional finance to network and discuss pressing topics. The initiative has welcomed 2,000+ professionals from 20+ countries. Now in its second year, the initiative has grown into a global series with events planned in New York, London, Toronto and Shanghai.

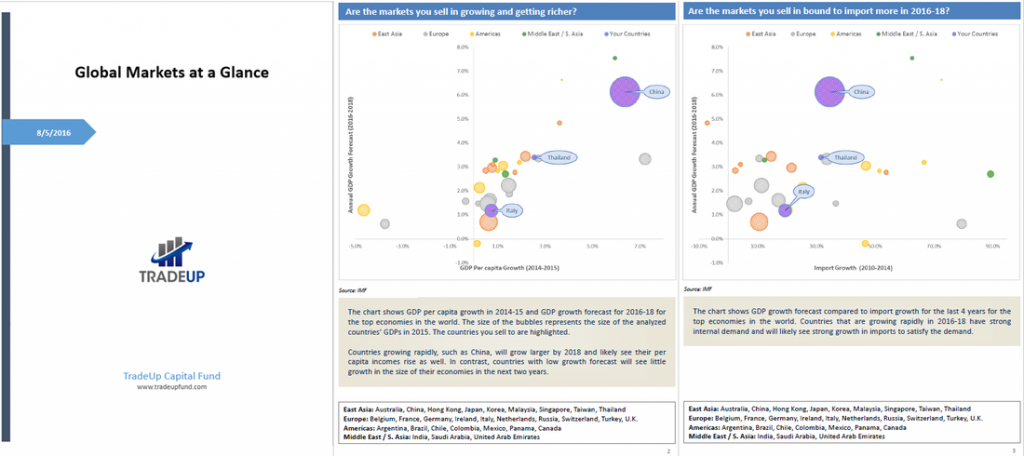

Grow VC Group Founder and Chairman Jouko Ahvenainen is a key note speaker in the event. His topic is "Bringing traditional finance and fintech together: Can’t Fight This Feeling Traditional finance and fintech don’t need to constantly be at odds. Can’t we all just get along?" Mr. Ahvenainen talks about digital hybrid finance models that combine fintech and traditional finance services, and make finance services more effective, transparent, and democratic. To continue to serve the community in Hong Kong and globally, Fintech O2O is setting the stage for its first multi-day conference. Register now to join 400+ professionals and 35+ speakers from 35+ countries! When: Tuesday, September 27, 2016 at 9:00 AM - Wednesday, September 28, 2016 at 4:00 PM (HKT) Where: Hong Kong Island - L3, Function Rooms 3, Cyberport 3 (Core F), 100 Cyberport Rd, Hong Kong, Hong Kong , Hong Kong Island, Hong Kong To see the list of speakers, the agenda and to register for tickets, click here. Sign up now for Global Markets at a Glance by TradeUp, a free tool for companies expanding abroad.

TradeUp is committed to helping SMEs and startups raise the growth capital they need to get into markets around the world.

Sign up for your free customized report here. Learn more here. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed