|

Nationalism and protectionism are rising in some countries, and we see speculation about global trade wars. National governments naturally want to control things as much as they can, especially when it comes to online businesses and services, particularly finance services. But as more and more people and businesses get connected to the internet, the way they interact with each other both inside and outside country borders is evolving fast. From a services standpoint, we are moving from a decentralized world to a distributed world for many services. Finance services are slowly but surely heading in the same globalized direction, and while government regulators may not like that, there’s little they can do to stop it.

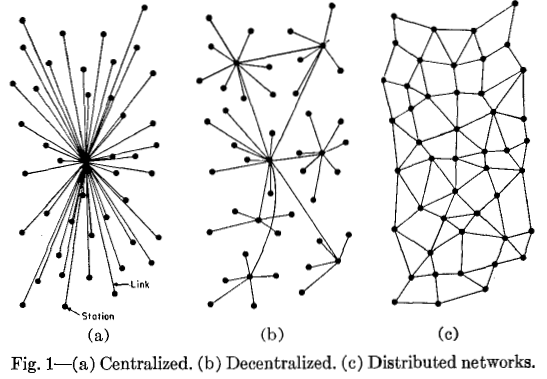

E-commerce, social media and low-cost communications services have changed our lives significantly during the last ten to 20 years, but money and finance services have developed slowly in comparison. It’s an area that’s not only heavily regulated but also dominated by old banks that have wanted to protect their positions, as well as expensive services for transferring money or keeping an account. Governments are also very interested in maintaining the status quo for such services when they want to follow the money (e.g. to prevent money laundering or terrorist financing) and collect taxes. Despite that, however, finance services clearly are evolving. Today, we can send money via international money transfer services, and even some chat, social media and email services. (We’re actually seeing speculation that Apple, Google and Facebook could become banks if they so desired.) We also have neo-banks, like N26, that are only in your mobile and bank’s servers. You can open a bank account from many countries without visiting a branch. And then there are p2p and crowd-financing and lending services that enable people to get loans and raise capital from other people and institutions directly. All of this heralds a push towards more decentralized finance services, although most of these services are local (on the national level) rather than global. However we’re already starting to move beyond this decentralization model. Bitcoin and blockchain have been important buzz words in FinTech for a couple of years – more generally, we talk about digital currencies and distributed ledgers. Some people say distributed ledger technology (such as blockchain, which is just one model) will do for finance what TCP/IP did for the Internet – it could change the whole finance world, just as the Internet has changed many businesses and operations since the 1990s. When this starts to happen, we’re no longer looking at decentralized finance services, but distributed finance services. (See this article for a good visual illustration of the difference between decentralized vs distributed.) Distributed finance services enable real p2p, bypassing some parties (like banks) to authorize and control your monetary transactions. It is more like having digital tokens – a huge distributed network can identify your tokens, confirm they are real, and allow you to send and receive them. As one FinTech expert said: you don’t need a credit card, you need credit, and you don’t need a bank account, you need a place to keep your money. What we’re really talking about here is re-inventing finance solutions, whether for investments, loans, investment vehicles, or many other instruments that enable individuals, companies and governments to finance their needs. We still need finance services, back office functions and applications, but they don’t need to be as old as our finance institutions. Blockchain is admittedly a somewhat overhyped term. Banks use it for their internal database solutions – but that is not really what “distributed” means. We already have a lot of open API solutions, p2p services and cloud-based finance back-office services – very concrete components to build new solutions for distributed finance. But we still need to see some development with distributed ledgers to make it real. But this brings us back to the earlier point about protectionism and border control. How can we see a more distributed finance world if governments that want to regulate finance services want to take more control? Well, we know from our experience with the internet (which, again, is based on TCP/IP, an open standard) that it’s not easy to control things when people have easy low-cost access to them. Of course, some countries respond with national firewalls, and they can slow down development – but they cannot stop it, whether because of political pressure on finance institutions or younger digital-savvy generations who have no patience for old-fashioned solutions and will seek out services that make sense to them. At the very least we will see distributed finance solutions appear within country borders. This will be a huge challenge for national finance regulators, but perhaps it’s the incentive they need to think of new ways to collect taxes and manage fiscal policy. Despite all the idealism about bitcoin and blockchain, the finance sector will probably still develop more slowly compared to other areas, and there will always be some form of regulation in the future. But we have enough evidence to conclude that nothing will stop this development. It is just a matter of time before distributed finance services hit the mainstream and replace old services. Those old services won’t completely disappear – we’ll still have them just as we still have circuit-switched phone calls today. But when finance services become globally distributed, then we can talk about real globalization. This article was first published on Disruptive.Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed