|

In recent times, everywhere one turns, disruption seems to impacting every aspect of the diversified financial services space, leaving no sector unturned whether it is in lending, borrowing, alternative finance or investment space. Financial technology coupled with social media input is altering the dynamic of the sector in pushing costs lower while creating a more efficient but equally more personalized user experience for investors and borrowers. The clear winner amidst this disruption and democratization of financial services is the consumer. Disruption has also allowed challengers to pose credible threats to age old traditional institutions drawing customers and funds away from the behemoth institutions. Despite the rampant change in funds flows and business models, a A PwC report from 2016 conveys that asset managers don’t see a significant threat coming from emerging technology, stating that even though many believe that asset and wealth managers will be disrupted by Fintech, industry players hold the belief that they are immune to the disturbance potential of new entrants. When asked about any type of threat, Asset managers were the least concerned. The surveyed industry players believe Fintech will have only a limited impact on their businesses. The primary challenge to the asset management space comes from financial technology developments in the form of robo-advisors and efficiency gains from big data and analytics which are paving the way for cost effective strategies. The impact of technology on the asset management space is particularly interesting because it seems to follow a set cycle for disruption; after leading the way with technology in the 1980s, asset and wealth managers (AWMs) have become dismissive of contemporary technology innovations and disruptions to their industry, which is surprising considering that the current model disrupted the traditional asset and wealth management space. In reality, prices significantly dropped. Eventually, the upstarts introduced new pricing models by splitting advice from transactions – full service brokers started to charge on a fee per asset under management basis versus fees per trade. How does this period of innovation appear unique from the those before?

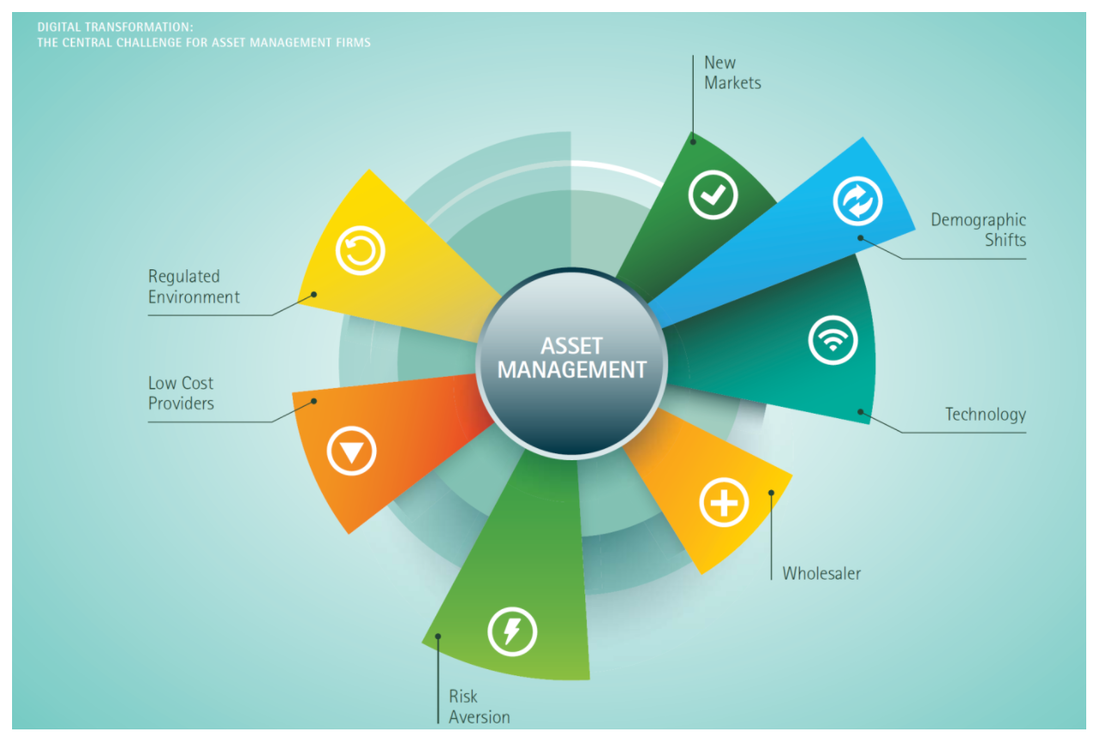

Since millennials hold just $1 trillion in wealth, with just $250 billion invested (and hold the bulk of the $1.2 trillion in US student debt), traditional wealth managers contend over high-net-worth baby boomers. This represents a huge opportunity to target younger HENRYs—high earners not rich yet. Millennial investors have shown a strong preference toward passive investing. Having lived through two crashes and a steady upward creep in asset prices in the recent environment, millennials don’t believe in beating the market. These millennial investors are tech savvy and conscious about fees. Active investment management is becoming an increasingly tough sell. Demand for index mutual funds and ETFs is accelerating. Digital investment managers use them as building blocks, and digital financial advice platforms tout them as effective alternatives to pricier fund options. As these digital disruptors gain momentum, they’ll contribute to the decline of active investment management. Even those investors who stick with active management could question the conventional wisdom about where investment talent resides, as social investing sites expose exceptionally talented individual investors. Advisors may create the stickiness, but the digital experience and the technology become the enabler to provide an omni-channel experience with the right amount of professional support. This can have a large impact on the economics of the industry as technology can reduce the friction causing high attrition rates and putting the market share of incumbents at risk. A recent PwC survey quoted an asset manager “The organization is not quite sure what to make of Fintech yet.” On the other hand, Fintechs and challengers have evaluate their potential impact for the AWM space extensively and would be looking to either collaborate or disrupt the current ecosystem, which shows increasing amount of assets under management as technology enables greater access and democratization. Crowd Valley’s infrastructure can support both challengers and incumbents embrace the capabilities of financial technology to provide quality digital user interfaces that are robust and accommodate a range of asset and wealth management functions. Feel free to evaluate our offering at www.crowdvalley.com and drop us a message. Read the whole article on Crowd Valley News. Image Source: Digital Transformation: The Central Challenge for Asset Management Firms (Accenture).

|

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed