|

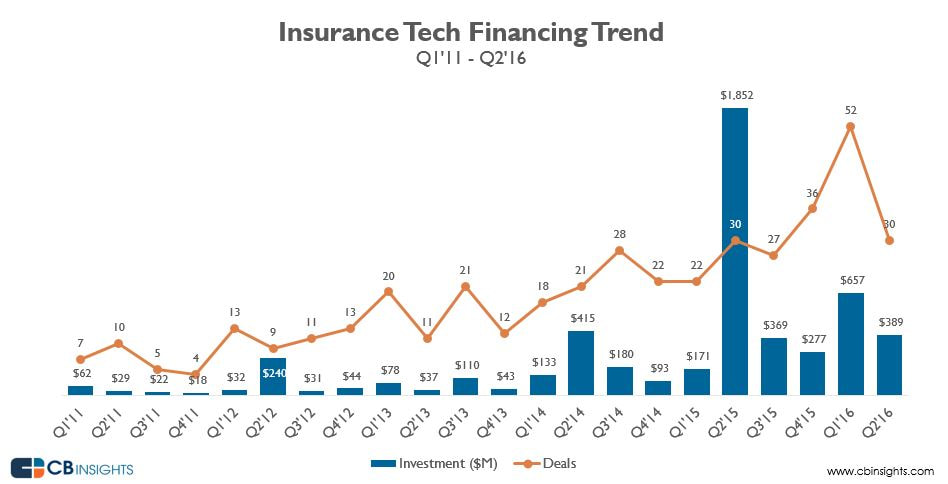

As the senators in the United States Congress maneuver a health care bill of massive significance for the insurance industry, let’s a take a closer look at the wave of disruption that has firmly placed the insurance industry and Insurtech in the spotlight of the cross industry technological wave borne out of the great recession. Insurtech joined the party at a later stage than its related counterpart Fintech. Given the revenues volumes and investment flowing into both these sectors, in 2014 insurance premiums amounted to $3,8 trillion while banking revenues were $3,6 trillion, it does come off, initially, as a surprise but a closer look at consumer relationships and regulatory changes in both spaces do provide an answer. In considering the early uptake of Fintech or Bankingtech; first, insurance is a very passive product. Ideally, consumers have limited contact with their insurance provider , because ideally nothing goes wrong. Around 70% of all insurance customers interact with their provider only once a year or less. In comparison, the study states, consumers interact with banks 200 times per year on average, compounding the level of dissatisfaction and frustration. Furthermore, the wave of regulatory changes introduced after the 2008 financial crisis, forced the banks to put massive efforts into adapting to the new rules. Financial regulators, most notably the American Department of Financial Services (DFS), the Fed, and others, started investigating banks more closely and burdened them with heavy fines, as well as more compliance enforcements. This forced the banks to restrict their business and shift resources, opening up a tremendous opportunity for innovative startups in the banking industry, from non bank lending, because banks could no longer provide enough capital, to consumer friendly apps and efficient payment solutions. The dissatisfaction with the banking sector on issues of inclusion, transparency and consumer agency further prompted a significant exodus of talent from the banking sector and related financial services to pursue solutions to these issues. The insurance sector encounters the same issues but due to relatively limited exposure, focus and the passive nature of consumer engagement, did not experience the same forces of change that both the public and regulators demanded on financial services. Fast forward a few years down the line, according to data from CB Insights, global Insurtech investment totaled $1.7 billion, across 173 deals, in 2016. Both those numbers are roughly double what they were in 2014. In terms of total investment, 2015 was actually the bumper year to date, at $2.7 billion, although $1.4 billion of that was due to two mammoth investments, the financing of Zenefits and Zhong An. In January 2017, investors from around the world were asked what the hottest area for investment in Fintech and the same sector kept coming up again and again: insurance. At the Economist Finance Disrupted conference in London in January, three out of the four VCs on the panel "Unicorns vs. Unicorpses" named insurance specifically when asked what was of most interest to them as an area for investment. The sector was name checked by Yann Ranchere, a Geneva based partner at Fintech VC Anthemis, Reshma Sohoni, the CEO and cofounder of early stage UK fund Seedcamp, and Timo Dreger, a managing director at Berlin based Apeiron Investment Group. All the panelists offered up other areas of interest, such as optimising banking backends and artificial intelligence, but somehow the conversation kept returning to insurance. Dreger summed up it up well, telling the audience: "Right now we are looking at Insurtech. It's for sure the hottest thing in 2016 and for sure the hottest thing this year too. The answer is pretty easy why. In the whole insurance industry, there's a lack of innovation and the user experience is pretty horrible." Rachel Botsman, a recognized expert on digital technologies and visiting academic at the University of Oxford, says, “the insurance industry is ripe for disruption”. Botsman has made this statement on the basis of her theory of collaborative consumption that identifies four root causes that are putting the insurance industry at high risk for disruption. Our first cause is the complexity of the experiences people have in engaging with insurance providers, with the processes consumers have to go through are usually far from user friendly, entail a lot of paperwork and are cumbersome. Compared to earlier, this is of more significance as the Fintech space is significantly more saturated with startups addressing pain points as well as institutional funding backing these ventures. Hence, both increasing inefficiencies and opportunity for investors to get in at an early stage in an unsaturated environment have placed Insurtech in the spotlight. The second cause is the lack or the low level of institutional trust in the entire system. The global financial crisis is often pointed out as a reason for this lack of trust, but there are two other major drivers. First, there is a lack of transparency in the insurance industry which creates uncertainty and dissatisfaction for consumers in accepting policies that protect their assets and lives. Second, peer trust is preferred above institutional trust. The third stated cause is the concentration of inefficient intermediaries which hinders the ability to operate and react in a lean and agile way due to the longevity of the relationships