|

With its high GDP, 2nd highest e-commerce volume in Asia and high rate of technological adoption, Japan presents a high potential for Fintech investment and adoption. However, the uptake has been lukewarm so far, owing to significant cultural and regulatory obstacles with Japanese investments accounted for only 0.40 percent of the roughly US$12 billion invested into Fintech globally in 2014, according to a report by Accenture.

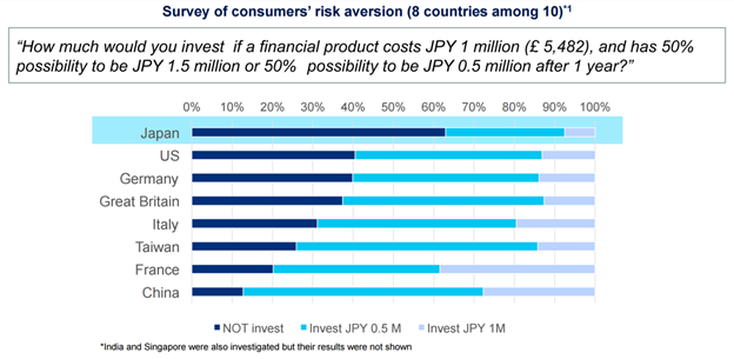

However, with efforts being made by incumbents and the FSA, 2017 is poised to be a potentially mercurial year for Japanese Fintech with the 2020 Tokyo Olympics representing a key trigger to accelerate legal revision and inject momentum into the Fintech industry. With the West continuing to display consistent growth and adoption of financial technology, there are significant changes afoot within the institutional and regulatory framework to act as catalysts for Japanese Fintech growth. The changes are part of a national effort to push financial technology, highlighting fears in Tokyo that Silicon Valley could damage Japan’s banking sector as it did the country’s mobile phone industry in the past. “Japanese institutions are concerned that a Google Bank or Facebook Bank will conquer Japan,” said Naoyuki Iwashita, head of the Fintech Centre at the Bank of Japan. It also means that Japan could become a big new source of capital for startups, especially in Asia, that are experimenting with technologies such as Blockchain or Artificial Intelligence. Yasuhiro Sato, Chief Executive of Mizuho told a conference in Tokyo in October 2016 that Japanese banks had been constrained by regulators wanting to preserve old, but tried and tested, IT systems. IT investments by Japanese financial groups have historically stagnated at around 3%, a level well below their global peers. This can partly be explained by the lack of support towards innovation from senior management, and, most importantly, by the legal limitation on banks’ IT investments. Until recently, the Banking Act prevent Japanese banks from having a stake higher than 5% stake in an non- finance-based company, limiting them from investing heavily in Fintech startups. Taro Aso, Deputy Prime Minister, suggested that some of the same spirit from the West needed to be instilled in Tokyo. “We have revised the Banking Act and, through the revision, people in banks, in business suits work together with young people in T-shirts and jeans. They work together and the combination of this gives rise to new things.” He added: “The financial ministry which used to regulate the industry must now nurture the industry. We are making efforts towards this end. We haven’t done enough but with this new policy we have greatly changed our thinking in approaching the issues.” Beyond the Banking Act, Japan has also taken other steps forward, like recently legislating to regulate digital currency exchanges in the country and establishing a number of working groups involving the Bank of Japan and the Ministry of Finance. But there is still a lot of bureaucracy to get through in order to launch and grow a new company. The regulatory environment in Japan ties in closely with the prevalent culture towards banking and investment. Traditionally, Japanese people have been seen as risk averse with regards to banking and investment practices. Over 52% of personal assets are composed of cash and deposits, with 0% interest. This is complemented by a lack of financial literacy that hinders investment and makes it harder for Fintech services in the wealth management and investment sectors to grow. This same trust is seen in the massive banking system in Japan. While Fintech is certainly growing in the country, it appears the reason it hasn’t taken off so quickly is partly due to a strong bank-branch culture. The Data Market has found that the number of commercial bank branches per 1,000 square kilometres in Japan in 2013 was 103. This is significantly higher than those found in the rest of Asia. Ripple, the US Fintech that uses Blockchain technology for payments and settlement, has entered into a joint venture in January, 2016 with Japanese financial services giant SBI Holdings. It's called SBI Ripple Asia, and in August 2016, it was announced that a consortium of 15 Japanese banks, will build a platform using Ripple technology to enable instant national and cross-border payments. It plans to expand the consortium to 30 banks and launch the service in spring 2017. The number of merchants accepting the cryptocurrency is expected to quintuple to 20,000 this year. By 2016’s end, there were over 4,200 bitcoin-accepting merchants and storefronts in the country, quadrupling from the total from 2015. The frenetic growth followed a bill, approved by the Japanese cabinet, to recognize digital currencies as real money, or legal tender. CoinCheck’s chief of business development Kagayaki Kawabata points to Japan’s regulatory moves as the primary factor for bitcoin’s growing popularity in the country. Once shunned in a negative light during the fallout of the now-defunct Mt. Gox exchange, the cryptocurrency is seeing plenty of press that is helping spread awareness in the country. Mitsubishi UFJ Financial Group and the two other Japanese megabanks have been laying the groundwork ahead of the rules change, such as establishing dedicated divisions and launching contests designed to unearth promising startups. The legislation's passage opens the door to full-fledged investments and tie-ups. Sumitomo Mitsui Financial Group is interested in operating a virtual marketplace much like Rakuten's. The rapid growth is in part due to the recent deregulation. In addition to the existing lending and funding types (‘Charity’, ’Rewards’ and ’Lending’), the ‘Equity-type’ market has emerged since 2015. Due to the contribution of this new funding type, we expect to see a further growth in the market with recent market trends expected to provide a boost to foreign players in entering the Japanese market and domestic players are likely to seek global partners to access overseas investors, technologies and ‘Equity-type’ knowledge. This is going to be a big year for Japan. Is it heading towards its next financial data monopoly or an era of open APIs and blossoming startups? No one knows for sure, but Fintech is here to stay and we at Crowd Valley look forward to supporting your digital finance venture in Japan. Read the whole article on Crowd Valley News. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed