|

Last year MWC was the time of minimum knowledge and maximum hype for blockchain. Now we have much less hype, but there are also much more real uses for blockchain. Edge has had much less general hype, rather it has been telco hype. But actually Edge and blockchain together can be components for true significant changes in internet services; to the point where the internet is not same anymore.

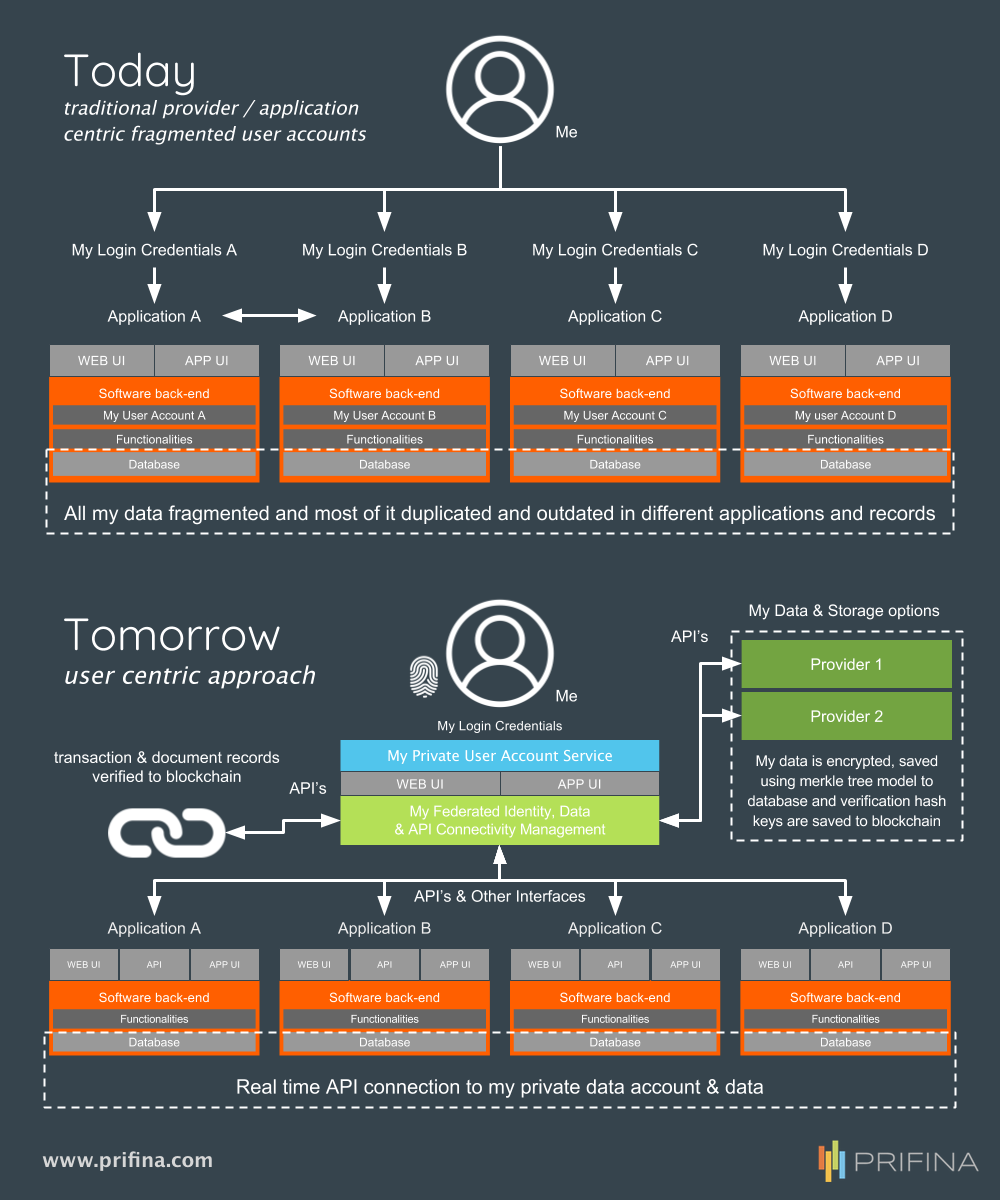

For example, last year I was listening to a middle Asian telco describing a strategy to conduct bitcoin mining, because they have cheap electricity. I see great longer-term opportunities with blockchain and crypto finance, but listening to that made me feel bad. Fortunately, we have made a lot of progress during the last 12 months. This year MWC we had much more concrete and realistic cases for blockchain, for example, supply chain, settlements and data privacy. Several cases are still in the proof-of-concept phase, but this still reprents progress from vague ideas. Now the next very important phase is to get several parties in an industry and cross-industry to cooperate and really build working ecosystems. Blockchain related startup investments imrpoved to $3.9 billion last year from $1.1 billion in 2017, and estimated capital market spending in banking from $210 million to $315 million (source: McKinsey & Company). Accenture presented at MWC a blockchain case in supply chain. It includes, for example, ABInBev, Kuehne + Nagel and European Customs Authority to manage supply chain and logistics for beverage production. The PoC focuses especially on bill of lading process, when the whole logistics process still includes so many paper and EDI documents that it takes more time and effort to get all this on blockchain. Generally, blockchain is brought to services especially to bring traceability, immutability and decentralization. One case where all these components are important is tracking of coffee beans or other foodstuff items. It offers transparency also to consumers. Clear presented, together with Difitek, solutions to make settlement and clearing based on high performance blockchain solutions. Clear has especially worked to implement solutions to offer high capacity blockchain for solutions that require a lot of real-time or near real-time transaction processing. Difitek offers finance engine, back office and open APIs to integrated then these solutions to many finance systems and blockchains. Edge is, of course, totally different technology from blockchain, but the common attributions are distribution and de-centralization. Edge is now driven especially by telcos, because it is an opportunity for them to compete better with, for example cloud companies. In addition, Edge solutions must be near customers, where telcos are. But as with blockchain, to get to real success, it is important to get many different parties and industries to work together. If someone wants to be the central point of de-centralization, it is quite easy to see that something is wrong with that approach. Together Edge and blockchain can offer really exciting models for how data, computing, trust and verifications are distributed. Then we can see solutions where consumers manage their own data and AI, and basically carry their own data to interactions with vendors. Prifina is one company that develops this kind of solutions, and also testing blockchain and distributed storage solutions as components into the service. We are still living the early days of these de-centralized solutions. Regardless, it is clear that we are reaching an era where companies build real solutions based on real use cases, and pilot them with real users. The next phase is then to get many more parties to work together with these models. These solutions are built to connect many different stakeholders. Amazon, Facebook and Google are the giants of the centralized internet and data. Then we have banks and credit card companies that authorize most finance transactions. They won’t lose those positions quickly. But with the de-centralized internet, data and finance will have its own pioneers that change the world. Telcos can have a new role in this new era, as well as those established companies and startups that are ready to commit to build these new solutions now. The article first appeared on Telecom Asia. |

AboutEst. 2009 Grow VC Group is building truly global digital businesses. The focus is especially on digitization, data and fintech services. We have very hands-on approach to build businesses and we always want to make them global, scale-up and have the real entrepreneurial spirit. Download

Research Report 1/2018: Distributed Technologies - Changing Finance and the Internet Research Report 1/2017: Machines, Asia And Fintech: Rise of Globalization and Protectionism as a Consequence Fintech Hybrid Finance Whitepaper Fintech And Digital Finance Insight & Vision Whitepaper Learn More About Our Companies: Archives

January 2023

Categories |

RSS Feed

RSS Feed