existing with these middlemen. Customers experience these layers of intermediaries as something that ultimately does not add real value to the product, although they account for an estimated 15 to 20% of the average P&C insurance premium. This is tough obstacle to overcome for the traditional insurance industry, which has focused on distribution through brokers, financial advisors and more recently comparison sites, and typically lags behind other industries in its ability to provide seamless, multi channel customer experiences. Botsman’s fourth cause is the limited access to insurance. Exclusivity echoes as a core issue for scores of individuals as insurers change policy conditions and premiums at their discretion, pricing out thousands of the ability to get coverage in both a partial or comprehensive manner. As a result, in the last few years, Insurtech has started to steal revenues and increase market share, by addressing these pain points with technology, pushing overall costs lower and thus premiums lower as well as introducing new models that promote trust and transparency such as Peer to peer insurance models and blockchain based infrastructure. These new avenues are making insurance companies uncomfortable in holding onto their legacy systems, principles and models. Insurtech Trends So, what kind of technologies do these challengers invest into? McKinsey’s 2017 global digital insurance report sheds more light on this matter. It shows that 85% of insurtech firms are focusing their innovation efforts on one of the following six domains: 1) Software as a Service (SaaS) & Cloud Computing - 21% 2) Big Data & Machine Learning - 20% 3) Usage based insurance - 13% 4) Internet of Things (IoT) - 12% 5) Digital insurance & Robo-advisory - 10% 6) Gamification - 9% Other top ten innovation domains include more complicated and comprehensive themes such as the usage of blockchain technology, peer to peer insurance, and the improvement of micro insurance through the use of technology. A slew of smart startups have sprung up and are attracting heavyweight financial support. They include US companies like Zenefits, Oscar Health, Clover, Collective Health and Gusto (formerly ZenPayroll) as well as Chinese innovator Zhong An. Agile companies are using digital technology to leap frog competitors by delivering highly personalized online customer services and creating new, lucrative markets that are bringing more consumers into the space via the digital medium. To develop our understanding of the energy and interest in the Insurtech space, it is worthwhile to review the reports PWC’s collaboration with Startupbootcamp through their Insurtech programme and fast track events. Aligning with the sentiments echoed within Botsman’s statements, the largest volume of applications to the Startupbootcamp programme came from startups aiming to enhance the quality and frequency of insurers’ interactions with customers and, as a result, to build more trusted relationships with them. (Botman’s second cause). It reflects the evolution of the broader digital economy, where customer expectations are constantly increasing in a cross industrial manner set off in a domino style fashion by rapid Fintech growth. Consumers want the same levels of service and engagement from other businesses, including insurers. They want to use their smartphones and digital devices to secure insurance that is customized, priced right and employs easy to use payment solutions. The latest annual survey conducted by Engine, the service design consultancy, ranked insurance as the worst of all industries for customer experience. Startups recognise this issue and are well placed to exploit it. Unburdened by complicated legacy processes and technologies, innovators do something quite powerful in going beyond just digitizing existing interactions; they combine digital with the human touch, often using technologies such as artificial intelligence (AI), machine learning and robotics, utilizing more and more data to understand their consumer base on an individual level allowing for a personalized solution versus a general broad spectrum approach promoted through intermediaries in a scripted manner. The need of the hour seems to be adaptation and customization and this bespoke approach is where a lot of institutional investment is flowing. But this raises an interesting question about the fundamental nature of the insurance industry and the principles on which its models function. The fundamental age old purpose of insurance is to allow people or companies to pool their risk, thereby obtaining relative safety (from unfortunate or unforeseeable events) in numbers. But personalisation is gradually allowing us to de-pool that risk. Insurers are starting to understand, at an increasingly personal and forensic level, which policyholders might be more prone to unfortunate or unforeseeable events and to price accordingly, or to refuse cover altogether. Hence, through Insurtech, we may be embarking on a path that espouses a fundamentally different approach to insurance overall that may result in a model that is more punishing to those who, for example, are bad drivers or those of us who don’t make sufficiently regular use of our gym memberships and thus more rewarding to those who are considered lower risk. This dilemma will increasingly feature as avenues such as the Internet of Things gathers greater traction connecting more devices in our lives in a constant flow of personalized data with a prediction of 20.8 billion connected devices in use worldwide by 2020. Large companies, both from within insurance and beyond, are already investing in Internet of Things technologies such as Generali, Aviva and Allianz, as well as Google. Insurtech Innovation Using a variety of approaches such as online aggregation and comparison, self service, new distribution channels, education and engagement of customers and omnichannel offers, startups can enable ongoing engagement that leads to trusted relationships. In embracing new paths, while AI has previously been seen as most useful to underwriting, its application in distribution is helping insurers increase conversion results. AI and robotics help insert a human characteristic into what might otherwise be an impersonal digital experience. Robo advice, including applications of AI, is now starting to gain traction in insurance. Robo advisers provide customers with 24 hour access to information that empowers them to take financial decisions at a much lower cost. Meanwhile, some 7% of applications to Startupbootcamp also came from peer to peer insurance startups. And reflecting on the earlier mentioned statement that consumers are now placing greater trust in peer ventures versus institutional set ups, these ventures have the potential to both disrupt the status quo and improve the image of insurance. Built to deliver trust and transparency, they address these key concerns of many customers today. Peer to peer insurance businesses are now beginning to take off. Examples include Lemonade, which recently raised a $13 million seed round, Guevara and Friendsurance, which is growing at 20% a month and has plans to expand globally. The model is tough, however, as it is much more capital intensive than other types of Insurtech startup. It may take time for customers to get to grips with the concept of peer to peer in insurance, and for startups to prosper. At the ground level, P2P insurance refers to a set of practices and models which, through technology and community, allow individuals and companies to get together in order to diversify and mutualize common risks. In a way, Due to long value chains prone to friction, high overhead costs, and a lack of transparency for the end customer, these market failures and frictions result in higher premiums being borne by insured parties, while displaying a lack of transparency and agency by the consumer. By redefining the traditional insurance structure, P2P insurance aims to eliminate some of these frictions, and to remove the inherent conflict of interest (between the insurer and the insured) that arises during a claim. P2P insurance is now growing quickly. 2015 was the real ‘lift off’ year, which saw 16 launch announcements from P2P startups. That’s more than during the previous five years combined. As the momentum has built up, so the P2P models have also evolved: from broker or distribution only models (where the P2P firms simply group people together based on their insurance needs, and then arrange for a traditional insurer to cover the group) to carrier models (where the P2P firm looks to cover some or all of the risk themselves, and not necessarily as formally underwritten insurance). Moving Forward on Insurtech In moving forward, efficiency and skill specialization becomes of increasing importance. By increasing the efficiency of insurers' back office processes and systems, these startups have the potential to enable insurers to operate more profitably at greater scale. Such efficiency can be most easily achieved through collaboration with API based infrastructure that allows existing system to supplement their current infrastructure with new plug in systems that can act as a concierge of sorts for boosting data aggregation, analytics, fund transfers and even creating peer to peer marketplaces or incorporating blockchain technology. There are a number of firms in this space that are establishing themselves. Crowd Valley is an industry agnostic pioneer in this regard that is able to offer a very robust set up for its clients across the globe. In contrast, the cost of developing and implementing proprietary new systems is quite prohibitive. As we move forward, newer technologies such as AI, Internet of Things, the sharing economy and blockchain technology will push the boundaries of modeling effective value chains and revenue streams across the board, highlighting an accelerated form of the natural process of disruption in a sector that is very due for change. Information proliferation and education play an even greater major role in these times. Almost a third of insurers in PwC’s research said that they are not familiar with blockchain at all. The Insurtech firms, by contrast, are eyeing this opportunity. But it also presents much more exciting opportunities for insurers to leverage their deep industry knowledge to not only assess the viability of these emerging use cases but also to identify other opportunities where it may be possible to measurably improve efficiency and transparency, particularly in back office operations. There’s growing recognition across the financial services sector that, whereas banking and capital markets may have started their Fintech journeys earlier (and built up a considerable weight advantage), it will ultimately be the insurance industry that sees the most benefit, and the greatest levels of disruption, from this global upsurge of innovation. This post originally appeared in Crowd Valley Blog. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed